The thought of budgeting is enough to make the eyes of most people glaze over in boredom. We hear you – it’s not the most exciting of subjects, which is why we’ve never covered it until now; and will be a big reason why so few people can commit to it.

But we think our approach is better than the usual penny-pinching approach touted elsewhere.

We suspect that the inability to stick to a budget is partly due to how you’ve been taught to do it. We’re guessing that previously you’ve been told that budgeting involves tracking everything you spend down to the penny.

You’ve also probably been incorrectly told that you must go over your last 3 months bank statements and also heard that you need to deprive yourself from everything you enjoy in life. It doesn’t have to be this way.

We’re not going to lie and say budgeting can be fun – it can’t! But hopefully in this article we can show you the techniques we use to keep it as simple as possible – and hopefully they’re ones that you can stick to as well.

If you head over to the Money Unshackled Offers page, you’ll find tons of great offers, such as free stocks worth up to £200 when you sign up to Freetrade or 6 months with zero management fees with Nutmeg. It’s definitely worth checking that page out.

Why You Need To Budget

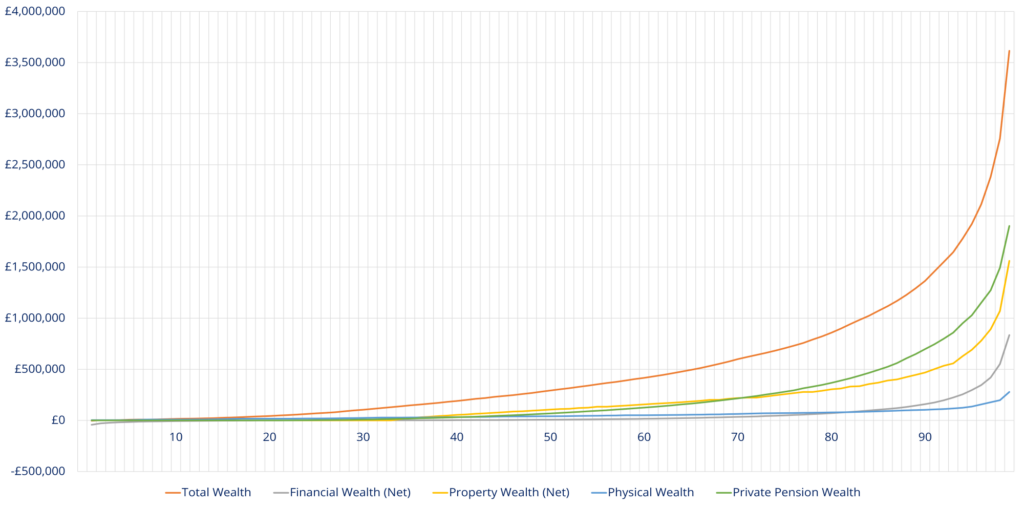

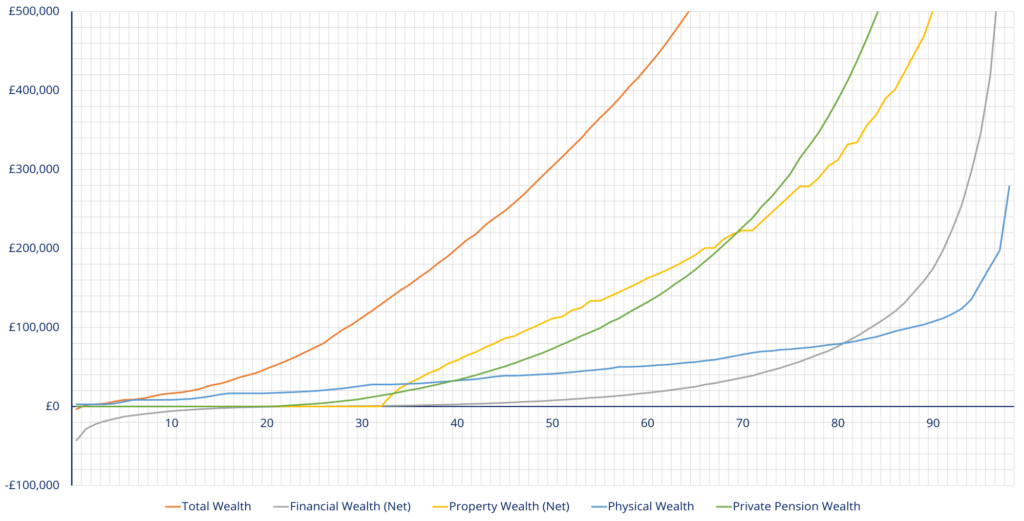

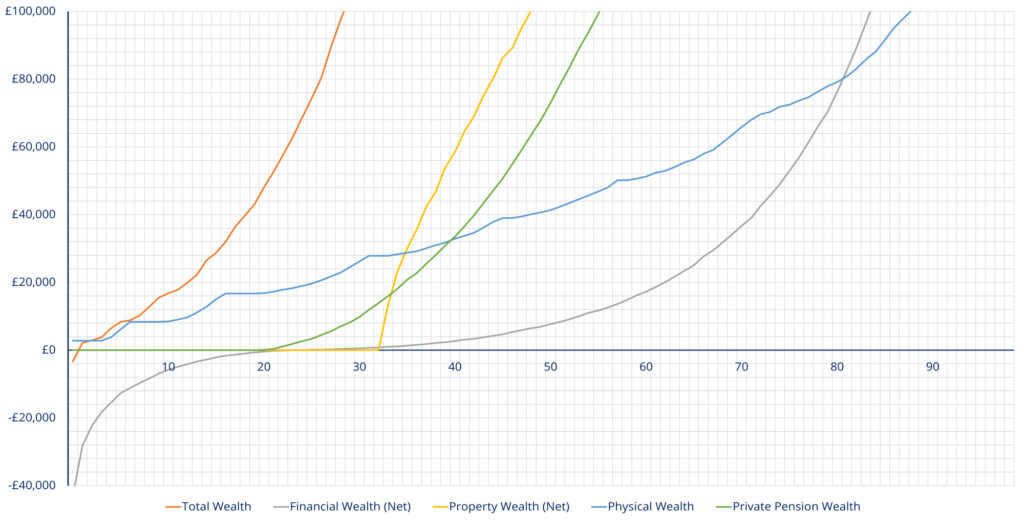

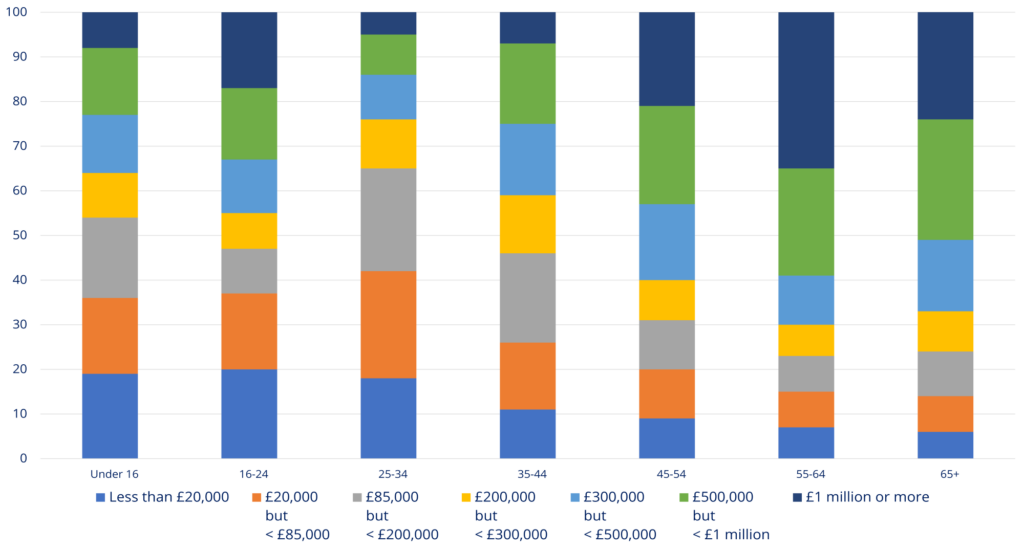

It’s no coincidence that those that don’t budget never have any money left at the end of the month. They live paycheck to paycheck. We’d go further and say there’s a clear rich/poor divide between those who budget and those who don’t.

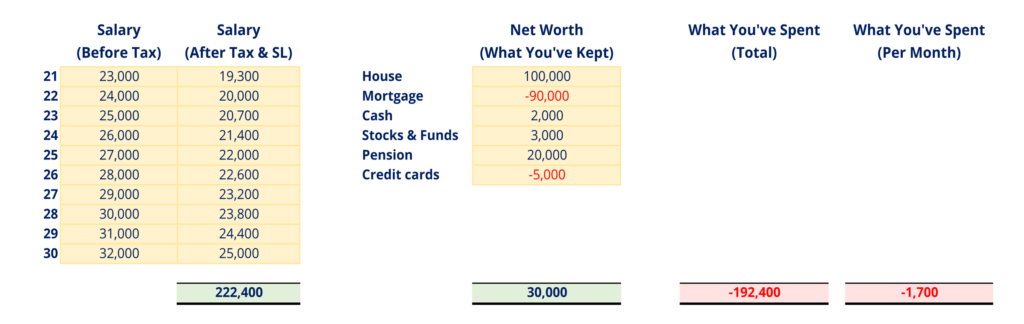

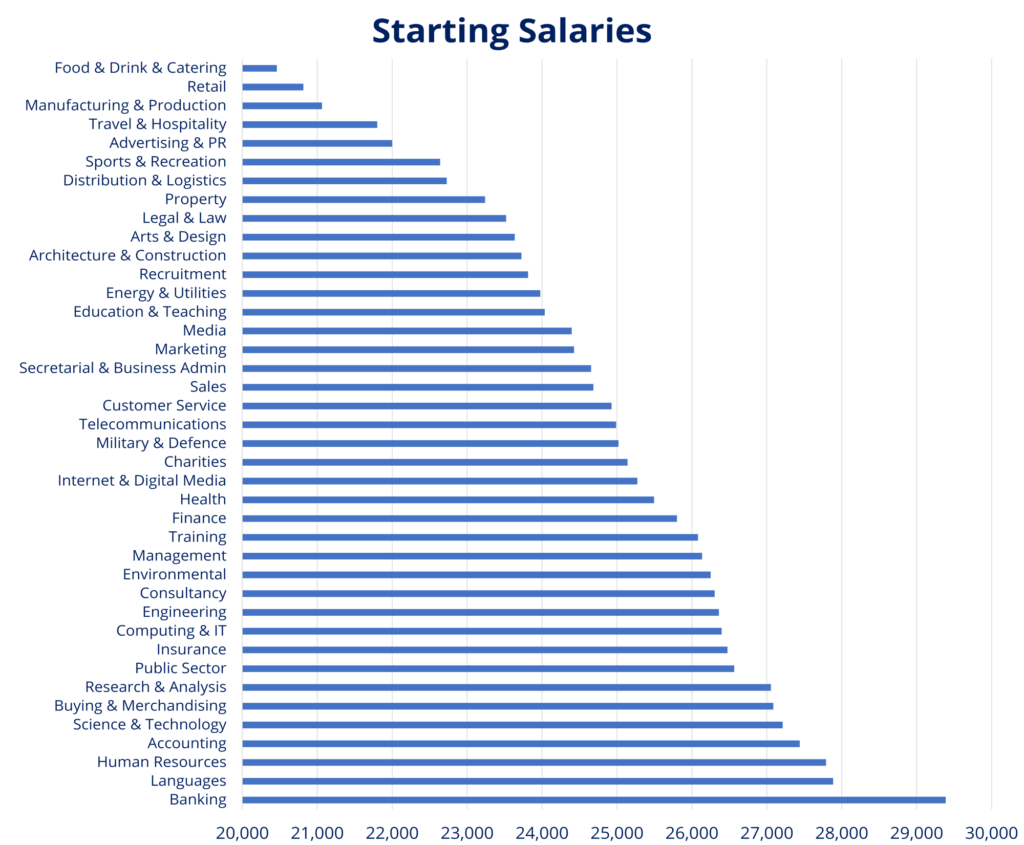

Many people might find this surprising, but it makes little difference how much money you make. We know many people who earn what most people would consider to be awesome salaries and yet they struggle financially.

Even in fields like accounting you would expect these people to have some financial sense, but you’ll be amazed just how many struggle – many of whom are counting down the days to payday just like someone who is on minimum wage.

Even premier league footballers and other celebrities who have earned millions end up broke!

Despite earning a massive £20m from his football career, famous England goalie David James declared bankruptcy in 2014, and ended up selling signed shirts to pay the bills.

Why do people have this problem? In many cases it’s because they fail to budget properly. You need to control your money, or it will control you.

When people earn more money what generally happens is their expenses quickly follow suit – bigger houses, faster cars, better holidays, fancier restaurants, private schools, horse riding lessons… you know.

Some lifestyle creep or lifestyle inflation is perfectly fine. It’s okay to reward yourself and enjoy the fruits of your labour.

But without a proper budget you are likely to let this get out of control and don’t really know what you can and can’t afford. This is where a budget comes in handy.

Pay Yourself First

A phrase you have probably heard us and every other financial commentator utter. It’s one of the most important things a person can do when it comes to managing finances and taking care of your future.

When we started paying ourselves first it really did change our lives. If you take away anything from this read, let it be this.

Paying yourself first means buying assets such as shares, gold, property and so on as soon as you get paid. Bestselling author Robert Kiyosaki calls these investments your asset column.

Paying yourself first allows you to spend the rest guilt free knowing that your financial future is taken care of.

How much should you pay yourself and what can you afford? This is what a budget will tell you.

By paying yourself first and then living on the remainder, you’ll know whether you can afford something or not. It will force you to tighten up in that month if you’re over-spending.

It’s amazing how simple this is and how effective it can be. It’s very important that you never dip into your investments – if you do it means your budget is failing and you’re stealing from your future.

Avoid Bad Debt

Sadly, a lot of people are not in the position yet to pay themselves first because in many cases they chose to use debt to plug any gaps between their income and expenditure. This means they have to pay their creditors first.

While this is not ideal it just means you have to clear this first before working on your own asset column.

Whether you’re paying yourself first or paying down your debts our budgeting techniques will help you take control of your finances.

Why Budgets Fail

We’ll get to the specifics of how to budget very soon, but first let’s look at why people usually fail with their budgets.

#1 – Tracking All Expenses

A lot of budgeting advice says that you need to track all expenses. This is time consuming and, in most cases, unnecessary. In theory this is the best way to budget and companies themselves do this; but they have entire accounting departments doing the work – you don’t!

For most people, this complex and time-consuming work is the cause of them jacking in the budget entirely. It’s better to focus on the important bits if it means you will stick with it and we’ll show you exactly how to do this.

The less affluent you are, and the tighter your budget, you will have to go into more granular detail than those who have a higher income. That’s because the cost of a coffee is more significant to them than for those with higher incomes.

You’ll work out for yourself the amount of granularity that you need to track to, but you don’t need to track everything.

#2 – Irregular Expenses

Another major reason why budgets fall down is because you’re often told to look at your last few months bank statements to work out what you spend.

This won’t work on its own because it does not include irregular expenses. A lot of what we spend is not monthly but is often yearly or even once every several years. At this point their budget fails and they quit. Our budgeting technique which we’re about to cover handles this.

Moreover, this often leads people to spend what they call their savings on these irregular expenses. Therefore, these people’s saving are not savings at all – they’re delayed spendings.

How To Budget Like A Pro

These are the steps that you want to take as soon as you get paid your salary:

1) Pay yourself first i.e. Invest

2) Transfer money for bills into a separate account (using a standing order)

3) Transfer money into a provision account for delayed spending (using a standing order)

4) Live on the rest

This means you will have a bank account that you get paid into, an investment account (probably a Stocks & Shares ISA), a separate current account for monthly bills, and a separate savings account (or accounts) for building up a delayed spending provision.

Budgeting is about looking forward. It’s about knowing what you will spend, so that you can avoid bad debt, live comfortably, and build a freedom fund or retirement pot – whatever you want to call it.

The best way to assess your current spending is to look at bank statements and also make reasonable assumptions about irregular expenses such as an annual holiday. Don’t forget that irregular expenses occur very infrequently, like a new car.

What we suggest you do is come up with a list of categories for your spending. This will probably include: Mortgage or rent, council tax, energy bills, phone and tv bills, food, clothes, entertainment and so on.

This list needs to be comprehensive. You should absolutely include things like Christmas spending, car maintenance, a provision for buying your next car, and new furniture such as a new mattress. It needs to include everything.

Don’t worry too much if you miss the odd thing. It’s not likely you will get it perfect first time, but do your best and always continue perfecting your budget.

How Much To Pay Yourself First/ Invest

This is the last part you can work out from your budget. Calculate what you can invest but make sure the action to invest on a monthly basis is done first. We use standing orders on pay day to automate this and we suggest you do the same. As long as you are disciplined you will make sure you never exceed what you put aside for living on.

You should aim to invest as much as you can here, but not to the point that you deprive yourself from having any fun.

If you calculate you can invest £100, try £150 and squeeze other areas tighter. It all helps Future-You.

Transfer Money For The Bills Account

Bills are usually consistent every month and are normally taken by direct debit or standing order. This usually includes the mortgage, utility bills, council tax, tv subscriptions, gym membership or sports clubs, and so on.

This means you should be able to budget for these with a great level of accuracy. Transfer the total spend into a separate bank account on the day you receive your salary and then you don’t need to worry about them not being paid.

If you could individually arrange for all of these to be paid at or near the day you receive your salary, then you can forgo the separate account. But you will probably have so many – with little control on the payment dates – that it’s best to have a separate current account for monthly bills.

Delayed Spending

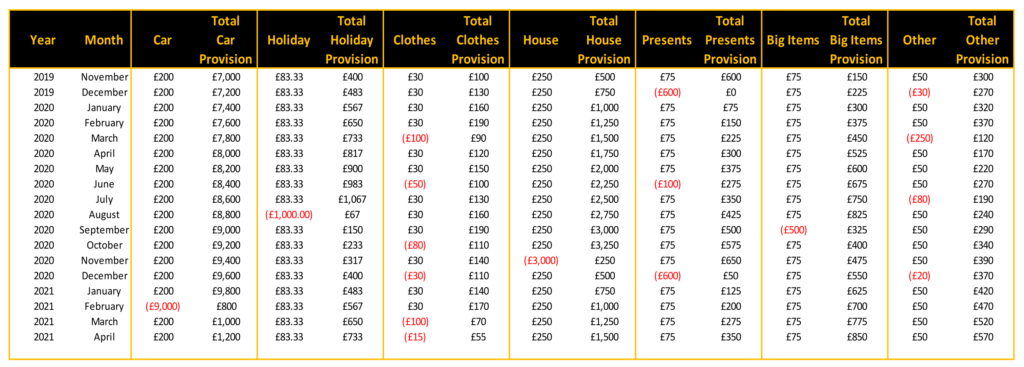

Irregular expenses are not as straight forward. They need to be broken down into monthly equivalents. For example, an annual holiday costing £1,000 let’s say, should be split into 12 months, so that £83.33 is put into a separate delayed spending account. It’s what an accountant would call a provision.

The same should be done with Christmas. If you normally spend £600 on Christmas, then it makes sense to put aside £50 a month (£600 /12 months) to prepare.

You should do this with every irregular expense. These might be saving for a new car, new house furniture, a boiler replacement, redecorating the house, etc.

This exercise might highlight that what you thought you were saving before was actually just all delayed spending. It might be demoralising to have to set so much aside for expenses which won’t happen for another year or so, but you should feel proud to be finally getting a grip on your finances.

Over time you will build up sizable pots and you will also run them down as you spend.

For example, over the course of a few years you may have built up a large pot for a new car, and then you deduct from this pot whenever you buy one.

It’s the best way to remove any guilt from spending as you know it’s all been planned for.

We tend to record each category on a spreadsheet and record each time money is added or withdrawn from the category. You probably want to aim for just several different categories, so you don’t overcomplicate things:

These might be Car, Holiday, Clothes, House, Presents, Big Items, and Other to mop up the rest. What we’re showing is just a simplified version of what it might look like.

Earlier we said that budgets often fail because they tell you to track all expenses. The method we are proposing only tracks irregular expenses, so is far less of a burden.

In the past we’ve tried to track all expenses and quit almost immediately and yet we’ve been able to track irregular expenses without fail using this method for years.

Some people with spreadsheet phobias might prefer to set up multiple savings accounts instead – one for each delayed spending category. Or there’s always the old-fashioned notepad and pen method! Do whatever works for you.

Live On The Rest

The remaining money in your main bank account is for you to live on. It means you can spend it as you please, as long as you don’t run it down to below zero before next payday.

Your expenditure here might include supermarket food, meals out, petrol or train fares, coffees, small purchases, nights out and whatever else you buy frequently.

What To Do If Your Budget Is Failing

Over time you will perfect this budget – and we expect it will take a few months of tweaking – but at first it might go wrong. In the first instance it would be okay to access your emergency fund or even your investments if it got to that stage.

If your boiler breaks and you had forgotten to put money aside for this in your delayed spending account, you do have a genuine emergency. Just make sure you replenish the emergency fund asap – and adjust your budget to add in future boiler breakdowns.

As this should be a planned for event, typically this would not be an emergency and so don’t get comfortable doing this. This is where your self-control comes into play.

We don’t normally advocate using debt for everyday spending, but if you have not yet built up an emergency fund, then using a 0% credit card might be a short term solution until you can plug the hole in your budget. Avoid payday loans and overdrafts like the plague!

How do you budget, and will you be adopting any of the techniques discussed today? Let us know in the comments below.

Alternatively Watch The YouTube Video > > >

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: