S&P Global, the index provider behind the S&P 500 and other stock indexes, provide some great insight into the markets which help everyday investors like us to understand the investment world better.

One of these insights is the SPIVA report, SPIVA being an acronym for S&P Indices Versus Active. It’s a comparison between actively managed funds and the passive indexes that they are benchmarked against.

With this report we can see exactly how stock market indexes, and hence index tracking funds and ETFs, are actually performing versus actively managed funds.

From this we can better answer questions like: “if I want my wealth to grow, should I invest in a managed fund with a famous reputation like the Cathie Wood funds, or in an index like the S&P 500?”; “Can fund managers help you avoid the worst impact of a market crash?”; and “are top performing fund managers skilful, or just lucky?”.

In this article we’ve got the answers to all these questions and more. We’re going to try to put to bed once and for all the argument between active and passive funds. Let’s check it out!

Commission-free trading app Freetrade has over 300 index-tracking ETFs available, including the FTSE 100, S&P 500, and commodities like gold and silver. There’s even niche areas like cybersecurity and green energy ETFs too.

Sign up using the special link here with as little as £2 and you’ll be given a free share worth up to £200!

Alternatively Watch The YouTube Video > > >

The Active vs Passive Debate: Why It Matters

The reason why actively managed funds still exist is the lingering belief that with enough skill, a fund manager can consistently beat the market, or technically speaking, outperform their index benchmark.

When Vanguard founder Jack Bogle challenged this view decades ago with his low-fee index funds, it began a performance war between the managers and the indexers over which approach is best.

Should you pack your portfolio with actively managed funds chosen for their managers’ reputations, kooky strategies, and past performance? Or with index funds and ETFs chosen for their geographic coverage and low fees?

The Main Finding

The main takeaway from the report is that whatever geographical region you look at, indexes have outperformed managed funds the vast majority of the time.

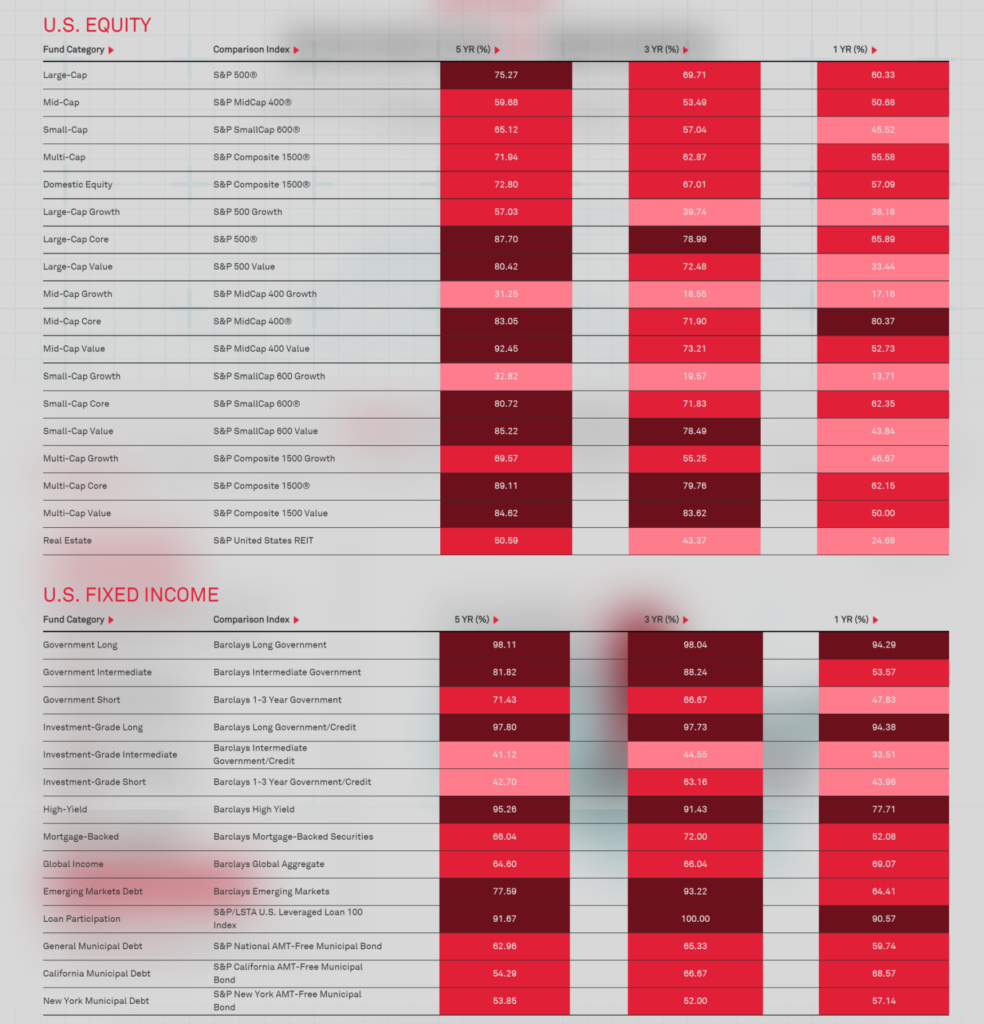

If we drill into the US, we can see the detail. These numbers are the percentage success rate of indexes vs active funds, with better success rates for the indexes in darker shades of red.

We see that over 5 years, active funds have a terrible success rate overall, but might see a better performance over a 1-year period.

Even over just 1 year, it is still a less than half-chance that your actively managed fund will beat the market. As investing is a long-term game, the 5-year figures are pretty damning for managed funds.

It’s not just Equity funds that fail to beat their index benchmarks – active bond funds also fail to beat ETF and index fund equivalents the vast majority of the time.

It’s worth noting that there were certain market niches that fund managers were able to beat the market consistently over 1, 3 and 5 years.

These were mid-cap and small-cap growth stocks.

There are good reasons to think that at the small-cap end of the market, fund managers have a better chance to beat their benchmark, because there is less information than at the large-cap end of the market.

There is almost no chance that a fund manager can trade Apple or Amazon at a market beating discount, because these companies are so well known that everyone else has the same information.

But maybe by focusing on tiny companies they can eke out an advantage.

The data here certainly holds open that possibility anyway. But when we zoomed out to a 20-year horizon, a paltry 4%, 10%, and 6% of large-, mid-, and small-cap growth funds beat their benchmarks, respectively. So maybe not!

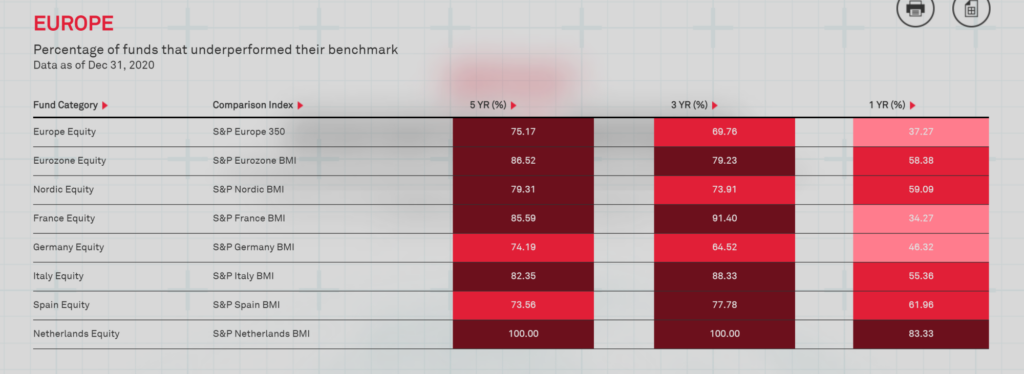

If we look at Europe, it’s the same story. The S&P Europe 350 index, which includes the UK as some of its largest holdings, outperforms actively managed funds 75% of the time over 5 years. But short-term punts have paid off most of the time.

Can Active Fund Managers Steer You Through A Downturn?

Surely the benefit of having a human at the helm is that when a major storm hits, you have a captain to steer you through the chaos. That’s a nice thought, but what does the data say?

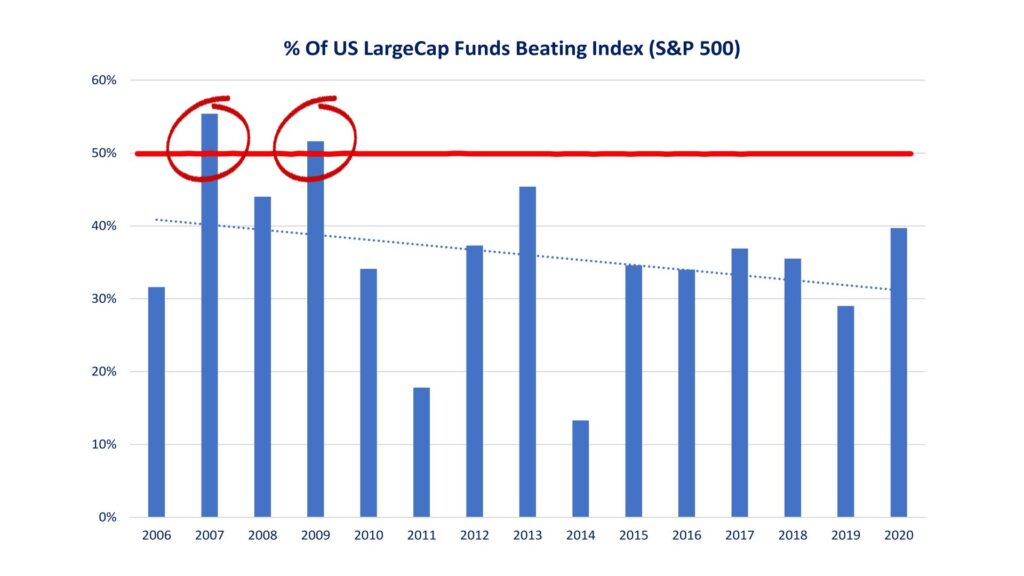

This chart shows the percentage of actively managed US large-cap funds that beat the S&P 500 index in any 1-year period going back to 2006.

One obvious point to note is that only in 2 years were the active funds more likely to outperform the S&P 500.

One of those years though was 2009, a terrible year for the stock market which was during the global financial meltdown, which started in 2008.

Active funds were slightly more likely to outperform their index in this year. Funds failed to outperform in 2008 though. Or in 2020, with the Covid Crash.

So it seems that active managers are not especially well placed to steer you through a downturn, at least for large-cap stocks.

A separate point to note is that the trend of active funds’ success rate is falling the trend line is down by 10% over the 14-year period.

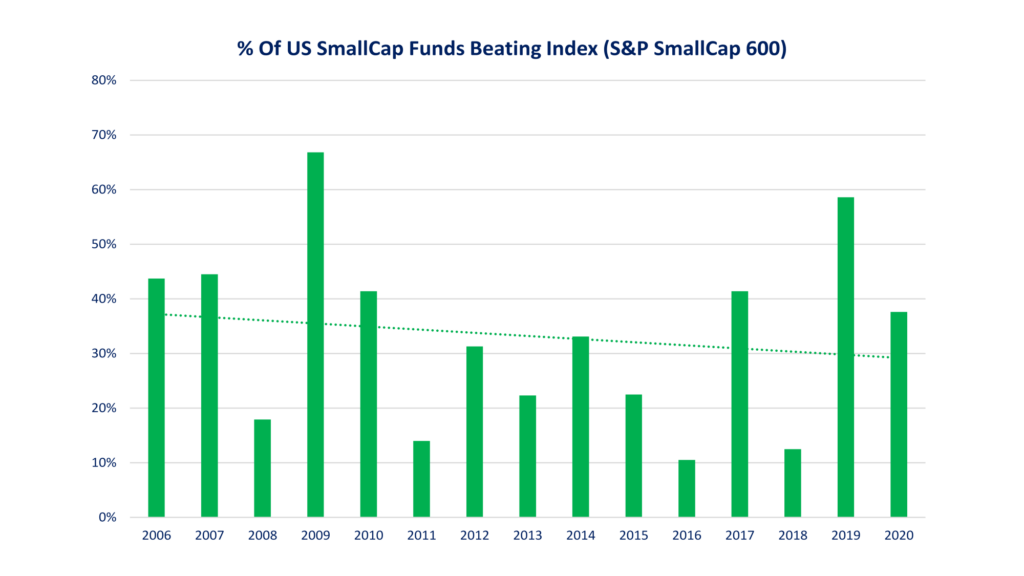

If we look at small-caps, the area where fund-managers should excel, we again see a fall in the success rate trend, but 2009 was an incredible year for actively managed small-cap funds.

This did however come after one of the worst performance years in 2008. And 2020’s performance was mediocre.

So, can active managers better steer you through a downturn? The data says… there’s no reason to think so!

The Winning Managed Funds: Was It Skill, Or Luck?

Maybe we’ve been a bit unfair to actively managed funds. Yes, most of them fail to perform, but there ARE STILL a load of winning fund managers that you can put your trust in, right?

After all, 25% of American and European managed funds WERE able to beat the market over 5 years. But did their investment results come from skill, or luck?

That distinction is important, because genuine skill is likely to persist into the future (which is all that matters to an investor), while luck is random, and those results are unlikely to continue.

One way to measure a fund manager’s skill is to look at how long that good performance hangs around relative to its peers.

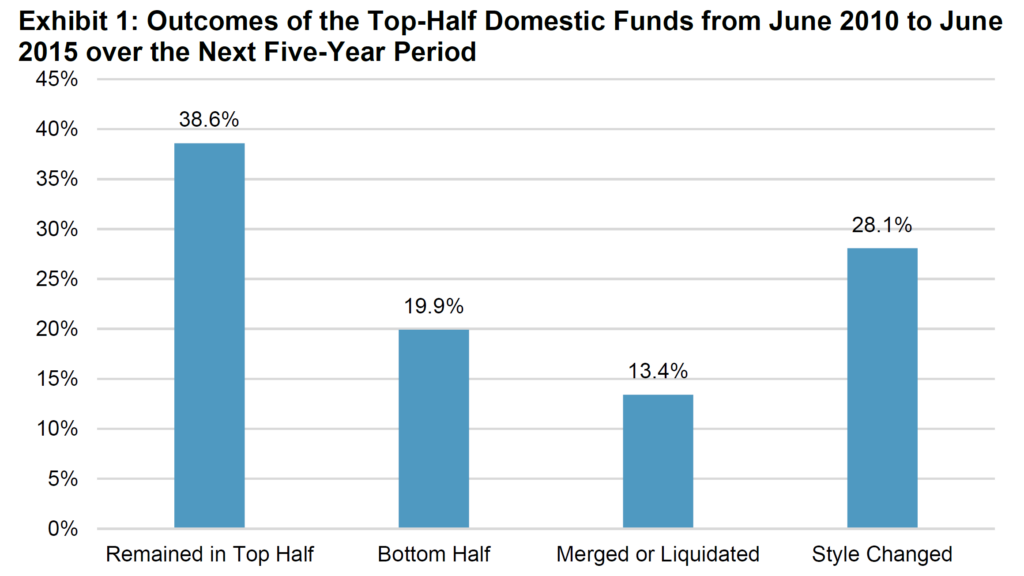

SPIVA’s Persistence Scorecard attempts to distinguish luck from skill by seeing what happened to top performing funds from 2015 over the next 5-years.

This chart shows that active management outperformance is typically short-lived in the US market. Just 39% of top performers stayed in the top half of the league table after 5 years, with 20% being relegated to the bottom half, and 13% were gone altogether.

A further 28% were the same fund in name only. Funds often have to drastically change their approach to survive, and an investor in such funds might find they are no longer invested in the sectors they initially chose.

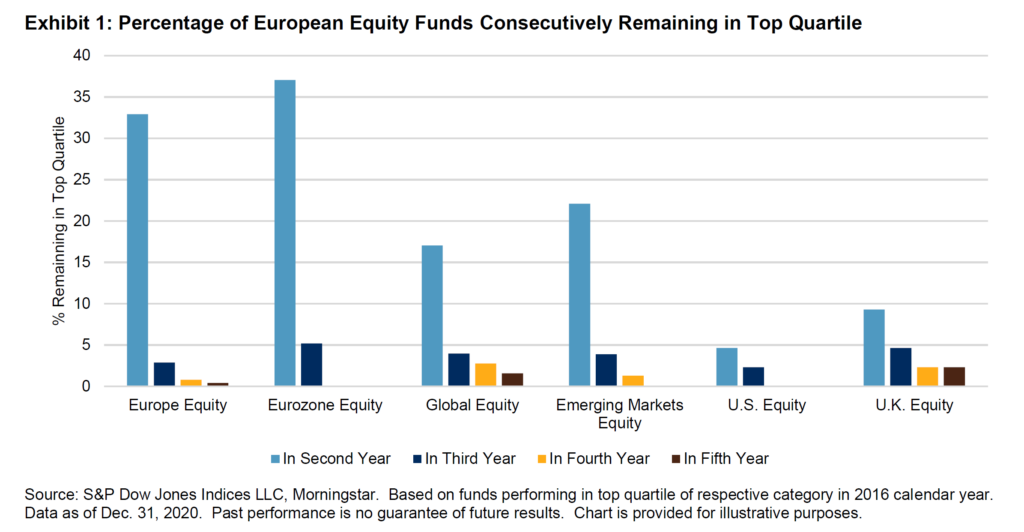

If we look at the Europe market, which for this purpose includes the UK, some analysis has been done into how many funds stayed in the top quartile of the league tables after 2, 3, 4 and 5 years. The top quartile is the best performing 25% of funds in any 1 year.

Of the Europe Equity funds based in Europe, after 2 years, only 33% of the top performers could still be called top performers.

Most of the other equity categories were much worse even than this. And look at what happens in years 3, 4 and 5. In year 3, only 3% of top performers from year 1 were still in that top quartile.

If you think that investing should be done for the long-term, why would you want to trust your money to a top performing managed fund, when data like this proves beyond a reasonable doubt that most of their performance is down to luck?

After 5 years, less than 1% of European Equity managed funds were able to maintain their performance.

Other Key Findings Of The SPIVA Report

#1 – Fees Really Matter

The report confirmed what we already knew; that fees have an important impact on fund performance. Actively managed funds typically have FAR higher fees than passive index funds, and this massively hinders them from beating or even matching their benchmarks.

An active fund must cover the high costs of its analysts’ salaries. Even if picking the right stocks were simply a flip of a coin, the fund managers would still be worse off most of the time due to having to over-perform simply to cover the costs of their own high fees.

The complexity of the investment strategy in some managed funds can also raise the fees, as the fund is perceived to be doing something clever.

In our view, it seems that overly-complex investments mostly exist to profit those who create and sell them, rather than their investors.

#2 – Active Funds Who Invest In Foreign Markets Do It Poorly

Think, for instance, of a London based actively managed fund which invests in US stocks. On average, it will perform worse than a New York based fund which invested in US stocks.

Part of this might be to do with foreign dividend withholding taxes, which shaves a slice of returns off the top for the US taxman.

But part of the reason is surely also to do with local knowledge. A US investment firm may know a little more about the American companies that its fund managers shop at, or that they see every day in the newspapers, than a UK investment firm would.

We can take from this that if you want to invest in the US market from the UK, or any other foreign market for that matter, you’re even more likely to do better with an ETF than by using an actively managed fund.

#3 – Fund Size Matters

The data shows that generally, larger funds were more likely to be able to beat their benchmarks than smaller funds were.

So if you ARE going to use an actively managed fund, a fund with Assets Under Management in the BILLIONS of pounds should perform better than one with only millions.

So When SHOULD You Use Managed Funds?

As it stands, there seems to be little reason to invest in actively managed funds, based on this report. Sure, there may be some niche areas of the market that are not adequately covered by index funds and ETFs. But even then, can you be sure that you’re particular niche will be the one that beats the market?

We subscribe to the school of thought that believes we should all be investing broadly into a globally diversified pool of equities, with many countries, market sectors and asset classes covered – or at least into a major index like the S&P 500, which can be tracked cheaply and includes companies that operate globally.

The “Owning The World” approach is very likely to provide you with solid market average returns.

There’s nothing wrong with market average. Don’t mistake market average for an average return.

If you’re able to score the market average, you’re very likely to be beating the vast majority of investors who try in vain to beat the market, and end up losing out.

In league table rankings, index funds are unlikely to ever be amongst the highest flyers – but nor are they likely to be at the bottom.

There will always be actively managed funds who luck their way to the top, to crash out the next year and be replaced with another lucky fund. Meanwhile, the investors riding the index will be coasting their way to a comfortable retirement.

Which funds form the core of your portfolio? Are they actively managed or tracking an index? Join the conversation in the comments below!

Written by Ben

Featured image credit: leolintang/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday:

All offer links here.