Hi guys, here at Money Unshackled we love investor surveys. We’ll take any chance we get to delve into the mindsets and behaviours of fellow investors, and Freetrade recently carried out just such a survey. In this video we’re looking at the responses from over 2,000 investors.

We’re particularly interested in this set of data because, as we’ll soon show you, Freetrade’s userbase are similar in age to us and our YouTube audience.

Also, this is hot-off-the-press information and includes the opinions of both experienced and first-time investors – many of whom have had incredibly good fortune to start investing since those March 2020 Covid lows. Without further ado, let’s check it out…

First, we want to give a big shout out to Freetrade who carried out the survey and sponsored the video version of this post. Freetrade doesn’t charge any commissions when you trade, and has thousands of stocks and ETFs available, including the FTSE 100, S&P 500, and so many more.

Sign up from as little as £2 using this special link and you’ll be given a free share worth up to £200!

Remember, as with all investments, your capital is at risk – the value of your portfolio can go down as well as up and you may get back less than what you invest.

Alternatively Watch The YouTube Video > > >

First-Time Investors Or Experienced?

Until the dawn of commission-free trading apps like Freetrade investing was seen as an activity that was mostly for the wealthy. It was too cost prohibitive to begin building a diversified portfolio of stocks, and it astounds us that in the UK the old heritage platforms still continue to stick to their outdated business model of charging on a per-trade basis.

So, with this said it comes as no surprise that Freetrade has amassed an army of 800,000 customers, up from 600,000 in March 2021. This is phenomenal growth for a company that only launched its first app at the end of 2018.

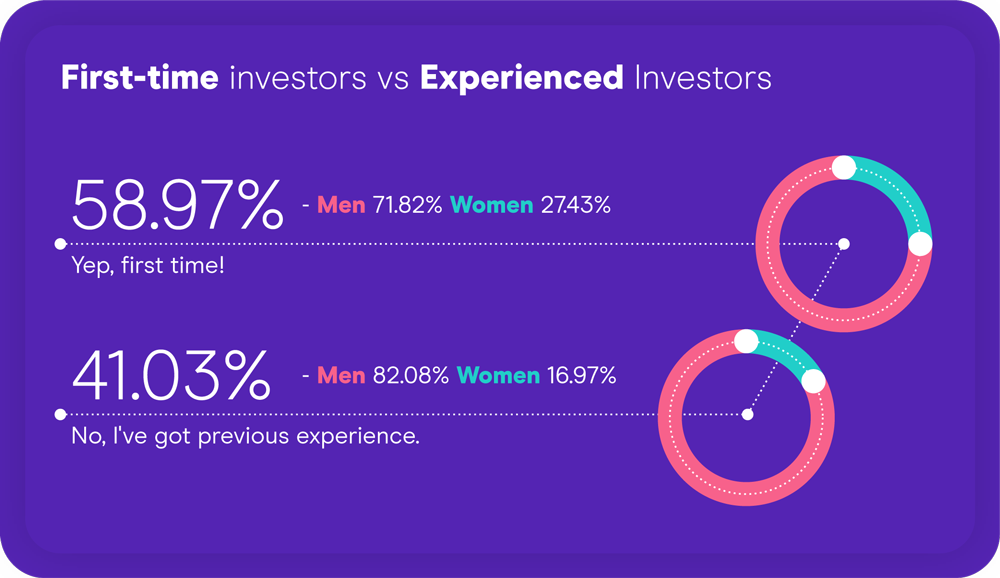

According to the respondents in the survey, a whopping 59% are first-time investors and have joined Freetrade to kick off their investing journey. Just 41% are joining Freetrade with existing experience.

When you think about it this statistic is insanely high. With a typical investor likely to be investing for decades throughout their life, in normal times you would expect these percentages to be the opposite and overwhelmingly in favour of those with previous experience.

Our hunch is that while the old heritage platforms continue to grow their users slowly, the commission-free apps are hoovering up the new generation of investors in their droves. Users of the heritage platforms may be stuck in their ways.

UK Retail Investors – Who Are They?

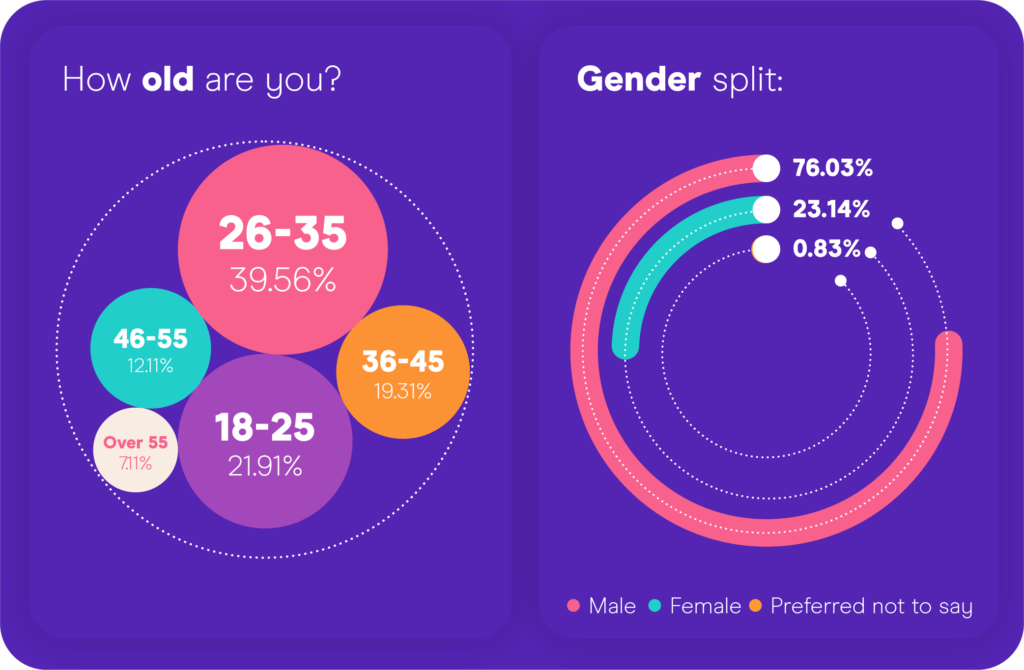

Here are the age ranges and the overall gender split. It comes as no surprise to us that men make up the vast majority of investors, consisting of over 76% vs 23% for women.

Freetrade state that the reason fewer women are investing is partially caused by the inequalities in pay between men and women. We disagree!

Investing apps like Freetrade have all but eliminated fees, so if the take-up of investing still remains low amongst women, then we suspect it is something more innate than just a difference in salaries. Freetrade is proof that anyone can invest from as little as £2, without fees. So why should size of salary cause a significant difference?

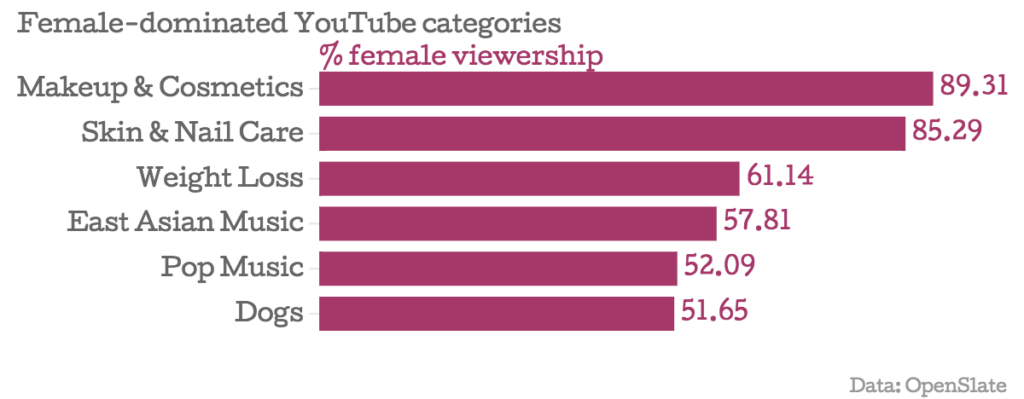

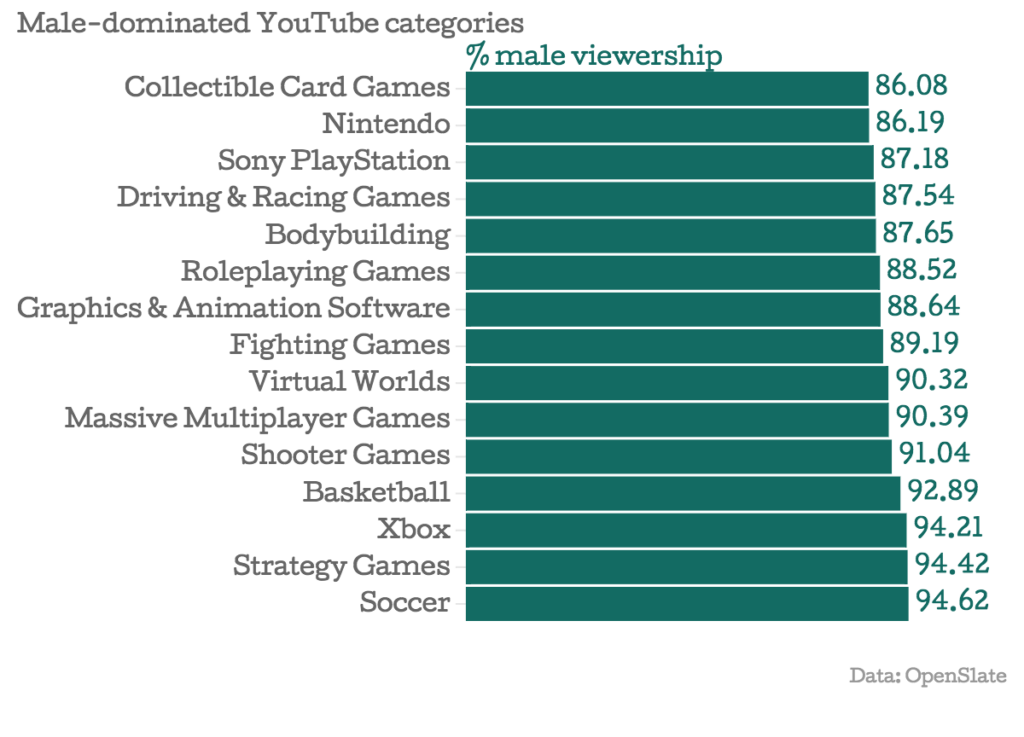

If we look at a study like this one of YouTube video categories it is clear that some subjects are favoured by either men or women. Men and women simply have different interests.

Anecdotally, out in the real world we meet loads of guys who have a keen interest in talking about the stock market, but personally have found women as a whole are far less interested.

Next, on to age. 61% of the surveyed users are under 35 years old, with 40% being between 26 and 35 years old. This is probably to be expected and comes as no surprise to us. That age group have started to make some good money from their jobs and so have more disposable income to invest. They are probably also keener to invest through an app than perhaps older generations who might prefer a web-based interface.

One interesting point was the living situation of the respondents. 45% of respondents are owners of their property, 24% rent, and 20% live with parents.

Considering the young ages of Freetrade’s investors and the fact that home ownership is known to be shrinking in that demographic, we’re surprised that almost half of the survey respondents own their own home.

Unfortunately, the survey results do not mention investors’ employment earnings. But if 45% own their home we suspect that many of their customers are doing rather well financially.

Freetrade’s mission is to get everyone investing and there’s no doubt they are doing a great job but based on this statistic it would seem they might be helping more middle earners than those right at the bottom. Perhaps the message that anyone can invest from as little as just £2 needs more time to filter through.

Key Reasons Why UK Investors Start Investing

45% want long-term financial stability and the key reason was wanting peace of mind knowing they were building their savings, and another 30% wanted to retire early. Respondents were able to choose more than one answer, so there will be some crossover.

We don’t think there is any better reason than these to start investing. It’s not a coincidence that wealthy people take deliberate action to grow wealth and end up wealthy.

In 20 years or so, their peers who didn’t invest will no doubt claim that these investors got lucky or have some excuse why they didn’t get started themselves. But the reality is these investors took deliberate action today to invest to take care of their futures!

A worrying number of people – 19% – said they invested because they were bored in lockdown.

These sound like the sort of people who see investing as akin to gambling and are looking for a thrill. We can imagine that these guys are probably the sort investing in meme stocks and looking for that quick win.

The markets have been very kind to all investors since the Covid crash and delivered unprecedented growth. Therefore, even those who have had no idea what they’re doing have come out the other side smelling of roses.

Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.”

What Are The Main Goals For UK Retail Investors

49% want more disposable income to support their lifestyle. This is a great reason to invest but we reckon that many people have unrealistic expectations. Building up a portfolio that supports a lifestyle, or at least partially, takes a lot of money and a lot of time. When we say this, we absolutely don’t want to deter people from investing because every little bit put aside helps.

The 4% rule gives you an idea of what you can withdraw each year without running down your pot. So, for every £10,000 invested you could withdraw £400 per year. On its own this won’t change your life but build that investment pot over time and that 4% can you set you free.

36% said they were investing for fun and had no goals. To be fair we also partially invest for fun. Who doesn’t like making money? 34% said they were investing for a property. We’re not sure this is a good idea unless the property purchase was many, many years in the future or they don’t mind waiting longer if the stock market fell. Stock market investing is way too volatile for money that is needed in the short-term.

How Do DIY Investors Research What To Invest In?

46% spend a couple of days researching an investment before pulling the trigger, 32% spend less than a day, 19% spend more than a week, and 3% spend months researching.

This is probably a little simplistic because if we look at our own behaviours, we spend no time thinking about investing when its business as usual. For instance, our monthly investments into ETFs take no consideration time whatsoever. We know exactly what we’re buying, when we’re buying, and how much we’re buying!

On the other hand, when it’s a new investment strategy, like when we first started investing in synthetic ETFs, or using leverage to enhance returns, it took us weeks of detailed research.

46% were investing with Freetrade at least once per month. Most people are paid their wages monthly, so we would have assumed this was the most popular response. 22% said once every few months.

16% said they have only invested once or twice. These don’t sound like the type of people who are prioritising their wealth building. 14% said they invest at least once per week. We don’t think many people can successfully day trade, so long-term we’d expect this group of traders to lose money.

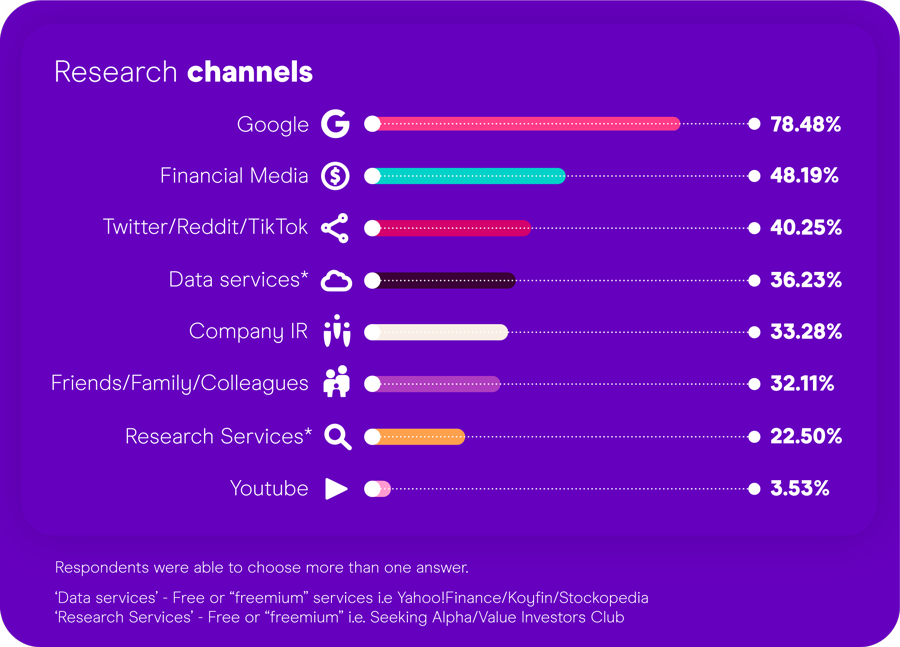

Here are the research channels being used and the percentage of people who use each channel. Unsurprisingly, Google is the most popular with 78% of people using it to get their information. Next up is the financial media at 48%.

Generally, the financial media can be a great source of information. But you also need to be wary of sensationalist and fear mongering stories. If you believed all the hype in the media, you would be selling everything due to an imminent crash caused by future inflation, a tech bubble, and tensions between the US and China. The next day you would be throwing everything at GameStop as it’s going to the moon.

Social media comes in at 40%. It’s interesting that they’ve grouped Reddit with useless social media sites Twitter and Tiktok. Reddit may indeed have idiotic subreddits but there’s also some brilliant ones, so we won’t tar them all with the same brush.

Data services and research services come in at 36% and 23% respectively. Data services includes sites like Yahoo! Finance and Stockopedia, and research services includes the likes of Seeking Alpha. Every investor who is investing in stocks should be using these kinds of sites. The sheer amount of quality data and research that you get is incredible and we highly recommend them.

And finally, YouTube comes in at just 3.5%. Shocking! As we primarily deliver our content through YouTube our audience are part of this elite group and obviously know where the best content is!

A Senior Analyst at Freetrade said, “Social media can make the headlines for the strangest of reasons but dismissing these platforms means ignoring the truly valuable educational content young people are finding on them.” He must watch Money Unshackled!

What Do Retail Investors Have In Their Portfolios?

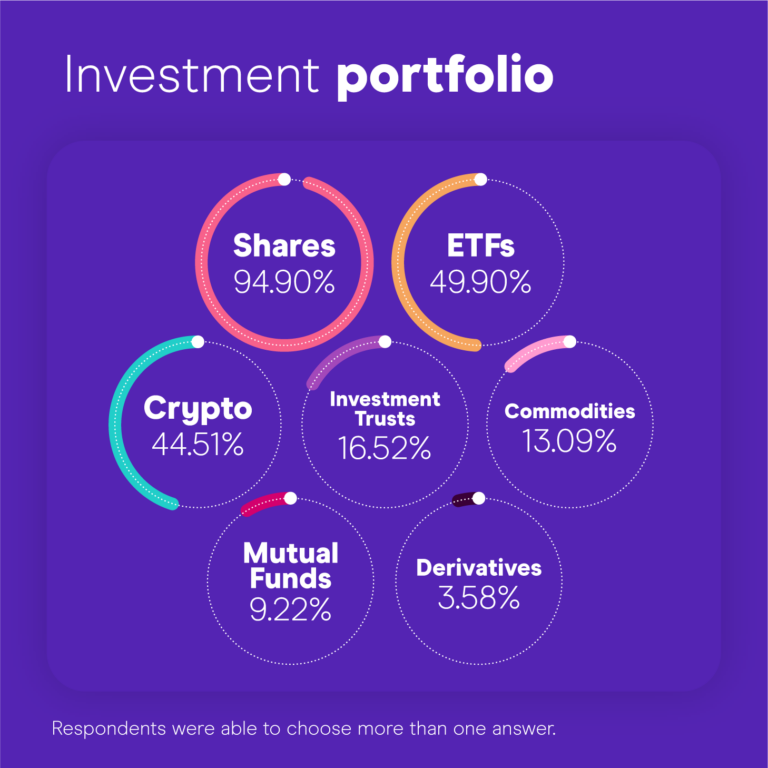

We’ve saved the best until last. 95% said they invest in individual companies and only 50% own ETFs. While this doesn’t surprise us, we don’t think most investors should be buying stocks directly. Or at least they should limit it to a small part of their overall portfolio, which is what we do. We’re not told what their portfolio allocations are so there’s no way of knowing but my gut feeling is these investors are too exposed to some of the so-called trendy stocks.

We have long banged the drum that ETFs should make up the core of every investor’s portfolio. If you watch our videos, you probably own ETFs yourself. A shocking number of people – 45% – own Crypto. Freetrade doesn’t offer crypto, so presumably this is bought elsewhere, but this is a very speculative asset that most normal people probably shouldn’t own due to the real risk of losing a tonne of money.

If you do invest in Crypto it’s probably best to limit your exposure to a small part of your overall portfolio. Also, this volatile asset contradicts the main goals for retail investors that we looked at earlier. 34% were saving towards a property purchase and 24% to help raise a family.

As always, we hope you found this post interesting and don’t forget to go grab your free share on Freetrade using this link.

Where do you do your investing research and why? Join the conversation in the comments below.

Written by Andy

Featured image credit: Prostock-studio/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: