In a post back in May, I showed how my portfolio had grown to £200k over 5 years, starting from almost nothing.

Now I want to talk about my plan to grow that £200k to £1m over the next 10 years or less. It’s already up to £254k since that last article, thanks to the property market – a good start!

This won’t just be about what I’m doing. It will be packed full of tips and key steps to take that you can apply to your own financial journey.

There are a lot of ways to get to £1m in 10 years, but the plan outlined here is one that literally anyone can do if you’re willing to take your investments to the next level.

That’s right – a super high salary isn’t required, nor do you need to wait a lifetime for compounding returns of 4 or 5% to take their course.

This is a fast, sensible route to riches that I’m taking, and that you might want to consider taking too. Let’s check it out!

ETFs are the bedrock of my stocks portfolio. With InvestEngine you can build a portfolio of fractional ETFs for free. Just set the percentage allocation for each ETF and you’re done – say goodbye to spreadsheets! And rebalancing your portfolio is as simple as couple of clicks. New users to the platform will receive a £50 welcome bonus if you use this offer link.

Alternatively Watch The YouTube Video > > >

Getting To £200k – A Recap

The first £200k of my Freedom Fund was built over 5 years mostly from cash contributions from salary savings, and from home equity release on my house. Together that made up around 2/3rds of the portfolio’s value.

Actual returns from my investments contributed the other 1/3rd of the value to that initial portfolio.

In the early stages of your Freedom Fund’s life, your contributions from your salary will have far more of an impact than your returns on investment.

Enormous percentage returns don’t really matter all that much at this stage: a 20% return on £1 is still just 20p. You will be able to grow your portfolio at a steady rate just by adding new cash.

Why The Next £800k Needs A New Approach

Soon, those monthly contributions from work will become almost inconsequential. In fact, right now I’m adding barely anything from my salary from Money Unshackled, and my portfolio is still growing fast under its own weight, simply from compounding.

Cashflow from rent payments on my properties goes into the stock market, and the market values of the properties and the shares are growing like mushrooms.

New money from your salary will be a nice little extra boost at this stage in a portfolio’s life, but it’s not a requirement if your investing returns are high enough. We can demonstrate this nicely using the Money Unshackled Early Retirement (FIRE) calculator.

The blue cumulative contributions bars are quickly outstripped by compounding returns as the years go on.

Left to grow in index funds or ETFs without any further contributions or effort, £200k would still get to £1m, but over a couple of decades. ETFs will always be a major part of my portfolio, but I will need to pull all the levers that I’ve learned about during my investing career to maximise my returns to get me to £1m in under 10 years.

What’s In Our Toolkit?

There are 4 main components that we consider appropriate for building a Freedom Fund. These are:

- Contributions from salary or other earned income;

- Cash from extracting equity from your own home;

- Index investing in the stock market – this is our bread and butter, and will use ETFs held in Stocks & Shares ISAs and SIPPs; and

- Leveraged investments in both stocks and property.

To grow rockstar wealth in under 10 years I’ll need my salary contributions, ISAs and SIPPs to be supported by the power of home equity release and, very importantly, by leveraging.

Leveraged investment property already makes up a significant chunk of my portfolio – going forwards, leveraged stock market indexes will do too.

The Plan

The following is based on real numbers from Ben’s current and forecast future portfolio. The Returns On Investment are based on the following assumptions:

- Inflation of 3%: all numbers are after deducting inflation.

- 5% pre-inflation annual growth in the property markets, which is at the low end of historical average UK house price rises going back to 1952. Adding in leverage from mortgages, capital growth ROI is increased in this portfolio to 17% pre-inflation.

- Rental income is based on what I actually receive now.

- Investments in Stocks & Shares ISAs and S IPPs will grow by 8% pre-inflation.

- Leveraged stocks, bonds, and gold in the portfolio will grow by 18% pre-inflation.

We also assume a smooth ride in the markets, for ease. In reality, it’s more likely there will be really good years and some bad years, maybe even a crash followed by a recovery.

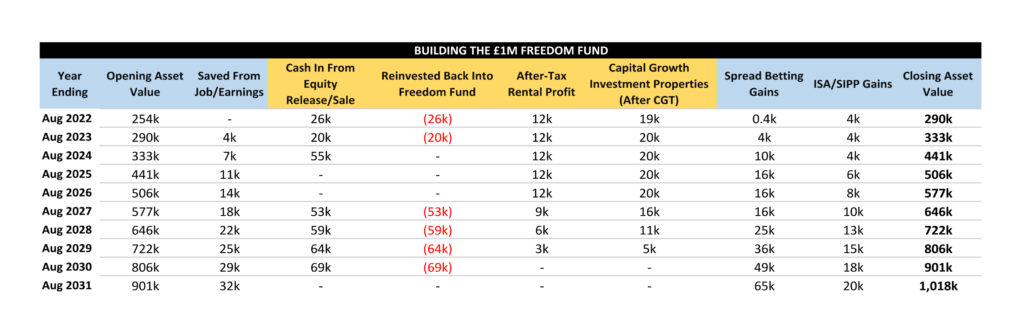

So, here’s my smoothed-out forecast route to £1 million:

The orange headed columns are all property related. We don’t want to bog you guys down in too many numbers, so we’ll just point out the interesting things. There’s the opening and closing sizes of the Freedom Fund each year, while the numbers in-between are the various additions to the pot each year.

There’s Cash From Savings, which starts off at zero and assumes monthly salary will grow by a moderate £300 each year. As we are business owners rather than employees, this is a very conservative assumption. It should easily grow faster than this. That’s lesson #1 – work for yourself!

Now let’s talk about what’s happening with property investments in the middle there. My eventual goal is to have the option of selling my properties in the final years of the plan if, as I suspect, government meddling makes it more and more tiresome to operate as a landlord.

In the final years, property is gradually sold off rather than all at once, to take full advantage of the annual capital gains allowance. Rental income and capital growth go down as a result.

You get stung by capital gains tax on rental property, because HMRC fail to account for inflation. So even if you had only made an inflationary gain each year – and hence nothing in real terms – you’d still be taxed as though you had made a big gain when you eventually sell the property.

Cash is funnelled from the sales into other assets, which has a net zero overall impact on the value of the portfolio since I’m already accruing for capital gains tax. In the earlier years, I’m able to take cash out of the properties by remortgaging them. In one case, I plan to remortgage my own home and injecting that cash as fresh money into the Freedom Fund.

I don’t mind having a slightly higher mortgage as a result, if it means I can buy investments that pay me an annual double-digit rate of return.

We don’t include the values of our own homes in our Freedom Funds, as they can’t be spent. But if you extract cash from your home in a remortgage, that cash is fair game to be invested and then included here.

So, where’s that cash from the property equity release going? It’s primarily going into ETFs in my Stocks & Shares ISAs, and into Spread Betting.

For a full introduction to our method of doing spread betting check out this article/video next, where we explain what we’ve been doing to make killer returns!

Here’s why this portfolio grows so quickly over the next 10 years, from August 2021 to August 2031:

The light and dark green segments are the leveraged assets; light green for rental properties, and dark green for spread betting (which is leveraged stock, bond and gold market indexes). As I sell off the properties, they are being replaced with spread betting investments. This keeps leverage in the portfolio throughout.

The leverage, and hence the risk, is intentionally decreased though as a proportion of the overall portfolio over the period. The unleveraged ISAs and SIPPs right now make up 31% of the portfolio, while by the end they make up 45%.

The leveraged assets start out at 4x leverage as they are almost all mortgaged properties with 25% deposits, but leverage falls to 3x by the end – our current preference for spread betting.

In practice, I will be reducing my leverage much further than this towards the end if I’m doing well – volatility should ideally be reduced when you reach your goals. I almost certainly will reduce my leveraged assets to around 1.5x or less when the portfolio hits £1m, making the overall portfolio around just 1.25x leveraged.

As well as reducing leverage as I go, I’m also reducing effort. By the end, all my portfolio will be manageable from a web browser, at just a few clicks per month – no more tenants; no more calls from agents; no more mortgages to manage.

Of course, I always do have the option to just keep the properties, but I don’t need to.

Andy’s (MU co-founder) plans are similar to mine, but he’s using spread betting from the outset as his source of leverage, instead of investment property. The returns are expected to be not too dissimilar, but could be considered higher risk, since there’s a chance the debt could be called in if it’s managed poorly – in what’s known as a margin call. Crucially though, it’s almost completely passive to manage.

How Pensions (SIPPs) and ISAs Slot Into This Plan

I’ll still be building up my Stocks & Shares ISAs – the holdings won’t be leveraged but they’ll be safe. No matter how much the market falls (outside of all-out nuclear war), I will always own these positions as the market can’t fall to zero. Despite the magic touch that leverage provides, an ISA is still my favourite tool for growing and holding wealth for this reason.

The ISA is the reliable base layer of the portfolio, that I will feed with cash from elsewhere in the portfolio until it matches the size of the leveraged assets (see right-hand side of bar chart above).

Our SIPPs hold all the pension money from our previous jobs, and neither of us are touching our SIPPs for now, until it becomes advantageous in the future to filter money from our business holdings through a pension.

For our age group, the likely age at which we could access our private pensions is 58. As we’re planning to retire a decade or two before this, the question must be asked whether we should be including SIPPs in our Freedom Funds at all.

In both our cases, it can – if you’re young, a pension should only be considered part of your current wealth if it is a relatively small-to-medium sized chunk of your overall net worth, such that you have other pots to draw an income from between now and retirement.

If a pension is where you’re holding most of your wealth, it can’t help you much while you’re young!

Also see this article for a much more in-depth analysis of how Stocks & Shares ISAs work alongside pensions to allow you to retire at any age.

Will you speed up your own investment journey to riches, or are you content to wait it out? Join the conversation in the comments below!

Written by Ben

Featured image credit: Andrey_Popov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: