Is buying a property always better than renting? In the UK we’re obsessed with home ownership, and you’ll have heard people say that renting is just throwing money away. But is this really the case?

Because of this belief many young people stay living within their childhood bedroom well into their late 20s because they can’t afford to buy and yet refuse to rent.

Owning your own home is both very exciting and scary at the same time.

You have the freedom to live how you like, can decorate it how you please, and can get a furry companion to keep you company, but every little problem is now your problem to deal with.

Saving for a house deposit is a tall order but let’s assume you have been saving diligently and have managed to put aside enough to secure a home.

Before taking the leap into home ownership you need to answer ‘yes’ to the questions in this article. Plus, we’ll finish up with our best less-talked-about financial tips for when buying a home. Let’s check it out…

Alternatively Watch The YouTube Video > > >

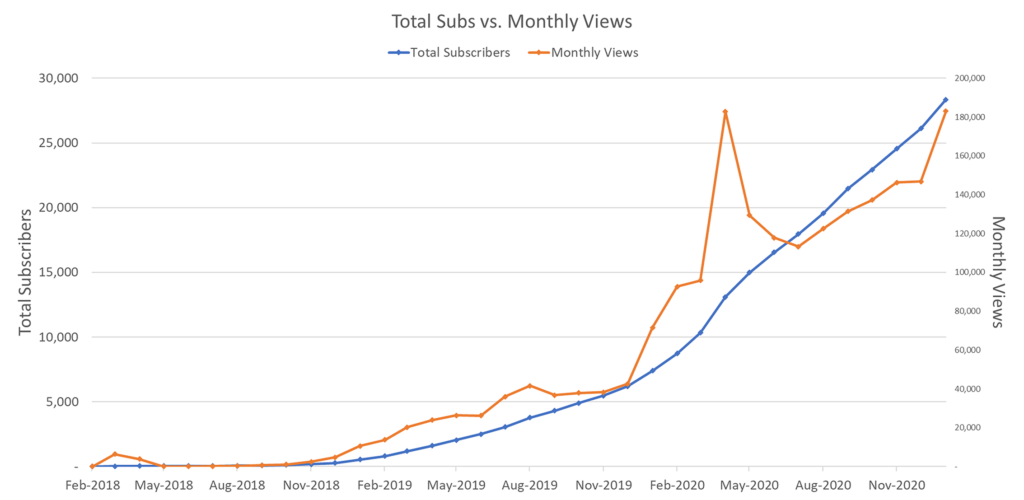

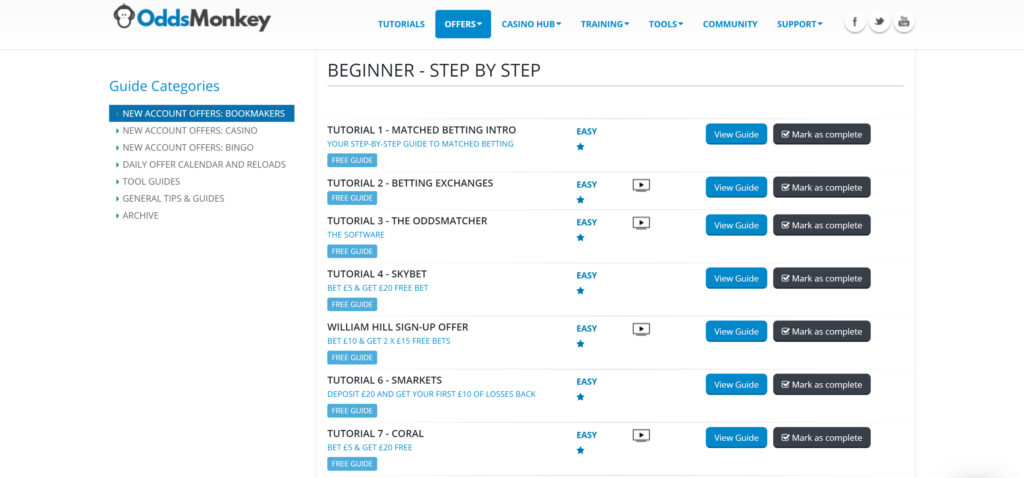

If you’re looking to bring in some extra money alongside your day job to build up your house deposit then check out our guide to matched betting, along with free trials and discounts to the software that walks you through the entire process. Despite the name it isn’t gambling and can be a great way to bring in an extra £500 a month!

Question 1: Do You Plan To Live There At Least 5 Years?

Buying a home is a huge commitment and the running costs can often be far steeper than people expect. But before you even get your hands on the keys, you will have to pay all manner of fees and taxes. There’s always someone with their hand in your pocket!

If you’re intending to live in this property for years – we suggest it has to be 5 years minimum to warrant these high upfront costs – then they become less and less important.

So, what upfront costs can you expect to pay? You’ll have surveyor fees, legal fees, mortgage arrangement fees, and the savings-destroyer: stamp duty. Then you’ll have to furnish the house and bring it up your standard.

You’ll even be stung for little things that you would never expect. When I (MU co-founder Andy) bought my last house, I had to pay the council £50 just to get some wheelie bins – ridiculous.

You can expect all this to add up to thousands and thousands of pounds, and this will vary hugely based on the value of the home you’re buying, the state it’s in, and what furniture you already own.

For those interested here’s an article with some estimates of what this may cost.

Some of these costs don’t affect the buy or rent decision because you can still keep whatever it was you bought.

For example, if you buy a sofa you will very likely be able to take this with you should you move elsewhere.

Unfortunately, a boat load of those fees are expenses that once spent is lost money. It’s gone forever.

For example, and ignoring the temporary stamp duty holiday, stamp duty will cost thousands. On a £400k house you are charged £10k in stamp duty alone. Ouch!

Many people are so desperate to own their own home they buy based on their current lifestyle, but a lot changes in life, especially in your 20s.

That 1-bedroom studio apartment in the city centre might be perfect for you now when all you want to do is party all the time, but will it be suitable when you’ve met someone and now want a bigger house or to live in a better area?

You also probably bought the best property you could afford at the time and sacrificed a great deal because the budget wouldn’t stretch that far.

Within a few years you could potentially have doubled your income and that small and dingy apartment will no longer be good enough.

Question 2: Do You Expect House Prices To Keep Going Up?

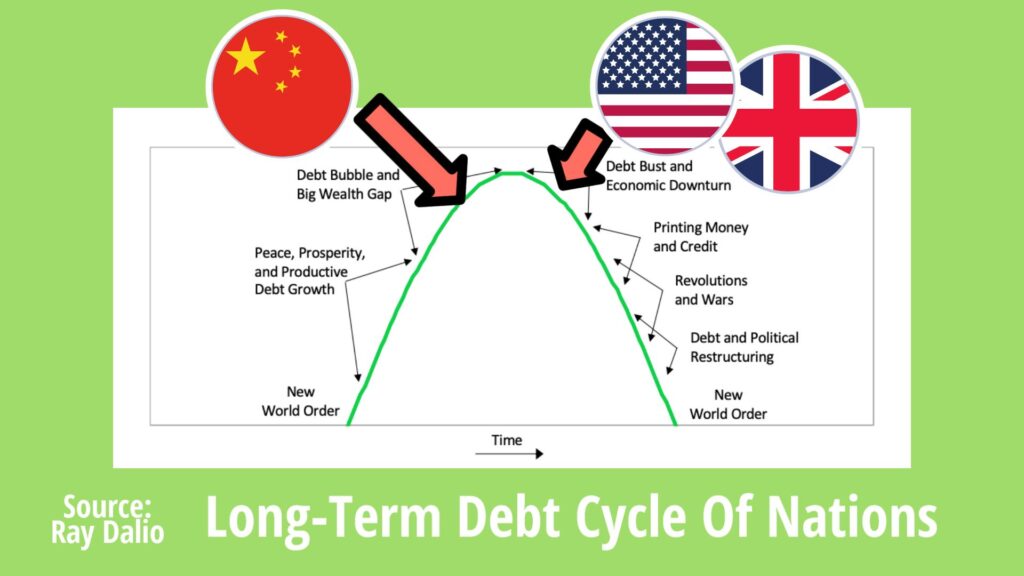

There’s a widespread belief that house prices only go upwards, so you should get on the property ladder asap and ride the property wave to a wealthy retirement!

We get why people think this. This is a trend that has been mostly true for the last 3 generations. All we have ever known is increasing house prices.

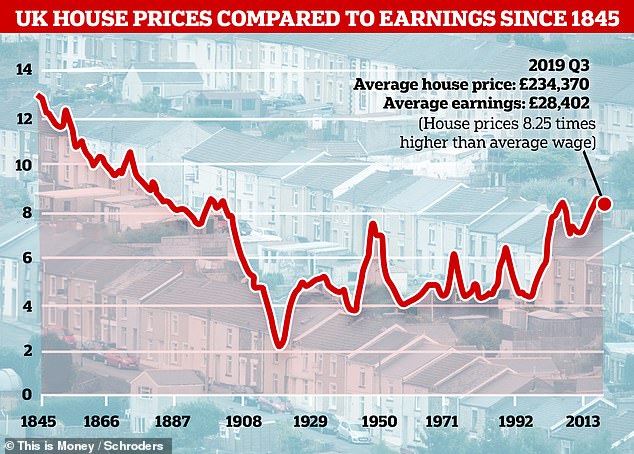

Thisismoney.co.uk published a really powerful chart showing house prices vs average earnings over the last 174 years:

For the first 70 years they just kept getting cheaper. So maybe we’re due a spell where house prices at the very least stagnate.

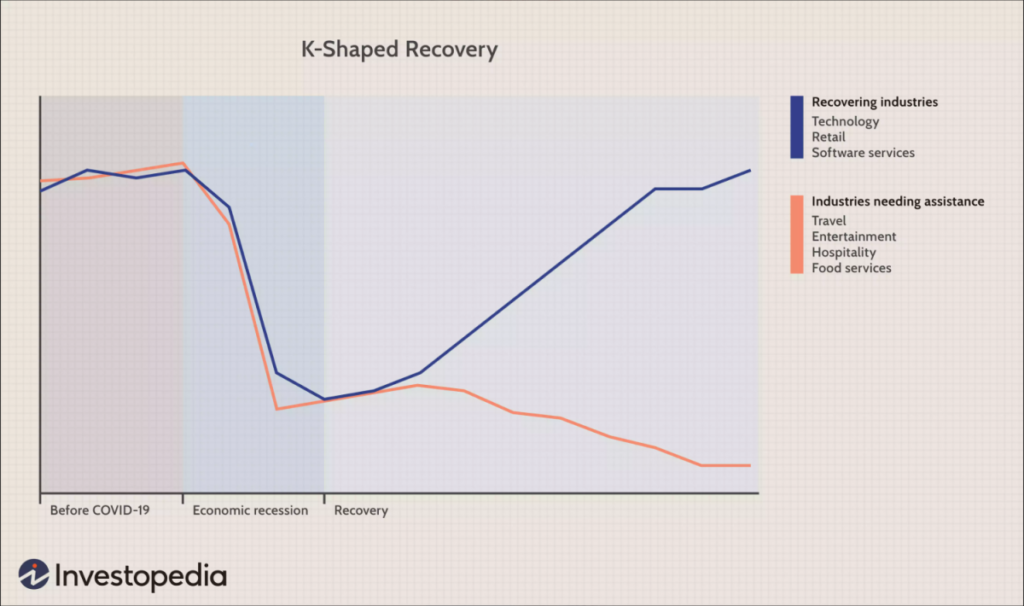

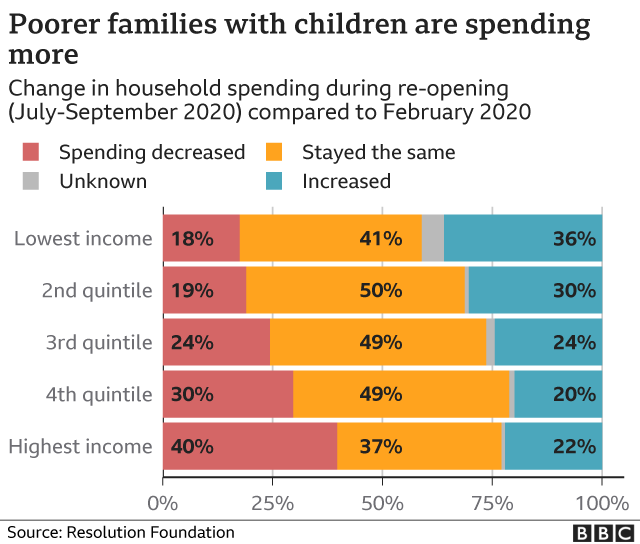

House prices are already over 8 times the average wage, and if we combine that with current economic stagnation, rock bottom interest rates which long-term can only go up, and massive unemployment being masked by government job retention policies, then one does have to question whether house prices can continue to rise.

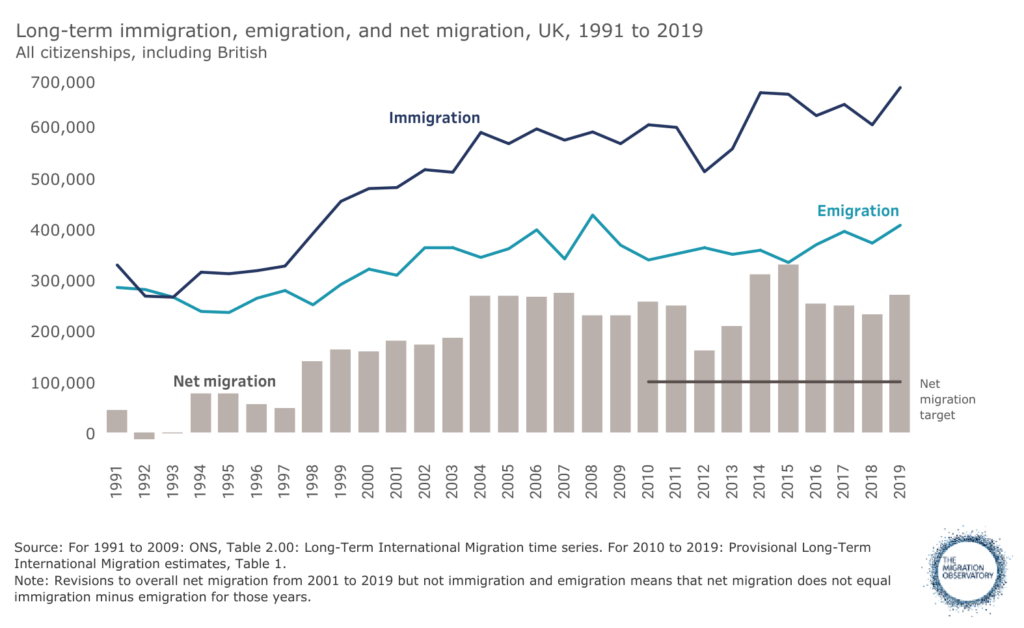

Arguably one reason for such epic house price increases over the last few decades has been due to high immigration and not enough houses being built to meet the demand.

We have no idea what immigration policies the UK will implement now that we’ve Brexited but with the UK fertility rate per woman at just 1.7, there could now be a shrinking population, which isn’t good for house prices.

Question 3: Is A House Deposit And Associated Expenses The Best Use Of Your Money?

If we assume that house prices do continue to rise, that doesn’t automatically mean that home ownership is a must.

Right from the outset there is a massive opportunity cost that comes from having to pay a big deposit and all the associated expenses. Over time as you pay down the mortgage you will end up with equity of hundreds of thousands of pounds just sitting there doing nothing.

For those of you who aren’t boring accountants, an opportunity cost is the forgone benefit that you would have received if you’d chosen to spend your money differently.

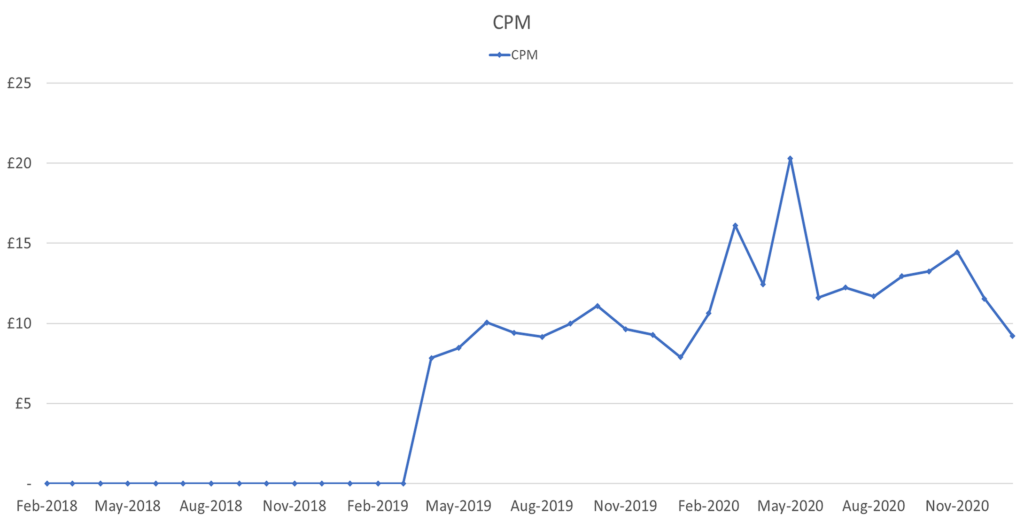

For example; if you don’t tie your money up in property, you could instead use it to invest in the stock market – or boost your employment prospects with an expensive professional qualification.

Better yet, could that capital be used to start a business instead? The stock market can be very lucrative but there’s no better route to wealth than to cast your employment shackles to the ground and go into business on your own.

Most businesses require some upfront capital, and with most young people struggling to gather enough money for a house purchase, there is slim chance of there being any left over to start building the business empire.

In other words, that mortgage is just another set of chains preventing you from achieving your ambition.

Question 4: Are You Willing To Sacrifice Your Current Lifestyle?

As a finance channel we typically encourage delayed gratification. Any small amount of money saved and invested today could be worth 10 times that amount in the future.

Nevertheless, what you do with your money is up to you, and renting can give you access to a better-quality home than you could afford to buy.

You might not be able to afford to buy in the trendy part of town where you have great access to the best bars and restaurants, or fantastic public transport connections, or a good local school. However, you might be able to afford to rent there.

If we wind the clock back to the good old days when we were at University, we had a big house in the centre of the main student area surrounded by everything a 20-year-old would want.

There was no way a bunch of poverty-stricken students could have afforded that house, but by renting we could live the high life!

Question 5: Do You Know The Area You Are Buying In?

Never buy a property in an area you don’t know. As we’ve already mentioned, buying a house is a medium to long-term purchase. If you don’t know the area… how do you know if you like it?

You can do all the research but some things you won’t know until you actually live there.

On paper the area might have everything that you want, but the commute to work could be a nightmare or maybe the mobile signal is non-existent.

You’ll likely never find the perfect home, but renting in an area first before buying can help you get a little closer to perfection.

Question 6: Are You Good At Budgeting?

One of the best things about renting is you know with a degree of certainty what your housing costs are each month.

Rent will be the same each month, so will council tax, and utility bills will be roughly the same month in, month out. So, if you suck at budgeting, then renting will make it as easy as it can possibly get.

For homeowners, however, it’s not quite so simple. While the mortgage payments often stay consistent in the short-term (if you’re on a fixed-rate mortgage), there could be any number of unexpected costs.

From boiler breakdowns, to clogged guttering, to leaky pipes, to birds living in the roof – there is an infinite number of potential faults that can occur at any time that must be paid for by the homeowner.

If You Are Buying…Consider These First

Don’t Buy The Most Expensive Home You Can Afford

It’s a common belief that you should buy the most expensive house that a bank will allow you to, because property only ever goes up and therefore you will get the maximum returns possible.

We’ve already busted the myth that property only ever goes up but let’s also consider 2 other reasons why buying the most expensive house is a bad idea.

- Being crippled by mortgage payments is no way to live and it can tie you to a career and life you hate. If you want to gain extra exposure to the property market it can be done with a BTL property. It doesn’t have to be done with your own home; and

- Buying an expensive property which you can barely afford now leaves no wiggle room if interest rates go up, you lose your job, or your partner decides to pack up and leave you.

Only Buy A Property Others Would Want To Buy

From a financial perspective never ever buy a property that has some unusual feature or is of a Non-Standard Construction.

A Non-Standard Construction uses materials that don’t conform to the ‘standard’ definition, which means brick or stone walls with a roof made of slate or tile. A Non-Standard Construction is basically anything that falls outside of this definition and can include thatched roofs, or walls constructed from concrete or wood to name just a few.

A Non-Standard Construction can cause a property to have increased costs to maintain and insure. In fact, potential buyers may even struggle to secure a mortgage on such a property.

Even though you may think it’s your dream home now, there’s a high chance that you will want to move in the future and selling might be problematic. Our tip is to always think of selling even when you’re buying.

Beware Of The New Build Premium

New build homes are awesome. Everything is in a perfect unspoiled condition and any issues that arise within 2 years will be fixed by the builders as part of the guarantee.

But these positives don’t come for free. According to Zoopla and data from the Land Registry, in 2019 the average new home sold for £290k, compared to a typical sales price of £225k for older properties – that puts the new build premium at £65k or +29%.

Does that mean from a financial perspective that you should never buy a new build property? We don’t think so.

Older properties tend to need a lot of work to bring them to a condition that you’re happy with. You might need to install new bathrooms, a new kitchen, rewire the house, and so on. All this costs a substantial amount of money and has to be 100% paid for today.

A new build, however, doesn’t need any major work for several years, so you have essentially been able to pay for all the renovation work to be done with a mortgage instead.

Although the new build property is more expensive, it is better for your cashflow. A fixer-upper on the other hand costs far more in cashflow and time – but you do have a significantly higher chance of increasing the value.

Have we changed your views on the Rent vs Buy debate? Let us know in the comments below.

Features image credit: Keith Ryall/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: