Where do you want to be in 10 years? If we’d asked our 18-year old selves that question, the answer would have been “F-ing rich!”. But of course what we meant was Financially Free.

There are millions of pathways you can follow to get to Financial Freedom, but these mostly converge into 1 of just 2 super-highways. 2 very different journeys, but with the same end destination.

These routes can get you financially free after 10 years if you really want it. Most don’t, so don’t achieve it. At the very least you will improve your financial security allowing you to control your own life.

Which 10-year plan will you choose?

Route 1 – The Graduate

Overview

This route involves being at the top of your game as an employee, while converting all possible disposable income into investments that will support you financially.

Qualifications Are Everything

If you’re following this route, you want to be the highest paid employee you are capable of being, which means qualifications.

Like it or not, graduates get paid more than non-graduates. A lot more.

Statistics from the Department for Education show the average salary for graduates over their lifetime is £34,000. The corresponding figure for non-graduates is only £25,000.

But the qualification has to be relevant and targeted.

When Qualifications Aren’t Everything

You can’t be a Performing Arts graduate and expect to make decent money – well you can but know you are defying the odds.

All qualifications have a Cost to Benefits Ratio, and many UK degrees are unfortunately not worth the paper they are written on.

We can do some analysis to see which qualifications offer the best returns relative to the cost, essential if you’re to reach Freedom in just 10 years.

Seeing as the broken university system in the UK charges over 9 grand per degree, whether you’re studying Brain Surgery… or Knitwear… at least for starting salaries it’s as simple as looking at which career offers the highest wage.

Best Performing Degrees

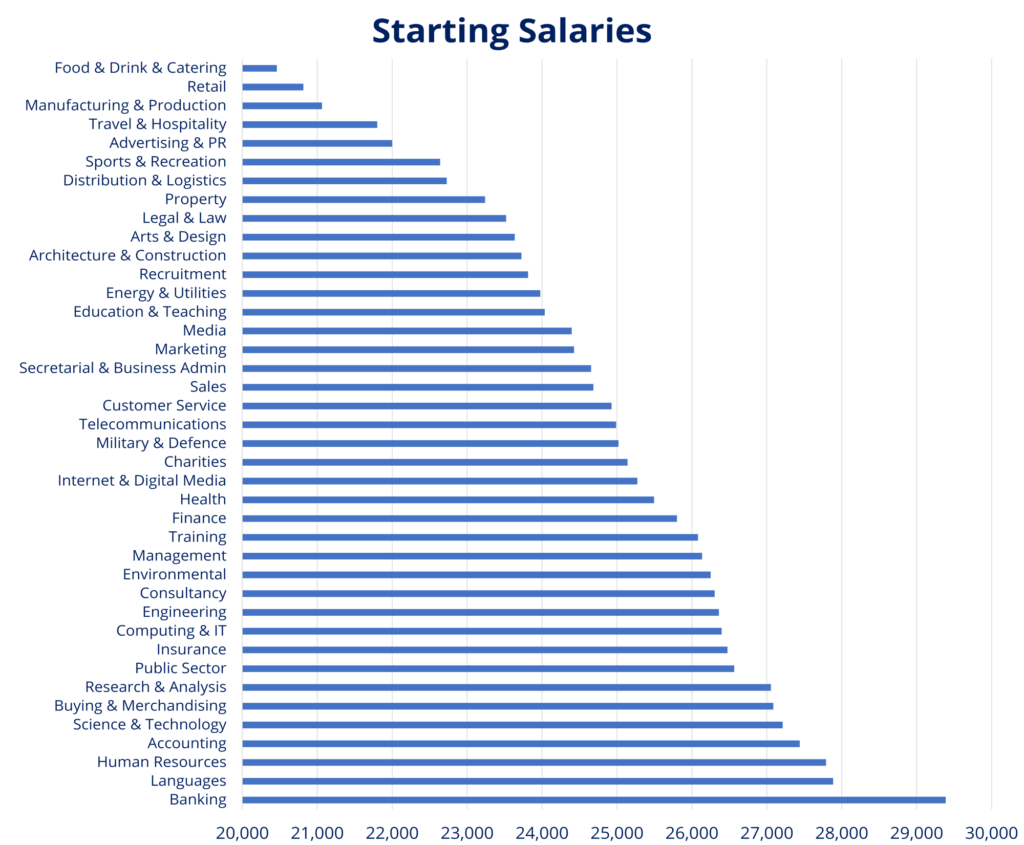

Above is a league table of degrees by cash output from Graduate-Jobs.com.

There’s a £9k swing between the lowest and highest paid careers, though you could have chosen to do either and both cost the same to study.

At the low end are jobs that you don’t traditionally associate with needing a degree, except surprisingly Law, which we’ll come back to soon.

At the top end you have science and finance type jobs. League tables like these were the reason we chose Accounting for our degrees instead of pursuing careers in Knitwear – amongst other reasons.

Keep Going – Professional Qualifications

As well as a good starting salary, you also need speed. For this 10-year plan, you don’t have time for gradual pay rises. This is where professional qualifications come in.

This is a 10-year plan, not a 40 year one, so you need to ramp up that income fast. Best to choose a career that balances a good starting salary with lightning-fast progression.

Jobs in the 3 traditional professions – Law, Accounting and Medicine – typically offer structured routes up the career ladder with further professional qualifications, and a few other careers do too.

It’s why Lawyers all end up loaded, despite starting out as the tea-boy.

Converting Wages Into Assets

You might have built up a killer wage at this point relative to your living costs, but you need to be converting that disposable income into financial assets. This is the exit lane on the Graduate Route.

Most high paid graduates convert their large disposable incomes into a bigger house, big new cars, big holidays and big lifestyle choices.

You can’t afford any of this if you’re shooting for an exit from the rat race. Instead, you need to be buying big investments.

You don’t have much in the way of spare time for compounding in a 10-year plan, so a stock market portfolio of ETFs and index funds won’t be sufficient; but they should do fine for a 20-year plan.

You need big cash-flowing investments with 20%+ annual returns.

Why Property Works

Investment property leveraged with an interest-only mortgage can yield cash returns of 10% per annum, and a further 10% of return from leveraged capital growth – totalling that elusive 20%.

These huge returns are only possible with leveraging by using a mortgage. The property returns mentioned are for carefully selected properties. You won’t achieve this on any and every property.

You might be able to get similar overall returns from picking individual stocks, though these are far more volatile than property.

We use Stockopedia to give us the best analysis and screening tools available for stock picking. It’s how we try to get market beating returns.

Check out the link on the MU Offers page for a 25% discount!

The Snowball Effect

The ideal scenario for someone on the Graduate Route is to buy a rental property with a deposit of maybe £40,000 from their incredible salary, and then set aside the rental profits each month towards the next deposit.

By reinvesting all of your cash profits, each subsequent house purchase should be a few months quicker to save for than the one before it.

Route 2 – The Entrepreneur

Overview

This route shuns formal education and instead involves starting-up and owning a business. You build your own assets, which eventually run themselves.

The Hard Way

Respect to people who go down this route from the start. It’s harder than the Graduate Route, in the sense that it’s unstructured and goes against social norms.

There’s no roadmap to success like you get with exams. You have to chart your own course.

The Plan

Being an entrepreneur usually involves a couple of years or more of zero or negative profits while the business is established, and followed by expansion hopefully into a successful organisation that pays for your lifestyle and then keeps growing.

Expect years 1-2 to involve scraping by on the breadline, after which things hopefully pick up significantly. You should be aiming to outsource all tasks to employees that you hire by the end of the 10 years.

Where the Graduate Route ended in a big pile of investments that were propped up the whole way by salary income, the Entrepreneur Route can build assets from almost no initial capital.

You’re building assets using your time rather than your money, though it helps if you have some capital to put in too. It is both your job and your Freedom Fund.

If this business also produces excess cash, then that can also be invested into such things as stocks or property.

Getting Out

Unless you can sell your business for a fortune and reinvest the winnings, the most likely exit lane from this route is hiring employees to run the business for you.

10 years should be ample time to turn a start-up into a small business run by 2 or 3 employees, though we’d hope for bigger success than this.

The trick is to only choose a business model which has significant expansion potential. It doesn’t really matter what the product is, what matters most is that the delivery method must be scalable.

Most people will class owning a single shop that you run yourself as a business.

But do you own a business, or are you the business? Can the shop be run without you? Do you own a shop, or a job?

If you were interested in retail, instead of opening a shop you might open an online retail store, or make it easy on yourself by selling your designs through established networks like Teespring or Etsy, like we do below our YouTube videos.

You don’t see us selling mugs in a high street boutique, stood behind a till!

In theory we could sell 100,000 mugs by having an online presence, with zero overhead costs. Maybe on the high street you could shift 20 a day, while paying crippling rent and business rates.

Thinking of a business idea is too hard, people always say. It’s not really – it’s implementing it that’s the challenge, and committing to it every day.

You just need to look at the world and find a product that needs improving on, or a problem that needs a new solution.

If an idea can’t be scaled up using the internet, forget it and try again. You’re only making it harder on your future self for trying to find the exit lane.

Any business idea for Financial Freedom in 10 years must be capable of removing you from the driving seat.

Other Considerations

Location

Whichever route you take, you want to make sure you’re following the path of least resistance. Where you choose to live does have a big impact.

You don’t want to be tossing all your disposable income on bills and living expenses when you could be investing them into your property portfolio or business instead.

Using your biggest living expense, your housing cost, as a proxy for earnings power, there is a clear North/South divide.

According to CompareTheMarket.com, while the average salary for Southerners at £26k is a little higher than those of Northerners at just over £21k, the disparity in average house prices is far scarier; £144k for the North vs £328k for the South.

Better still, some entrepreneurs manage to lower living costs by living in a more affordable place, and yet sell products and services in affluent parts of the world.

Mission Accomplished – What Next?

If you’re committed we believe 10 years is all it takes to turn your life around; from a school leaver with nothing to being either financially free, or free enough so that your life isn’t controlled my money decisions.

Your next steps for an Entrepreneur could be growing that business further until you reach millionaire status, or if you followed the Graduate Route, starting again down the Entrepreneur Route – made far easier now by having passive property income to fall back on.

What other routes to financial freedom are there? Let us know in the comments below.

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: