What This Article Is Not About

If you’ve ever read or watched anything before on the topic of money regrets, you might be expecting us to reel off a list of predictable mistakes that any self-respecting financial blogger should not be making in the first place.

Things like racking up a huge amount of consumer credit card debt is the obvious one or blowing their life savings on a brand-new car. We’ve always been sensible with money and never squandered it, so we don’t have any major spending regrets as we’re too damn tight!

Sure, back in my student days I was living in my overdraft just like everyone else seemed to be doing, but it was interest free, and the debt was small enough to easily be paid back with a summer job.

Our financial regrets are stuff we would actually go back and change if we could.

Regret #1 – Focussed On UK Stocks And Dividends

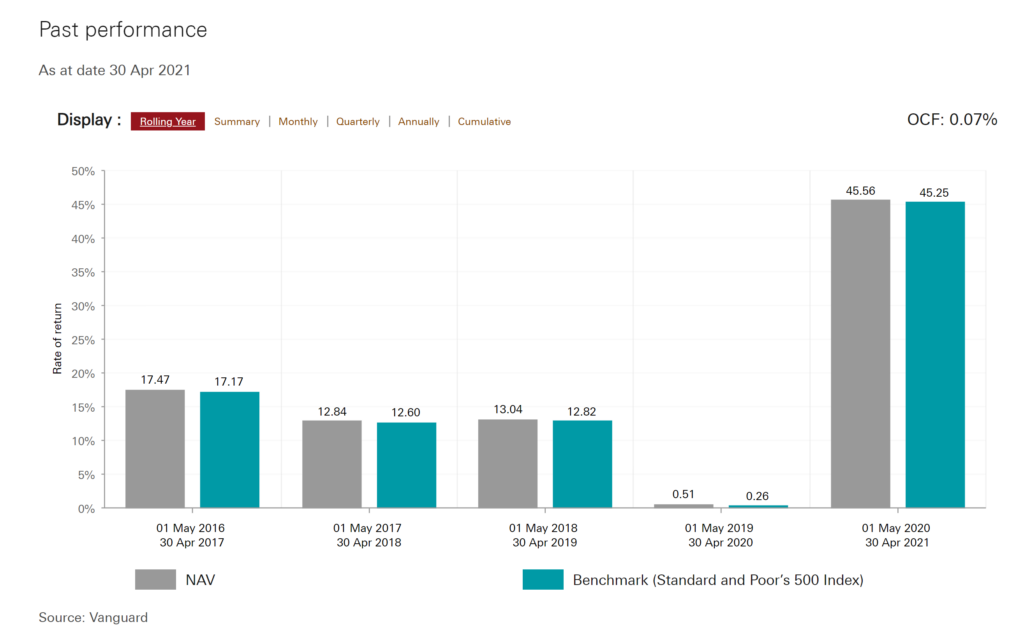

This one must have cost me tens of thousands of pounds since I started investing properly in 2010. All we ever heard back then was the FTSE this and the FTSE that. The financial news would come on and tell you how many points the FTSE 100 had moved that day but there was never any mention of the performance of a world index.

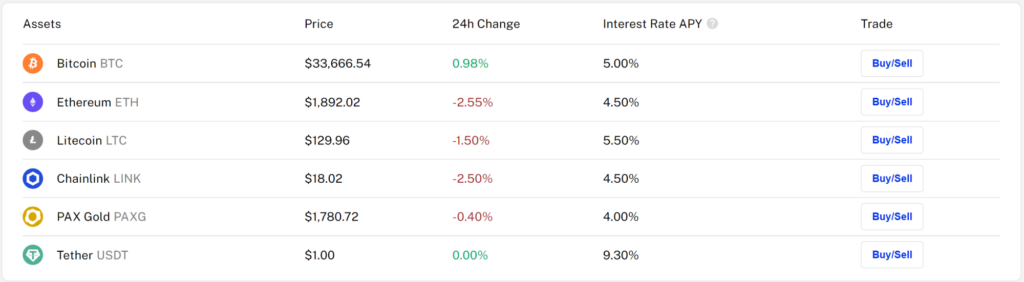

Investment platforms would actively discourage investing in foreign markets like the US by charging extortionate trading fees on non-UK investments. Popular investing website The Motley Fool would run seemingly daily articles of 5 UK dividend stocks that every investor needed in their portfolio.

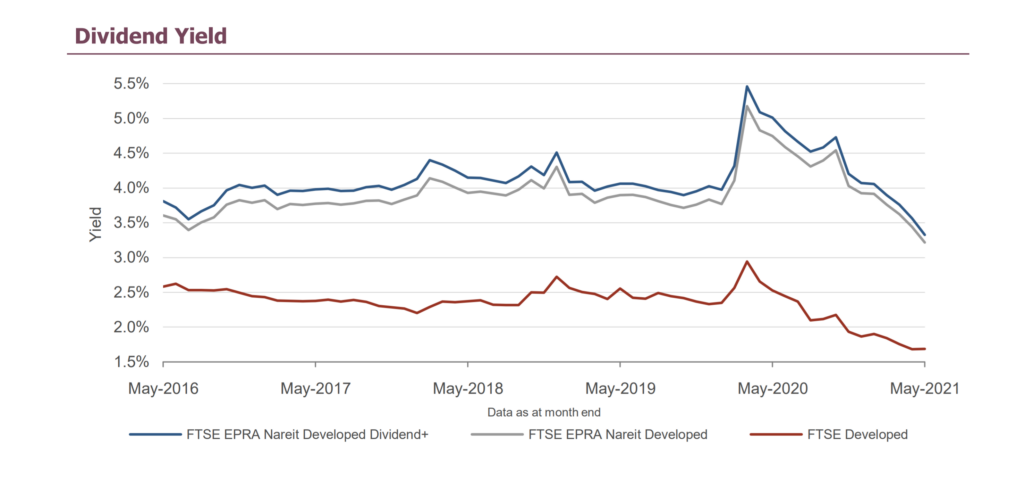

Dividends were spoken about as if they were the only way to make money in the stock market. You’d hear facts like 40 or 50% of overall long-term returns come from dividend reinvesting.

With all this potentially misleading information it’s easy to see why a new investor might be led down the wrong path.

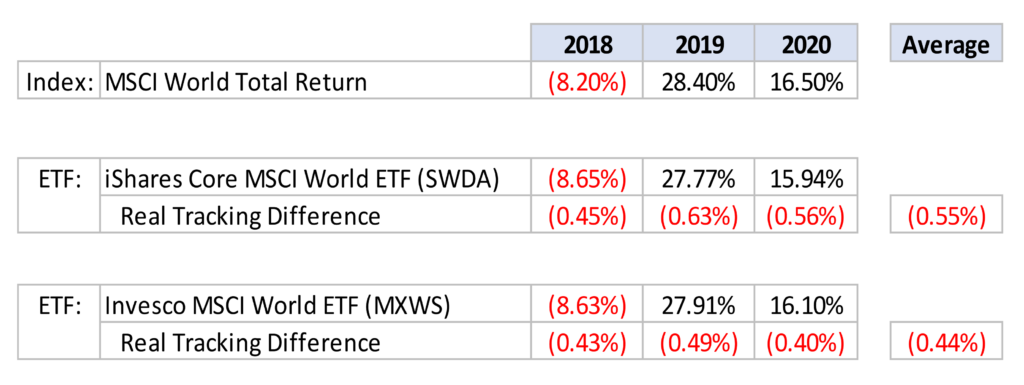

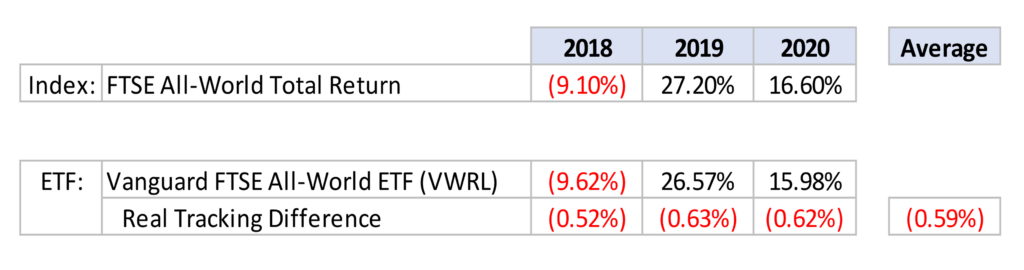

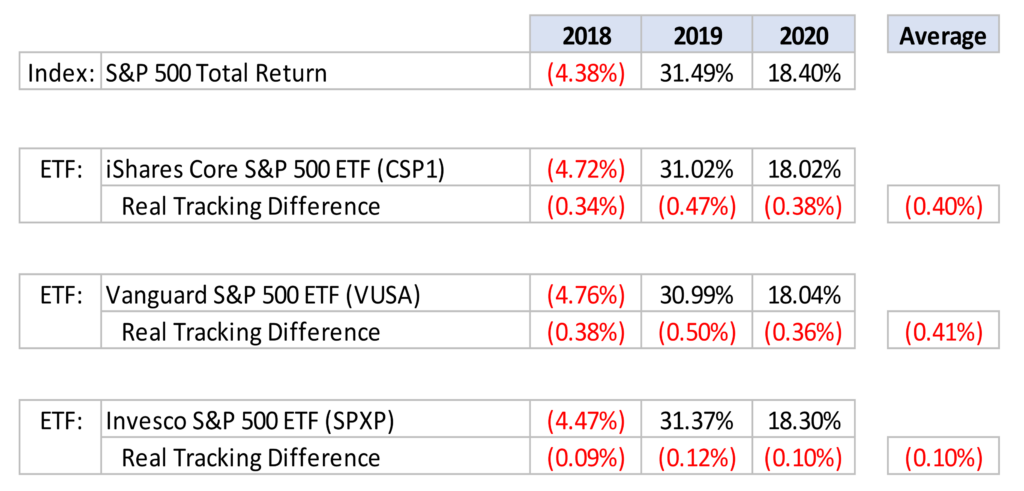

Over the last decade or so the returns on UK stocks have been lacklustre at best, while US stocks have powered ahead. With hindsight it’s always easy to say you should have done this or should have done that. It’s not the past returns though that make me regret going heavy with UK exposure. It’s the fact that UK stocks only make up around 4% of the world’s market capitalisation.

Also, with my human capital (that being my ability to work and live) limited to the UK, it makes no sense to invest with home bias. Exposure to the whole world – or at least mostly US stocks which make up about 55% of the world’s market cap – would be a far more sensible allocation.

As for dividends, there’s nothing wrong with them per se, but by only targeting high yield stocks meant better growth stocks like Amazon, Google and Facebook were ignored. You don’t need to be an investor to know these stocks have left most others in their wake.

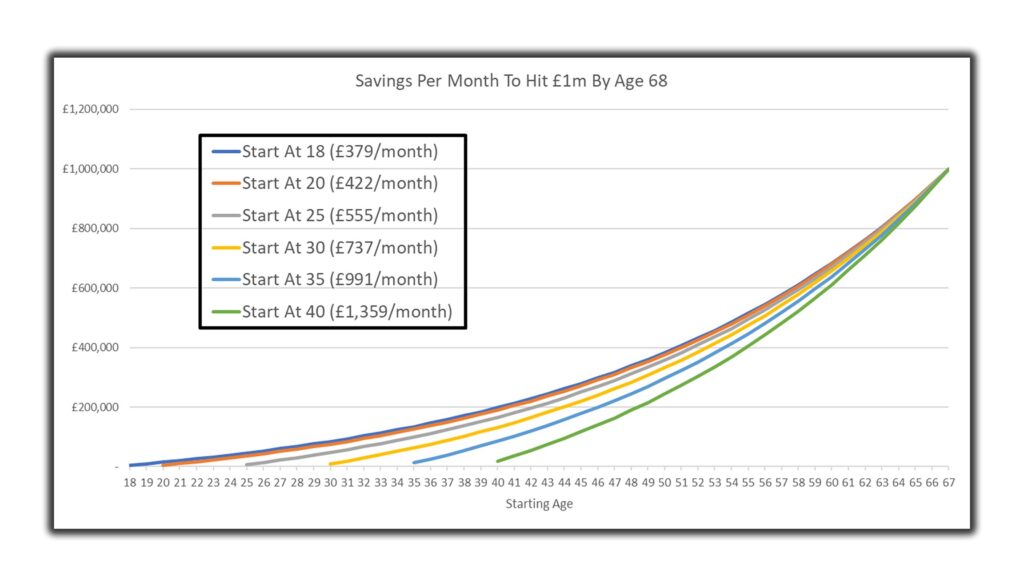

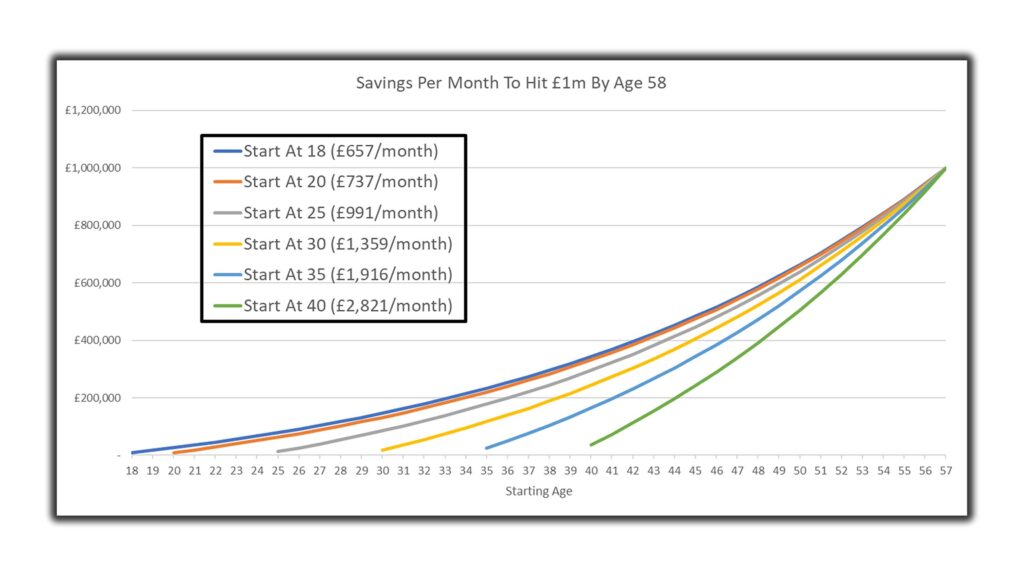

Regret #2 – Wasting Our Early Years

This regret is two-fold. Firstly, we both wish we had started investing earlier. Growing up, my parents saved up a small amount of money in a building society for me and I remember how cool it was to see money making money – back then of course interest rates were something like 5% so passive income and the magic of compound interest was clear for all to see.

However, you have to wonder what would have happened to my small pot had it been invested instead. Moreover, later in my early twenties when I did start investing, I was so slow to shift what cash I had into equity, that much of my cash was sitting idle as the stock market went on a bull run.

For Ben (MU Co-founder), he sat in cash even longer. But rather than gradually moving from cash to equity as I had, he had an epiphany after reading Rich Dad Poor Dad at age 27, which was six years ago.

From that moment on he was all in. He went on a buy-to-let shopping spree, buying as many as he could as fast as he could. This even included extracting equity from his own home to jumpstart his asset purchases.

The second part of this regret is about wasting our early years when we had so much time on our hands.

Ben and I lived together at Uni with a bunch of other likeminded people, all of whom had big dreams like we did. Looking back, we had so much time on our hands but did nothing productive with it. We drank, watched Lost, and became rock gods on guitar hero. Could that time have been used to build a business empire like Mark Zuckerberg did?

Most people who don’t start a business use the excuse that they have no time, but we know from having lived it and squandered the opportunity, that students have an abundance of time. We literally must have only spent around 15 to 20 hours a week doing Uni work, spending the rest of the week chilling. If only we had that time back now!

Regret #3 – Pigeonholing Ourselves In An Unscalable Career

A lot of people’s careers start when they’re around 17 and they choose a university degree with little understanding of where that leads to in terms of career. That decision in many cases dictates what they will likely do for the rest of their life. A frightening proposition for any 17-year-old, if only they understood the impact of their decision.

At best, a clued-up youngster might consider the earnings potential of different careers and choose one of the best paid.

Back then, we had no idea about the difference between trading time for money, owning passive income streams, or scalable income. We ended up learning accounting which does lead to a relatively highly paid job, but the work doesn’t lend itself well to scaling.

The best paid work is scalable, which means it can be rolled out to multiple customers with little to no additional work. For instance, if you provide online training courses, then you can create a course once and sell it to an unlimited number of customers.

The same can be said for software engineers who are able to code computer programs, apps and games that have endless reach. Do you remember the game Flappy Bird? Its developer said that it was earning $50,000 a day during its peak popularity. Incredible. That’s the difference between scalable income and trading time for money.

Generally, once you’ve learnt a skill, you become pigeonholed, but we think anyone that has something between their ears can apply themselves to any profession.

While basic accounting is an absolutely vital skill for any business owner to possess, it probably isn’t necessary to study for 6 years of combined university and professional level qualifications in the subject. Better we think, to learn a scalable set of skills.

Regret #4 – Lack Of Leverage

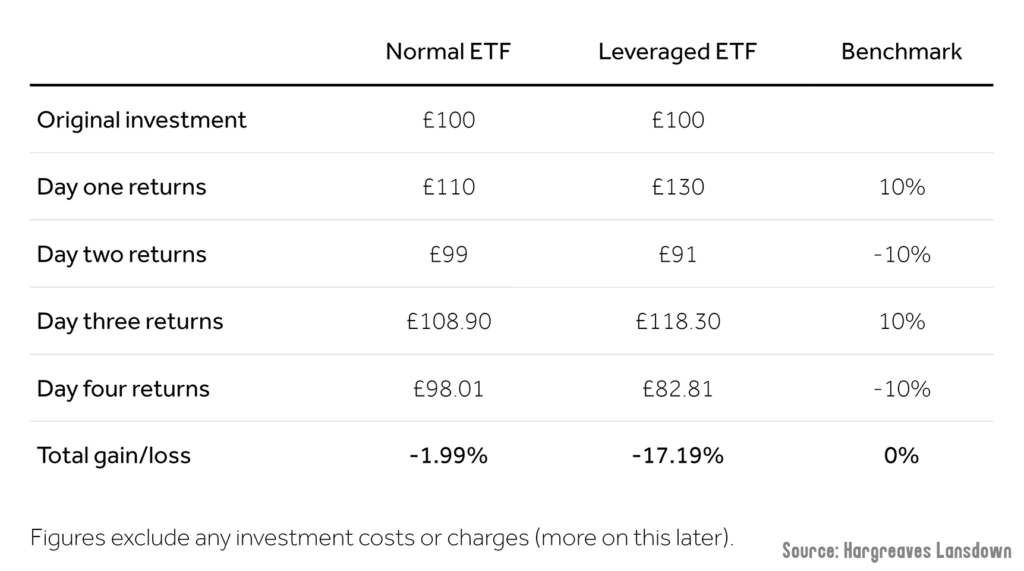

Leverage is the use of debt to amplify potential returns. So, if the stock market rose by, say 8% and you were using 3x leverage, you would get 24% returns, less any financing costs. High returns like this make an enormous impact when compounded over time.

Our regret of not using enough leverage runs contrary to what most people feel about borrowing money to invest. Most people believe that debt and therefore leveraging is inherently risky and so won’t ever touch it. They may regret using debt, while we regret not using enough of it.

Leverage is a useful tool that can enhance returns when used appropriately. For us, the biggest money risk is having to spend a lifetime working and not having the time left at the end of a career to live the life of our dreams. Leverage can be used to more easily achieve that dream life!

In fact, we’ve recently been swotting up on the use of leverage and came across some really interesting theories. One put forward in the book Lifecycle Investing, argues that we should all be using leverage in our early years to diversify across time, and the book makes a compelling case that this actually reduces risk. Can you believe it? Leverage being used to reduce risk!

We’ll probably do a full video on this soon because the theory is so eye-opening and deserves a full explanation, but to summarise, the theory says that because you have so little wealth at the beginning of your life, the movements of the stock market make almost no difference relative to the impact it has later in your life when your pot is large.

From a temporal diversification perspective, it’s as though your 20s and 30s didn’t even exist.

Another use of leverage that we’re only just beginning to use ourselves is a risk parity strategy. Again, this needs a dedicated video as we can’t give it the credit it deserves here.

In brief the asset allocation in a portfolio is adjusted, so that the assets have the same risk level, but then leverage is used to obtain the desired return. This risk parity strategy should have the same return as a stock dominated portfolio but crucially with less risk.

For example, a traditional portfolio might be 60% stocks and 40% bonds, but stocks contribute 90% of the volatility. A risk parity strategy might allocate 20% stocks and 80% bonds but then leverage the portfolio to obtain the desired returns.

Regret #5 – Trapped In A Fixed-Term Mortgage

Fool me once, shame on you; fool me twice, shame on me. Well, it looks like Ben’s a fool (his own words) as he’s made this mistake twice and regretted it both times.

Fixed-term mortgages look appealing. You can lock-in a low interest rate for a number of years and he’s done this with a 5-year fixed term mortgage twice.

Fixed-term mortgages have their uses, such as giving you certainty over repayments – you won’t ever get any nasty surprises from your bank telling you your monthly repayment is going up. But the downside is that they’re very inflexible, and life is bound to throw up many surprises during a 5-year timeframe.

The first time he wanted to release some equity from his house to invest in Buy-To-Let property, he was forced to pay an early repayment charge of a few grand. He then somewhat sensibly chose a 2-year fix, which allowed him to extract more equity just 2 years later.

At the end of the two years, he convinced himself that he wouldn’t ever want to extract equity again, so foolishly (his words again) opted once more for a 5-year fixed term.

Surprise, surprise, he changed his mind and wants to extract some further equity now that the property market is sky high – only to be facing another hefty early repayment charge. The moral is, think twice before locking yourself into a mortgage term… and if thinking twice doesn’t work, definitely don’t get it wrong a third time!

What financial regrets do you have and why? Join the conversation in the comments below.

Written by Andy

Featured image credit: Golubovy/Shutterstock.com