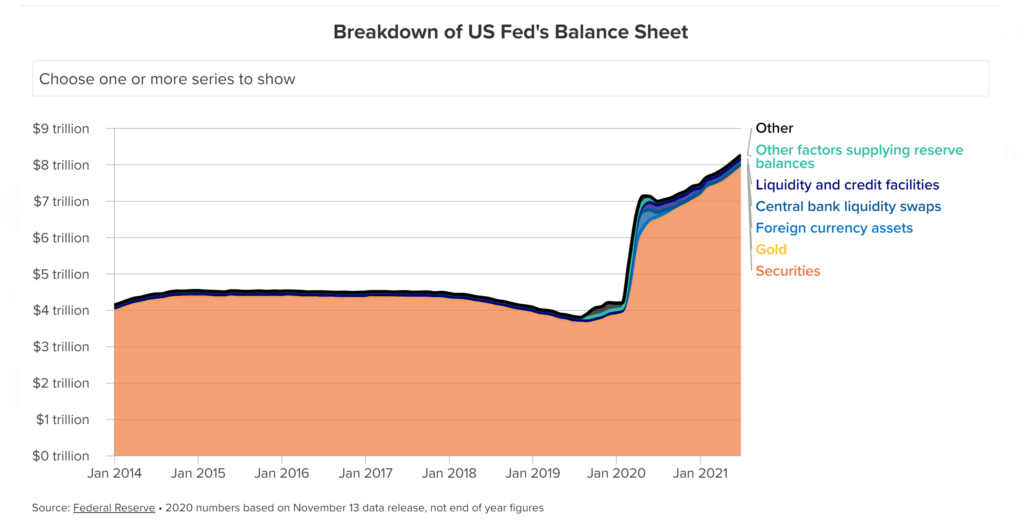

Since 2008, major central banks have pumped over $25 trillion into the global economy, with over $9 trillion in response to Covid-19 alone. Around half of that has come from an America that is addicted to money printing, doubling their magic money tree from $4trn to $8trn during the pandemic.

These are astonishingly huge sums. The thinking goes that all that extra money sloshing around, along with record low interest rates, may have already pushed stocks to unsustainable highs. But is this the calm before the storm?

The UK consumer price index, which measures the cost of a typical basket of goods and services, flew up from 2% in July to 3.2% in August, and it’s forecasted to keep climbing.

In America, the Biden money-printing could “set off inflationary pressures of a kind we have not seen in a generation,” wrote a prominent figure in Biden’s own party. Bank of America estimates that the U.S. government will have spent $879m every hour in 2021. The results could be devastating.

The shut-down of the global economy and subsequent policy responses have us teetering on the brink of a period of runaway inflation. Whether or not it happens will depend on the competency of Western politicians to fight it – the same politicians, incidentally, who got us into this mess in the first place.

So, assuming they cock it up, what impact will runaway inflation have on your investments and home finances? Let’s check it out…

And the end of the article we cover the best investments to defend against runaway inflation, along with the best places to buy them. Offers for all of these investing platforms are available on the Money Unshackled Offers page.

Alternatively Watch The YouTube Video > > >

Panic In The UK

There are lots of reasons to be startled by the latest inflation figures. A CPI of 3.2% in August not only puts it at the highest level in nearly a decade, but the month-on-month change from July to August is the biggest increase since the CPI was introduced as a measure of prices in 1997.

That’s high, but fine if it’s a temporary thing. We know the world has gone mental recently, and crazy economic statistics are becoming the norm in 2021.

But what if it’s not temporary? There are still inflationary pressures heading down the tracks, including a massive shortage of truck drivers set to result in food shortages and increased prices over winter. There’s even talk of Christmas dinner being cancelled for all but the wealthiest of families due to the shortages. All this continuing pressure on prices may cause high inflation to become “sticky” – meaning it hangs around for the long-term.

It’s now looking like the best outcome would be inflation rising to just 4% by the end of 2021. And that’s double the target rate of inflation desired by the UK’s central bank.

Across the board, prices are rising far faster than usual. In the past few months, the wholesale price of electricity in the UK has almost quadrupled from £40 to £160 per Mwh, spiking in the past fortnight to the highest level on record.

It is widely predicted that due to a shortage of gas and greater reliance on expensive green energy that we are facing further sharp increases in both electricity and gas bills in the coming months.

The Bank of England warned earlier this year about a “nasty surprise” coming our way. They’re right to be worried. An inflationary spiral, where prices rise ever higher, is what inflamed the economic instability and high unemployment in the 1970s, an ordeal which took many years, if not decades, to recover from.

House Prices Through The Roof!

The CPI measure of inflation doesn’t include the cost of buying homes. If it did, we would see a far higher figure for inflation.

The latest house price inflation data runs to July 2021, and shows house prices up a massive 8% annually, reported as a good thing by the press because that’s down from an even higher 13% in June.

“Ah, but this is due to the meddling of the UK government in temporarily relaxing stamp duty”, I hear you say. But that’s not the whole story.

Over in America, the median sale price of a home rose 22.9% in the year from June 2020 to June 2021, smashing all records. And this obviously has nothing to do with relaxing stamp duty in the UK.

The so called ‘new normal’ of home working, combined with low interest rates, has massively increased the demand for homes.

Where before 3 or 4 people would be content in a house share, they all now want their own space. But new houses are not being built fast enough.

These same economic forces are at play in the UK. House prices are creeping up, and up, and up, stamp duty holiday or not.

Is Inflation Good Or Bad For Investors?

Inflation means the prices of things go up… so good if you own assets… right? Well, inflation typically refers to the price of consumer goods, not investment assets, and is in fact one of the main reasons you need to invest – to try and beat inflation. A higher rate of inflation makes that task more difficult.

There is inflation itself; and then there is the government response to it.

If inflation gets too high, governments will try to squash it back down. This could include raising interest rates or cutting back on the money printing… or both. Doing either is bad for investors.

Increased Interest Rate

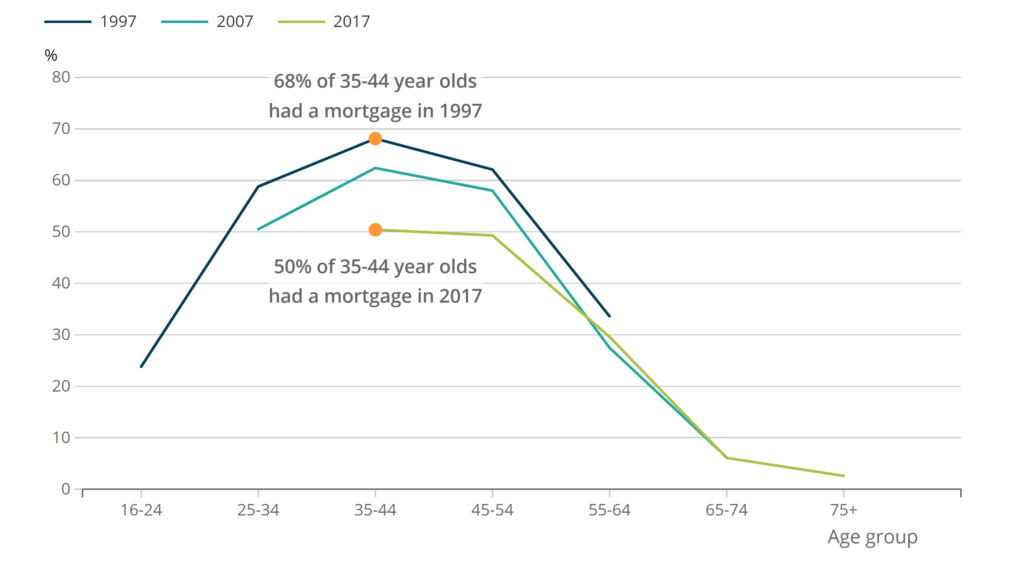

Increased interest rates are bad for leveraged investors, such as landlords with mortgaged properties, because their loan interest costs go up, and there are fewer people in the market who are able to afford to take on debt to buy your assets from you, reducing their market prices.

Increased interest rates are bad for owners of stocks too, because the businesses they are invested in have increased costs of borrowing, reducing profits, and with them, dividends and stock prices.

Cutting QE

It’s widely accepted that ridiculous levels of quantitative easing are responsible for record high prices in the stock and other asset markets.

Pumping cash into the economy makes cash less attractive, and pushes up the prices of assets like stocks, bonds, property, gold, crypto, and so on.

To fight inflation, central banks could claw back some of their money printing. When they magic money from thin air, central banks like the Fed typically lend it to the government in return for government bonds. In 2019, the Fed was selling down their holdings of these securities, reducing the amount of cash in the economy. They would need to try doing something similar now if inflation got out of hand.

Taking cash out of the economy would make cash more attractive again, moving money out of stocks and other investments and reducing their market prices.

High Inflation Impact On Stocks

High inflation itself also drives down the profitability and growth potential of companies, and hence share prices. Fewer customers can afford to buy products, and the costs of materials and labour go up.

And if inflation suddenly goes from 2% to, say, 4% very quickly, investors will want a higher return to compensate. The stock market will likely drop as a result to give investors that extra value.

Is Inflation Ever Good For Stocks?

Inflation is not all bad. Some inflation can be beneficial. Mild inflation is generally good, because it’s a sign the economy is growing, and businesses can raise prices.

“When examining S&P 500 returns by decade and adjusting for inflation, the results show the highest real returns occur when inflation is 2% to 3%,” says Investopedia. That’s about where we are now. So, a modest amount of inflation is in fact a good thing.

High Inflation Impact On Investment Property

We’ve mentioned how a government response to inflation could push up interest rates, putting the boot into the ribs of hard-pressed property investors and homeowners alike.

But the run-up period of inflation before this will likely send your properties’ prices soaring.

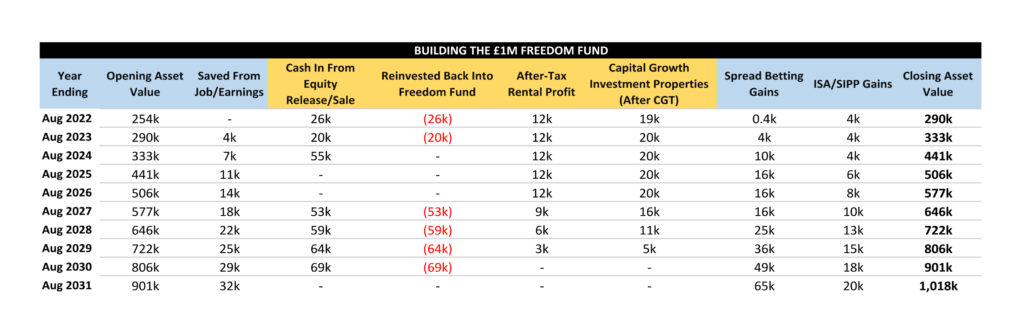

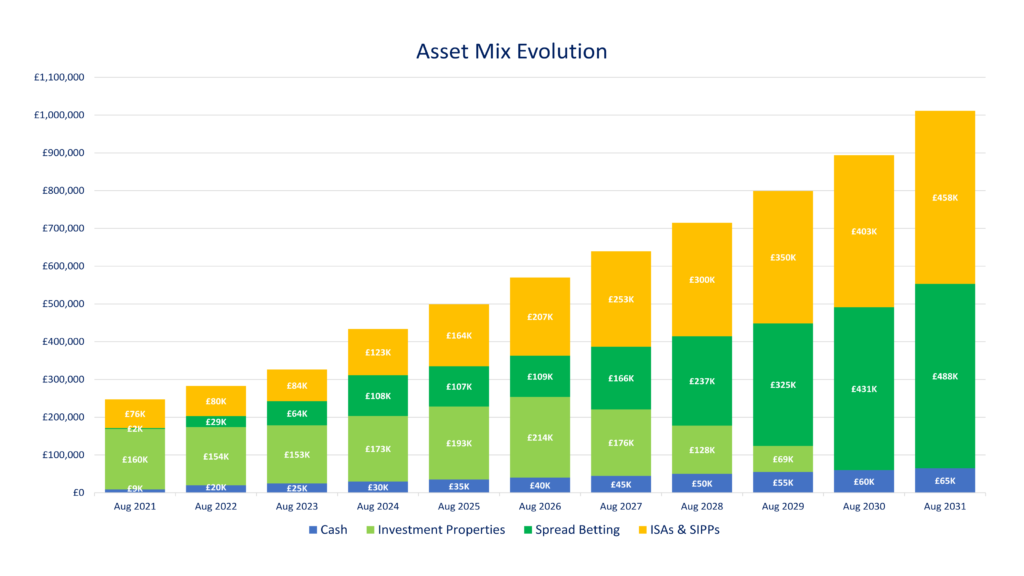

As an owner of multiple properties, I’ve been rather enjoying the recent double-digit inflation in the housing market. But it must be a bitter pill to swallow for new investors.

This initial inflationary boost to your equity may provide a cushion that helps to counteract any negative fallout if interest rates do go up.

Savers May Be Glad… At First

Savers may initially rejoice at a raising of interest rates, as they watch their high street savings account go from a 0.5% rate of interest to perhaps a 2% rate of interest.

That joy will turn to ash though when they realise that inflation in the shops has gone up by more than this, meaning their actual real returns are EVEN MORE negative than they were before. No matter how high inflation gets, central banks can only increase interest a LITTLE, or risk collapsing the economy.

Presumably cash savers are 100% reliant on their job for their income too, as opposed to investors who may own passive income generating assets.

We are all familiar with the pathetic 1% annual pay rises in the UK. When inflation is 5%+, but wages are stagnant, how will cash savers be able to keep building their wealth?

High Inflation Impact On Bonds

Holders of fixed income securities like bonds do poorly in a high inflation environment, because that fixed income has less and less purchasing power, driving down the price of bonds. Higher interest rates on newly issued bonds drives down the value of existing bonds as their lower coupons are less attractive.

How To Defend Against Rampant Inflation

So, stocks overall do poorly in a high inflation world, as do bonds, as does cash, as does property. So where exactly can we store some of our wealth to help defend against runaway inflation?

Many investors, including us, believe gold offers protection from long-term inflation. Gold is a store of value: its supply is limited, unlike cash which can be magicked in and out of existence.

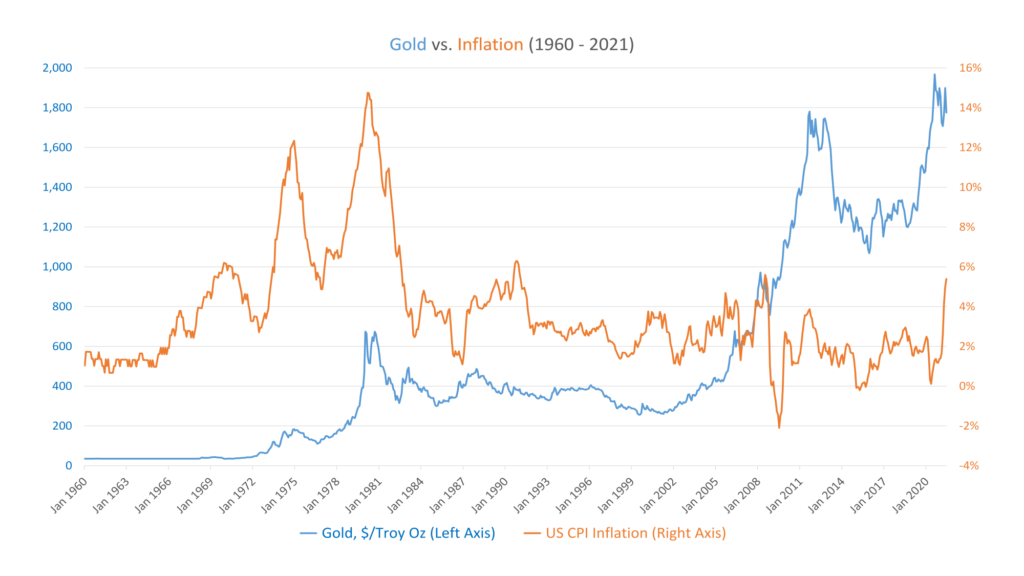

Also, its history doesn’t lie. We see below how the gold price shot up in response to inflation in the 1970s, then loosely tracked it. In 2008 there was a massive correction in gold’s favour when people lost all faith in cash following the 2008 crisis and the resultant quantitative easing. During the pandemic, gold has shot up again when the banks once more fired up the printing presses, ahead of the inevitable inflation wave that is now hitting us.

We buy gold through the iShares Physical Gold ETC, and it’s free to trade on platforms like Freetrade, Trading 212 and InvestEngine. If you buy your gold through any of these platforms, new customers will get free shares worth up to £200 or a £50 welcome bonus.

Cryptocurrencies like Bitcoin, in theory, should do the same job as gold. They have similar qualities to gold in that there is a limited supply, and they are beyond the reach of meddling central bankers. But unlike gold, we can’t prove this hunch with a nice historical graph because, well, there is no history!

New users to Coinbase, one of the most popular crypto trading platforms, will get some free Bitcoin when you sign up using this offer link.

You can also hedge against rampant inflation by investing in certain stocks that benefit, or at least are not disadvantaged, by a high interest, high inflation environment.

These include:

- banks like HSBC and Lloyds (who love it when interest rates on their loans can go up);

- big blue-chip stocks like Coca Cola that sell everyday essential products and have little in the way of debt;

- quality high-dividend stocks like British American Tobacco, who have a history of growing their dividend in real terms.

Grab a free trial subscription to Stockopedia here to get a full analysis of these stocks, and thousands more. The link also gets you a 25% discount on a paid subscription.

Are you worried about runaway inflation? Or are you upbeat about the economy? Join the conversation in the comments below!

Written by Ben

Featured image credit: Brian A Jackson/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: