In this post we need talk about the impending catastrophe that is the state pension. We’ve said it before and we’ll say it again, don’t expect the state pension to be around when you retire. Even if the state pension is not completely scrapped it will be heavily cut by at least one of many methods available to the government. It’s practically a certainty!

We’d assume that most people who watch our videos have some money invested, even if it’s just a little. Well, you guys should be especially concerned about future changes to the state pension because its people with money who will be most in the firing line.

We don’t think the impending retirement disaster gets anywhere near the amount of coverage that it needs. Our guess is that the media don’t mention it because it’s a story that’s been slowly growing for a generation, and it always seems like tomorrow’s problem. But if the media don’t mention it the government won’t feel the pressure to act.

The whole country is always preoccupied with more pressing issues – a few years ago it was Brexit, then it was Covid, and right now it’s war and rising inflation and the cost of living. How much longer can we kick the can down the road?

Today we’re looking at the importance of the state pension, why it will almost certainly be scrapped or changed for the worse in some way, what will likely happen in our view, and how you can prepare for the inevitable. Now, let’s check it out…

The video version of this post was sponsored by Penfold. Penfold is a fully digital pension service and offers four investment plans, with their most popular being the Lifetime plan, which automatically adjusts the risk level of your investments over time as you approach retirement. Open an account with penfold via the link found on the MU Offers page and you’ll get a £25 bonus added to your account. T&Cs apply, and as with all investments your capital is at risk.

Alternatively Watch The YouTube Video > > >

Why The State Pension Matters

From April 2022 the state pension will be around £185 a week, which is £9,628 a year, or about £802 a month.

According to Which? research two people would spend £26,000 a year to achieve a comfortable retirement, which buys you some lower-end luxuries, such as European holidays, hobbies and eating out. A couple would need £41,000 a year if you included luxuries such as long-haul trips and a new car every five years.

We’re going to largely ignore what Which are saying is needed for an Essential lifestyle (£18,000), which allows no luxuries whatsoever, as merely surviving is no way to live. We imagine nobody watching our videos would be content with so little. But it’s interesting to note that a couple could theoretically survive with just 2 state pensions and no savings of their own. According to research by unbiased.co.uk, one in six people over-55 have no pension savings whatsoever, so the state pension is a lifeline to them.

Running with the £26,000 figure for a comfortable retirement would likely require an investment pot of £650,000 by our calculations. Let’s be frank, most ordinary people have no chance of ever achieving this.

But if we take into account the 2 state pensions that a couple would receive that means they only need to fund £6,800 a year from their own investments. This lowers their required investment pot to just £170,000, which is much more achievable, and means the state pension for a couple is effectively the equivalent of a £480,000 investment portfolio for the income it provides.

Essentially when combined with private pensions the state pension has the power to lift people out of poverty and into relative comfort. The state pension is not just a safety blanket – it’s transformational, turning a basic retirement funded by private pensions alone into a comparatively lavish one.

Going forwards people are likely to be even more dependent on the state pension than what these numbers suggest. The research carried out by Which was conducted by speaking to existing retirees but based on generational changes we’re predicting that peoples’ finances on average will be far worse than the existing crop of retirees.

For a start, if you are retired and own your own home outright, then you don’t need to worry about paying any rent, but can this achievement be assumed to be replicated for those still of working age today? Housing costs make up a huge portion of your budget, so all those numbers we just discussed should be hiked upwards for those who won’t own their home.

This is super important because there are decreasing numbers of young people who own homes. In 1991, 67% of the 25 to 34 age group were homeowners. By 2011, this had declined to just 43%. More recent data showed that people in their mid-30s to mid-40s are three times more likely to rent than 20 years ago.

These trends are likely to have a double impact: more people will be forced to pay rent throughout retirement, perhaps requiring an extra 10 grand a year of pension income to reach a comfortable lifestyle; and they are likely to save less during their working years as rent payments always rise over time. The inevitable result of which is them needing the state to bail them out in their old age.

Why You Can’t Rely On The State Pension

The age you receive the state pension depends on when you were born; the age will rise to 67 by 2028, and according to the government’s own prediction it should rise to 68 by the mid-2030s, and 69 by the late 2040s. The age is already being slowly increased, so it seems a given that we should expect further rises.

The current cost of providing the state pension is greater than the money being collected in national insurance contributions, and according to FTAdviser the difference is being funded by Treasury grants that are limited to 17% of the year’s expenditure, and even with these payments the Government Actuary’s Department estimates that the UK’s state pension fund could run dry by 2033.

The cost of the state pension is now at £100bn a year and is rising rapidly year-in, year-out. The country is underfunded in so many areas such as the NHS and policing (and everything else come to think about it) that you have to wonder how the government can continue paying out such an expensive benefit.

With rising tensions and a clear threat from a changing world order it’s very important that we spend more money on our military. Not doing so would be dangerous and irresponsible. Cuts elsewhere will need to be made.

The state pension is effectively a gigantic pyramid scheme. When you pay national insurance, this isn’t put aside for your future, no, no, no. This is spent immediately on existing pensioners. Your future state pension relies on future generations paying for you. With the current setup you’ll likely be relying on kids who haven’t even been born yet to toil in factories and office buildings to pay for your retirement with their hard effort. We’ve never heard of a pyramid scheme that can continue indefinitely. Sooner or later the whole thing comes crashing down.

There are 1,000 contributing workers supporting every 310 claiming pensioners. By 2036, this is expected to rise to 1,000 workers for every 360 pensioners. Why do you think the government does everything in its power to keep the population growing? They proclaim to desire to reduce immigration but ensure they do nothing to prevent it, or else risk toppling the pensions pyramid.

The situation is made worse by the fact that the money paid to pensioners increases by the triple lock, whereas national insurance contributions increase in line with earnings. Following a period of low wage increases and low inflation, the pension cost will climb and become even more excessive. One of the guarantees of the triple lock is that pensions increase by an arbitrary minimum of 2.5%.

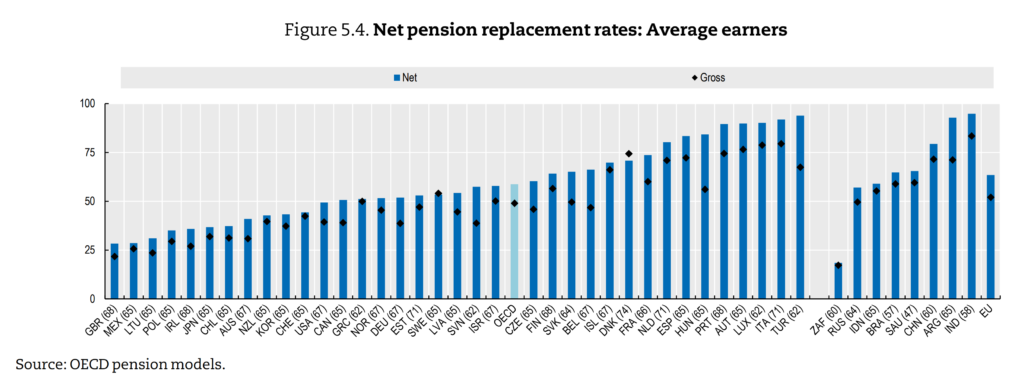

It’s commonly claimed that the UK has the worst state pension among developed countries, based on data published by the OECD as seen in this chart. UK pensioners who were average earners can expect just 28% of their annual career earnings from the state pension. Interestingly, many countries like Austria, Portugal, and Turkey can expect to replace almost all of their job earnings with their state pension.

The UK launched the auto enrolment scheme some years back. Many people might consider this to be a top-up to the state pension, but we think it’s been brought in to lay the groundwork for a future government to finally slash the state pension by claiming that these people don’t need it.

The suspension of the triple lock during 2022 is another incremental step towards the government’s end goal. Once seen as untouchable, the triple lock was temporarily removed, citing a “statistical anomaly” caused by Covid. Sadly, this demonstrates that even an ironclad guarantee like the pension triple lock can be broken! And when it has been done once it acts as a precedent in future for further cuts.

And finally, and perhaps one issue we have never even considered until recently is the possibility of a total collapse of the country. A few weeks ago, a situation like this might have been considered so unlikely that it was nothing less than sensationalist panic, but the Ukraine crisis is a terrible reminder that we can’t take anything for granted.

The humanitarian crisis created by Russia’s invasion of Ukraine has caused millions of people to flee. One consequence of this is that these people are likely walking away from any state pension they might have earned. We can’t imagine any Russian puppet state will honour any pensions that were being accrued, and likewise should Ukraine repel the invaders their country will be in such a dire state it will take decades to recover.

We’re not saying this exact scenario will happen to the UK but it’s worth taking stock of what shocking events can happen and how severe the consequences can be.

What Will Likely Happen To The State Pension?

Avoiding any catastrophic events, one option is some sort of means testing that takes effect in the future. Considering that old people vote, and young people don’t it seems plausible that the government will eventually draw a line and say there will be no further automatic entitlement to the state pension. Past entitlements would likely be honoured as otherwise there would be riots in the streets – and the nursing homes.

Young people, say those under 25, will be less affected by this run-off because they should have a lifetime of saving into the auto enrolment scheme. Somebody who is auto enrolled into a workplace pension earning £30k for 40 years with typical investment growth might end up with a pension pot of £235,000 in today’s value of money and a couple could have double this, approximately replacing the purchasing power of the state pension.

A less decisive option they will continue to take is to keep gradually increasing the age you can claim the state pension. In theory this keeps people working longer and therefore continuing to pay into the system, and simultaneously reduces the number of people taking from the system.

They might also change the rules so that you need more NI qualifying years to qualify for the full state pension. Currently you need to have been paying NI for 35 years, but this was only recently changed from 30 years. This could be increased in steps to, say, 50 years.

Think about this, you may still choose to retire at 55 because you have the private retirement savings to do so, but you would be sacrificing your entitlement to the full state pension by not working the full 50 years.

But questions need to be asked about how feasible increasing the age you can claim is. Many jobs cannot have an average 65-year-old doing them. To be a bricklayer you need to be fit and strong, so it’s clearly not a suitable job for Albert and his bad back.

What You Can Do It About It

Relying on the government (or anyone for that matter) is a recipe for disaster. Nobody will care about your wellbeing as much as you do. Our suggestion for you is to pay the maximum that your employer will match into your workplace pension. Because you never see this money in your bank account you get used to living on your take home pay, which is one reason why saving for retirement like this is so effective.

Many workplace pensions will only match the pathetic statutory minimum, so you should also pay more into a private pension and/or a Stocks and Shares ISA.

A pension has age access restrictions, which on the face of it may seem limiting but for ordinary people who might be tempted to spend this money this restriction can be a blessing in disguise. Discussing the merits of ISAs vs Pensions would be an entire video/post in itself, but we discuss how best to use both accounts in tandem here to efficiently save for retirement.

How much should you pay in total to retirement savings? There’s no better way to estimate this than to play with an online retirement calculator. This one will tell you how many years you have until you can retire, and you can change all sorts of variables such as investment returns, your age, your earnings and expenses, and your withdrawal rate.

The rule of thumb has always been to save 10% of your earnings for your entire life but we feel this is too low. You should be looking to put at least 15% away. And if you’re young the more you can invest now, you might be able to take the foot of the gas later. We can’t stress how liberating it is knowing your future is already taken care of.

Barring any disasters and assuming investment growth will be consistent with long-term historical returns, both Ben and I (MU Co-founders) have already achieved investment pots that will pay for our retirements, just through diligent monthly investing during our 20’s and early 30s. Pretty awesome!

What retirement investment plans have you made? And what do you think the fate of the state pension will be? Join the conversation in the comments below.

Written by Andy

Featured image credit: Photographee.eu/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: