One request we get quite frequently is to do an update on our leveraged strategy – and if you don’t know what this is, not to worry, we’ll give a quick summary to catch you up. At first, we were reluctant to do this update so soon because the strategy’s performance will basically return the same as the market multiplied by whatever leverage was applied, which in our case was a very risky 3x.

But given recent events in the markets driven by the atrocities in Ukraine by Russia we wanted to address any worries you may have if you were implementing the leveraged strategy for yourself.

We had always wondered how we’d react if and when the markets tanked, and we were nursing big losses. The war is the first serious threat to our portfolios in a long time, which is scary enough when you just invest in ETFs or stocks but is downright terrifying when you are leveraged.

We won’t be covering the awful humanitarian crisis and the horrors of the war in this post but instead will focus on the stock market impact. This is in no way to downplay these serious issues, but these are well covered elsewhere in the news and social media.

We are going to revisit the risks of our leveraged strategy and consider whether we should reduce the risk in light of real-world events. Our backtesting had previously warned that we may face losses of up to 90% at 3x leverage.

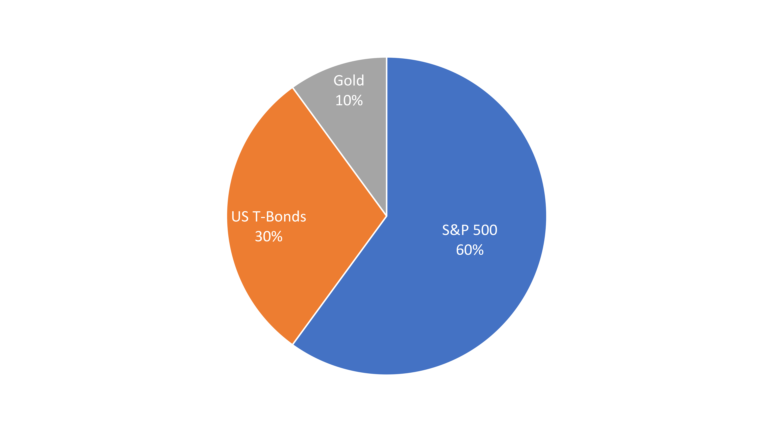

We’re going to look at my overall performance so far (early Mar 2022) and also break it down by the component parts of the portfolio, which was the S&P 500, long-term US treasury bonds, and gold. We’re going to talk about what’s worrying us right now and the reasons still to be bullish. Now, let’s check it out…

FYI: £50 cash bonuses and FREE stocks listed on the Offers Page.

Alternatively Watch The YouTube Video > > >

As always, check out all the offers for free cash, free stocks, and discounts to many investment services and apps at the Money Unshackled Offers page. We’re always updating this with more goodies and bonuses, so if you’ve not visited in a while check that out!

A Quick Catchup On The Leveraged Portfolio

Essentially, we’re borrowing money to invest with the goal of making massive profits. History tells us that we could make up to around 33% annual profits less any fees. This might sound super risky, but the risk depends on what return you want and the amount of leverage you use, and there are some solid reasons why borrowing a small amount of money to invest can actually lower your overall risk and increase your returns.

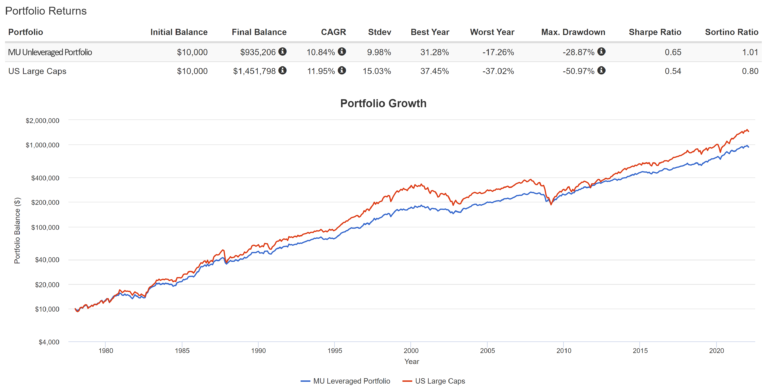

The portfolio we’re both using is 60% S&P 500, 30% Long-term US Treasury Bonds, and 10% Gold, and applying 3x leverage. We ran some extensive backtesting on this portfolio to see how it would perform with no leverage and benchmarked it to an index consisting of just US large caps, or in other words the S&P 500.

Over 43 years the unleveraged portfolio returned nearly 11% per year, not that much lower than the 12% from US large caps. However, it did this with significantly lower risk, measured here by the standard deviation, which is the volatility. Volatility is what usually kills investors using leverage, so we want to keep this down.

Note, that despite the small difference in annual returns, over 43 years the difference between the final balances is huge.

In a nutshell, this is why we are using leverage to improve our returns because every little increase to your annual returns will have a colossal improvement to your overall gains.

The portfolio’s worst year was a loss of just 17% compared to a massive loss of 37% for US large caps. And the max drawdown, which is the total decline from peak to trough was just 29% for the portfolio vs. a whopping 51% for US large caps.

Remember that these percentage gains and losses will be multiplied by the leverage factor you use. With a max drawdown of 29% this would be a nearly 90% loss with the 3x leverage we’re using. For a full guide on how we use leverage check out our Spread Betting posts, here, and here.

My Performance So Far

Since June 2021 I have deposited £12,400 and I have been drip feeding this money in on a bit of a sporadic basis – usually every month or two. With this cash I have opened up positions that at their peak were worth about £39,000.

I don’t record my profits or losses daily, but I do tend to value the portfolio about once a month. During December I was sitting on nearly £1,500 profit and at the time I had only invested £10,000, so I had made a huge profit in just 6 months.

Amazing! At this rate – with this strategy – we’ll all be millionaires in no time. Sweet!!!! Hang on, hold your horses, this is a leveraged strategy, so any downward swing will hit the portfolio hard and could easily erase all those gains. And it was about January or February time when things started to get bad.

First, we had inflation worries. Energy prices were surging, food prices were going up, and inflation was hitting highs not seen in 30 years. Inflation is particularly bad for speculative stocks because the value of those future profits is worth less – and the US market is full of these types of stocks. Some US stocks were getting hammered and the overall market began to fall – with the S&P 500 going from around 4,800 to around 4,300 – about a 10% decline.

The leveraged portfolio would surely be okay though, right? It’s got 30% allocation to treasury bonds after all, which are purposely in the portfolio to hedge stock market declines. Well, the bonds have been getting hammered too.

The usual way to tackle inflation is to raise interest rates and even just expectations of this will cause bond prices to fall as they have been doing over the last few months. Rising inflation is worrying but it’s the sort of thing that we would expect Western economies to be able to handle and therefore we weren’t overly concerned.

However, stories were also coming in that Russia was building up troops, tanks, planes, and all the military support that would be needed to mount an invasion of its neighbour Ukraine. The stock market was getting jittery.

By this point my near £1,500 profit had swung into a £500 loss, and I believe it was a £1,500 loss on the first day of the invasion. The point we’re trying to make is that the success of our leveraged spread betting strategy cannot be measured in such a short time period as massive gains (percentage wise) can become massive losses in a matter of days.

In early March 2022, my position in the S&P 500 had fallen just 1.2%. This seems so low because many of the investments were made months ago when the S&P was much lower than its peak.

The treasury bonds have fallen 5.3% but Gold however is up 6.5% and earns its place in the portfolio. Gold was intentionally included to save us in the event of a crisis, which at time of writing we certainly look like we’re in.

Why We’re Worried

We have a few big problems with our leveraged investment strategy. The first is the limited backtesting that we’ve run. Unfortunately, for these assets we can only test performance going back around 43 years using the resources available to us.

This might sound like a lot, but this time period does not cover all the events that could happen. Inflationary cycles, economic booms and busts, deadly pandemics, natural disasters, and war, amongst many other things, may not have happened during this time. Yes, we have had a pandemic, but Covid is not exactly the black death.

We honestly thought that World War 3 would never happen but based on recent events you can never say never. Is nuclear war a real possibility? We don’t know but what we do know is that events like this are not factored into our use of 3x leverage.

Other than the small exposure to gold, the portfolio is entirely dependent on the US stock market and bond market, and even though the stocks will have global exposure it is still very risky to put all your eggs in 1 basket, or market in this case.

On the day Russia invaded Ukraine, Russia’s stock market plunged 33% in a single day but it’s intraday low was a crash of 45%. If we had been doing our leveraged strategy with Russian indexes we’d have been wiped out. Who’s to say that a freak event couldn’t do the same with the US market? Yes, this seems much less likely, but we have to acknowledge that it’s always a possibility, no matter how slim.

The second problem that concerns us is bond prices and the low yields. Bond yields have already been rising recently due to high inflation and anticipated interest rate hikes, which causes bond prices to fall. It seems unlikely that bonds will provide the same level of insurance to the stock market as what we’ve experienced in the last 40 years or so. Over this time, the US Fed interest rate has come down to record lows. The only direction it’s going now is up and that’s bad news for bonds.

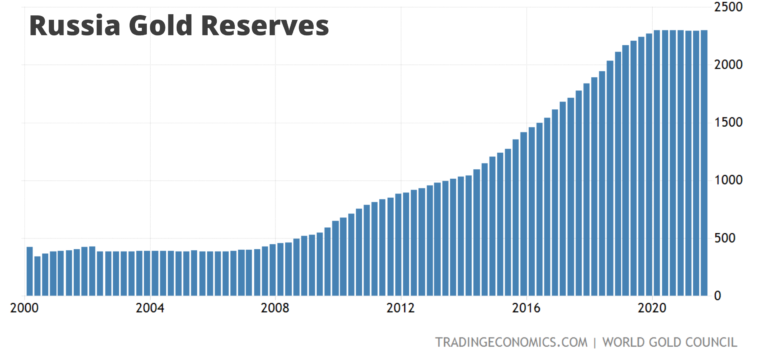

This is hardly news to us, which is why we added gold to the portfolio despite gold not having any significant effect over and above the insurance properties of bonds in our backtesting. So far, our gut feeling to include gold has paid off but recently we came across this chart that could change everything.

The chart shows the gold reserves of Russia since the year 2000. Up until the financial crisis around 2008 their gold reserves were flat. Since then, they have more than quadrupled. With a bit of hindsight our guess is that they were preparing for war.

You could argue that the Ukraine invasion has been 14 years in the making. Wars are expensive and what better way to fund a war than to raise money by selling your gold. Gold is real money and always has a buyer. So what does this mean? Our guess is that there will be tonnes of gold flooding the markets if Russia needs to raise money, which will put huge downward pressure on the price of gold.

To put it into context, there is approximately 34,900 tons of gold reserves in the world and Russia’s central bank has 2,300 tonnes – that’s 6.6%. Conversely, gold has always been a safe haven in times of panic, so the price could in fact rise even if Russia were offloading their reserves.

My third concern is whether I could stomach big losses to my leveraged portfolio. So far, having only put in just over £12,000 I wouldn’t be devastated if I lost the lot. In the grand scheme of things, it’s not that much money and I’m still young, so could rebuild. However, as I continue to build my leveraged portfolio there will probably become a point where the risk of loss is too much. I don’t know yet how much money I would need invested to start feeling uneasy.

Why We’re Bullish On This Strategy

We’re not going to repeat what we’ve said in other videos because you can go back and watch them but let’s look at some other key points:

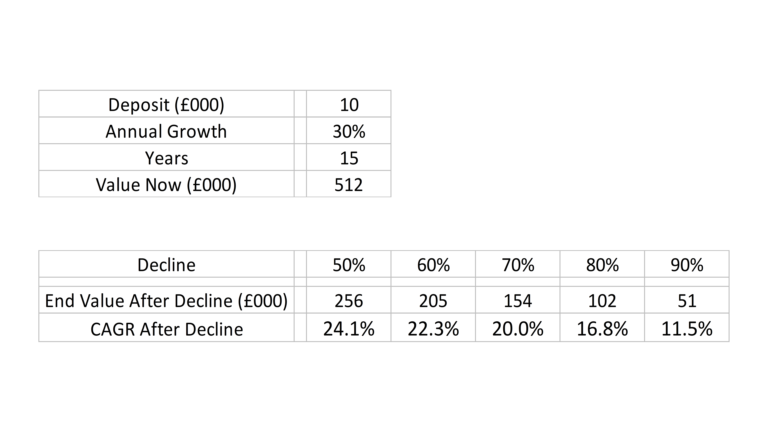

Firstly, the risk of losing your original capital is much higher at the start. But in theory when you’ve been running the strategy for a long time, say 15 years, losses will likely just eat into your gains. And even with what would seem like a catastrophic decline you would still likely have way more money than what you could get from an unleveraged investment.

Say you had £10,000 and earned 30% leveraged gains for 15 years, but then suffered a 90% decline. Your original £10,000 would still be worth an awesome £51,000, which is still an 11.5% compound annual growth rate despite the massive loss at the end. The table you see here is the annual growth rates earned after various declines. There is a lot of assumptions in this, but it goes to show that time with this leveraged strategy reduces your risk to your original capital significantly even if it doesn’t play out exactly like this.

We’re also bullish because new contributions reduce your overall amount of leverage. Say you had invested with 3x leverage, and the market fell, and your portfolio was now 6x leveraged. When you add more money at 3x leverage you dilute your existing portfolio, bringing it slightly closer to your target leverage. This is a key reason why we continue to add to our leveraged portfolios even when the market is down.

And what’s more, this strategy is very different to dumping money into high-risk stocks or crypto because we’re investing in whole indexes of stocks, bonds, and gold, in a precise mix that has been designed to weather any market crash, and to massively increase in value over time. Those other strategies rely on hope. Ours relies on data.

What do you make of our leveraged strategy? Are we bonkers or geniuses? Join the conversation in the comments below.

Written by Andy

Featured image credit: Andrey_Popov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: