We’re living in an age of rock-bottom interest rates, where investors have largely given up on cash flow in favour of capital growth, both in the stock market and even in high-stakes new markets like crypto.

My investing journey started with the wise words of Robert Kiyosaki in his book Rich Dad Poor Dad, that “wealth is the measure of the cash flow from [your] asset column”.

For Rich Dad, physical cash in your hand from interest, dividends or rental income is real, and can pay the bills – while holding an asset purely for its growth potential is just placing your hopes in the market.

While we at Money Unshackled are happy to place our trust in the market to go up long-term, we also like at least part of our portfolios to be diversified amongst cash-flowing assets, for the stability and liquidity they provide.

But good quality income generating assets are getting harder and harder to come by. It used to be that you’d just buy some bonds, or even just whack your money in a high-interest savings account.

Now you need to be far more astute – there are still investments with good income returns to be found, but these usually come with a trade-off of higher risk. You need to do your homework to avoid putting your precious money to work for you in the wrong place.

Today we’ve pulled together our favourite collection of income generating, cash flowing investments that are best placed to provide you with a good, consistent income, without the need to take on excessive risk. Let’s check it out!

We’ll be mentioning a few ETFs in this article, and all those mentioned can be bought on Freetrade and Trading 212 – pick up free shares when you sign up to either using the links on the Offers Page.

Alternatively Watch The YouTube Video > > >

#1 – High-Yield Bond ETFs

First up, there’s bonds. Bonds are the stereotypical fixed-income investment class, known for paying out a steady rate of interest to the bond holder.

The problem is that since the financial crisis of 2008, bonds have been known for their incredibly low yields that have kept getting gradually worse.

The interest rate you get from bonds is linked quite closely to the interest rates set by central banks, which as we know is close to zero in the UK and elsewhere.

Not all bonds are alike though. One option is to buy Government Bonds, which from developed countries are super safe but currently pay out typically less than 1% in interest.

Another option is Inflation-Linked Bonds, which claim to offer some protection against inflation, but still may fail to even provide an above-inflation yield.

The option with the highest yields is High-Yield Corporate Bonds, such as what’s offered by the iShares Global High Yield Corp Bond ETF (GHYS). It’s a distributing GBP-hedged ETF with a yield of 3.9%, which is incredible for bonds in today’s climate, but it does have a high fee of 0.55%.

Alternatively, have a portfolio of bond ETFs built for you by opening a Managed Income account on InvestEngine. Choosing the Enhanced risk level will build you a portfolio that is 75% high-yield bonds and 25% dividend equities, with an estimated 4.1% income.

That’s on InvestEngine’s robo-investing area of the platform, meaning they do the portfolio building for you. They also offer growth portfolios that focus on equities. It’s the cheapest service on the market that we’ve seen, with a platform fee of just 0.25%.

But InvestEngine are now ALSO offering a Do-It-Yourself service which lets you trade ETFs for free! That’s NO dealing fees, NO account fees, NO FX fees… nothing! This could be the lowest priced investment platform there is for ETFs.

Use this link to join the InvestEngine platform and you’ll also get a £50 welcome bonus. Or read our full written review of InvestEngine here.

#2 – Peer To Peer Lending

The Peer-To-Peer Lending market is slowly coming back to life after the pandemic, during which most of them went into hiding and stopped new investors from signing up.

But Loanpad, my favourite P2P Lending platform, stayed active throughout and continued to deliver a great return. Loanpad works operationally like a savings account – the main difference being that this is an investment and therefore your capital is NOT risk-free. Unlike bonds, the value of your investment doesn’t change with the market.

Your money is lent out evenly across a portfolio of secured property loans. Your investment is secured against commercial property values, with 2 layers of protection between your money and the risk of capital loss from falling property values.

They offer an interest rate of 4% on a 60-day access account, with interest paid daily. If your income investments are supporting your day-to-day lifestyle, that daily payment of interest really comes into its own.

Also, if you invest £5,000 or more using the offer link here you’ll be given £50 cashback for free from these guys too.

#3 – Dividends… From Crypto!?

