There’s a lot of financial content out there on the internet, TV, in newspapers and in magazines. Some of this content is extremely useful….and some, not so much! Then, we have businesses who are imagining up gimmicky financial products in an attempt to part you from your cash.

In this post we’re going to expose many of the pointless money tips, tricks, hacks, products and habits that are not helping you to become rich, even though common wisdom says that they have a positive effect on your wallet.

Please chip in down in the comments and give your opinions on all of these – we’re sure there will be many more that we don’t cover, so tell us what else you think is pointless too. Now, let’s check it out…

FYI: £50 cash bonuses and FREE stocks listed on the Offers Page.

Alternatively Watch The YouTube Video > > >

#1 – Save A Penny A Day Savings Challenge

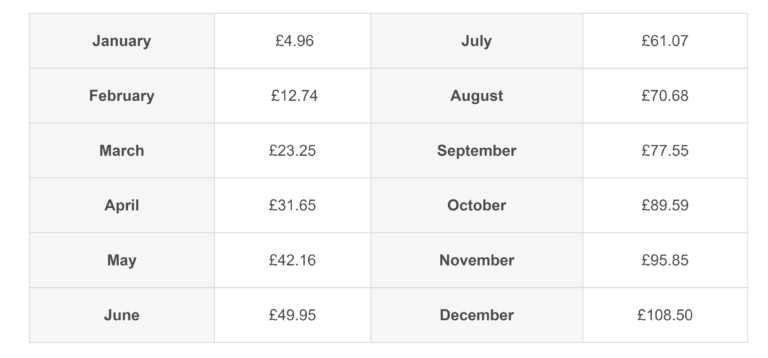

Just thinking about this pointless savings technique winds me right up. If you don’t know what it is it’s a savings technique that rears its ugly head at the very end and beginning of every year. It involves saving 1p on 1 January, then 2p on 2 January, then 3p on 3 January and so on.

Each day, you put aside what you saved the day before, plus a penny more – right the way up to £3.65 saved on the last day of December. It’s supposed to make saving feel easy. Do this for a full year and you’ll have a grand total of £667.95.

So, what’s the problem and why is it pointless? First off, if you’re skint and you’re using this technique to try and save without noticing, you’ll eventually run out of steam.

Each month gets harder and harder. January starts at £4.96 saved and December ends with £108.50.

You potentially could have saved a lot more in the beginning of the year but because of some stupid challenge you chose not to. Then, in the later months – which are typically more expensive due to Christmas and higher gas bills – you are expected to save significantly more, which you may not be able to. And, if you could save more towards the end of the challenge, why would you not at the start?

Our second beef with this nonsense is the practicality of it. Are you literally expected to transfer a sum of money each day into your savings account? Who can be bothered with that administrative ball-ache?

And thirdly, saving and budgeting is meant to be intentional. You should know how much you can afford to save each month before the month begins. The ‘pay yourself first’ budgeting technique – which works – has already handled your savings.

#2 – Round-Ups

This is another pointless savings technique, which we’ve criticised before but apparently is quite popular with young people.

There are a number of apps that offer this gimmicky service. Whenever you spend on your card, your purchases are rounded up to the nearest pound, and the spare change will be siphoned off and added to your savings or investment account. Again, it is supposedly a way to save without noticing.

As before, a good budget has already determined what you can save for the month, so if you’re doing this on top of a budget we have news for you – your budget sucks!

Another reason it’s pointless is because the spare change is not taken instantly. The apps tend to collect every week or couple of weeks, so you’ll have random amounts being deducted when you’re not expecting it, which is no way to control your money.

What’s more, realistically you’re going to save barely any money at all unless you have a serious spending problem. Most items you buy are priced ending in 99p or 95p, so you could literally be saving pennies on each transaction. Have you ever heard of a rich man who made his money via round-ups? No, we haven’t either.

If you want to save money, then save money intentionally, and save big. It’s counter intuitive to link spending and saving in this manner. Before we move on, we want to say that if you refuse to save intentionally, then please do carry on using both of these pointless savings techniques because they are at least better than nothing… but only just.

#3 – Credit Card Points

We both love reading books on personal finance and investing on the off chance we might learn something new or get a new perspective. Recently I’ve been reading the UK version of the book ‘I Will Teach You To Be Rich’ and the opening chapter about credit cards made me mad. The author was banging on about getting credit card points, which here in the UK is almost non-existent. A few years back you could earn a few percent cashback but today, you’ll be lucky to get 0.5%, which just isn’t worth the hassle.

The highest paying cards are Amex, which are not accepted everywhere in the UK, which means your spending needs to be split over multiple cards making budgeting more painful than it needs to be. The reason you earn points in the first place is because the card providers have calculated that you will spend more. They’re not charities and don’t give away money for nothing.

#4 – Chase The High Interest Savings Account

Back in the day when I was younger and the interest on savings accounts and Cash ISAs was actually good, I used to take the time to move my money around to the account which paid the best interest or at least make sure I was earning a competitive rate.

Today though, what’s the point? The top cash ISAs currently pay around 0.6%, which means if you have £10,000 in savings, you’ll earn a miserly £60 in an entire year. The interest you earn on your cash savings is almost irrelevant anyway. The bulk of your money should be invested in the stock market, property, or wherever else you feel will provide a decent return.

The amount you hold in cash should be a small emergency fund and whatever you have put aside for irregular or non-monthly expenses such as savings for a holiday or Christmas.

Far better we think, to accept the likely measly interest paid by the same bank that you use for your current account, and here’s why:

- Instant Access – you can shift money at a moment’s notice, which is vital when it’s your emergency fund. Nothing infuriates me more than when I send money to different banks and the money is lost in the ether for a day or two. Show me the money!

- In One Place – When your savings and current account are together with the same bank you can easily monitor it all at the same time, in one app, which is super convenient. Personal finance is complicated enough without having to login to yet another app.

To boil it down, with interest rates as low as they are, choosing a savings account should really come down to choosing the best current account for you, and taking whatever easy-access savings account is offered by that same bank.

#5 – Life Insurance If No Dependants Or Family

We believe that insurance is usually a waste of money if you can afford the consequences easily or if there are no consequences. So, in the case of Life Insurance, which is designed to pay out a sum of money upon your death, if you don’t have dependants, then it’s pointless taking out a policy.

The primary reason for Life Insurance is to ensure your spouse or children are financially taken care of in the unfortunate event of you dying prematurely. You may also have retired or sick parents who rely on your financial support for care and survival. In these cases, Life Insurance is of vital importance.

However, if you’re young and single with none of the responsibilities mentioned, then Life Insurance is likely to be totally pointless for you. If your situation changes, then you can get it then.

For those of you watching with dependants, then Life Insurance is likely to be critical. Visit our Life Insurance page to learn more and get a quote from our preferred partner.

#6 – Turning Plugs Off At The Wall

China’s power stations and factories are spewing out millions of tonnes of toxic gas and fumes, but Dorris thinks she’s saving the world by turning off her appliances at the wall. She thinks that standby light is causing global warming and she’ll also save a small fortune in energy bills.

Sorry Dorris, that just isn’t true. The Energy Saving Trust estimates that you could be paying around £35 a year for devices you’re not actually using. In the usual media hysteria, every article I’ve seen thinks this is enough justification to convince you to switch everything off when you’re not using it. That’s not even 10p a day making the entire exercise completely pointless.

Moreover, many devices such as TV’s, which are likely to be the worst offenders for energy usage in standby, are programmed to carry out software updates at night, so leave them plugged in for goodness’ sake.

#7 – Ethical Investing

We know, we know, we must be monsters. First, we’re saying leave your TV on standby and now we’re saying ethical investing is pointless. What evil will we say next? Well hear us out.

Ethical investing has grown in popularity in recent years and there are now many ETFs or funds badged with an ethical sounding name and objective. But everything is not what it seems.

Due to the surge in popularity for ethical funds it is being claimed that fund managers are taking shortcuts in order to meet this demand, which has led to some potentially less ethical funds being mis-labelled. Apparently, the underlying investments of the so-called ethical funds are actually little different from similar mainstream funds that are from the same fund providers.

One such case involves Vanguard, which runs the £389 million fund SRI European Stock. This fund is designed to mirror an index comprising 614 listed European companies, while excluding companies in the index which do not meet socially responsible criteria. Just 25 of 614 companies have been screened out. That still leaves an abundance of stocks in the SRI European Stock fund that most investors would expect to be routinely excluded from green ethical funds.

For example, still included are alcohol companies (the likes of Heineken and Carlsberg); gambling businesses (Entain and Evolution); mining giants (Rio Tinto and Anglo American); and oil producers such as BP and Shell. It even includes building supplies company Kingspan, criticised in the Grenfell Tower inquiry.

If socially responsible investing matters to you, then you should go back and re-evaluate your fund selections, because the name seems to matter little. Your intended ethical investing to date may have been pointless as the fees tend to be higher and you’re not getting what you paid for!

#8 – The Lifetime ISA

The Lifetime ISA is in some cases a very useful savings product but under certain circumstances if you’re not careful it can be not only pointless… but damaging to your money goals.

The Lifetime ISA is designed for two purposes: first-time home buyers and retirement savers. But if you’re one of these, don’t just assume a Lifetime ISA will help you.

The reason why it’s pointless for some first-time buyers is because it has a limit of £450k on the purchase price of the property. In many areas of the country that is way too low; you don’t get much home in London on that kind of budget for example.

Also, because of the cost of moving home – particularly due to excessive stamp duty – and the trend of starting families later, some people choose to skip the typical cheap starter home and buy a larger family home as their first house.

In these situations, your first property may exceed the £450k limit on the Lifetime ISA but now you can only access the money by incurring a massive financial penalty, which is ridiculous.

The problem is amplified because the limit is not tied to inflation or increasing house prices and they tend to rise fast. There is every chance that when you first start saving for your first home the house you desire is say £300k but by the time you are ready to buy – say in 10 years’ time – the house could easily exceed the limit. A £300k house growing 5% for 10 years would be worth £489k.

So, if you’re using a Lifetime ISA consider very carefully whether it’s fit for your needs.

What other money tips, tricks, hacks, products and habits are totally pointless? Join the conversation in the comments below.

Written by Andy

Featured image credit: Linda Bestwick/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: