Since 1978 – that’s 43 years – US stocks have returned roughly 12% per year. Not bad, but future returns are expected to be lower than this – maybe around 8%, maybe less. We here at Money Unshackled are not content with measly returns. No way! And if you’re like us you’re going to love what we’ve got in store for you today.

**EDIT 29th Sep 2021: The Step-By-Step Guide for putting the below into practise is now live! Read it here.

In this post we’re going to show you what we’re doing to make huge returns in the stock market with minimal effort. Our strategy is to take index investing to the next level, by investing in a portfolio of index futures using spread betting.

Don’t worry if you’ve no idea what any of that means, we’ll explain all the key things over the next few minutes.

Seriously, stick with us on this one – this is a lifechanging long-term investing strategy that might sound complicated at first, but give it a chance and it might just make you a millionaire in a fraction of the time that normal index investing can. Let’s check it out…

If spread betting isn’t for you but you still want to invest in indexes the good old-fashioned way, check out our handpicked favourite investment platforms here.

Alternatively Watch The YouTube Video > > >

Why We Started Spread Betting

If you want to get rich in the stock market you only have a few different levers you can pull:

(1) Wait longer for compounding to work its magic – This is not an option for us as we want financial freedom now. Retirement at old age is unacceptable to us and probably for you as well.

(2) Cut back and invest more – Again, not something we’re prepared do any further. We’ve already got well streamlined budgets and don’t waste that much money anyway.

(3) Earn more money elsewhere so you can invest more – Yes, we’re trying to do that within reason but achieving this is obviously not easy and we refuse to work all hours under the sun.

And (4) Earn a higher Return on Investment (ROI) – Most people cannot beat the market by stock picking, and so aiming to track the market using index funds is likely to give us the highest return we can get. We’re already doing this.

However, if we were to use leverage, we could amplify our ROI. The problem is that in the UK you can’t easily borrow money to invest in the stock market. But borrowing to buy property is both expected and relatively accessible for all. Whenever leverage is mentioned in the context of the stock market, it is almost always talked about negatively and you’ll be discouraged from using it. We think the naysayers are wrong!

Here in the UK the main ways to invest in stocks with leverage is with CFDs and spread betting but you only have to visit a brokers site and you’ll see that around 70% of investors lose money. Not very favourable odds!

The main reason people get burnt using leverage is because they have no idea what they’re doing and get too greedy. Done properly though there are big profits to be made!

And better still, spread betting is exempt from both capital gains tax and stamp duty. CFD’s are similar but any gains are however subject to capital gains tax. Therefore, we see no reason why anybody in the UK would trade CFDs when spread betting is available.

What Is Spread Betting?

Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indexes, commodities, or shares – without taking ownership of the underlying asset. Instead, you’d be placing a bet on whether you think the price will rise or fall.

Spread betting is generally referred to as a short-term way to trade but if you look beneath the surface, it provides an excellent means for long-term investing. This is literally a hidden gem as nobody is talking about spread betting in this way.

With normal investing you buy a set number of shares, but with spread betting you bet an amount per point. Say you bet £10 per point on the S&P 500, and it was currently at 4000. If the index rose to 4400 it has gained 400 points. You bet £10 per point, so your profit would be £4,000.

When spread betting it’s really important that you understand the notional value or exposure of that investment. In this example we may have placed a bet of £10 per point but the value of our investment was £40,000 (£10 x 4000 index value). If we’d started with £40,000 cash in the platform, our £4,000 profit would be a 10% ROI.

Other than its tax-efficient status, spread betting can be used to invest using leverage, which means you only need to deposit cash equal to a small percentage of the full value of the position. Each platform and instrument will have different margin requirements but typically for the S&P 500 it is 5%. This means that you only have to deposit 5% of the value of the open position, allowing you to trade with 20x leverage.

In our example, the notional value was £40,000, so the minimum deposit is just £2,000. So, we could have used leverage to get the same £4,000 profit as before but from just a £2,000 investment – a 200% return.

In practice, for what we’re doing, we won’t be using anything like this level of leverage. Using this amount will almost certainly put you on the fast path to being broke, as any fall in the index value will put you below the margin requirement – leading to a margin call.

A margin call is the term for when the equity on your account – the total capital you have deposited plus or minus any profits or losses – drops below your margin requirement. You will either have to deposit more cash, or risk your positions being automatically closed.

One fantastic feature of spread betting is that there is no exchange rate risk. With a normal investment in an S&P 500 ETF, it could go up 10% from 4000 to 4400 but if the exchange rate moved against you by 11% you would still lose money. Not so with spread betting.

It doesn’t matter because you are placing a bet per point. Regardless of what exchange rates have done, the index has gone up 400 points. Hopefully that makes sense but if not just trust us.

The Money Unshackled Spread Betting Portfolio

At first, we considered solely investing in the S&P 500 index, but volatility and investing on margin do not play nicely together.

We ran some back tests for the past 43 years. The max drawdown was 51%. Ouch! A max drawdown is the maximum observed loss from a peak to a trough, before a new peak is attained.

Assuming that history will repeat, a huge drawdown like this means that we can’t use much leverage – not even 2x before getting wiped out. Even when we don’t get wiped out it will be a hell of a roller coaster – one we could do without!

So, we had to do something that was even surprising to us – we have built a portfolio of stocks, gold and bonds, that significantly reduce volatility and the maximum drawdown.

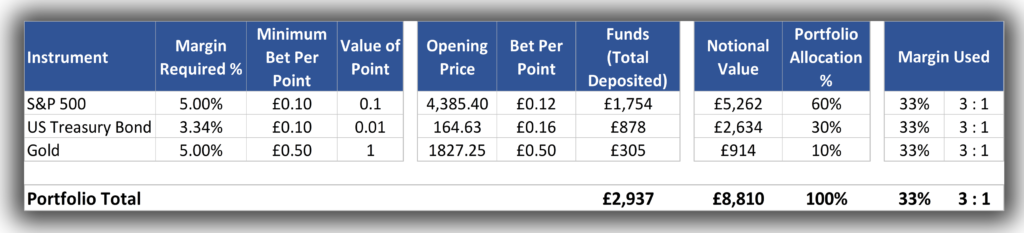

The target portfolio is 60% S&P 500, 30% long-term US treasury bonds, and 10% gold. A traditional 60% stocks / 40% bonds portfolio would historically have provided a similar return, so it’s not a bad alternative.

However, with all the money printing that’s going on and enormous national debts that countries are drowning in we personally think the portfolio will benefit from a touch of gold.

The stocks, bonds and gold portfolio has a max drawdown of just less than 27%, which means we could use 3x leverage and never have to worry about a margin call: 3 x 27% gives an 81% worst case historical fall, which keeps us safely out of the danger zone, which is around 95%.

Let’s stop there for one moment to remind everyone that this is based on 43 years of data. Future results could be worse than this, and if you copy what we’re doing you do so at your own risk!!!

If that concerned you, one way to reduce risk significantly is of course to just drop that 3x leverage to 2.5x, or 2x, or even less, but potential returns would fall too. Over time and as we age, we see ourselves reducing our use of leverage to less than 2.

The 100% S&P 500 portfolio does have the best compound annual growth rate of just under 12% but our more balanced portfolios have compound annual growth rates of around 11% but crucially with less risk.

The Sharpe ratio is a genius metric that shows the additional amount of return that an investor receives per unit of risk. As you can see in the table, the balanced portfolios have much better Sharpe ratios.

If history does repeat itself this 3x leveraged portfolio would return around 33% less any costs, which on our portfolio are negligible. If we invested £10k over 10 years earning 33% our portfolio would be worth £173k. Or unleveraged, earning just 11% the portfolio would be worth just £28k – a massive £145k difference!

That’s why we’re so keen to increase our return on investment. A good return can literally be life changing!

How To Start Investing

The mechanics of spread betting are ridiculously complicated and if you don’t have solid investing experience and the patience to learn you should avoid doing this. Period! With that said, I picked it up within about a week of making my first deposit. As with anything I find it best to learn by doing.

The first thing you will want to do is choose a spread betting platform. All the comparison guides online are of barely any use because they’re all geared towards short-term speculating and often compare platforms based on factors that aren’t relevant to this long-term investing strategy.

We will be investing in Financial Futures and two platforms we have found to be excellent for this purpose are CMC Markets and IG. I have used both and find them great for what we need. Their spreads on the instruments we’re buying are wafer-thin, which means it will barely cost anything at all.

We have found IG to be ever so slightly easier for beginners, but CMC Markets is our preferred choice as they give us more leverage on US treasuries. This is handy as it gives us a little more beathing space, so we can better avoid a margin call if the market tanked.

With typical spread betting strategies, you don’t need much money to get started, but to follow our long-term investment strategy you will need at least £2-3 grand.

Unfortunately, each instrument has quite a high minimum bet size and we’re trying to build a diversified portfolio. So, to invest in each of our assets with the right allocation we end up with a portfolio with a notional value of around £9.0k. At 3x leverage we need to deposit a third of that – so £3k.

This particular post is not meant to be a tutorial in how to actually place your spread bets but we’re working on a step-by-step guide, so keep your eyes peeled for that.

How To Manage The Leverage Properly

As we touched on earlier, we suspect that most people lose money spread betting because they don’t understand or underestimate how even a small swing in the stock market can wipe out a portfolio when it’s leveraged.

We’ve demonstrated that with our strategy, 3x leverage is about the most that should be used when making that initial investment. However, as the portfolio grows in value your leverage is reduced, and similarly if the portfolio falls in value your leverage is increased.

For example, say the notional value of your portfolio is £9,000 and you originally deposited £3,000, and so were 3x leveraged. If the portfolio doubled in value from £9k to £18k your equity is now worth £12k (£3k + £9k profit). Now your portfolio is only 1.5x leveraged (£18k/£12k).

Instead, if the portfolio had fallen by 20% from £9k to £7.2k which is a loss of £1.8k, your equity would now only be worth £1.2k (£3k minus a £1.8k loss). Now your portfolio is 6x leveraged (£7.2k/£1.2k).

Each time we invest, new contributions will be at 3x leverage. As the portfolio grows and our leverage falls, we will reset the leverage back towards 3x by investing some of the gains.

However, if and when the portfolio falls in value, we will not reset the leverage. This means that at certain times we might find ourselves at 5x, 10x or even 15x leveraged, while we wait for the market to recover and spring us back to our starting leverage. That’s the plan anyway. My heart will be in my mouth I’m sure if this happens.

Invest In Index Futures Contracts – Not Daily Rolling Cash Bets

When investing in an index via a spread betting platform you will typically have the choice between two different products: a daily rolling cash bet or a futures contract. In general, rolling daily cash bets tend to be used by traders looking for short term positions, and the futures contracts by those looking to take a longer-term view.

With the daily cash bets, you have to pay a financing charge for holding it overnight. Most spread betting platforms charge around 2.5%+LIBOR. However, for what we’re doing paying this is unnecessary. Long-term investors should use futures contracts because you don’t pay overnight charges with them.

Instead, futures contracts have an interest charge baked into the price but crucially it’s incredibly cheap and far cheaper than what you could get yourself anywhere else such as a loan. The embedded interest charge is known as the implied interest rate and will be close to the risk-free rate. The risk-free rate is assumed to be equal to the interest rate paid on a three-month government Treasury bill, which is currently near 0%.

If you’re new to Futures contracts this is probably super confusing. There’s no way we can explain everything you might want to know in this post, so we recommend doing some of the free courses on cmegroup.com. A good place to start would be their Introduction to Futures course, linked to here.

One thing you do need to understand about futures is they have expiry dates – normally quarterly. As they approach expiry, we’ll be automatically rolling them over to the next contract, and your spread betting platform can do this for you automatically.

Do You Receive Dividends?

When you invest in futures you won’t physically receive a dividend payment, but the expected dividend is factored into the price. Because you don’t receive the dividend the futures are priced under the current index price.

As the futures contract gets closer to the expiry date, the value of the index and the futures contract converge on one another.

We hope you’ve found this post useful and hopefully we’ve clearly demonstrated how we’re making bank using spread betting. If there’s anything that you want us to expand on let us know down in the comments and we’ll do our best to help.

What do you think about investing with leverage? Join the conversation in the comments below.

Written by Andy

Featured image credit: Rawpixel.com/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday:

9 Comments

We await your in-depth tutorial on this. very much interested

This is very interesting. The portfolio suggested is very similar to those recommended for retired people. One thing: if you invested this in ETFs say you would normally rebalance the portfolio at the end of a year as with different movements the relative proportions of the ingredients would change. I am finding it hard to think about this, but using spread betting doesn’t this mean that the portfolio balance would never need rebalancing because the proportions are for ever defined by the relative pounds per point which doesn’t change.

Out now! Thanks. Ben

It’s a very curious thing. Though you will not make 3x returns a year, even if you reset leverage every year. This is due to volatility decay. Example:

Period 1 Unleveraged: 100

Period 2 Unleveraged: 80 (-20%)

Period 3 Unleveraged: 100 (+25%)

Period 1 3x: 100

Period 2 3x: 40 (-60%)

Period 3 3x: 70 (+75%)

The leveraged example lost even when unleverged remained the same. This is a big reason why leverage can work against you as it has a bigger impact on down moves than it does with up moves. Even if each period was positive, the average wouldn’t be 3x unless there was zero standard deviation.

The 33% a year premise is therefore wrong. Not to say you can’t make a market beating return though.

Doesn’t the leverage become 6x in period 2? The strategy does NOT reset leverage, but your example does. The gain in period 3 is 150%, taking you back to 100.

I would be very interested in how you set this up on CME and/or IG.

We set it up on CMC Markets, the guide is live on the site now. Thanks, Ben

Hey

Thanks for this video. I have run below as an example on IG.

Let’s take SPDR S&P 500 ETF as the instrument.

Today’s value of ETF is: 45500

Trade size: 0.12

Deposit required: 1088.78 Notional Value: (at 5X because IG doesn’t let you choose leverage): 5443.75

A year later, expecting 11% gains in the ETF:

ETF value: 50505

Increase in points: 5005

Gains: 5005*0.12 = £600.6

Fees: 3% (2.5 + Libor) = Notional value * 3% (5443.75*.03) = 163.3

Profit: 437.28

Profit on capital employed: 40.15%

Capital at the end of the year: 1,526.06

Now lets take an example of a bad year:

A year later, after 11% fall in the ETF:

Reduction in points: 5005

Loss: 5005*0.12 = -£600.6

Fees: 3% (2.5 + Libor) = Notional value * 3% (5443.75*.03) = 163.3

Loss: 763.9

Loss on capital employed: 70.16%

Capital at the end of the year: 324.88

It appears that your position will close long before reaching 11% fall.

Check out the step-by-step guide that’s now live and see how it compares, posted as an article recently. Cheers, Ben

Comments are closed for this article!