Over your lifetime how much of your salary have you kept? It’s a big question and the answer has a lot of implications.

Have you wasted hundreds of thousands of pounds over the years? Have you managed to convert much of what you’ve earned into assets?

If your goal is financial freedom like ours is, maybe you could be much further along the path than you are today if you’d made a point to keep more of what you made.

The average worker will earn well over £1million in a lifetime – and yet most struggle to get by. Does it really cost over £1million to provide food and shelter for a few decades?

Probably not if you stop and think about it. How much of your salary have you kept? Let’s check it out!

It’s worth checking out the Money Unshackled Offers page as we have tonnes of awesome cash bonuses and ways to make money listed that are continually being updated, including how you could make £500+ tax-free monthly from Matched Betting.

Why It’s Important To (Consistently) Keep Money

Work is hard – it’s a struggle that you have to keep getting up for, day after day, week after week, month after month, and you should want to have something to show for all that work.

For us, it’s the knowledge that for every hour of work we do, we continue to get paid after we’ve earned it indefinitely.

We’re talking of course about investing what we keep. For any money that you’re able to keep from your job and invest, you’ll continue to make money from it for the rest of your life.

It’s the Work Once Get Paid Forever mindset that eludes so many people – most of whom work every day and spend every penny.

It’s also important from a practical standpoint to keep more of what you earn. The state pension is by no means guaranteed for our generation.

Planning for retirement used to be a breeze. Invented in 1880 by the Germans, the state pension meant people could stop work at age 70, having kept nothing of what they’d earned, and be supported for life by the state.

This worked well for the Treasury because the average person died at age 38!

State pensions have gotten less generous with time – it’s incredibly costly for the government to maintain and this cost is rising rapidly as people are living longer.

By the time we’re pensioners we expect it will be means-tested, available only to the very poorest of people.

Your Human Capital

We’re going to work out what your value is as a money-producing asset. This is your human capital – how much your time and energy has been worth over your working life.

You’ll might be annoyed with yourself at just how much money you’ve let slip away, perhaps with little to show for it in way of savings and wealth – but it’s largely been beyond your control, as we’ll soon show.

As an employee, the deck is stacked against you, but we’ll get to how you can reshuffle it to your advantage soon.

We’re not minimalists like much of the FIRE community are, but while our focus is on growing our wealth, it’s still true that we should be setting aside as much of it as possible.

That excess money should be being made to work hard for us as financial capital through our investments, so our human capital can put its feet up.

How Much Have You Kept?

Some money has entered your life. Quite a lot of it has left. What you have kept – your net worth – is what you have to show for your efforts.

Your net worth is the value of your assets, minus all debt (except UK student loan debt, which works more like a tax).

Most people have very little savings. The average 40-year-old only has £6,000 set aside. And only 4% of UK citizens invest in Stocks & Shares ISAs.

It should be fairly easy to work out the value of all your financial assets – your cash, your bank and savings accounts, and the current values of your stocks, bonds, investment property, commodities, plus your private pensions and any other investments.

We looked at the average net worth in the UK and it’s component parts in this video, which showed that around 1 in 5 households shockingly have a negative financial wealth, with more debt than they have cash or investments.

In purely money terms, these people have sadly wasted every one of their countless work hours with less than nothing to show for it. Around the same number of households have no private work pensions either.

The ONS includes the value of all of your assorted junk in their definition of net worth too – your car, your phone, laptops, and everything that’s not nailed down in your house.

But we, and likely you, know better – these things are all expenses. Wealth is no more securely stored in them than it would be by just leaving your cash in the street.

The only physical possessions that represent money kept are items that hold their value like jewellery and art, and your house – which you can include at market value minus the outstanding mortgage.

How Much Have You Earned In Your Life

So, you can easily add up how much you’ve kept – but how much did you earn in the first place?

For most people, what they’ve kept will be a joke compared to what they made – outgoings have a nasty habit of catching up to income.

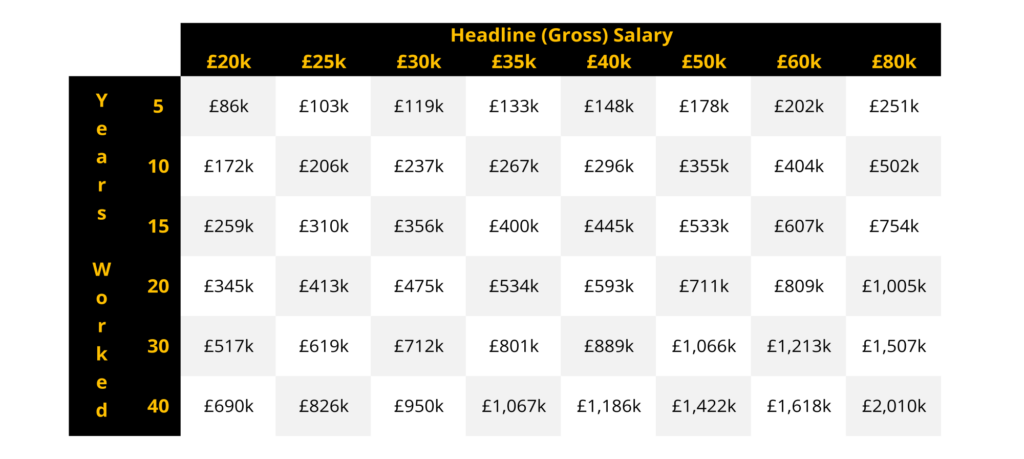

Above is a very, very rough approximation of your total take-home pay during your career depending on years worked and headline salary, after deducting tax and student loans, assuming you’re employed.

There’s some pretty chunky numbers there – if you’ve averaged a 35 grand salary over 15 years, you’ll have had around 400 grand enter your bank account.

Where’s that money now? How does it compare to the amount you’ve kept – your money, investments and property?

If you do have investment income alongside a job, don’t include it in this exercise.

Hopefully you’re reinvesting all of that anyway if you’re still working, and we’re just interested in how your blood, sweat and tears from time served toiling the mine – so to speak – translates into saved wealth.

The Question Reworded – How Much Have You Spent?

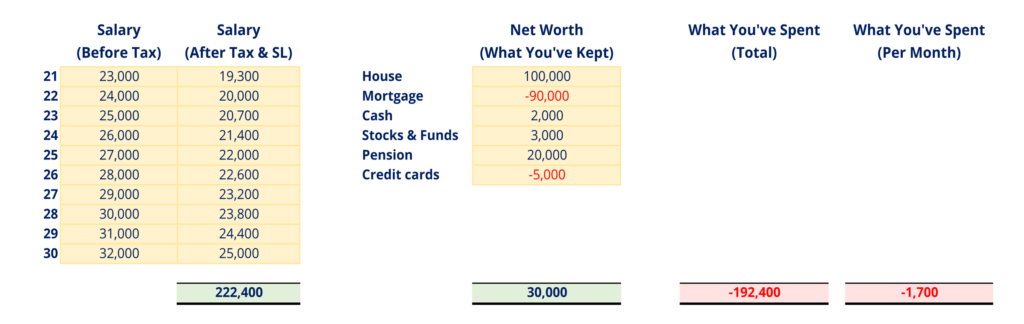

Above is what we think a fairly typical 30-year old’s workings might look like. Their after-tax salary, averaging £27,500 over 10 hard years of slog in the office has brought home £222k of bacon.

A 30-year-old might have just climbed onto the property ladder with their partner in an entry level home, with a claim to half of it – offset by a hefty mortgage, of course.

They’ll likely have a small cash buffer and the beginnings of an investment portfolio, if they’re sensible.

Their workplace pensions will have started to build, if only at a snail’s pace, and more than likely they’ll have some credit card debt too – hopefully at 0% interest.

This person would have held onto £30k of the money that they earned – the rest having gone up in a puff of smoke.

Total spending on expenses over the decade was £192,000.

Wow – it’s expensive being human. And to think a cat needs less than a fiver a week to live the dream life.

£192,000 translates to £1,700 per month. It’s not unreasonable to think that at least some of this could be being directed towards investments each month instead.

What You Really Make From Your Job

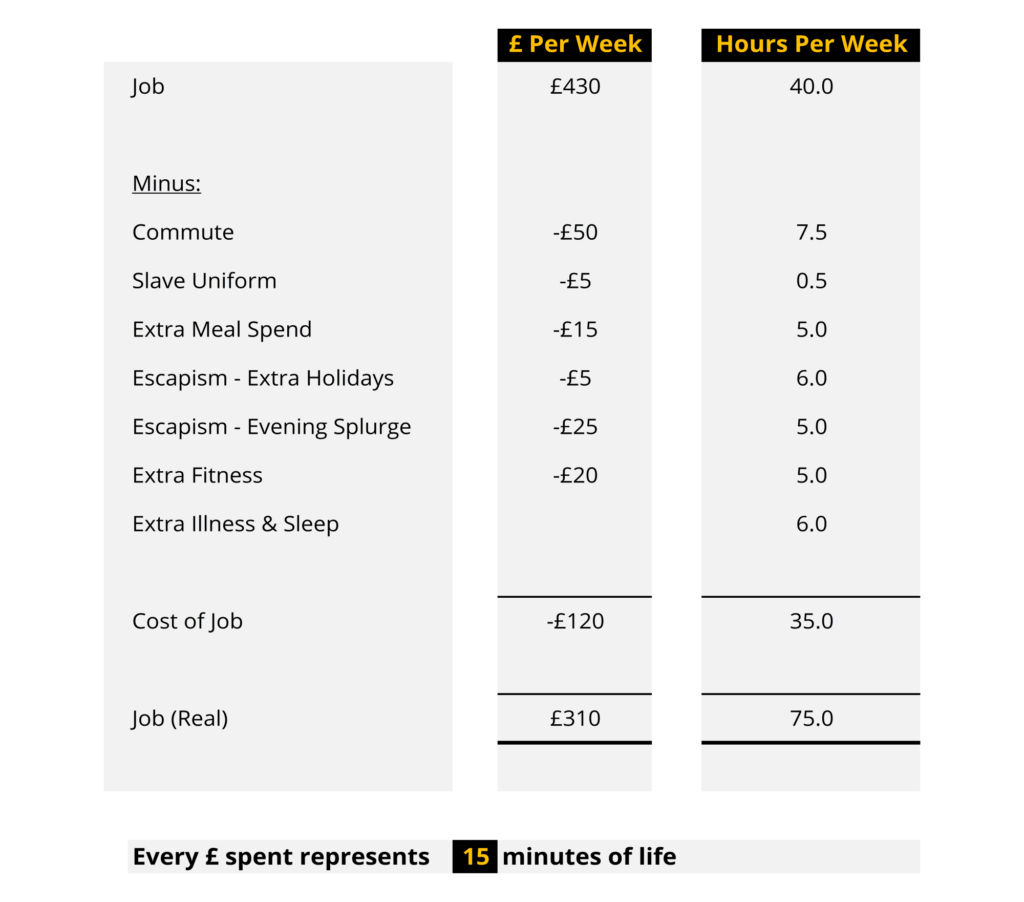

That imaginary worker on £27,500 a year gross salary has a take home pay of £430 a week.

But he doesn’t really make £430 – there are a whole bunch of work-related expenses that are only incurred as a result of having the job.

So how much of your income gets lost on maintaining a job?

Above is a reasonable example, inspired by the book “Your Money Or Your Life” by Vicki Robin.

You should knock off an amount for your commute – your petrol, wear and tear on car tyres, train fare, and the coffee you need to buy en route to make the journey bearable.

Then there’s your slave uniform – the clothes you only bought because you were forced to in order to comply with your job’s rules or culture.

Do you sit at your home computer in a full suit and tie? Probably not. But you might need to in the office.

You likely spend more on food when you’re at work – those Pret a Manger’s soon add up.

And the stress of work likely means you need more escapism, with extra holidays and meals out in the evenings to make up for the life you’ve not been living.

And maybe those long hours sitting at a desk are having health impacts that must be remedied with fitness classes and visits to the gym.

We can see that about a quarter of this guy’s earnings have gone on maintaining his job – £120 a week adds up to £62,000 over 10 years.

Think In Terms Of Hours Lost

Think of your outgoings in terms of the hours taken to earn it. Do this thought exercise before every purchase, and allow your default response to be to invest that money instead.

But you don’t just work 40 hours a week. All those job costs have a cost in time too, as well as possibly needing extra sleep on the weekends and time to recover from illness from overwork – like the example shown in the above table.

For this example employee, every £1 spent represents 15 minutes of their life that they had to sacrifice. Or put another way, every hour nets them just £4. Is that new BMW worth 7,000 work hours?

Slash The Biggest Cost

The largest controllable cost you have as an employee is probably your job maintenance cost.

It might be unreasonable to cut your rent or reduce your basic standard of living, but those jobs costs could be mostly eliminated by a permanent move to home-working.

Working from home removes the need for a commute, for a slave uniform, for expensive lunches, and getting rid of the commute alone will probably reduce the need for stress-induced spending splurges, and benefits your health by reducing the time you’re sitting in a vehicle each day.

Much of the country worked from home during 2020 and witnessed these improvements for themselves. It might be in your financial interest to keep this trend going if you can negotiate it.

Break The Time-Link

Your job probably pays you far less than what you’re worth. Are you willing to keep trading your time for a pittance an hour?

We weren’t – so we decided to start earning our money via an asset instead, rather than a salary, by which we mean a business that we own.

Every hour of work that you put into your business makes it a more efficient money-making machine, with efforts increasing scale, and value locked-in and built on.

You can’t do this as easily with a salary.

What’s your age and how much of your salary have you kept? Let us know in the comments below!

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: