InvestEngine Review

Low-fee Robo Advisor, or pick your own ETFs for FREE!

Updated: 28th July 2021

The InvestEngine Investment Platform

Update as of 28th July 2021: DIY ISAs are now live! You can also now have multiple DIY portfolios. And if you prefer video reviews, check out the video version of our review, here.

This is an independent review of InvestEngine – the opinions and insights that follow are our own! We advise you to read the review in full so you have all the facts. The “Do-It-Yourself” wing of the platform is a very different creature to the “Managed-For-You” part. If you choose “Managed-For-You”, particularly note the big differences between their Growth and Income portfolios.

First up, we love this platform’s philosophy. We appreciate what they are trying to do by addressing one of the biggest problems still prevalent in the industry – high investing fees. InvestEngine, founded by Gumtree co-founder Simon Crookall with his sister Joanna Crookall, have managed to get the platform fee down on their Robo-Advisor service to an impressive 0.25% for managed portfolios. And they also offer a “Do-It-Yourself” service which allows you to trade ETFs yourself and has no platform or trading fees!

Before reading on, note that if you use this link to create an InvestEngine account you will be given a FREE £25 cash bonus, credited to your new InvestEngine account. Don’t forget to take advantage of this free portfolio boost if you decide that InvestEngine is for you!

This is an affiliate link which means that we will also get a small commission when you use it, at no additional cost to you.

Sections

Robo-Advisor Service (“Managed for you”)

Pros and Cons

Pros

- Incredibly small platform fee (0.25%).

- Uses low-cost ETFs (average fund fees 0.15% for Growth portfolios).

- Offers an ISA at no additional charge.

- Simple user-friendly platform and onboarding process.

- Sensible global equity allocations, PLUS allocations to gold and silver (Growth portfolios only).

- Good app and website.

Cons

- The number of ETFs in our portfolio might be considered to be slightly bit excessive (over 10).

- Doesn’t offer a SIPP.

- Income portfolios perhaps focus too much on bonds, rather than dividend stocks.

How Does Investing On InvestEngine’s Robo-Advisor Platform Work?

InvestEngine offers a robo-advisor service, also known as a robo-investing platform. They launched at the start of 2021 so are new on the scene, but their fee structure and simple ETF portfolios have made a huge impact on us as index investors.

They ask you a series of questions and then allocate you a portfolio based on suitability, which includes attitude to risk and investment time horizon.

They offer 3 account types – Personal, ISA, and Business. Personal and ISA will be the account types of choice for most people. Business accounts allow companies to invest their surplus cash. Note that if you choose the ISA account, this is a Stocks & Shares ISA, and you are only allowed to deposit into one Stocks & Shares ISA in any one tax year.

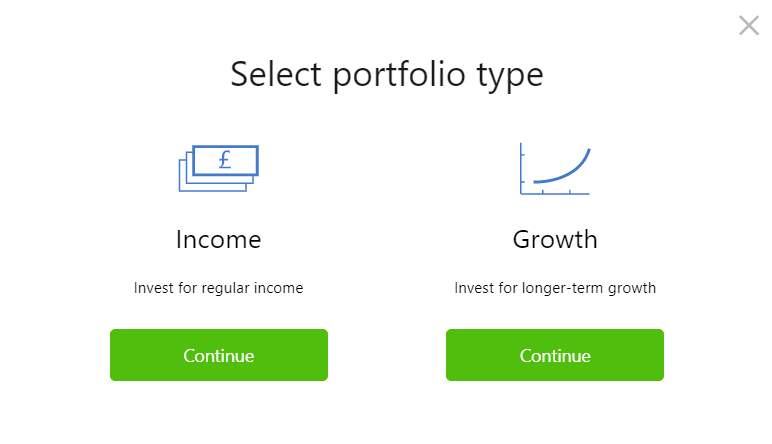

Within each account there are 2 portfolio types to choose from. These are Income (which pays you a monthly dividend) and Growth (which keeps your returns invested).

The Portfolios

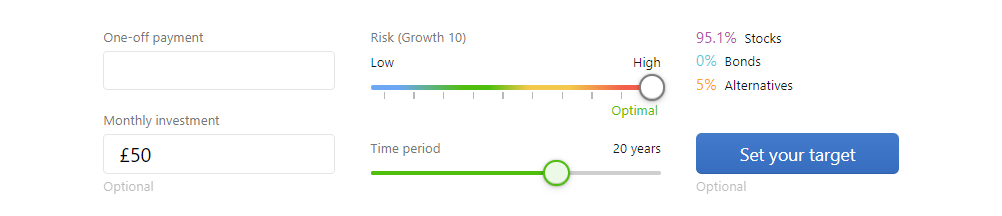

There are two portfolio themes to choose from: Income and Growth. Note: the two themes offer two very different approaches to investing. Ensure you read this section in full before choosing. The minimum starting investment for each is £100, and the minimum monthly investment is £50.

The risk level of each portfolio is achieved by the ratio of stocks to bonds. Lower risk portfolios contain more bonds; higher risk contain more stocks. Stocks have historically been the best performing asset class over the long-term (but volatile over the short-term), with bonds providing much lower returns than stocks but providing some portfolio stability.

1.

Growth Portfolios

Overview:

- Follows standard index investing theory of a sensible mix of stocks and bonds

- All returns are reinvested into the portfolio for compound growth

- Portfolios are named “Growth 1” through to “Growth 10” (with Growth 1 being the lowest risk and lowest potential return, and Growth 10 being the highest risk and highest potential return)

- Average ETF cost is very cheap at 0.15%

If you choose Growth, your money will be invested in low-cost ETFs, typically with a 5% allocation to Gold and Silver and the remaining 95% split between global equities (stocks) and bonds.

The split of equity to bonds will depend on the answers you give to a set of questions that the platform asks you at account set-up to determine your attitude to risk, though you can adjust this split at any time once your portfolio is up and running (it will take up to 2 business days to process this change).

The number of equity ETFs are a bit excessive in our view, but this isn’t something unique to InvestEngine – all the robo-advisor platforms do something similar (our test Growth 10 portfolio contained 11 equity ETFs and 2 precious metals ETFs). Despite the number of ETFs, this doesn’t negatively affect the fees – the average ETF cost is very cheap at 0.15% for the average Growth portfolio.

Despite an overcomplicated selection of ETFs, the resulting geographical split is sensible in our view as it weights roughly in line with global market capitalisation: that is, with a focus on US stocks.

Within our test portfolio, the total UK weighting was around 11% of the equity. A true market-cap weighted global portfolio might allocate around 4% to the UK. If you can accept or even prefer a little home bias, the Growth portfolios may be ideal for you.

2.

Income Portfolios

Overview:

- Pays income directly into your bank account once a month.

- Very high weightings to bonds, with the small allocation to stocks being undiversified geographically – will not be suitable for people wanting to grow their wealth over time.

- Estimated variable income of 1.8%, 2.9% or 4.3% a year (depending on portfolio risk).

- 3 risk levels: Cautious (100% Lower Risk Bonds); Higher (100% Bonds); Enhanced (25% Stocks, 75% Bonds).

- Average ETF cost is slightly more expensive than the Growth portfolios at an average of 0.25%.

We think the income portfolios are suitable for people who already have as much wealth as they need, and now just want to draw a steady income from it. We wouldn’t expect significant growth from the Income portfolios.

The 2 lowest risk Income portfolios are 100% bonds, and the “riskiest” portfolio is 75% bonds to 25% dividend stocks.

This is a very different product to the Growth portfolios – an entirely different approach to investing. If you were expecting a global mix of dividend stocks with a smattering of bonds, this is not it!

The bonds are a mix of government (least risky) and corporate (more risky) bonds, and the stocks are 3/5ths US to 2/5ths UK listed.

If you are willing to potentially sacrifice the growth of your wealth, and just want a steady income, Income portfolios might be for you. But if you want your wealth to grow, go for Growth.

What Are The Fees?

InvestEngine’s fees are the lowest we’ve seen for a robo-advisor. Their managed portfolios carry a platform fee of just 0.25% – this is cheaper or similarly priced to many of the most popular “Do-It-Yourself” platforms, but InvestEngine also will do everything for you for this tiny fee.

The “Do-It-Yourself” service is completely free – see the “Do-It-Yourself” review below for more information.

All of the investments on InvestEngine are low-cost ETFs, which have reasonable average fees of 0.15% for Growth portfolios and 0.25% for Income portfolios.

The full breakdown of fees is shown here, with comparisons included for the other major robo-advisors:

| Platform | Welcome Offer With Our Link | Minimum Starting Investment | Platform Fee | Fund Costs | Market Spread | Accounts Offered | Review |

|---|---|---|---|---|---|---|---|

| InvestEngine ("managed for you" portfolios) |

£25 welcome bonus | £100 | Managed Portfolios: 0.25% | Average growth portfolio: 0.15%, Average income portfolio: 0.25% |

Average 0.07% | Stocks & Shares ISA, Personal (General), Business |

|

| Nutmeg | 6 months with zero platform fee | £500 (Lifetime ISA & JISA: £100) |

Fixed Allocation Portfolio: 0.45% up to £100,000, 0.25% beyond |

Average 0.19% | Average 0.07% | Stocks & Shares ISA, Stocks & Shares Lifetime ISA, General, Pension, Stocks & Shares Junior ISA |

Full Review Here |

| Fully Managed Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.21% | ||||||

| Smart Alpha Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.18% | ||||||

| Socially Responsible Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.27% | ||||||

| Wealthify | £25 welcome bonus | £1 (Pension: £50) | 0.60% | Average: 0.16%, or Average ethical portfolio: 0.56% |

Included in fund costs | Stocks & Shares ISA, General, Pension, Stocks & Shares Junior ISA |

Coming Soon |

| MoneyFarm | 6 months fees free on the first £5000 invested with Moneyfarm | £500 | Up to £10,000: 0.75% Next £10,000 - £50,000: 0.60% Next £50,000 - £100,000: 0.50% On anything over £100,000: 0.35% |

Average 0.20% | Up to 0.09% | Stocks & Shares ISA, General, Pension |

Coming Soon |

| Wealthsimple | - | £1 (£5,000 for SRI portfolios) | Up to £100,000: 0.70% £100,000+: 0.50% |

Average 0.20% | Included in fund costs | Stocks & Shares ISA, General, Pension, Stocks & Shares Junior ISA |

Coming Soon |

| IG Smart Portfolios | - | £500 | 0.50% (capped at £250 a year) | Average 0.14%. 0.50% FX fee when converting foreign dividends |

Average 0.07% | Stocks & Shares ISA, General, Pension |

Coming Soon |

| evestor | - | £1 | 0.35% | Average 0.11% - 0.14% | Included in fund costs | Stocks & Shares ISA, General, Pension |

Coming Soon |

Portfolio Performance

InvestEngine haven’t been around long enough to showcase their portfolio performance history on their site. They project future performance for your portfolio within your account screen (the “Projections” tab), but the expected range is between 0% and 26% – not exactly precise!

This is because predicting future returns to the penny is a fool’s game. We think the best you can do when picking a portfolio is to own a bit of everything: stocks from all over the world (focusing on the major economies), tempered with a few bonds if you wish to lower the risk.

InvestEngine does this, so we would expect their highest risk/return portfolio – Growth 10 – to perform as well as any global stocks portfolio would over the long term. They themselves state in their FAQs that they are not trying to beat or time the market, only to track it as closely as possible with index investing.

History shows that a conservative estimate for global stock market returns is 8% before inflation on average, and we might expect something similar from the Growth 10 portfolio but of course there is no guarantee. The other portfolios should expect to return less than this, with returns getting lower as risk decreases. Note: returns are never consistent every year and 8% is an approximate historical long-term average annual figure. Past performance is no guarantee of future performance.

Alternative Robo Investing Platforms

Other good robo-advisors include MoneyFarm (offer link here) and Wealthify (offer link here). Check out their fee structures above, and if you sign up via our offer links you’ll also get a welcome bonus (see table above for bonus details).

ETF Free Investing Service (“Do it yourself”)

Pros and Cons

Pros

- It’s FREE! There are no platform, trading, FX, or any other fees applied by InvestEngine.

- Fractional ETFs.

- Offers an ISA at no additional charge.

- A decent and growing range of low-cost ETFs.

- Simple user-friendly platform and onboarding process.

- Good app and website.

Cons

- Doesn’t offer a SIPP.

- The range could be bigger at just 150 ETFs, but this is set to be increased over the coming weeks and months.

How Does Investing On InvestEngine’s Do-It-Yourself Platform Work?

InvestEngine’s DIY service launched in July 2021, and already their zero-fee offering has us captivated. The platform trades exclusively in ETFs, which is a very cheap form of index investing (tracking the performance of an index of stocks/bonds/commodities).

At time of writing almost all of their ETFs are physically replicated, which means that when you buy an ETF, you physically own a part of all of the stocks on that index.

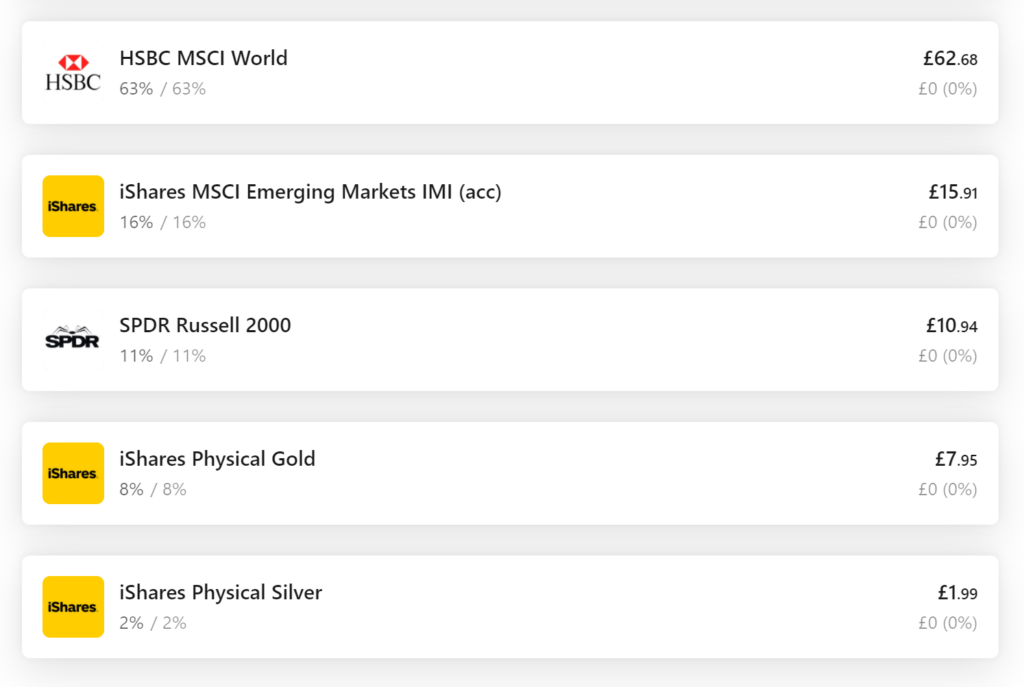

Example Portfolio

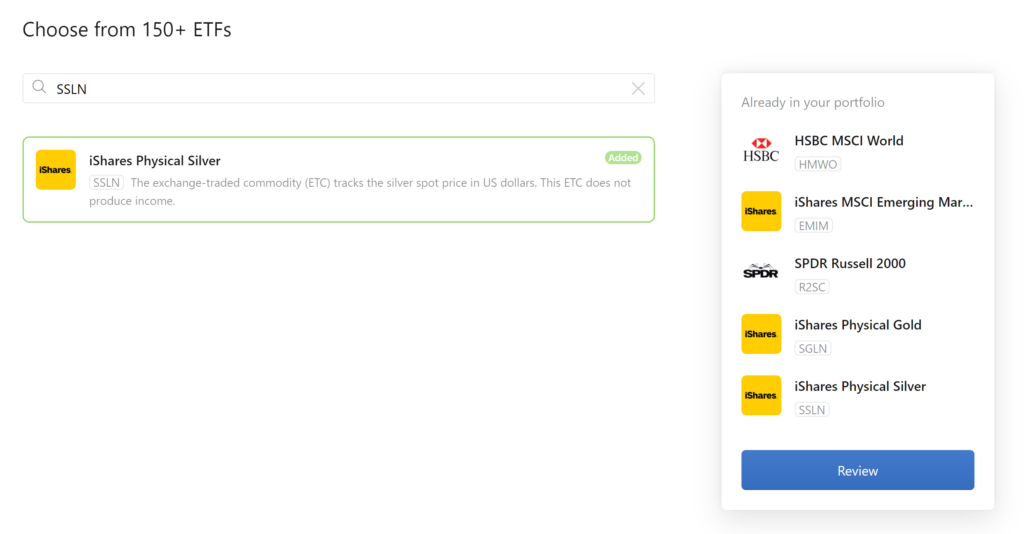

There are 150 ETFs available at time of writing, which we consider to be a small offering. But because there is no way to apply a filter, it can feel like you’re just looking at a long list, which might be overwhelming to inexperienced investors.

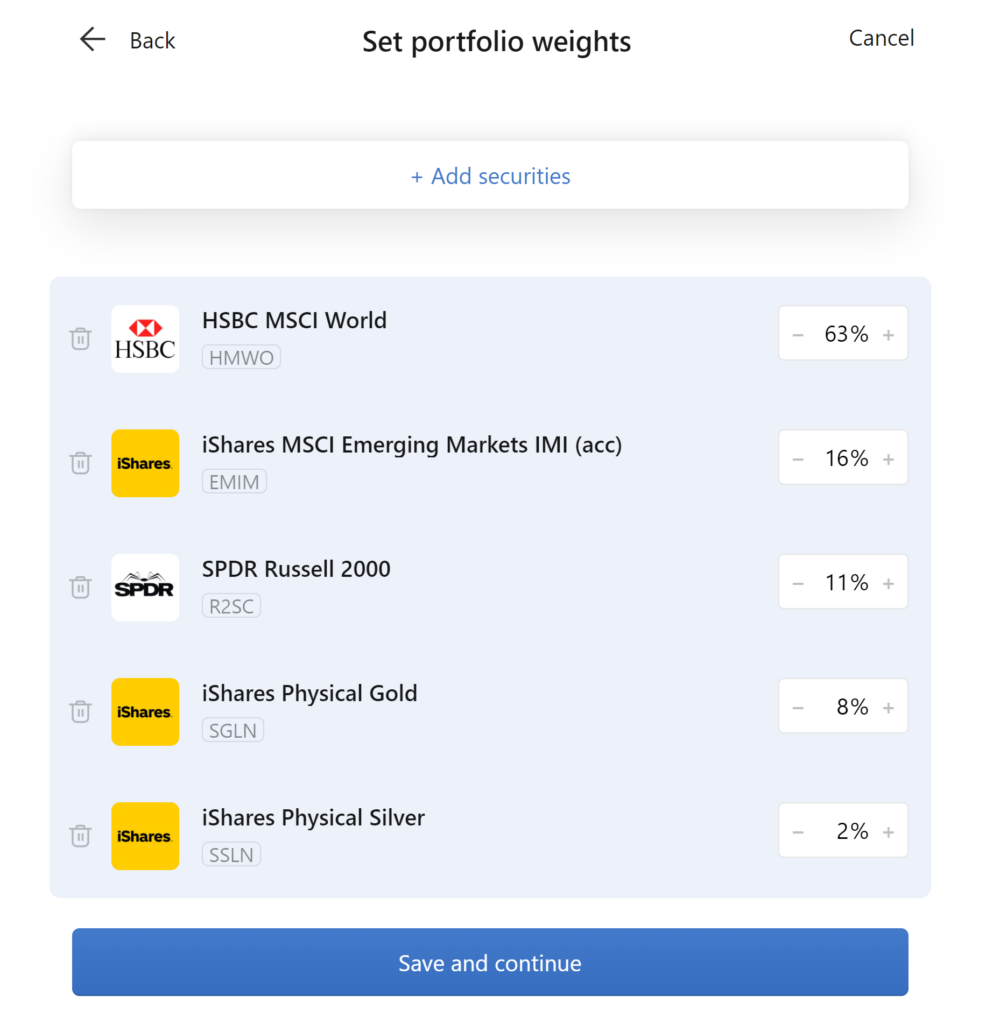

Here’s an example portfolio we built on the platform to follow a global approach:

If you wanted to add in bonds, there are many Bond ETFs to choose from. Other interesting ETFs include precious metals Palladium (SPDM) and Platinum (SPLT), commercial property (IWDP), and a number of futuristic technology ETFs. There’s also the standard offering covering the main UK, US and European indexes, and a range of other individual countries. Also, there’s the Vanguard high-dividend yield ETF (VHYL), and an interesting looking World ETF which holds 250 large stocks on an equally weighted basis (TGGB). And many more.

What Are The Fees?

All ETFs carry an ongoing charge, which is charged by the ETF provider e.g. Vanguard, iShares, HSBC, etc. This is typically in the range of 0.05% – 0.75% depending on what you’re buying. The same is true for ETFs on the InvestEngine platform – this is unavoidable.

But importantly, InvestEngine does not charge any fees for using the platform: no platform fee, no trading fees, and no FX fees.

This makes InvestEngine the cheapest place we know of to buy ETFs. Alternative “free” DIY investment platforms such as Trading 212 and Freetrade still charge FX fees, so InvestEngine wins our award for Cheapest Commission-Free Investing Platform for ETFs.

Portfolio Performance

Because you have total control over what goes into your portfolio, portfolio returns will vary wildly based on which ETFs you have chosen.

You may expect bond and commodity ETFs to have a lower return, and stocks-based ETFs to have a higher return. But actual returns will depend on market conditions.

Alternative Commission-Free DIY Investing Platforms

InvestEngine’s direct competition for their DIY platform in the UK are Trading 212 and Freetrade. They similarly offer ETFs with no trading fees, and don’t charge platform fees (though Freetrade has a premium version which does).

Both Trading 212 and Freetrade charge FX fees on investments denominated in a foreign currency, while InvestEngine does not charge any FX fees.

The range on InvestEngine is currently quite small compared to the range on both Trading 212 and Freetrade, so you might want to consider these instead if you wanted more choice. Not only do both platforms offer many hundreds of ETFs, but they also offer stocks.

We also have a welcome offer for Freetrade if you make your way to them using this offer link, which gets you a FREE stock worth up to £200 when you sign up and deposit at least £2.

We have a welcome offer for Trading 212 as well if you make your way to them using this offer link, which gets you a FREE stock worth up to £100 when you sign up and deposit at least £1.

Check out their fees here.

Using The Platform

1.

Opening The Account

Here again is the link to open a new account with the £25 free cash bonus. When you open a new account, you’ll be asked to choose between Individual and Business. You’ll then be asked to create an account with an email address and password.

Then you can choose either a “Do it yourself” or a “Managed for you” portfolio.

Managed For You

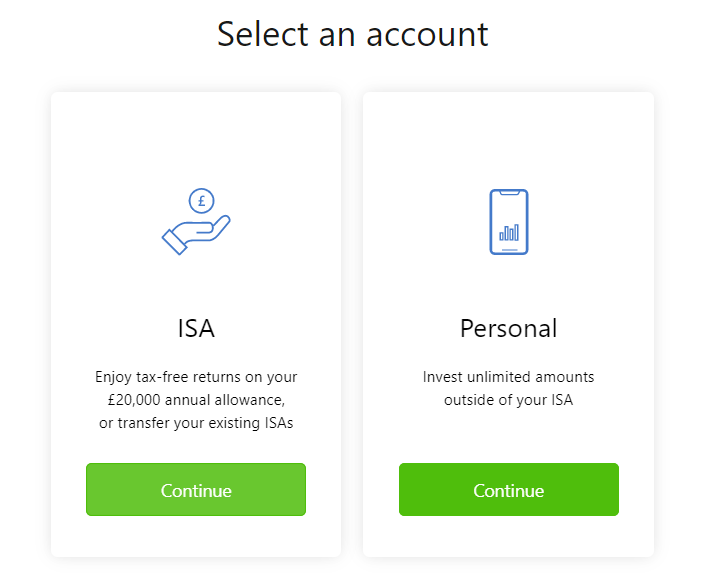

If you choose “Managed for you”, you then choose an account type (ISA or Personal if you’re an Individual), then a portfolio type (Income or Growth).

InvestEngine will ask you a selection questions which include the following:

- your age and your starting investment amount;

- what proportion of your total investable assets will this portfolio represent;

- your annual income before tax;

- your investing timeframe (Short/Medium/Long Term);

- do you prefer to minimise losses or maximise profits;

- what you’d do if the market takes a downturn;

- how big of a loss can you sustain;

- do you prefer returns to be guaranteed;

- if you’ll need to withdraw money from the portfolio in the next 5 years;

- if you’re prepared to accept the risk of capital losses to receive higher income;

- how much of your income needs do you expect this portfolio to provide;

- your previous investment experience.

InvestEngine will then serve you up the portfolio that they think fits you best. You can tweak the risk levels at this point if you disagree with the results of the questionnaire. Then your portfolio is built!

Do It Yourself

You will first be asked to choose your ETFs. Add as many or as few as you like to your portfolio, there’s no cost disadvantage to choosing more. Here’s our example portfolio, for which we chose just 5 ETFs:

You will then be asked to choose the percentage weightings you want each ETF to represent in your portfolio. These must be rounded to the nearest whole number, and add up to 100%:

You’ll then be asked to deposit money to finalise your portfolio.

2.

Depositing Money

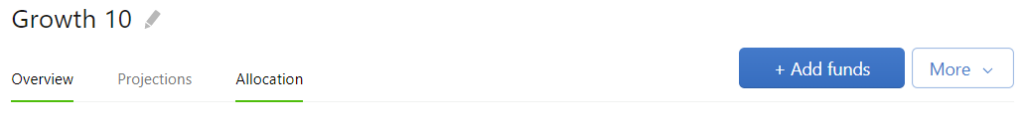

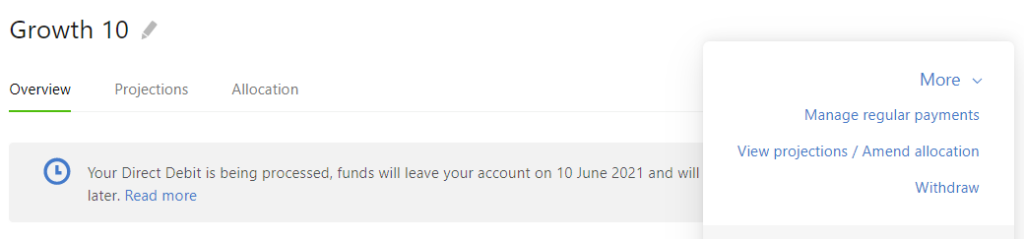

Depositing money is simple. In Managed portfolios, click the “+ Add funds” button. In DIY portfolios, click “More”, then “Add cash”. The first time you do this they will ask you to link your bank account. Future deposits will be even simpler once your account is linked.

Enter the amount to deposit (the minimum is £100). We dropped £200 into our Managed portfolio in our test, and a notification said the money would be invested into the portfolio’s ETFs within 1 working day. For DIY accounts, the trading window is between 2:30pm and 4:30pm daily (on days the stock market is open).

3.

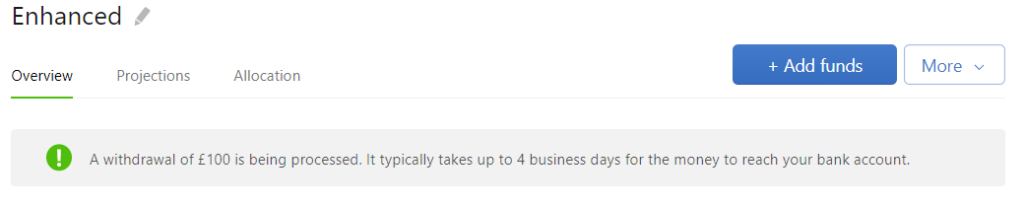

Selling/Withdrawing Money

You can withdraw your money from the “More” dropdown button in the Dashboard:

DIY investors have the option to either sell their whole portfolio or make edits through this dropdown too.

It typically takes up to 4 business days for the money to hit your bank account. Note that while the sale is being processed, the valuation of your investments can fluctuate during this time.

4.

Regular Investing

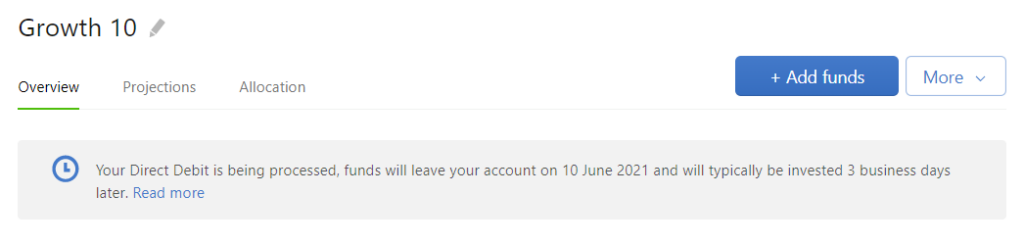

Set up a monthly payment into your account by clicking the link on the left side of your Dashboard. The minimum monthly investment is £50. You can choose the monthly payment day, between the 1st and the 28th of the month. In a Managed account the money may take up to 3 days after your monthly payment date to be invested. In our trial we chose the 10th of the month:

You can manage or cancel your regular payments/monthly top-up from the “More” dropdown button in the Dashboard (see Fig.8).

5.

Receiving Dividends/Interest

On DIY portfolios, all dividends are automatically reinvested if the ETF says it reinvests income. But if the ETF says it distributes income, the cash will be paid into your cash balance when it is received (which will differ according to each ETF).

For Managed accounts, the income from your portfolio’s dividends and interest payments are either reinvested (in the case of Growth portfolios) or paid to you once a month (in the case of Income portfolios).

6.

Adjusting Your Risk Level (Managed Portfolios Only)

This is easily done from the “Projections” tab in your Dashboard. Any changes take up to 2 business days to be processed.

7.

Rebalancing Your Portfolio (Do It Yourself Portfolios Only)

You’ll find this option in the “More” dropdown too. You also have the option to edit your portfolio’s percentages or holdings, which has a similar effect in that ETFs will be bought and sold to make your existing position match your desired percentages.

You might choose to rebalance once a year, to bring your investments back in line with your targets (since asset values will naturally drift over time).

8.

Customer Service

We asked several questions over a number of days as part of our trial in the chat box within the Dashboard. We got answers immediately, which were helpful and politely answered. No issues to report for quality of customer service.

Who Should Use This Platform?

InvestEngine is for 2 groups of people:

“Hands-Off” Investors

The first are people who want to invest their money, without the hassle of having to do anything themselves (other than set up an account and set up a Direct Debit), and who don’t want to be charged a high fee for the privilege.

InvestEngine’s incredibly low platform fee of 0.25% on Managed accounts and use of low-cost ETFs could easily make them the #1 choice of provider for such people.

However, they only currently offer 2 types of accounts for individuals – a general “Personal” account, and an ISA. They do not offer SIPPs (pensions), nor do they offer Junior ISAs or LISAs. This might make InvestEngine less attractive as a platform if you like to have all of your finances with a single provider.

InvestEngine effectively takes into consideration your tolerance to risk through their sign-up survey, so will be of use to you whether you’re a cliff-diving risk taker, or whether you have just come around to the idea of storing your money somewhere other than a bank account.

The minimum investment amount (£100 lump sum, £50 monthly) is small enough to be accessible to most people.

Low-Cost Index Investors

InvestEngine do not offer any individual stocks, Investment Trusts, or actively managed funds. However, if your investing style is one of passive index investing, and you are happy to manage this yourself, then you won’t find anywhere cheaper in the UK than InvestEngine’s DIY platform.

Investors confident in filtering through the range of ETFs to construct their own portfolio will be able to build an extremely low-cost portfolio to their tastes.

People who have used Trading 212 before will find similarities with the “Pies” feature here. You can add as many or as few ETFs as you like to your portfolio, and then you choose the percentage weightings you want each ETF to represent in your portfolio.

All the ETFs are fractional, and your ETF choices and percentage allocations can be monitored, adjusted and rebalanced easily from the dashboard, whether on the website or via the intuitive app.

How Safe Is Your Money?

First up, any investment carries risk. We can’t possibly comment on how safe the underlying investments are, other than to say we place a great deal of confidence in the ETF method of equity investing as you are tracking the prices of hundreds (if not thousands) of companies. Also, government bonds are widely considered to be one of the safest asset classes.

There is a good chance that your investments will go up in value over time, but a chance remains that the value of your investments could go down. The chances of losses are higher over the short-term. The longer you invest the more likely it is your investments will have grown.

But in terms of how safe your investments are with InvestEngine specifically:

- InvestEngine is authorised and regulated by the Financial Conduct Authority (“FCA”) and as such they must segregate client funds and assets; they keep your money and investments separate from their own.

- Your cash is held in a separate client money account at Natwest and any investments are held by a nominee company, with the assets of that company held in a segregated Euroclear (CREST) account.

- InvestEngine is a member of the Financial Services Compensation Scheme (FSCS), which means that you may be entitled to compensation of up to £85,000 of the value of your investments if InvestEngine do not meet their obligations.

That said, if InvestEngine did go bust, you might have to wait a while for access to your money while everything got ironed out with the FSCS. How likely is this?

The platform is run by ‘InvestEngine (UK) Limited’, incorporated in 2016. They are a tiny start-up company with a balance sheet of £2.7m at March 2020, making losses of £1.2m in that year. This does throw up questions about the company’s longevity (it’s tiny for instance compared to long-established brokers like Hargreaves Lansdown).

However, it’s normal for start-up fintech companies to make heavy losses in the early years, and InvestEngine have a great product that should keep their customers around for years to come.

Customer Views

InvestEngine scores 4.5 out of 5 (“Excellent”) on Trustpilot at time of writing, though as they are a newly launched website there aren’t that many reviews.

We think the platform speaks for itself. The fees are low (or zero), the interface is simple, and on both the Managed and DIY platforms it’s possible to get a range of investments similar to what we hold elsewhere on more established (read “expensive”) platforms.

Conclusion

We think InvestEngine fills a gap in the market at the low-fee end of the robo-advisor platforms. Not only that, but they are conquering the commission free “do-it-yourself” ETF market too. Their offering is clean, sensible and does what we need it to.

If you do open an account, don’t forget to grab your free £25 with this offer link.

So you know…

Some of the links above are affiliated links and therefore help Money Unshackled stay free to use, as it is tracked to us. If you use these links, they can sometimes result in a payment or benefit to the site. You shouldn’t notice any difference and the link will never negatively impact the product.

Most importantly, the things we write are NEVER impacted by these links. We review all products impartially. If an affiliate link for the top deal isn’t available, it is still included!

If you see incorrect information or a broken link, please let us know by emailing us at [email protected]