We’ve been producing videos on YouTube for about 4 years now and uploaded nearly 450 videos. Over that time, we’ve dished out what we hope are helpful financial tips covering investing, retirement, tax, debt, economics, business, and everything in between.

That’s a lot of content, so in this post we’ve hand selected our best ever money tips that we truly believe will make a massive positive impact on your life and wealth. Think of it as our greatest hits.

This post can only ever be a summary of these life changing points, so we’ll also provide links to some of the key videos that explain further. This particular post is a perfect demonstration of what Money Unshackled is all about, so if you’re new here and find it useful, consider subscribing to the email newsletter and YouTube channel. Now, let’s check it out…

Alternatively Watch The YouTube Video > > >

#1 – Avoid Dividend Tax With Synthetic ETFs

Broadly speaking Exchange Traded Funds (ETFs) come in two forms: Physical and Synthetic. Physical ETFs physically own the basket of stocks they intend to track the performance of, while Synthetic ETFs hold different assets and then swap the performance of that basket with an investment bank to achieve the desired index performance.

Synthetic ETFs are so awesome because they can be used to circumvent some country’s dividend withholding taxes, saving you a fortune and getting you to your financial goal potentially years earlier. Most notably you can avoid that horrid US dividend withholding tax, and with US stocks likely making up the bulk of your portfolio this is a game changer.

Normally any US equity ETF you invest in, like the S&P 500, would pay 15% withholding tax. In recent history the yield on the S&P 500 has been around 2%, so that’s a drag of 0.3% on your return. Doesn’t sound like much but that is huge over your lifetime.

An investor saving £500 a month for 40 years, earning 8%, ends up with a portfolio worth £1.62m. If that return becomes 7.7% due to the withholding tax, the portfolio is only worth £1.50m. £120k less.

There is also every chance that we are being conservative with those numbers. The yield on the S&P 500 in the past has been more like 4%, so that tax drag would be even more substantial at 0.6%. And, in our example we based it on a 40-year investment timespan. Realistically you will have some money invested in the market well beyond your retirement day and likely up until your deathbed.

Therefore, the more you invest and the longer you invest for the more important it becomes to avoid paying unnecessary taxes, which over time siphon off your wealth. Synthetic ETFs are awesome!

#2 – Optimising The Size Of Your Mortgage Deposit

Many people’s negative attitude towards debt means that the common financial advice is to have the biggest house deposit possible and overpay on your mortgage to rid yourself of the debt as soon as possible.

Contrary to this, other people argue the exact opposite that you should have the lowest deposit possible and do as much as you can to avoid paying down the debt. The argument is that the interest rate is so cheap you can get a better return on that money by investing it.

Both approaches are flawed. Instead of being in either of these camps we invented our own approach. We carried out an investment appraisal, thinking it might be better to target specific LTV bands to find a balance between avoiding high interest and freeing up cash to be invested elsewhere for greater return.

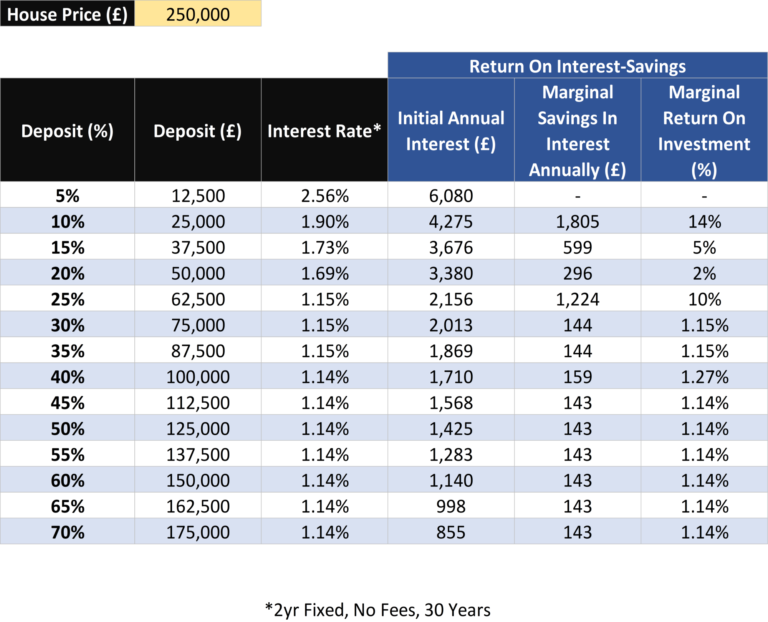

We crunched the numbers and found at the time of doing the video that the optimal deposit from a purely financial perspective was 10%. This an updated version of this analysis but this exercise should be carried out for your specific circumstances and the latest interest rates available to you at the time, so these figures are just a guide.

A 10% deposit currently gives you a 14% marginal return on investment over and above a 5% deposit, so it makes sense to put down at least a 10% deposit if you can. However, as you move to a 15% deposit the marginal gains on the extra deposit amount are just a 5% saving, and then just 2% as you progress to a 20% deposit. On the assumption we can earn 8% in the stock market, sitting within these bands doesn’t make financial sense for those who don’t mind a bit of risk.

With a 25% deposit there is quite a jump in the marginal benefit, so we wouldn’t give you a hard time if you chose this amount of deposit or home equity. But from that point on there is almost no marginal benefit from paying down your mortgage, so you would likely be better off investing.

#3 – Spread Betting Futures

This may well be the single biggest win for investors who are prepared to spend the time learning the ropes of this very clever but high-risk investing strategy. This is our own formulated strategy – you won’t hear this anywhere else. What we have done is create a balanced portfolio to reduce portfolio volatility, and then ramp the risk back up with leverage to earn hopefully mega returns.

The strategy involves using a spread betting account to invest in S&P 500 futures, long-term US treasury futures, and gold futures in a 60/30/10 ratio. This was specifically chosen because historically for this mix of assets the largest ever drawdown – that’s the largest fall from top to bottom – was less than 30%. Government bonds tend to move in the opposite way to stocks when stocks crash.

On the assumption that history broadly repeats itself it means we can leverage the portfolio with up to 3x leverage and never get wiped out, which is vital whenever you invest on margin. That’s a big assumption but the beauty of the strategy is you can choose the amount of leverage you use, so you could do 2x or 1.5x. You can even use no leverage.

That begs the question why would you use a spread betting account with no leverage? Spread betting is technically classed as gambling by the powers that be, so there’s no capital gains tax to pay, even though our particular strategy using indexes is no different to any other long-term investing strategy. The author of the book The Naked Trader refers to a spread betting account as a Spread ISA because of the tax benefits.

In the past a non-leveraged portfolio like this would have earned 11% annually, so with 3x leverage we would hope to get 33% less any fees. We’re not expecting quite this much going forward but even half that would be incredible!

#4 – Matched Betting

Matched Betting despite the name is a great way to make some side income with relatively little risk. On the back of some of our previous videos, we’ve had people thank us for introducing them to this great money-making technique. Some people even claim to have made several thousand pounds from it but as a minimum you should be able to make several hundred with just the welcome offers.

Matched betting is a betting technique used to profit from the free bets and incentives offered by bookmakers. Bets are placed on all outcomes of a sporting event, so a negligible amount of money is lost. You are then rewarded with a free bet. You repeat the exercise to turn that free bet into real cash you can withdraw.

There are usually over 50 different bookmakers all throwing free bets and incentives at you, so there is plenty of easy money to be made.

To do this efficiently and to maximise profits you will want to sign up to some matched betting software. These literally walk you through the entire process and serve up the best bookmaker odds. Visit this page where we have a range of exclusive offers to the leading matched betting service providers, so do check that out.

#5 – Massive ROI With Buy-To-Let Property

We talk about buy-to-let property a fair bit on this website (and on YouTube) because it has the potential to make ordinary people rich, in years rather than decades. Ben (MU co-founder) currently owns 4 buy-to let properties and he credits this investment as the single biggest factor in his wealth building journey.

The reason why buy-to-let is so effective is mainly because of the leveraged returns that are achieved by using a mortgage. We’ve substantiated these figures in some of our YouTube videos but on a high level, if your property increases in value by 4% and you only put down a 25% deposit, your return on investment from capital gains alone is 16%.

You will also earn rental profits on top that can easily push up your total return to somewhere around 20-25%. Obviously, this strategy doesn’t work if you choose a bad property. Not all properties make good investments and in a way your profits are determined by what house you buy and the price you pay.

As a property investor you need to remember to invest according to which properties do well, not necessarily the type of house you want to live in. My particular strategy is to buy terraced houses in northern city locations as they command good rental yields, have excellent demand, and are amongst the most affordable.

For those interested in investing in property, if you are prepared to spend a great deal of time learning the market and then managing your own properties you can do everything yourself, but if you want to avoid having to essentially take on a second job you could get in touch with our preferred property partner via the Find Me A Property page.

[H2] #6 – Equity Release

I put this right up there with buy-to-let property as a means to grow wealth, with one complimenting the other. In fact, my ability to buy so many properties was largely due to equity release.

Most people who own property for a long time end up with substantial amounts of equity tied up in their home that is doing nothing. A savvy investor might prefer to borrow against their home and invest that money elsewhere.

Typical mortgage rates are less than 2% and have been that way for several years now. The stock market is widely expected to return 8% a year on average, so you could profit in the tune of 6% on average per year by moving equity from your home to the stock market.

The reason why mortgages are so good for this is because it’s long-term debt that is not callable. As long as you are meeting your agreed monthly repayments the mortgage cannot be called in no matter what else is happening in the wider economy and stock market. This gives your investments time to recover if they happen to fall in the short-term.

If you could release equity of £100k and profited 6% a year, you would earn £6,000 extra a year going forwards for doing relatively little other than moving some money around and taking on some minimal financial risk. As Ben chose to invest the money from the equity release into buy-to-let property he was earning significantly more on what otherwise would have been wasted capital.

[H2] #7 – Retire Early With A Pension Bridging Strategy

We believe everyone should be working towards retiring as early as possible, but pensions put up some roadblocks as they have an age restriction on when you can start withdrawing from them. Currently this is 55, which is due to increase to 57, then 58, and who knows how high this could climb?

Many hard workers who have diligently invested wisely may have enough money or be able to save enough so they never need to work a day again. However, it’s no good if it’s all locked away in a pension.

It seems that many ordinary people save exclusively within a pension, of which some build up huge sums and yet still can’t retire early due to the aforementioned age restriction. While some other aspiring early retirees disregard pensions completely despite the huge benefits.

What we teach is to use multiple investment products including accessible accounts that allow you to retire earlier in the most tax-efficient way possible. These accessible accounts enable you to bridge the gap between your desired retirement day and the day your pension becomes available.

Most people will want to invest in a pension because they are epic. You should get matched contributions from your employer, which is effectively free money and a 100% immediate gain. You also get tax relief, which for a basic-rate taxpayer adds 25% to your contribution, or 67% for higher-rate taxpayers. And if you’re lucky enough to have an employer using salary sacrifice you can avoid national insurance and student loan repayments.

But before you can access the pension cash you can use the likes of a Stocks and Shares ISA, buy-to-let property, and spread betting accounts to bridge the gap. You could even borrow against your home, which can be paid back with your tax-free pension lump sum when you get it.

[H2] #8 – Diversify Across Time

When we first heard this, it blew our minds and changed how we perceived risk forever. It was a concept we read about in a book called Lifecycle Investing. Essentially, due to how people come into wealth they start with relatively little when they’re young and end with a big sum at retirement age.

This uneven distribution of wealth across your lifetime means that the investor is almost completely exposed to the stock market risks at the end of their life; the market movements in those early years are largely irrelevant to your overall lifetime wealth as you have so little money invested.

The author’s proposition is for you to try and control as much of your lifetime wealth as possible as early as possible. To achieve this they recommend using 2:1 leverage and are only proposing this amount of leverage at an early stage of life. This way, investors only face the increased risk of wiping out their current investments when they are still young and will have a chance to rebuild.

The suggested path is to first leverage your investments in stocks, then reduce the leverage in the middle part of your life, and then finally move into an unleveraged stocks and bonds portfolio as you approach retirement.

We can’t say we agree with their precise strategy but the concept of diversifying across time is a game changer.

Which of these financial points has had or will have the biggest impact on your money? Join the conversation in the comments below.

Written by Andy

Links to key videos on these subjects:

Synthetic ETF (Ultimate Portfolio): https://youtu.be/xIK07tgv_14

How Big Should Your House Deposit Be: https://youtu.be/nuj456bkslU

Spread Betting Futures: https://youtu.be/1hzb_zIIdmY

Matched Betting: https://youtu.be/R6zbzk04BHI

Massive Returns With Buy-To-Let Property: https://youtu.be/gmioY5HxlDk

Equity Release: https://youtu.be/XA-an3NozVo

Pension Bridging Strategy: https://youtu.be/Nd-GUcBZFCo

Time Diversification: https://youtu.be/JpoWZ_K_iA0

Featured image credit: daniiD/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: