The State Of The Housing Market

If you were thinking that everyone else seems to be on the property ladder but you’re not, then know that you’re in good company because the reality is quite different. One in three of the millennial generation, born between the mid-1980s and the mid-1990s, are expected to never own their own home, according to the Guardian.

The FT stated that in early 2021, the average house deposit for a first-time buyer reached almost £68,000, which was around £18,000 more than in 2019. That’s deposit inflation of 36% in just 2 years.

How Much Should You Spend On A House?

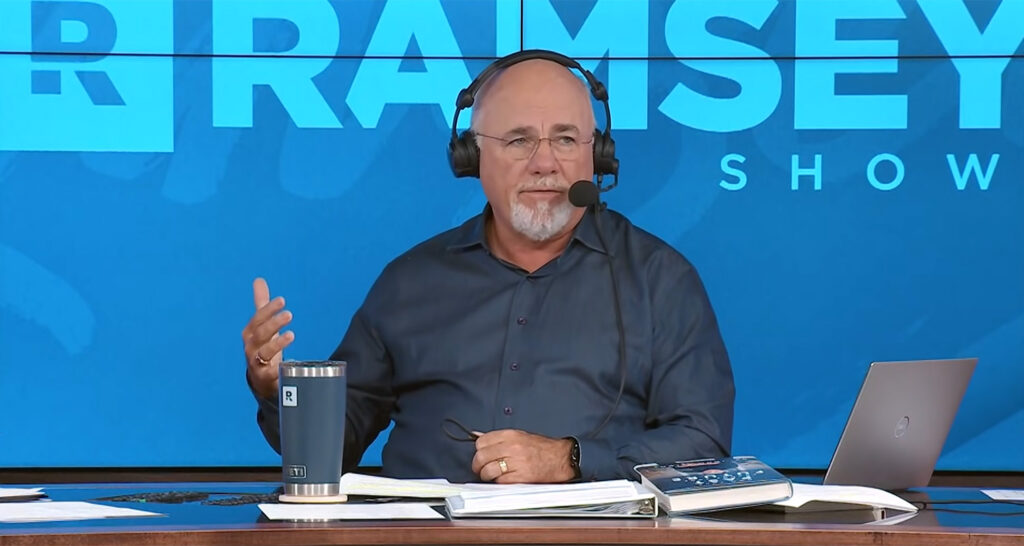

Dave says you want a 15-year fixed-rate mortgage where the payments are no more than 25% of your monthly take-home pay. In fact, that 25% should include all your housing costs such as property taxes, which is essentially the US equivalent of our council tax. So as a couple if you earned £4,000 after tax, then your total housing costs would be no more than £1,000 a month.

He goes on to say that “the reason your mortgage payment should never be more than 25% of your monthly take-home pay is because you’ll have plenty of breathing room in your budget to tackle other financial goals—and keeps your house from owning you.”

Straight off the bat we have multiple problems with this. Firstly, we don’t know what the US mortgage market is like, but we checked a big mortgage comparison site in the UK and there seemed to be only one lender offering 15-year fixes, which was way more expensive than a typical 2-year deal. At time of writing a 2-year fix might cost 2% a year, whereas fixing for 15 years would cost around 3.7% a year.

To be fair, although this seems like a huge difference, 3.7% might turn out to be cheap considering the expected direction of interest rates right now, but first-time buyers need every upfront cost saving they can get their hands on.

Plus, we would never encourage anyone to lock themselves into a deal for more than 2 years, let alone 15. The fact is that relationships breakdown often forcing you to sell the house; the person you love right now could be impossible to live with in a few years’ time. The UK divorce rate is estimated at 42% and almost half of these breakups tend to happen in the first decade of marriage, when you’re buying that first house together. Our bet is that the number of breakups outside of marriage is even higher.

The problem is that mortgage fixes always come with horrendous early repayment charges. In this case it would be 5% in the first 5 years. That would be a £15,000 penalty if the mortgage outstanding was £300,000. These might be incurred if you had to sell the property. You can often avoid these if you move the mortgage to another house, but you must stick with the same provider, limiting your options.

Also, Dave is also saying that the mortgage should be paid off in full by the end of this 15-year fix. But let’s not forget to mention that a 15-year mortgage term is ridiculously short for a first-time buyer – almost laughable. Most people in the UK can’t even get on the property ladder with 30-year terms, which have more affordable monthly repayments.

With house prices surging, one of the only levers to pull is to extend the mortgage length in order to reduce monthly payments. It’s a must! In this example (Debt: £250,000, Interest: 3.5%) monthly mortgage repayments would be £665 more based on a 15 vs a 30-year mortgage term (£1,788 vs £1,123).

Another point Dave misses is that even if you want a short mortgage term (some of you will) it’s often better to get the longest mortgage term you can get and make overpayments (make sure you get a mortgage that allows this without penalties).

If you get a short term, you are contractually obliged to make those payments, whereas overpayments are optional. If you default on your mortgage you run the risk of having your home repossessed. Life will throw a lot of curve balls, so there’s no need to tie your hands for the same end result.

How Big Should Your House Deposit Be?

Dave recommends a 20% deposit as it gets you out of paying for private mortgage insurance. However, as this seems to be a US specific insurance, it doesn’t apply to us in the UK. Nevertheless, he says if you can’t do 20%, that’s okay but don’t go any lower than 10% – otherwise you’ll be stuck paying extra in interest and fees, putting you further in debt for decades!

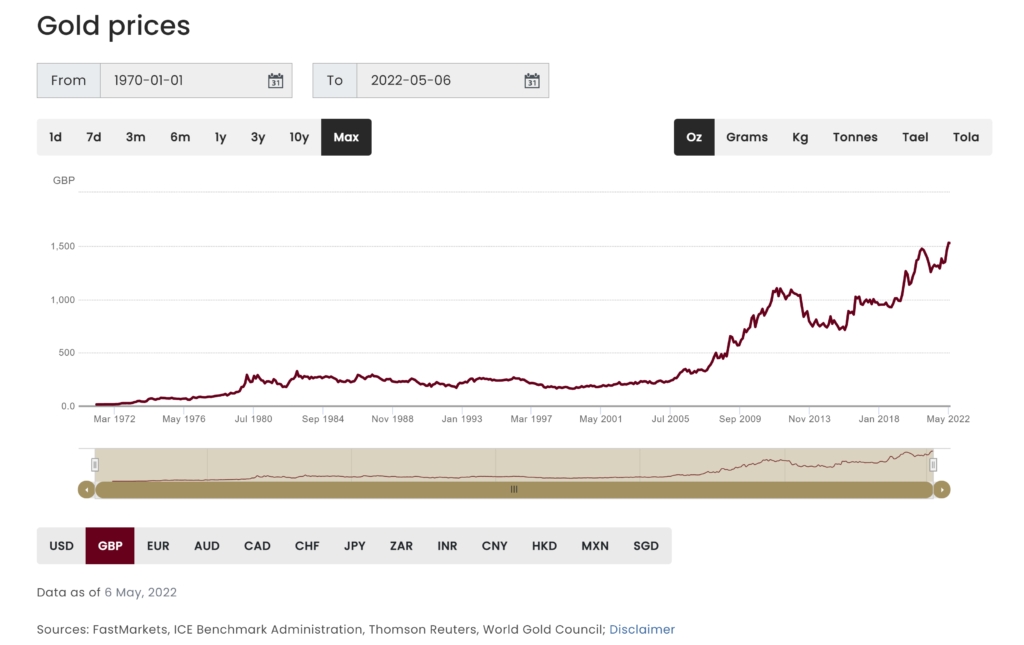

Our views on mortgage debt, especially cheap mortgage debt differs from what Dave believes. He considers mortgage debt to be a necessary evil, but when interest rates are low, we consider mortgages to be an incredible wealth building tool.

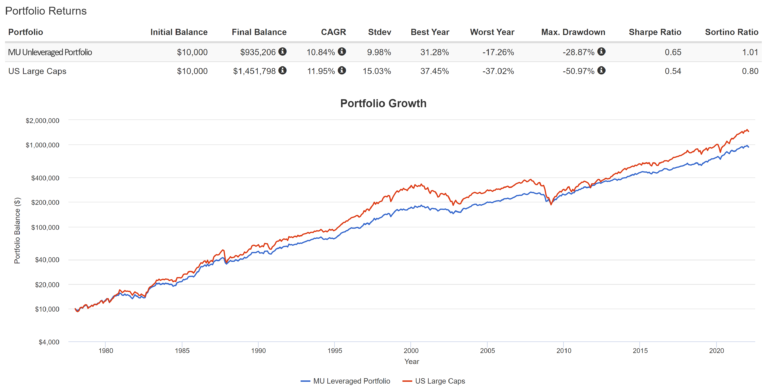

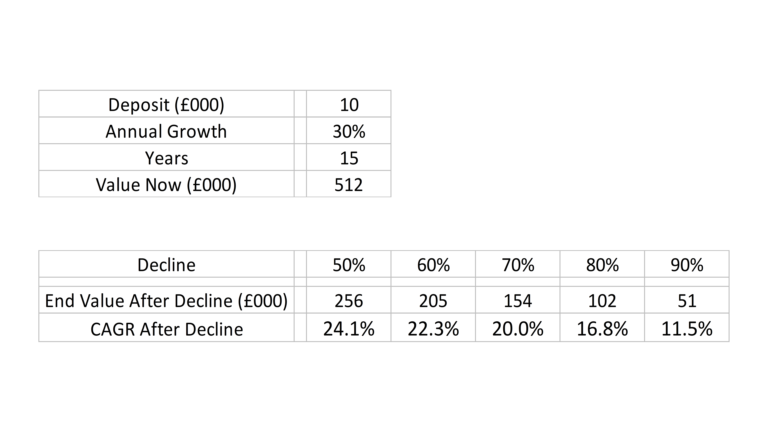

If you can earn 8% in the stock market on average but only pay 2% on your mortgage, then over time your wealth could be hundreds of thousands of pounds higher by choosing to pay as little as you can on the mortgage and investing this instead.

This doesn’t mean put down the lowest deposit possible though. Due to banks giving preferential rates to those with more equity, we previously calculated that the optimal deposit size or house equity was somewhere between 10-25%, and anything over this was wasting an opportunity to invest with dirt cheap money.

It’s important to note that the optimal mortgage deposit size depends on your specific circumstances and prevailing interest rates. If you want the full explanation of how we worked this out so you can calculate it for yourself, we go into some detail in these videos (here and here), so these will be worth watching next.

Because mortgage debt is long-term – it can be up to 40 years – this is enough time for any stock investments to ride out any bad years. Dave Ramsey must believe this to a certain degree because even he recommends paying 15% of your household income into retirement savings before paying down the mortgage early.

How Long Should It Take To Save A Deposit?

Dave says it should take no more than 2 years to save a deposit. Again, this might be reasonable in the US – we don’t know – but in the UK we can’t imagine many people being able to do it in 2 years. As we said earlier, the average age of a first-time buyer in the UK is 34, and we think most people will start actively saving from their mid-twenties. The fact of the matter is you will need tens of thousands of pounds which for most people will take several years.

Where Should You Save The Money For A House Deposit?

Dave’s recommendation is a US specific product called a money market savings account but in the UK that would just be savings account. And we agree. If you can save for the deposit in a few years, then stash the cash in an easy access savings account, Premium Bonds, or a Cash Lifetime ISA if the house price will be below £450,000. You can’t risk losing your home purchase by investing the cash and seeing it fall in value.

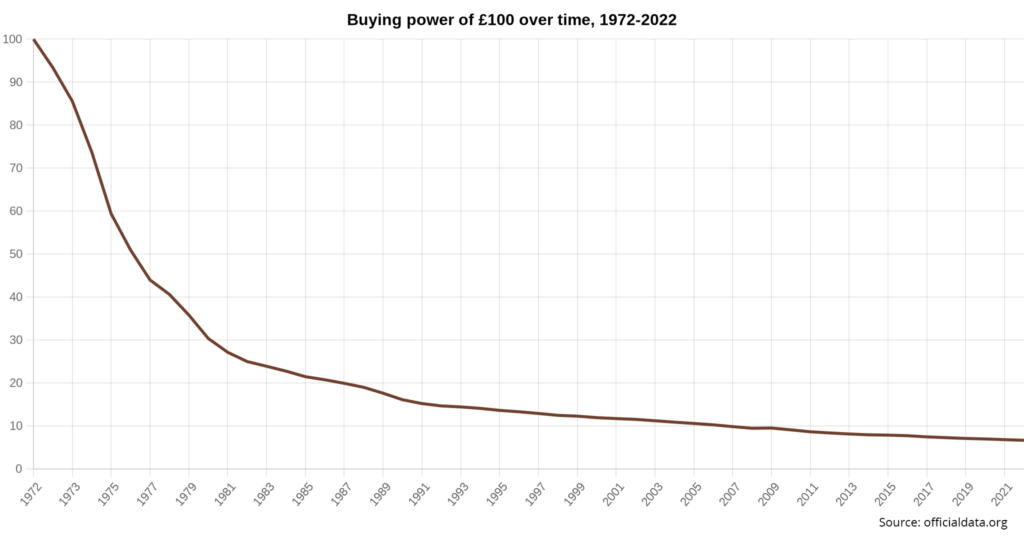

We know that inflation is killing that cash while it sits there. But we think this is one occasion where we wouldn’t be happy to wait a decade for the stock market to recover if it halved in value right before we wanted to purchase a home.

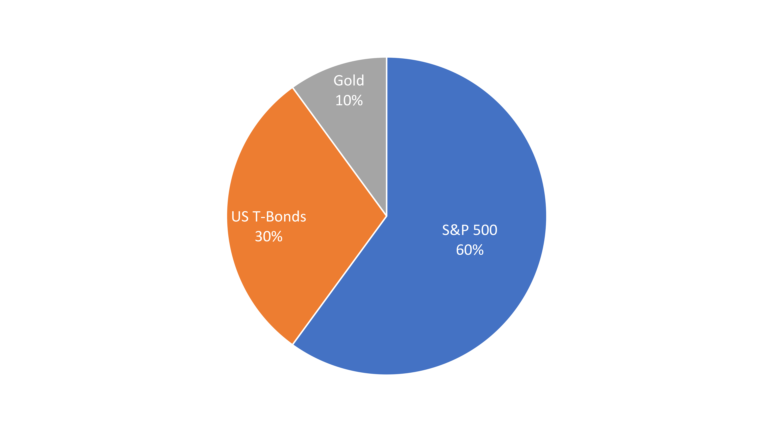

The exception might be if, realistically, you know it will take many years to save for. When the dream of buying your own home is looking at least 5 to 10 years away, then you might think about investing in the stock market instead, perhaps with some bonds to reduce portfolio volatility.

Streamline Your Budget

This is Dave’s fancy way of saying, “cut all joy from your life and live like a pauper”. Some ideas from Dave include taking a break from the gym, stop eating out, and stop buying clothes, amongst other things. Apparently, these alone could save you in the region of £450 a month.

Yes, you probably could make some savings, but this sounds like a massive exaggeration for most cash strapped people who are likely already watching what they spend like a hawk.

Some expenses might even help you save money elsewhere; Netflix is cheap and could alleviate boredom, so you don’t go out and spend even more. Same with the gym. If you’re spending 4 days a week working out, at least you’re not going elsewhere and having more money escape from your pocket.

We definitely agree there should be cuts where possible – just remember you might be saving for many years, so make sure you’re still living a life worth living.

Temporarily Pause Your Retirement Savings

In a surprising twist Dave says it’s okay to temporarily pause your retirement savings. Just make sure this is only a one-to-two-year detour, not a five-year pause! This means that Dave Ramsey’s 7 Baby Steps is really more like 8 steps, with saving for a house deposit slotting in as the new number 4.

We would tend to agree with cutting down on the retirement savings if the timeframe was short, except we would always take advantage of any employer matched pension contributions. Most employers will only match 3% to 5% so whatever you save into your employer pension shouldn’t be too much of a drain on your house deposit savings. But as this matched contribution is effectively free money you don’t want to miss out on this.

Boost Your Income

If you’re familiar with Dave Ramsey you’re probably anticipating that he will say, “get a 2nd job, like delivering pizza during the night!”. And Dave does not disappoint.

Never mind that Americans already work on average 47 hours a week, Dave now wants you to take the graveyard shift at Dominoes. Sleeping and some recovery time is obviously seen as a luxury at Ramsey Manor.

Here in the UK maybe there’s a little more scope for some extra work – the average hours worked comes in at 42 hours a week, but unless it’s a hobby you’ve managed to monetise, we wouldn’t want to do this at all. Going gazelle intense as Dave would say might be a short-term solution for someone drowning in debt but it’s a tall order for someone who just wants to own a home.

As for what second job you should take, not to worry, Dave has some suggestions. Apparently, if you like driving, get a second job with Uber. Because as we all know, cruising down a nice open country road is the same as ferrying drunks around in the back of your cab at 2am in the morning.

For those of you who don’t mind working all hours, then don’t let us stop you. We ourselves effectively had a second job while we got the Money Unshackled YouTube channel off the ground, but this was a hobby at the start.

Perhaps a better money-making option is to double down on your existing job. Can you get a payrise or a promotion, or do some paid overtime? At least this way the extra effort will help boost your primary income and your reputation with the boss, which could have longer lasting effects.

Cut The Extras And Save Even More

Dave has already slashed your day-to-day budget but evidently that wasn’t enough. Now, you must skip the summer vacation as well. He might be on to something, but we’d first look to see if you can still go on holiday but find somewhere cheaper. You don’t need to spend several grand going to Disneyland Florida when you can go to Tenerife for a fraction of the price and still have a wicked time.

Dave also says to sell some stuff. I bet most people will think this is a waste of time or their stuff isn’t worth jack, but I’ve been clearing out loads of clutter and have already made around £2,000 with more stuff to go. By the time it’s all gone I reckon I will have made £3,000. A couple could have double this!

How realistic are Dave Ramsey’s tips on saving for a house deposit? Helpful or out of touch? Join the conversation in the comments below.

Written by Andy

Featured image credit: YouTube