As a sidenote, check out the Offers page if you want to grab some free stocks from multiple investing apps, as well hundreds of pounds of free cash, and discounts to investment services.

Don’t Pay To Trade Anymore

At the end of the day the fees (and taxes) you pay make a huge difference to the amount of money you make. Investors have a hard enough challenge to pick winning investments without having fees dragging them down.

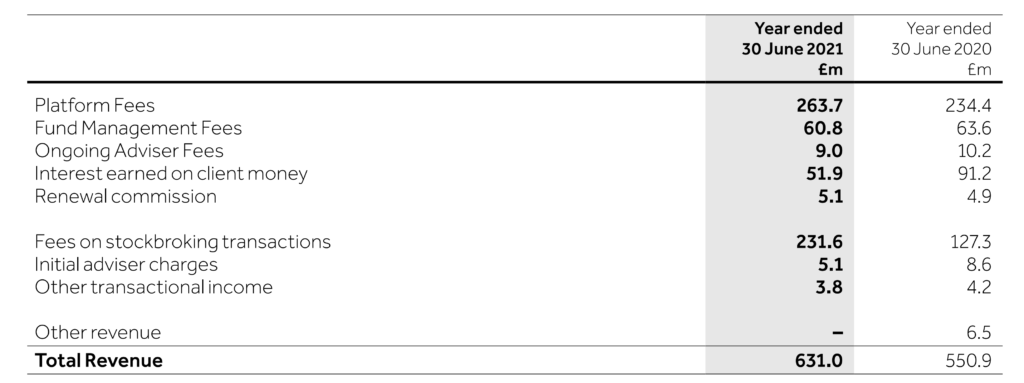

But the good news is that the days of paying £10 or more every time you want to buy and sell are over – even if some of the heritage platforms don’t know yet. I would love to be a fly on wall in the boardroom of the older platforms as they frantically strategize how they can protect their revenue stream. For years now their business model has always been to rip-off investors for placing trades despite the direct cost of these trades to the platform being negligible.

In Hargreaves Lansdown’s result for 2021, they were enthusiastically announcing they had a record 233,000 net new clients, taking the total to 1.6 million. On the face of it this is impressive but apps like Freetrade and Trading 212 have achieved this in just a few short years.

We’ve been producing videos for 4 years now and one thing we’ve noticed is that new investors are overwhelmingly choosing commission-free apps over their expensive rivals, and who can blame them?

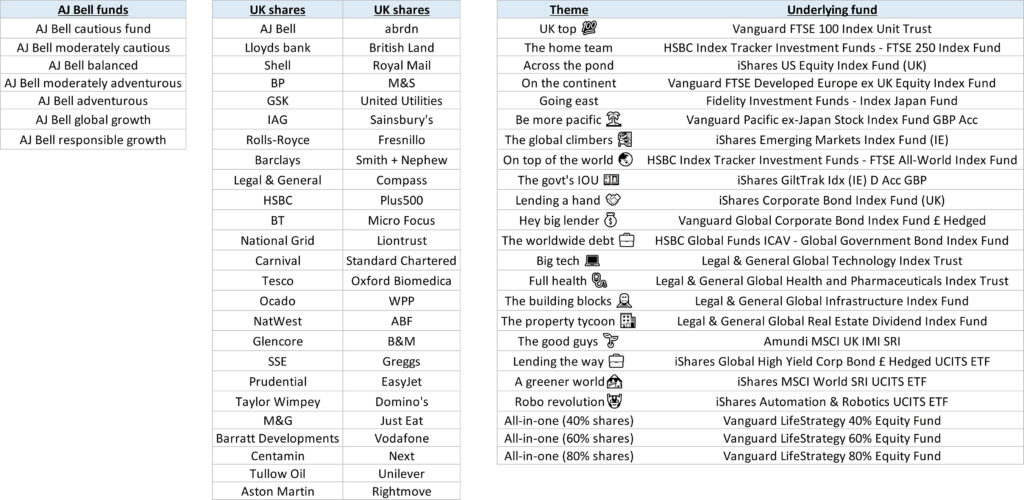

AJ bell have identified the threat as they will launch their own commission-free app sometime this year but at launch this looks to be just a heavily watered-down offering.

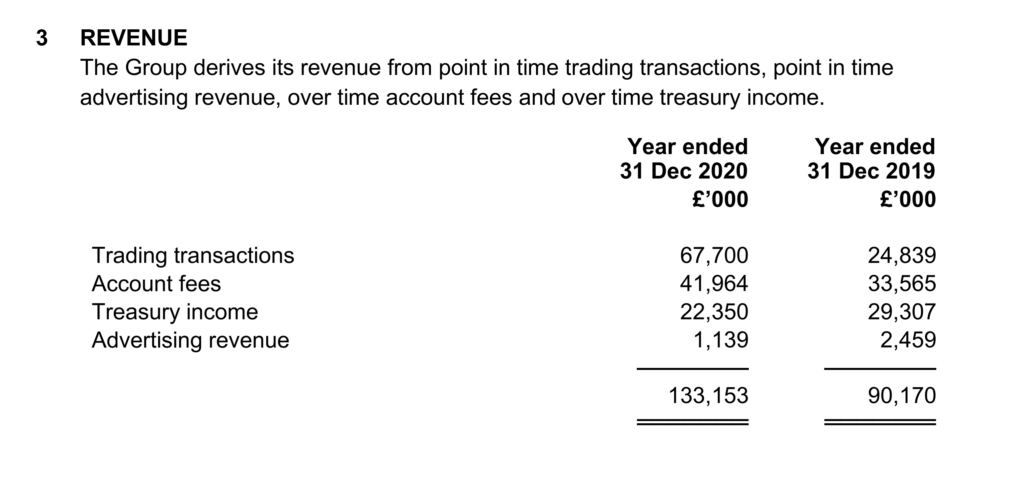

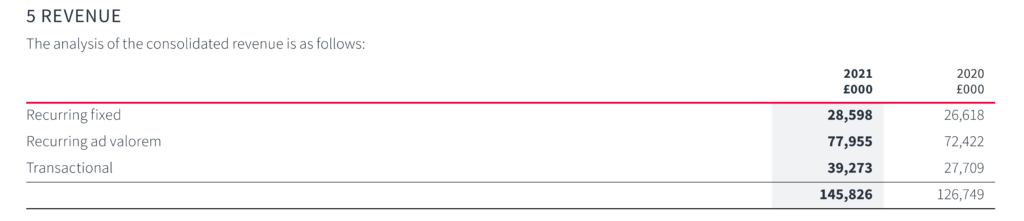

Some of the new apps that have sprung up in recent years offering commission-free investing include Freetrade, Trading 212, InvestEngine, Stake, Orca, Revolut, Wombat, Lightyear, and even big names like Vanguard don’t charge to trade. There is plenty of choice, and it seems to be getting better day-by-day.

Interactive Investor, who are the second largest platform by assets under management include free trading credits each month, and it’s surely only a matter of time before they fully commit.

From conversations I’ve had with older investors I gathered that they were less bothered by trading commissions because: (1.) Their trades were so large that the fee was less significant, and (2.) They were used to paying fees having paid them ever since they started investing.

But for younger investors, who want to invest say £2,000 over 20 stocks, that £10 fee per trade would cost them 10% of their portfolio just to buy, which is crazy high!

The slashing of trading fees has mostly been focussed on General and ISA accounts, and we have to admit there is still less choice for commission-free pensions, although this is slowly improving.

Other than the excessive cost, the other big reason to avoid paying trading fees is they negatively influence how you invest. You need to be free to rebalance your portfolio as and when it is needed. Trading fees interfere and affect your investing behaviour.

Between the platforms there is also a race to charge the lowest platform fees. Our favourites all charge zero or near zero fees to hold your investments with them.

As it stands right now, most platforms will compete on price in one specific area such as ISAs but be less competitive with another product such as SIPPs. For this reason, it usually makes sense to have your different accounts across multiple investment platforms, ensuring you’re always paying the lowest fees possible.

How Are Your Investments Protected?

This is a super popular question, and we can tell based on community answers that it’s very misunderstood. Most people focus way too much on the Financial Services Compensation Scheme, which protects up to £85,000. Because this is quite low people wrongly believe that they aren’t protected above this amount and should spread their investments over multiple platforms, but it’s not that straightforward.

Let’s deal with what is hopefully obvious; if you make a bad investment and the share price crashes, you’ll have to take that on the chin and put it down as a lesson learnt. You are not protected against making poor investment decisions.

But how are your investment’s protected against platform failure? The first line of defence is the segregation of client assets. Your platform is not permitted to use your capital in running their business, so they won’t be selling your shares to pay their salaries.

So should the platform collapse, your assets should in theory be safe and transferred to another platform. The cost of the administration and legalities of this may have to come from the client assets but this is when the Financial Services Compensation Scheme’s £85,000 comes into play as a last resort. Therefore, although the FSCS is just £85k, you are in effect protected by much more than this!

Another thing that could happen – no matter how unlikely – is a provider of the ETFs and funds you are invested in becoming insolvent. For example, imagine you hold an iShares ETF on Freetrade, and iShares goes bust.

Most ETFs are domiciled outside the UK, typically in Ireland and Luxembourg. If the manager of an overseas-based ETF becomes insolvent, there may be a compensation scheme in that jurisdiction, but it’s unlikely to be covered by the FSCS.

The underlying stocks within the fund do not legally belong to the provider (such as iShares and Vanguard), so if they get into financial difficulty, your investments would be protected from its creditors. And in any case, these fund providers are probably too big to fail. They each manage trillions of dollars’ worth of assets.

The likely worst thing that will happen from any firm failure is your money getting tied up for a period of time. If you wanted to err on the side of caution you might want to invest in funds from a range of providers (such as iShares, Vanguard, and Invesco) and invest across a couple of platforms. We do this by ensuring our pension is not with the same provider as our ISAs.

It’s Harder Than You Think. It’s Easier Than You Think

That might sound like a contradiction, but it’s aimed at 2 different types of people. First you have new investors who think they are the bee’s knees, when in reality they are just taking wild punts. And in a bull market, which is when the market is going up, their recklessness is often forgiven.

Most of these investors couldn’t even tell you the difference between a balance sheet and an income statement but for some deluded reason they believe they have a knack for picking winning stocks… they don’t! Ben and I (MU cofounders) both have degrees and professional qualifications in accountancy, not to mention years of experience, but we still sometimes struggle with the overcomplicated and tedious accounts published by most companies.

Then you have scaredy cats who are the polar opposite. They are totally overwhelmed by investing and if they do overcome this fear, they will only invest through a managed service like a robo advisor because they wrongly believe you need to be some sort of investing professional to invest properly. Robo-Advisors are typically unnecessarily expensive but at least they get them investing, so are better than nothing.

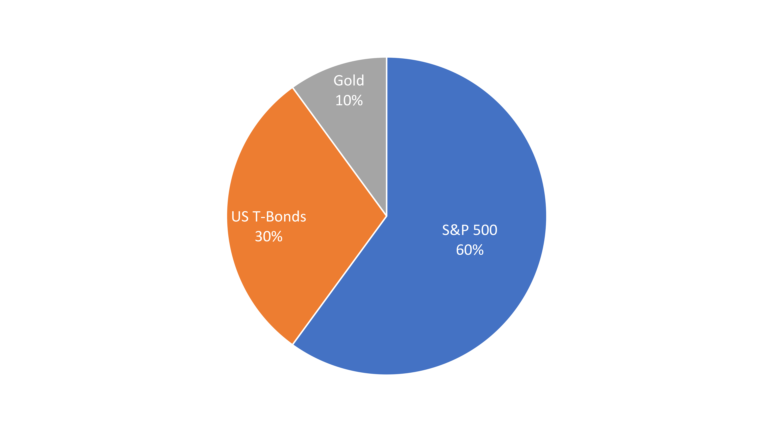

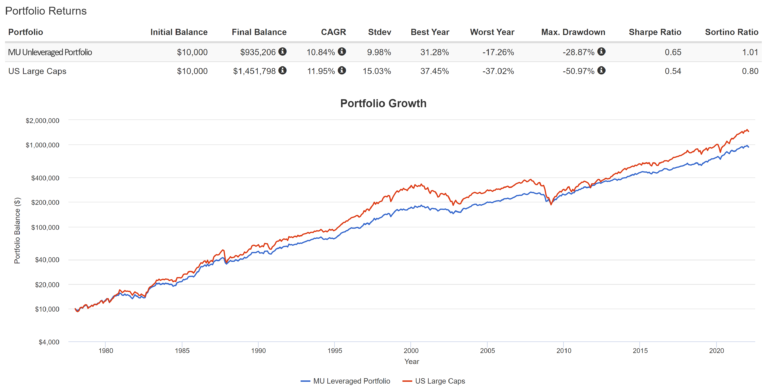

The best way to invest in our view is somewhere in between these extremes. Hand picking your own Exchange Traded Funds which track broad indexes should produce better returns for each type of investor and is super easy. We even share our own portfolios on this website – what we call the Money Unshackled Ultimate Portfolio, so you can just copy this or at least use it as a starting block.

Limit Stock Picking And Crypto To The Bare Minimum

Picking stocks that outperform the market is insanely difficult and usually you will do worse than had you just dumped your money in an index tracker. There are tonnes of studies proving that even professionals underperform.

However, we get it; picking stocks is way more fun, so what we suggest is you put the majority of your money (say 85% or 90%) in boring index trackers, and have a little fun with the rest. We don’t mean toss it up the wall by any means, but feel free to have a go.

One problem with stock picking is you have to be right twice. You need to know when to buy and when to sell. The first one isn’t easy but knowing when to sell is super tough. Where most beginners go wrong is failing to understand that a good company does not mean a good investment. If the rest of world already knows how good the company is, then it will be factored into the share price. An industry like Veganism may seem like it’s taking off, but buying shares in, say, Beyond Meat, won’t necessarily be a good investment just because a lot of people want to eat plant burgers.

Stockopedia is an incredible resource for analysing and screening stocks, and we can’t recommend it highly enough. For most beginners it’s probably too expensive but you do get a free 14-day trial with our link, and a 25% discount if you choose to keep using it. For stock investors definitely take a look at Stockopedia.

As for crypto, that Freetrade survey we mentioned earlier found that 45% of their customers also invest in crypto. If this was just a little fun money, then we have no real issue with this, but we hope people aren’t investing their life savings into it.

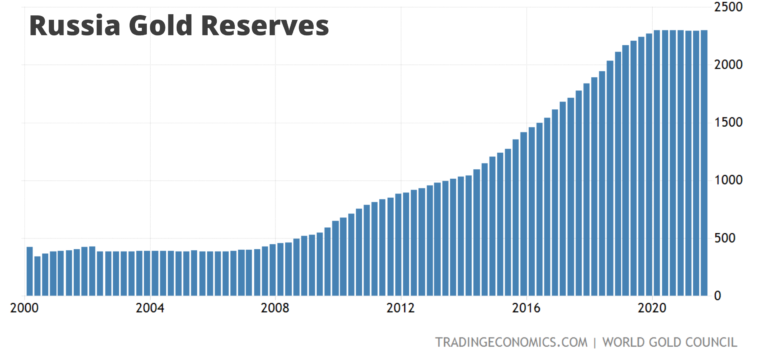

With the stock market it’s usually a select few companies that drive overall market growth. With crypto the success of the asset class will be determined by an even narrower set of assets. There are 19,000 different coins according to Coinmarketcap.com, with the majority of crypto’s market cap coming from just a handful of coins – primarily Bitcoin and Ethereum. What are the chances of you picking a winning crypto from that large pool? Most of them will go to zero.

Also, we don’t think you should invest in what you don’t understand. Sure, you probably know the basics like you store it in a digital wallet, and you can buy it from Coinbase or other exchanges. But do you understand what applications crypto has and the value of them? Or why certain coins are better than others? We’re not convinced it will even become widely accepted for payment. You can’t spend Euros in a British Tesco, so what are the chances of being able to buy your milk with Bitcoin?

Personally, we don’t speculate on currency movements such as the British pound vs the US dollar. In our eyes, crypto is just another currency… albeit more complicated. Most of our money goes into productive assets. With stocks, it doesn’t matter in the short term if other investors don’t see your point of view. A good stock will generate massive profits (and dividends) regardless of what is happening to the share price. With crypto it’s only worth what others are prepared to pay.

Investing Is A Long-Term Game

Investors now hold onto their shares just 0.8 years on average before selling them. In 1980, the average was 9.7 years, representing a decline of almost 92%, according to finder.com.

This tells us that most investors are effectively gambling, rather than investing, at least when it comes to stocks. The problem with investing for short periods is that the market is highly volatile in the short-term, by which we mean a few years. In the short-term you could quite easily lose almost all your money even if you invested in the best stocks.