Cryptocurrencies like Bitcoin notoriously do NOT pay a dividend.

That’s because they are what’s known as an unproductive asset – they do not generate cash like a business or a loan does, which is how stocks, bonds and P2P lending are able to pay you an income.

But new technologies have been springing up which means that now, cryptos CAN pay you an income.

BlockFi is a bitcoin wallet that works like a P2P Lending site, in that it lends your money out to – in their words – “trusted institutional and corporate borrowers”.

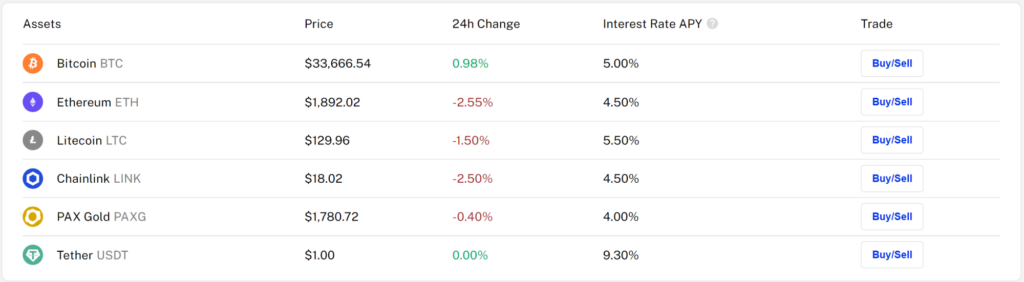

Above are the interest rates on offer: at time of writing you could get a 5% rate of interest on your Bitcoin, and 9.3% for your Tether. Rates are variable from month to month.

We’re just scratching the surface of this innovation and will be sharing OUR experiences in a future article – stay tuned. Let us know in the comments below if you’ve found a better way to earn money on your crypto outside of normal price growth.

#4 – High-Yield Dividend Stocks and ETFs

The stock market isn’t just for growing wealth – it can also be a great source of income. We cover dividends all the time on this channel, and for our latest thoughts on the very best dividend stocks to own right now, check out this article next.

In it we build a portfolio of the best 20 dividend stocks on Trading 212 using a blend of data from stock picking tool Stockopedia and the Dividend Aristocrats global index. Here’s a link to the Trading 212 pie.

If you just wanted to invest using an ETF, one of our favourites is the SPDR S&P Global Dividend Aristocrats ETF (GBDV). All the stocks on the index have a 10-year track record of maintaining or increasing their dividend. The index dividend yield is currently 4.72%.

Another route to dividend success in the stock market is with investment trusts. Investment trusts have special rules that allow them to hold back cash, to be distributed out to shareholders in bad years – this helps to ensure a constant, steady flow of cash to the investor.

The industry-standard investment trusts for income are those marked with the Dividend Heroes stamp of approval. The numbers are the number of years that each fund has consistently increased their dividends.

None of these trusts would want to risk their status as a member of this coveted league table by failing to provide you with an annual pay-rise, but you should check the basics like their dividend cover and revenue reserves first.

#5 – Cash-Flowing Property & REITs

You don’t need to part with tens of thousands of pounds to invest in property – you can do it on most investment platforms by investing in a type of fund called a REIT, which stands for Real Estate Investment Trust.

REITs are famous for paying dividends. With property as the underlying investments, there is always a lot of cash flowing in from property rents, and REITs have a rule that at least 90% of rental profits MUST be distributed out to shareholders.

We like to get a broad basket of properties in our REIT investments – the iShares Developed Markets Property Yield ETF (IWDP), with a Total Expense Ratio of 0.59%, does this by investing in 333 separate REITs. Each of these invest into multiple properties in the developed markets and must each have a dividend yield of at least 2%.

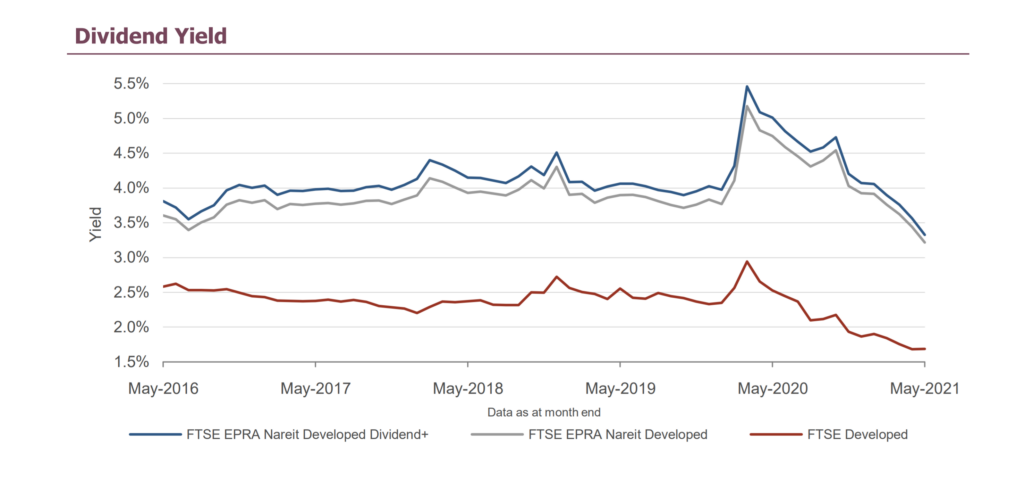

Here’s the dividend history of the index the ETF tracks, in blue – the FTSE Nareit Developed Dividend+ Index. It typically hangs around 4% but got a little erratic during the pandemic. It’s yield significantly outperforms the yield from the developed world stock markets, in red.

A note of caution against REITs: commercial property is going through a rollercoaster period of change right now, with office culture and working practices in the midst of a fast-paced work-from-home revolution.

What are now offi ce buildings might soon become residential flats. City centres will be fundamentally different.

What about residential? The residential sector is doing very well recently, with house prices AND rents soaring.

There ARE some REITs that focus on residential properties like apartment blocks, but these are few and far between: Equity Residential (EQR) is one example and has a 3% yield, which is forecast to grow.

We still think the best way to invest in property is by buying a few Buy-To-Let rentals in the UK.

Regular viewers will know that most of my wealth in is property, as we showed in this article. My cash-flow rental profits are about 9% – the capital growth is another matter, which because of mortgage leverage is around an additional 12%.

That 9% income is a significant game changer – I use the income from my properties as a base layer of income to support my lifestyle, meaning I can invest more of what I make elsewhere.

The higher income return of BTL reflects the increased effort involved – it’s the only investment we’ve covered today that can’t just be managed by a few button-taps on an app.

When To Avoid Income Generating Assets

Income generating assets are great for portfolio diversification as an add-on to your growth assets, or for people who have reached the point that they can retire on their investments.

If you’re still on the journey to financial freedom and want to build your wealth further, assets which focus on capital growth typically have better total returns than cash-flowing assets.

Using the stock market as an example, we would prefer for most of our portfolios to be invested in stocks with low dividends, as the act of paying a dividend (a) provides opportunities for the taxman to take a slice of your money, and (b) means the company cannot reinvest that cash in its operations.

Part of the reason why tech stocks have experienced a boom over the last decade is that they generally don’t pay any dividends – all that cash goes into product development instead. They can invest shareholder’s profits better than the shareholders could themselves.

When Income Is Essential

That said, I wouldn’t be without my investment property income. It has provided a safety cushion of monthly cashflow which has meant I could safely leave a job I hated, could start a business without needing it to pay out profits straight away, and now means I could survive even the rockiest patches of self-employment.

Would I have the same stability from a portfolio of growth stocks?

The eventual goal of most people in the Financial Independence community is to build an investment pot of many hundreds of thousands of pounds worth of stocks.

A small portion of their stocks can then be sold each year to provide an income, without upsetting the overall portfolio’s growth by too much.

We both intend to follow this plan too. But that is years away. Having extra income streams NOW oils the gears, and improves your ability to grab life opportunities.

What do you think about income generating assets, and what do you have in your portfolio? Join the conversation in the comments below!

Written by Ben

Featured image credit: ESB Professional/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: