Since 2008 the interest you earned on your cash savings had become a joke, getting to the point where you had no choice but to invest it or otherwise, you’d get no return on your money. The Bank of England had slashed the base rate in response to the Great Recession, and for most of the time since it was just 0.5% which was about the best interest rate that you could expect to earn on your savings. During Covid it was slashed even further taking it just shy of 0%.

But times are changing, and interest rates are now rising, which wrongly might put a smile on the faces of some people with savings. They don’t understand how much worse off they’ll really be when rates rise.

The Bank of England meets roughly once every six weeks to vote on the base rate. They’ve raised it in the last 4 consecutive meetings, and it now sits at 1% – a 13-year high! It’s also expected to continue rising because as you will know inflation is soaring. According to Sky News, markets expect the interest rate to hit 1.25% later this year, going up to 1.5% by mid-2023 – and there’s a chance it could go even higher.

In this post we’re going to be looking at some of the best places to stash your cash in this age of high inflation and rising interest rates. We’ll discuss some of the pros and cons of each of these, look at when you should hold cash and help you to decide on whether you should be doing more with it such as paying down debts or investing. Let’s check it out…

Alternatively Watch The YouTube Video > > >

Rising Interest Rates Is Bad News

When interest rates were slashed savers were effectively being punished for stockpiling cash. The intention of low interest rates is to force savers to spend their money and consequently boost the economy.

Although interest rates were low over the last decade, so was inflation, so the buying power of your money was only being eroded at a snail’s pace. For example, if the interest you earned was 0.5% and inflation was 2%, then your real return is minus 1.5%.

This is bad but it still allows you to hold cash for years without losing significant buying power. However, this negative real return completely destroyed cash as a means to grow wealth. Unfortunately, although this is a basic concept most of the British public don’t understand this and still continue to save, rather than invest. All they see is the headline interest rate and their bank depositing interest into their accounts monthly.

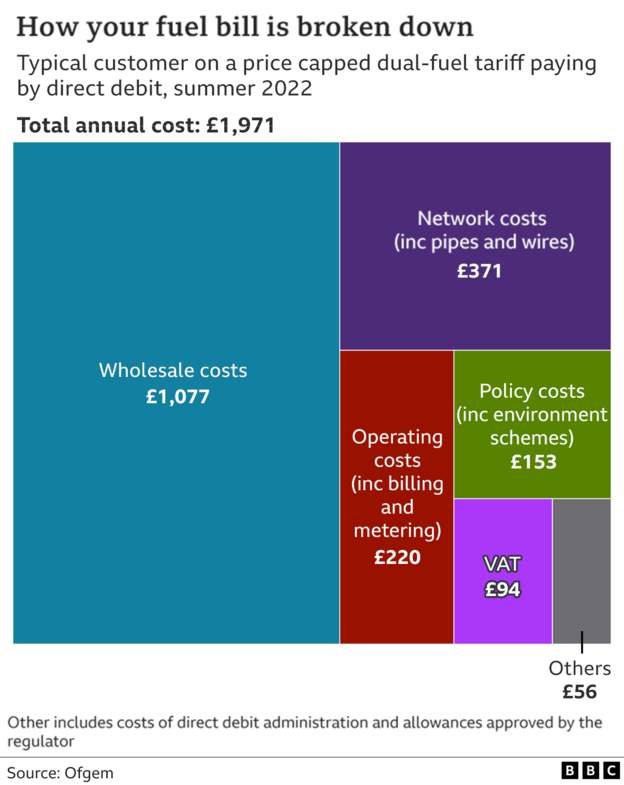

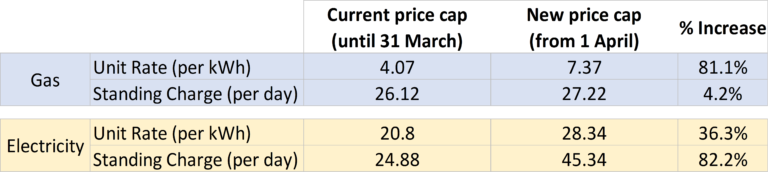

With rising interest rates you’d be forgiven for thinking this was good news for savers, but the problem is that real interest rates (that’s after deducting inflation) are getting worse, far worse! Inflation is predicted to peak above 10% in the fourth quarter of 2022 meaning you’ll be earning a negative real return of around 8.5%, assuming the interest you earn is 1.5%.

In a single year this is a terrible blow to saver’s cash but if this continues for longer, people’s cash will be wiped out in real terms. It’s now more important than ever to ask the question, should you be doing more with what savings you have? This could be paying down debts or investing in something that gives your money a fighting chance.

Another and probably more obvious reason why rising interest rates is bad is that it means the cost of borrowing goes up. We’re betting the majority of the people you know have some form of debt – and probably a lot of it.

A small hike in your mortgage rate would add hundreds of pounds to your monthly payment. For example, a mortgage of £300k, over 25 years, costing 2% has a monthly payment of £1,272. If that interest rises to 4% the monthly payment increases by more than £300 a month (to £1,583)!

Best (& Worst) Ways To Stash Your Cash Savings

The following list is not ranked best to worst because the best place to stash your cash depends on what you’re holding cash for.

#1 – Easy Access Savings and Cash ISAs

Since the Personal Savings Allowance was introduced there’s been little difference between a normal savings account and a Cash ISA, hence why we’ve grouped them together. Basic rate taxpayers can earn £1,000 interest each year before paying tax and higher earners can earn £500. So, with interest rates still fairly low, the decision will likely boil down to whichever pays the highest interest.

At time of writing the best rates are from Chase Bank which pays 1.5% on their easy access savings account and Marcus by Goldman Sachs pays 1% on its Cash ISA. There’s no point mentioning any more because this info will probably be out of date within weeks, especially if the Bank of England base rate continues to climb. See here for best rates.

The important part here is that you can access your money whenever you need, which is required if it’s an emergency fund. On that note, we would avoid any account that stipulates rules such as limiting the number of withdrawals or forces you to give notice to withdraw.

#2 – Fixed Savings Accounts and Cash ISAs

With fixed savings you can’t withdraw your money until the end of the term, which will make them useless for most people. The main reason to have cash in the first place is for emergencies but it’s no good if it’s locked away.

1 or 2-year fixes might be useful for a short-term savings goal, and these tend to have relatively impressive headline grabbing interest rates. There’s a bunch currently paying around 2.5%.

But some fixed accounts lock your money away for 5-years, and barely give any additional interest despite the lack of access. With such a long time horizon, we think investing would be a better use of your cash.

See here for best rates.

#3 – Premium Bonds

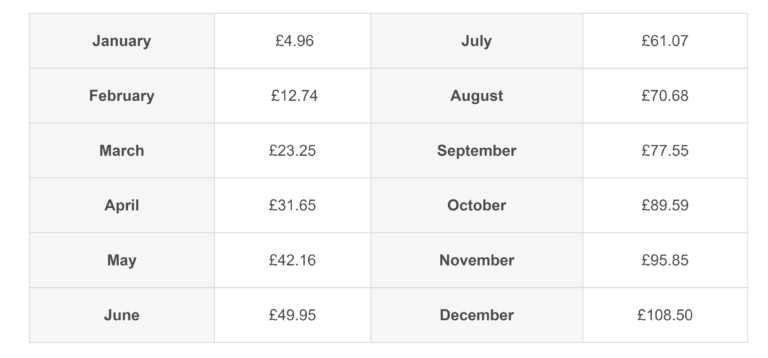

Premium Bonds are the nation’s favourite savings product with a whopping £117 billion saved in them. Until recently Premium Bonds were paying the best interest rate at 1% overall but most people would earn less and sometimes nothing at all.

Premium Bonds are essentially a giant lottery and the more bonds you own the higher your chances of winning. Money Saving Expert crunched the numbers and found that someone with average luck and who had £10,000 worth of bonds would earn 0.75%.

With interest rates on the rise across the board and other savings products now offering more, the reasons to buy Premium Bonds are getting smaller. But all that could change if they raise the prize pool, so let’s see what happens.

#4 – Cash Lifetime ISA

Cash Lifetime ISAs are the go-to savings product for first-time homebuyers. The interest rates available are not great but you get that 25% government boost. But whatever you do, don’t use a Cash Lifetime ISA for your retirement savings. As the decades go by, due to inflation your retirement money will be worth diddly squat.

See here for best rates.

#5 – Regular Savings Accounts

This type of savings accounts is a joke these days; they used to be far more generous! The banks try and draw you in by offering what seems like a headline grabbing high interest rate (often 3-5%) but attach a load of conditions.

The main drawback is usually a ridiculously low monthly deposit limit in the region of £200. There’s no point earning 3% if it’s on a tiny sum of money. And secondly, you’ll usually only earn interest for 12 months, so by the time you’ve slowly drip-fed a meaningful amount of money in, the offer expires. Regular Savings Accounts are probably not worth your time.

See here for best rates.

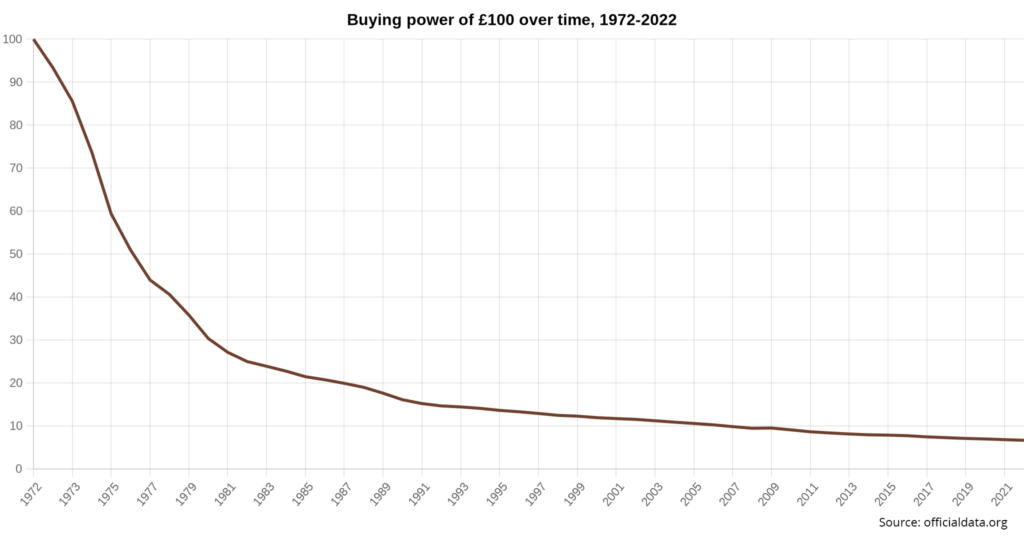

#6 – Buy Gold & Silver

Government money such as the British pound or the US dollar lose value over time due to inflation. Over the last 50 years the British pound has lost around 93% of its purchasing power according to officialdata.org. £100 in 1972 is worth less than £7 in today’s money.

Saving your money and earning some interest on it will limit the loss of purchasing power slightly but during my adult life I don’t recall any year when interest earned was greater than inflation. Therefore, holding cash is a hidden raid on your wealth.

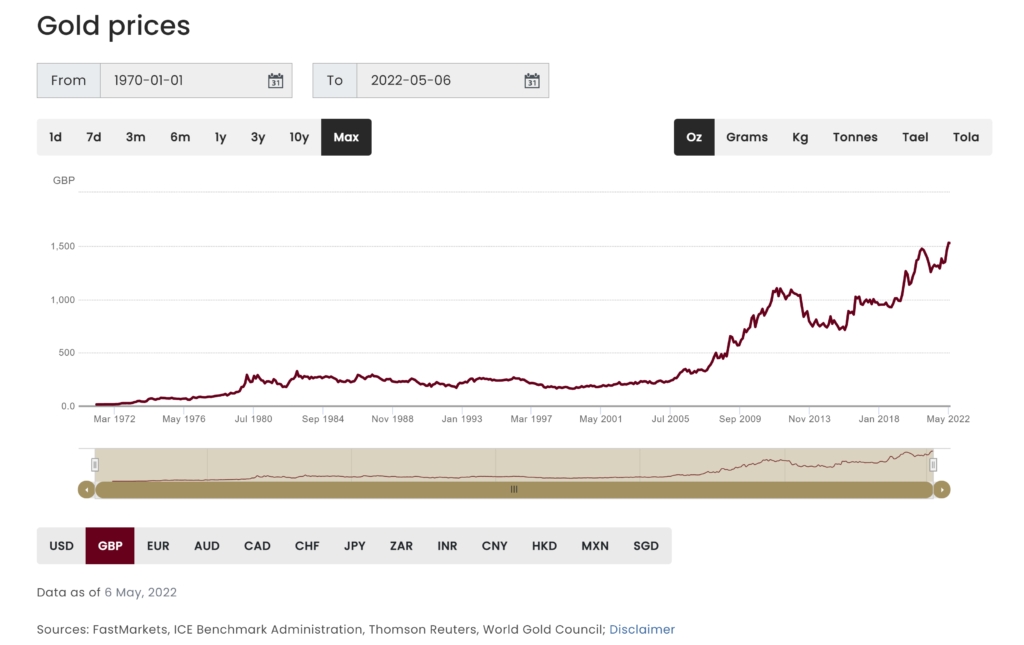

One potential way to preserve that value over the long term is by holding gold and silver instead – which is the original money and has a positive record going back thousands of years.

This chart shows the price of gold in pounds sterling for about 50 years. Although the growth in value is not a straight line there is huge appreciation over time, which is in stark contrast to the declining value of the pound which the previous chart showed.

By the way, new customers can get some free silver and cash when they open a BullionVault account when they follow the link here. BullionVault is the world’s largest online investment gold service. T&Cs apply.

#7 – Money Market Funds

You’ve probably heard of the term but you probably don’t know too much about what money market funds are. A money market fund is a very low-risk investment that gives you a place to hold rather than grow your savings, while aiming to give you a slightly higher return than cash.

They do this by buying short-term debt from governments, banks and companies with strong balance sheets and high credit ratings. You will earn a small amount of interest, all while the capital value of your money stays stable, in theory.

I personally invest in these types of funds when I have money just sitting idle in my investment account. This is because most investment platforms pay zero interest on your cash balance, and a money market fund is a way of at least earning something on your cash.

I invest in the Xtrackers GBP Overnight Rate Swap ETF (ticker XSTR) but if you’re looking for an open-ended fund, then there’s also the Vanguard Sterling Short-Term Money Market Fund.

How Much Cash Should You Have?

The amount of cash you should have is specific to your unique circumstances but if you’re working in a relatively secure job (if there is such a thing), then a general rule of thumb is that you want 6 months of your normal monthly expenses in accessible cash – this is your emergency fund. And that assumes you have no bad debts.

You might also have some additional cash if you have a short-term savings goal, say you’re getting married next year, or you intend to buy a house in 2 years’ time. You shouldn’t invest for short-term goals because you can’t afford the market crashing when you need the money.

For any long-term savings these should be invested because this is the only way to grow it and at the very least you want to avoid that nasty inflation chopping away at it. If you’ve stopped working due to, say, retirement, then you might want up to 2 years’ worth of cash with the rest invested. This should be enough cash to avoid having to sell investments during a downturn.

You Should Invest Or Pay Down Debts

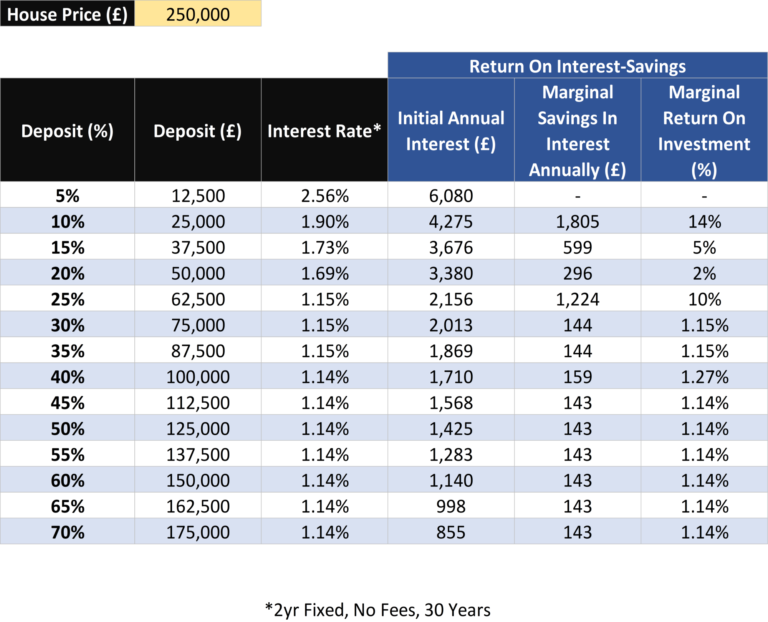

If you agree with me that holding cash is detrimental to your wealth, you will likely want to invest, or else pay down your debts. It’s scary how many people sit on a big pile of cash and continue to pay interest on their mortgage and other debts. This is the sort of behaviour you can only get away with when interest rates are low, like they have been in recent years.

When interest rates are low, I personally choose to invest spare cash (even going as far as to borrow to invest) but as interest rates creep upwards there becomes a point when the risk overshadows the potential returns.

If the expected market return is 8% and the debt costs 2%, then I aim to profit from the difference. However, say the interest rate you were paying rises to 6%, there is little profit to be made but an awful lot of risk. If interest rates rose over 8%, for me, it would be madness to invest if I had debts.

During much of the 70s and 80s interest rates were in excess of 10%, so this is a perfect example of when I would stop investing, stop hoarding cash, and pay down as much debt as I could.

What Are you doing with your spare cash? Join the conversation in the comments below.

Written by Andy

Featured image credit: ullrich/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: