Using debt to invest really does divide opinion. Personally, we think using other people’s money is a great tool at your deposal to grow your own wealth at a far faster pace than what otherwise would be possible.

In previous videos we’ve talked about some of the more easily understood ways you can use leverage to invest, such as extracting mortgage equity. In today’s post we will of course be briefly looking at this but we’re also going to introduce you to a few different ways to invest using leverage in the UK that I don’t think we’ve covered much before.

How to invest in the stock market using leverage in the UK! Let’s check it out…

If you’re looking to get a boost to your investments head over to the Money Unshackled Offers page where platforms like Freetrade, Trading 212, Stake and others are giving away free stocks and welcome bonuses when you sign up.

Alternatively Watch The YouTube Video > > >

Investing Is A Marathon – Not A Sprint

One of the biggest problems with investing is that for the average person who is able to make contributions of just a few hundred pounds each month, it takes a really long time for their investments to grow to a size where their assets can financially support their lifestyle.

In fact, for a typical person saving for retirement it might take 30-40 years from when they start contributing to when their investment pot becomes big enough to retire on. Waiting 40 years to become financially free is not acceptable to us. What about you?

So, why does it take so long? There are 3 things that dictate how much investments grow by: the amount invested, the time invested, and of course the investment returns.

Most of our amazing readers will be investing as much as they can, and they want financial freedom as soon as possible. That leaves us with one choice. We must increase our rate of return and therein lies the problem.

All the evidence shows that most people cannot beat the market, so picking the next 100 bagger stock is unlikely. Most people are more likely to pick a stinker.

Therefore, we primarily invest in index funds and ETFs that aim to track the market instead. We would expect this to return around 8% per year, or 5% after inflation. The answer to our problem is that we need to supercharge that index return, and leverage is a very useful tool that might just help us do this.

What Is Leverage?

To quote Investopedia, “Leverage is the use of debt (borrowed capital) in order to undertake an investment or project. The result is to multiply the potential returns from a project. At the same time, leverage will also multiply the potential downside risk in case the investment does not pan out.”

That means if you invested say £1,000 of your own hard-earned money and earned 8%, you would make profit of £80. But had you invested £3,000 – with £2k coming from leverage, and only £1k of your own money, that 8% return would turn into 24%.

You’ve earned £240 profit on your investment of just £1,000. Amazing!

In practice using leverage would incur some small amount of interest payable to the lender, which would reduce that return ever so slightly, but you get the point!

Warning!

We can’t stress this enough – don’t use leverage unless you have lots of investing knowledge.

Even then, start slowly. We all have a tendency to be overconfident in our investing abilities. Lots of people can be great investors but when leverage is thrown into the mix, they start breaking their own rules and end up investing very poorly.

Remember, that all the benefits of leverage we just mentioned also work the opposite way. So, if we relook at that previous example of a 3x leveraged instrument, had the market fallen by 8% instead of risen, you would lose £240, which is a 24% loss.

The stock market is very volatile and can fall by more than 50% as it did between 2007 and 2009. If you were using the amount of leverage in our example you would have lost all of your own money.

5 Way To Invest In The Stock Market With Leverage

#1 – Leveraged ETFs

The popularity of Leveraged ETF’s has really ballooned in recent years. We now regularly see some in the top traded tables of UK platforms. In Q1 2021 the WisdomTree FTSE 100 3x Daily ETP (3UKL) was the 6th most popular buy on the Interactive Investor platform.

Leveraged ETFs are collective investment funds where lots of investor’s money is pooled together into one investment. They have been developed for short-term trading and therefore are said not to be suitable for long-term investors. They’re designed to multiply the short-term performance of an index or commodity. If we take the WisdomTree FTSE 100 3x Daily ETP as an example – this one is meant to provide three times the daily performance of the FTSE 100.

For example, if the FTSE 100 rises by 1% over a day, then the ETP will rise by 3%, excluding fees. However, if the FTSE 100 falls by 1% over a day, then the ETP will fall by 3%, excluding fees.

At first glance, leveraged ETFs look great. We know that in the long-term stock market indexes should go up, but when you delve a little deeper into leveraged ETFs, the numbers paint a very different picture.

What this financial instrument is not designed to do is to track the performance of the FTSE 100 over an extended period of time. That’s because leveraged ETFs reset daily to maintain the same leverage ratio – in this case 3x daily.

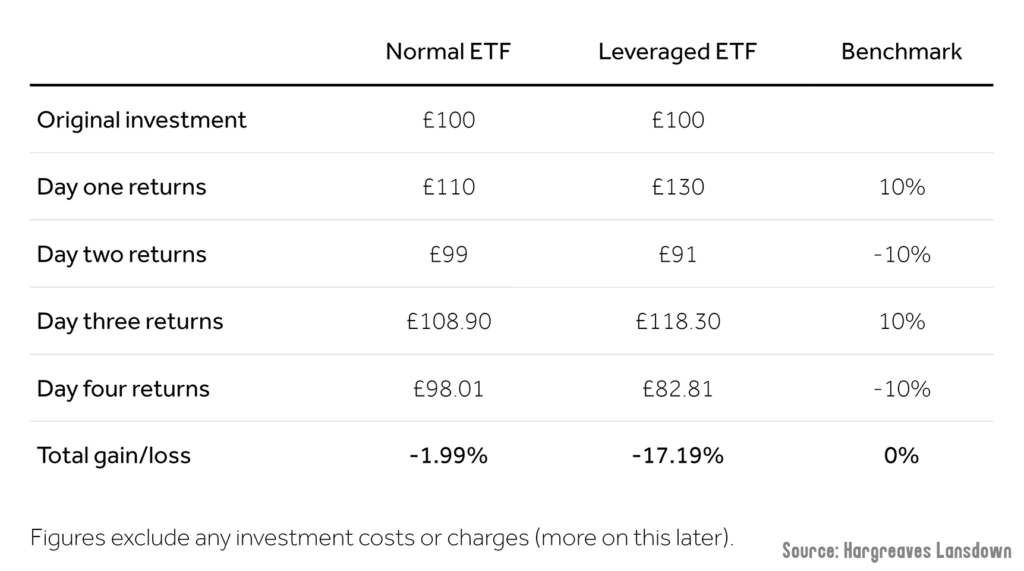

Hargreaves Lansdown had an interesting article on the subject and demonstrated the impact on returns for investors who hold leveraged ETFs for any longer than one day.

On day one the normal ETF returns 10%, so the leveraged ETF returns 30%. Then the normal ETF drops by 10% the next day, so the leveraged ETF drops by 30%. As the days go on the leveraged ETF completely strays away from the benchmark index. In this example, the leveraged ETF has lost 17% but the normal ETF has barely moved.

If you’re trying to take advantage of short-term market movements these might be worth it.

#2 – Extract Equity From Your Mortgage

In the short-term the stock market is just as likely to be down as it is up, so short-term debt is very dangerous for use as leverage. Conversely, mortgages are one of the best ways to leverage stocks-based investments because a mortgage is a long-term source of debt. Your investments have 20, 30, or even 40 years to recover from any temporary setback. It’s very unlikely for the stock market to be down for such a long time.

How can you buy stocks with a mortgage, which are in fact loans intended for property purchases? Well, once you’ve paid down some of the outstanding mortgage on your home, or the property has gone up in value, you will be able to renegotiate your mortgage terms and extract equity in the form of extra mortgage debt.

This can then be used to buy and hold stocks, or preferably index funds, over the long-term.

A while back we calculated the optimal LTV at around 85%. Say your property was valued at £200k and your equity was worth £100k, you could take out £70k of additional long-term mortgage debt, which would leave £30k in equity and put you back on an 85% LTV.

You can now invest that £70k as you see fit (just don’t tell the bank). In effect you are using a mortgage to invest in the stock market. Just because society tells you to pay down your mortgage quickly, why should you? Better, we think, to grow your wealth with investments, and use the investment gains to pay off the mortgage later.

Another key benefit of using mortgages as your leverage source is that mortgages tend to be for a fixed term, so even if the stock market crashed (as long as you are meeting the monthly mortgage payments) the loan cannot be called in.

This is unlike most short-term debt offered on stock trading platforms, which could call in debts just when you’re at your lowest point.

#3 – Margin Loans

Margin loans are a form of secured lending offered by stockbroking platforms. The stockbroker uses the stocks & shares in the portfolio as security. The main drawback compared to a mortgage is that they are callable.

This means that if the value of the portfolio falls below a certain level, the broker will eventually sell some of your positions. They do this because the value of your collateral may have dropped to a level where the lender hasn’t got enough cover to protect them from you not repaying the loan.

Before selling your positions, the stockbroker should first serve you a margin call, which is essentially a demand for you to deposit more money. The problem is you are probably using margin because you don’t have the money or deliberately stretched yourself. If you did have the cash set aside to cover you for a margin call, there’s probably little point in paying to access the margin in the first place.

In the UK none of the major investing platforms offer margin accounts. In this respect, the UK is very different from the USA – where most reputable stockbrokers would offer margin.

Interactive Brokers seems to be the leading broker offering margin loans in the UK and are offering margin rates in GBP of around 1.5%. If you guys want us to review this service, let us know down in the comments. We’ll jump right on it if there’s enough demand.

Degiro is another broker that offers margin loans in the UK but the only others we’re aware of are private banks, which require hundreds of thousands or even millions of pounds to access.

#4 – Spread Betting / CFDs

Spread Betting and CFDs are similar, and both are definitely not for beginners. The main difference between the two is that Spread Betting is tax-free. Spread betting is illegal in many countries, so we are very fortunate in the UK as it’s legal here.

If you are an experienced investor, don’t let the term ‘betting’ put you off. It’s only considered betting because you are technically placing a ‘bet’ with a broker that the market will move one way or another, but it can be done in such a way that it’s very similar to normal investing if you understand it. You don’t actually own the underlying investment!

We have a big video planned on Spread Betting, where we’ll show you how we’re making big returns, so make sure you subscribe so you don’t miss it when we release it.

With Spread Betting you place a bet per point. Say you bet £10 per point on the S&P 500. If the S&P 500 moved from 4000 to 4200 you would have made £2,000 profit (200 points x £10).

Most spread betting firms will allow you to deposit just 5% (20 x leverage) of the overall exposure on indexes like the S&P 500, so in this example you could have made a 100% return on just a 5% gain in the index value.

Although this scenario is possible, we would encourage you to limit the amount of leverage you use at the beginning because if the financial instrument swings the wrong way you’ll lose a lot of money, very fast.

Spread Betting and CFDs get a bad rep because too many people try it without understanding how leverage works, and so naturally lose a boat load of cash. We’ll be going into a lot of detail in the soon to be released Spread Betting video, including what we’re investing in and what strategies we’re using, so keep an eye out for that.

#5 – 0% Credit Cards

0% credit cards can be used for a small amount of leverage, and they have a medium-term time horizon of around 2 years. I have used 0% purchase credit cards to spend on my normal day-to-day expenditure. But rather than paying down the full balance each month I would invest it instead. However, you must always make the minimum payment, or the credit card company will remove the 0% offer.

At the end of the 0% term, you can pay down the debt or use a 0% balance transfer credit card to move the debt to another card. We consider 0% credit cards to be a small, short-term advance, rather than a permanent leverage tool.

Should You Use Leverage?

If you have to ask this question, it’s probably best not to use leverage. It’s a high-risk strategy and should only be done by those who understand the risks and those who have the knowledge. Having said this, you learn to drive by driving, you learn to swim by swimming, and you learn to leverage… you get the point.

Where do you stand on using leverage to invest in the stock market? Join the conversation in the comments below.

Written by Andy

Featured image credit: Andrey_Popov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: