Nutmeg Review

One of the most popular and largest Robo-Investing platforms

Written 1st July 2021 (figures updated 12th January 2022)

The Nutmeg Investment Platform

This is an independent review of Nutmeg – the opinions and insights that follow are our own! We advise you to read the review in full so you have all the facts.

For us, Nutmeg is the archetypal robo-advisor. It uses index tracking Exchange-Traded Funds (ETFs) to provide you with a globally diversified range of stocks and bonds, tailored to your risk profile and required investing time horizon, and does all this while giving solid market-matching returns.

Before reading on, note that if you use this link to create a Nutmeg account you will be given the first 6 months with ZERO management fee (T&Cs apply). Don’t forget to take advantage of this free boost to your portfolio’s returns if you decide that Nutmeg is for you!

This is an affiliate link which means that we will also get a small commission when you use it, at no additional cost to you.

Pros and Cons

Pros

- Uses low-cost ETFs (average fund fees 0.19% for Fixed and 0.22% for Fully Managed portfolios).

- Offers a wide range of account types: General, ISA, Personal Pension, JISA, and LISA.

- Simple user-friendly platform and onboarding process.

- Sensible global equity allocations.

Cons

- The Managed portfolios are a bit pricey at 0.75% platform fee up to £100k (Fixed portfolios are better at 0.45%).

- Deposits can take several days to be invested (there’s a twice-weekly investment cycle).

Sections

How Does Investing On Nutmeg Work?

Nutmeg is a robo-advisor, also known as a robo-investing platform. Their performance history goes back to 2012, with an average 9.6% annual return over that time frame on their highest risk offering. These guys have an impressive track record of managing their customer’s money.

They ask you a series of questions when you sign up and then allocate a portfolio to you based on suitability, which includes attitude to risk and investment time horizon.

They offer 5 account types – General, Stocks & Shares ISA, Personal Pension, JISA, and LISA. Note that legally you are only allowed to deposit into one of each type of ISA (Stocks & Shares ISA/LISA/JISA) in any one tax year.

Within each account there are 4 portfolio themes to choose from: Fully Managed, Smart Alpha (powered by J.P. Morgan Asset Management), Socially Responsible, and Fixed Allocation.

The Portfolios

1.

Fixed Allocation

Overview:

- A multi-asset, globally diversified tracker fund portfolio that is not regularly managed by the Nutmeg team.

- Allocation is set, and regularly rebalances back to the original allocation.

- The cheapest of the available themes with a 0.45% management fee.

- Average ETF cost is 0.19%.

- 5 Risk levels (Cautious, Steady, Balanced, Growth, Adventurous).

This is the only portfolio theme of the 4 that does NOT attempt to beat the market through active management – this might be a benefit, since on average, fiddling by professional managers has rarely had a positive effect historically speaking, and there is a reduced fee as a result of not having to pay these guys an expensive salary in order to try.

If you choose Fixed Allocation, your money will be invested in low-cost ETFs, split between global equities (stocks) and bonds.

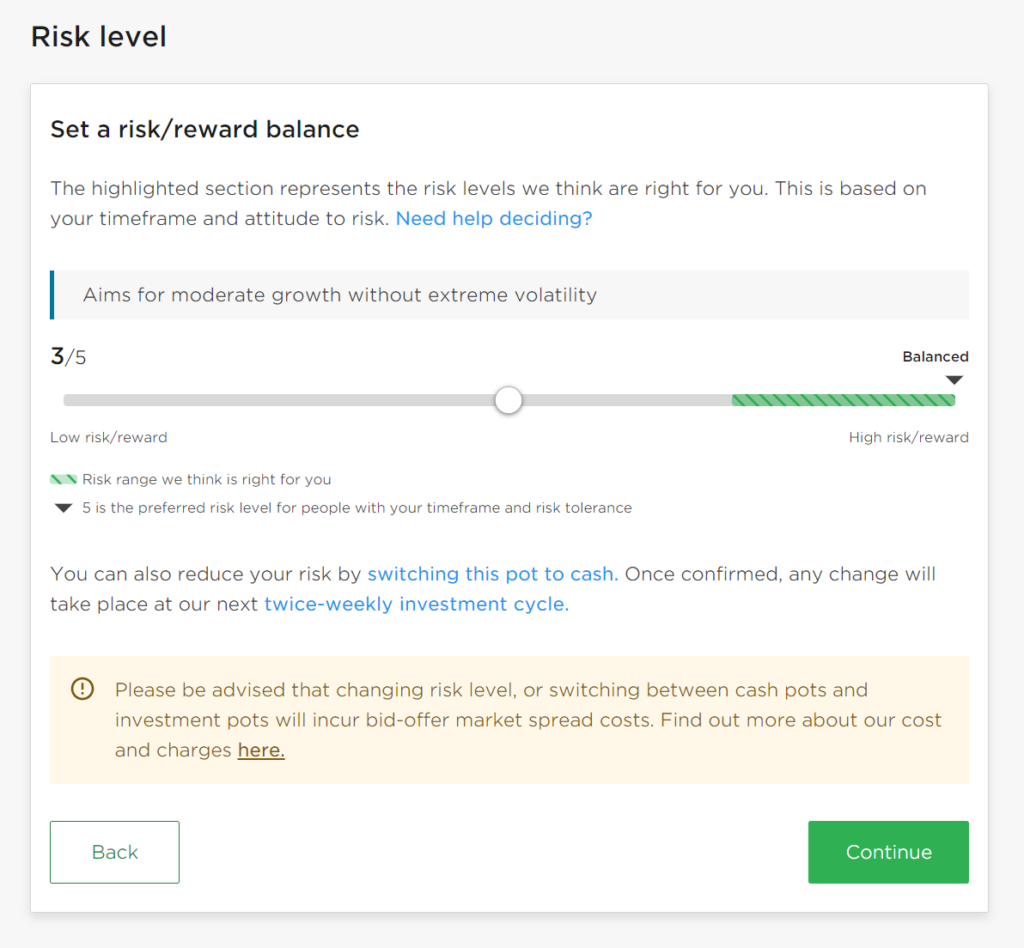

The split of equity to bonds will depend on the answers you give to a set of questions that the platform asks you at account set-up to determine your attitude to risk, though you can adjust this split at any time once your portfolio is up and running (any change will take place at the next twice-weekly investment cycle).

The number of equity ETFs are a bit excessive in our view (18 ETFs in the Adventurous portfolio), but this isn’t something unique to Nutmeg – all the robo-advisor platforms do something similar. Despite the number of ETFs, this doesn’t negatively affect the fees – the average ETF cost is still reasonable at 0.19% for the average Fixed Allocation portfolio.

Despite an overcomplicated selection of ETFs, the resulting geographical split is sensible in our view as it weights roughly in line with global market capitalisation: that is, with a focus on US stocks.

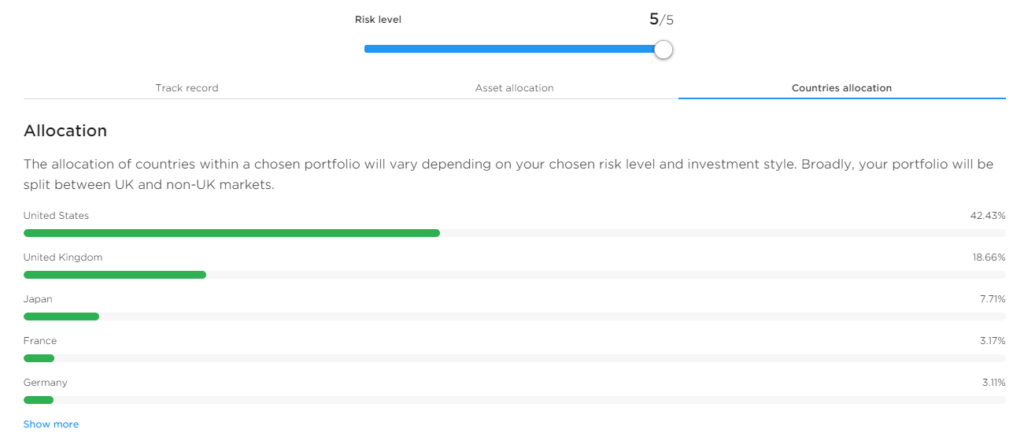

The geographic split is typically around the levels below, with the top 5 countries shown. A wide range of the Developed and Emerging Market nations are included in the fund with over 50 countries included.

2.

Fully Managed

Overview:

- An actively managed version of the Fixed Allocation portfolio.

- Makes strategic adjustments to reflect the economic environment.

- Has a 0.75% management fee.

- Average ETF cost is 0.21%.

- 10 Risk levels to choose from (Cautious through to Aggressive).

Very similar to the Fixed Allocation theme above, except the allocations are regularly tweaked to try and beat the market. This comes with a higher management fee of 0.75%.

Your money will be invested in low-cost ETFs, split between global equities (stocks) and bonds in line with your Risk level.

The number of equity ETFs are again excessive, but again doesn’t negatively affect the fees – the average ETF cost is still reasonable at 0.21% for the average Fully Managed portfolio.

The geographic split is always changing, but typically hovers around the levels in Fig.1 above, which shows the top 5 of over 50 geographies.

3.

Smart Alpha (by J.P. Morgan Asset Management)

Overview:

- Based around JP Morgan ETFs which aim to selectively track world markets by excluding companies perceived to be low performing.

- Asset allocation is decided by a collaboration between Nutmeg in-house staff and JP Morgan specialists.

- Has a 0.75% management fee.

- Average ETF cost is 0.18%.

- 5 Risk levels to choose from.

This has a similar geographic mix to the other portfolios, but tracks “enhanced” indexes which seek to only include the best performing companies.

Your money will be invested in low-cost ETFs, split between global equities (stocks) and bonds in line with your Risk level.

The number of equity ETFs are more sensible (just 7 at the top Risk level). The average ETF cost is cheap at 0.18% for the average Smart Alpha portfolio.

The geographic split is always changing, but typically hovers around the levels in Fig.1 above, which shows the top 5 of over 50 geographies.

4.

Socially Responsible

Overview:

- Actively managed, taking an emphasis on environmental, social and governance factors.

- Has a 0.75% management fee.

- Average ETF cost is pricey at 0.27%.

- 10 Risk levels to choose from.

This has a similar geographic mix to the other portfolios, but tracks Socially Responsible Investment (SRI) indexes which seek to only include the most socially responsible companies.

Your money will be invested in low-cost ETFs, split between global equities (stocks) and bonds in line with your Risk level.

The number of equity ETFs are slightly excessive (9 at the top Risk level). The average ETF cost is pricey at 0.27% for the average Socially Responsible portfolio.

The geographic split is always changing, but typically hovers around the levels in Fig.1 above, which shows the top 5 of over 50 geographies.

What Are The Fees?

Their managed portfolios carry a platform fee of 0.75% (about average for a robo-advisor), but their Fixed Allocation theme is much lower at 0.45% and is one of the most competitively priced products on the robo-investing market. Fees matter, and this saving of 0.30% would be enough for us to seriously consider going down the Fixed Allocation route.

All of the investments on Nutmeg are low-cost ETFs, which have reasonable average fees of 0.19% for Fully Managed and Fixed Allocation portfolios, a cheap 0.14% for Smart Alpha portfolios, and an expensive 0.32% for Socially Responsible portfolios.

The full breakdown of fees is shown here, with comparisons included for the other major robo-advisors:

| Platform | Welcome Offer With Our Link | Minimum Starting Investment | Platform Fee | Fund Costs | Market Spread | Accounts Offered | Review |

|---|---|---|---|---|---|---|---|

| Nutmeg | 6 months with zero platform fee | £500 (Lifetime ISA & JISA: £100) |

Fixed Allocation Portfolio: 0.45% up to £100,000, 0.25% beyond |

Average 0.19% | Average 0.07% | Stocks & Shares ISA, Stocks & Shares Lifetime ISA, General, Pension, Stocks & Shares Junior ISA |

|

| Fully Managed Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.21% | ||||||

| Smart Alpha Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.18% | ||||||

| Socially Responsible Portfolio: 0.75% up to £100k, 0.35% beyond |

Average 0.27% | ||||||

| InvestEngine ("managed for you" portfolios) |

£25 welcome bonus | £100 | Managed Portfolios: 0.25% | Average growth portfolio: 0.15%, Average income portfolio: 0.25% |

Average 0.07% | Stocks & Shares ISA, Personal (General), Business |

Full Review Here |

| Wealthify | £25 welcome bonus | £1 (Pension: £50) | 0.60% | Average: 0.16%, or Average ethical portfolio: 0.56% |

Included in fund costs | Stocks & Shares ISA, General, Pension, Stocks & Shares Junior ISA |

Coming Soon |

| MoneyFarm | 6 months fees free on the first £5000 invested with Moneyfarm | £500 | Up to £10,000: 0.75% Next £10,000 - £50,000: 0.60% Next £50,000 - £100,000: 0.50% On anything over £100,000: 0.35% |

Average 0.20% | Up to 0.09% | Stocks & Shares ISA, General, Pension |

Coming Soon |

| Wealthsimple | - | £1 (£5,000 for SRI portfolios) | Up to £100,000: 0.70% £100,000+: 0.50% |

Average 0.20% | Included in fund costs | Stocks & Shares ISA, General, Pension, Stocks & Shares Junior ISA |

Coming Soon |

| IG Smart Portfolios | - | £500 | 0.50% (capped at £250 a year) | Average 0.14%. 0.50% FX fee when converting foreign dividends |

Average 0.07% | Stocks & Shares ISA, General, Pension |

Coming Soon |

| evestor | - | £1 | 0.35% | Average 0.11% - 0.14% | Included in fund costs | Stocks & Shares ISA, General, Pension |

Coming Soon |

Portfolio Performance

Nutmeg have been established since 2012 and have a healthy track record of returns over this time period for their Fully Managed portfolio – a 9.4% annual average.

But Nutmeg is able to give a much more meaningful impression of what this portfolio can return over a longer period of time, by looking at what the individual funds it invests in have returned over the 23 years since 1998.

The actual portfolio we chose for our test (Fixed Allocation, Highest Risk) boasted an 8.71% average annual return over 23 years, after factoring in what fees would have been. Not bad at all.

Using The Platform

1.

Opening The Account

Here again is the link to open a new account with the first 6 months with zero management fee (T&Cs apply).

When you open a new account, Nutmeg will ask you your current investing experience, then asks a selection of questions which you need to say how strongly you agree or disagree with, including:

- I would be happy to risk losses to get potentially greater long term gains;

- I worry about the instability of the stock market;

- I would not be put off risky investments even if on a past investment I had made a big loss;

- If there’s a chance of making better long term returns, I’m prepared to take an investment risk;

- I would worry a great deal if I thought I would lose money in an investment;

- The idea that the value of my investments can be variable makes me feel anxious;

- I am willing to take financial risks with my investments;

- I would worry about losing money in the stock market;

- To get a good return on my money, I am prepared to risk a portion of my wealth;

- I would be anxious if I saw my investments had gone down in value.

Nutmeg will then serve you up a risk profile based on your answers. At this point, you have the option to retake the assessment if you disagree with the results of the questionnaire.

You then choose an account type – General, Stocks and Shares ISA, Stocks and Shares Lifetime ISA, Junior ISA, or Personal Pension.

They’ll ask you what you are saving for (we chose retirement) – and how long you plan to invest for (we chose 25 years).

Then choose your starting contribution – the minimum is £500, except on Lifetime ISA and JISA accounts (£100). Here you’ll also say how much you wish to contribute monthly (you can change this later).

Finally, you choose your investment style, from Fully Managed, Smart Alpha, Socially Responsible, and Fixed Allocation. We chose Fixed Allocation as it has the lowest fees at 0.45%. Nutmeg will ask you to confirm your Risk level at this point too.

You’ll have to click “confirm” a few times, and finalise the payment of your initial deposit – then your portfolio is built!

2.

Depositing Money

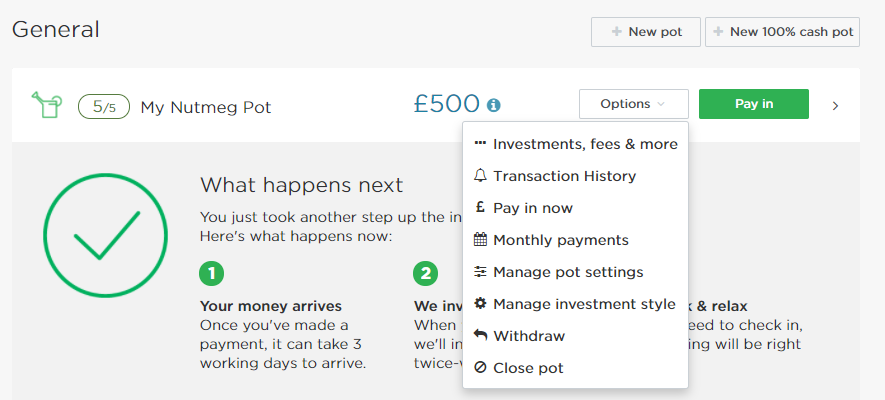

Depositing money is simple. Click the “Pay in” button in your dashboard:

There’s a £75 minimum for card payment deposits (after the initial deposit to open the account, which is £500, or £100 for LISAs) and it can take 3 working days to arrive, but this minimum limit can be avoided if you link a bank account via the Bank Transfer option – this also makes deposits faster.

3.

Withdrawing Money

You can withdraw your money from the “Options” dropdown button in the Dashboard:

Investments are sold on the next twice-weekly trading cycle, typically on a Monday and a Thursday. Factoring this in, it should take 3-7 business days for the money to hit your bank account. Note that the valuation of your investments can fluctuate during this time.

4.

Regular Investing

Set up and manage monthly payments into your account by clicking the “Options” dropdown and selecting “Monthly payments” (see Fig. 3).

There’s no minimum, and payments can be set for any day of the month between the 1st and the 28th.

5.

Receiving Dividends/Interest

The ETFs are a mix of Distributing and Accumulating, but this distinction is largely irrelevant for Nutmeg investors because none of the cash is paid out to you, but reinvested. All income from your portfolio’s dividends and interest payments are reinvested automatically back into the fund on the twice-weekly investment cycles.

6.

Adjusting Your Risk Level

At some point your circumstances may change and you might want to change your risk level. This is easily done from the “Options” dropdown and selecting “Manage pot settings” (see Fig. 3). You can then adjust your risk slider as below to your preferred level:

Any change will take place at the next twice-weekly investment cycle.

7.

Customer Service

We asked a question as part of our trial in the chat box within the Dashboard, about the investing cycles. A human confirmed straight away that these were on Mondays and Thursdays. No complaints from us on the customer service!

Who Should Use This Platform?

Nutmeg is for people who want to invest their money, without the hassle of having to do anything themselves (other than set up an account and set up a Direct Debit). They have a lower priced option for true believers in passive investing (the Fixed Allocation theme), and 3 higher priced options for those who value the input of experts.

Nutmeg have a long history, powerful brand name and dominant position in the robo-investing market that makes them the 1st choice for people who want to know their money is in good hands.

Whether you’re looking to open a pension, one of 3 types of ISA, or just a general account, Nutmeg have it covered.

Nutmeg effectively takes into consideration your tolerance to risk through their sign-up survey, so will be of use to you whether you’re a cliff-diving risk taker, or whether you have just come around to the idea of storing your money somewhere other than a bank account.

The minimum investment amount of £500 might be a bit too much of a commitment for many people, but hopefully is small enough not to act as a deterrent to this otherwise great platform.

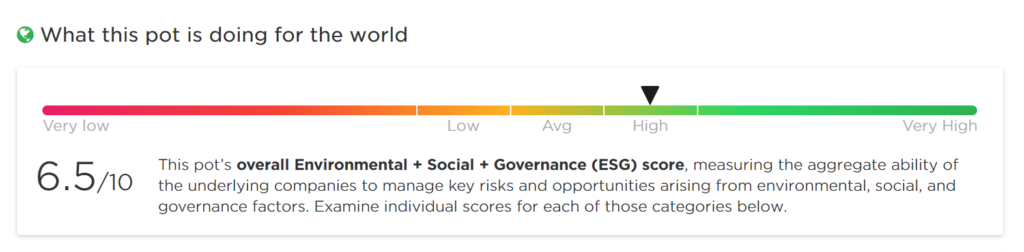

If you’re interested in ethical investing, Nutmeg has a specific Socially Responsible theme. But this is not strictly necessary, since even the cheaper Fixed Allocation is rated by the platform as ‘High’ for ESG, using data from MSCI ESG Research:

How Safe Is Your Money?

First up, any investment carries risk. We can’t possibly comment on how safe the underlying investments are, other than to say we place a great deal of confidence in the ETF method of equity investing as you are tracking the prices of hundreds (if not thousands) of companies. Also, government bonds are widely considered to be one of the safest asset classes.

There is a good chance that your investments will go up in value over time, but a chance remains that the value of your investments could go down. The chances of losses are higher over the short-term. The longer you invest the more likely it is your investments will have grown.

But in terms of how safe your investments are with Nutmeg specifically:

- Nutmeg is authorised and regulated by the Financial Conduct Authority (“FCA”) and as such they must segregate client funds and assets; they keep your money and investments separate from their own.

- Your cash is held in a separate custodian bank, State Street. State Street holds your investments in a segregated account for added security and never lends your assets to third parties. This means that your investments are protected in the unlikely event that either Nutmeg or State Street are declared bankrupt.

- Nutmeg is a member of the Financial Services Compensation Scheme (FSCS), which means that you may be entitled to compensation of up to £85,000 of the value of your investments if Nutmeg do not meet their obligations.

But still, Nutmeg going bust would likely cause you some temporary inconvenience, even with these protections. How likely is this though?

Nutmeg are a loss making company, like many expanding FinTech companies (2018: loss of £18m. 2019: loss of £20m). But they continue to attract investment into their business (they raised £47m in 2019 alone), and are trusted by their customers to manage over £4bn of client money.

In June 2021, JP Morgan, a global mega-bank, announced they were buying Nutmeg, subject to regulatory approval. The weight and support of JP Morgan will now help to prop up Nutmeg going forward, if help were required.

Nutmeg is a large and growing operation, and (fingers crossed) should be around for many years to come.

Customer Views

Nutmeg scores 4.3 out of 5 on Trustpilot at time of writing, with over 1,000 reviews, with 84% of people rating it Great or higher (74% Excellent; 10% Great).

Alternative Platforms

In our view, the main place that Nutmeg falls down on is their price. They’re the market leaders in the robo-advisor space, and so maybe don’t need to worry too much about keeping fees to a minimum. If this concerns you, a popular alternative that we’ve used and reviewed ourselves is InvestEngine.

As you can see in the fees table above, InvestEngine costs a tiny 0.25%, but comes with a much shorter track record (they only launched in 2019). But their offering is clean, sensible, and competes for our attention with that super competitive fee. Check out our InvestEngine review here for more information.

We also have a welcome offer for InvestEngine if you make your way to them using this offer link, which will give you a FREE £25 cash bonus.

Other good robo-advisors include MoneyFarm (offer link here) and Wealthify (offer link here). Check out their fee structures above, and if you sign up via our offer links you’ll also get a welcome bonus (see table above for bonus details).

Conclusion

We think Nutmeg probably offers the best and most comprehensive service of the robo-advisor platforms. Not only that, but their fee for the Fixed Allocation portfolios is very reasonable at 0.45%, making Nutmeg a good balance of service and cost.

If you do open an account, don’t forget to grab your first 6 months with ZERO management fee using this offer link.

* Capital at risk. Tax treatment depends on your individual circumstances and may change in the future. Past performance is not a reliable indicator of future performance.

So you know…

Some of the links above are affiliated links and therefore help Money Unshackled stay free to use, as it is tracked to us. If you use these links, they can sometimes result in a payment or benefit to the site. You shouldn’t notice any difference and the link will never negatively impact the product.

Most importantly, the things we write are NEVER impacted by these links. We review all products impartially. If an affiliate link for the top deal isn’t available, it is still included!

If you see incorrect information or a broken link, please let us know by emailing us at [email protected]