Hey guys, we recently created a blog post and video showing how we’re using spread betting to invest in a portfolio of financial futures with 3x leverage, so that in theory we make killer tax-free returns over the long-term.

Our strategy essentially applies all the basics of long-term index investing that we know historically has produced an 11% return and leverages the portfolio to maximise our profits – theoretically making 33% annually less any financing costs.

The response to that first video has been amazing, with so many of you pleading for a step-by-step guide to our spread betting strategy. Well, we don’t like to disappoint, so in this post we’re thrilled to be sharing with you exactly how we’re spread betting with financial futures.

There are several spread betting platforms you could use but we’ll be using CMC Markets to demonstrate exactly what we’re doing. Throughout this guide we’ll be using the term “bet” as this is the industry language, but this is really a misnomer for our strategy as we’re actually making an investment.

If spread betting isn’t for you but you still want to invest in indexes the good old-fashioned way, on our site we have handpicked our favourite investment platforms, linked here. Plus, don’t forget to grab your free stocks, which can be found on the Money Unshackled offers page, linked here.

Alternatively Watch The YouTube Video > > >

Let’s kick off by highlighting the dangers of spread betting. As per the warning on CMC Markets’ website: Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Honestly, we think most people lose because they haven’t got the foggiest what they’re doing. Even with the help of this guide we don’t think any novice investor should be doing what we’re about to show but if you understand the risks and want to make big potential profits let’s dive right in.

Step 1 – Decide What You’re Investing In

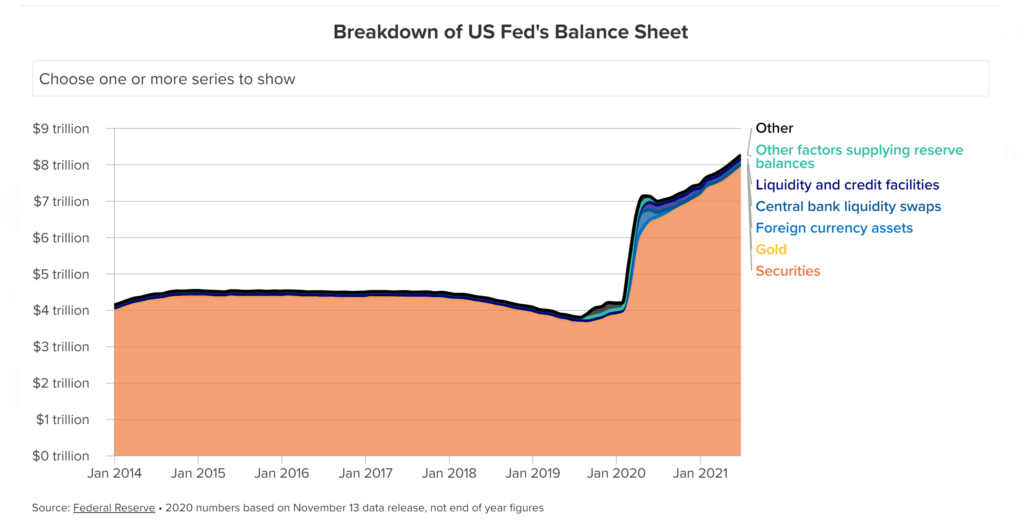

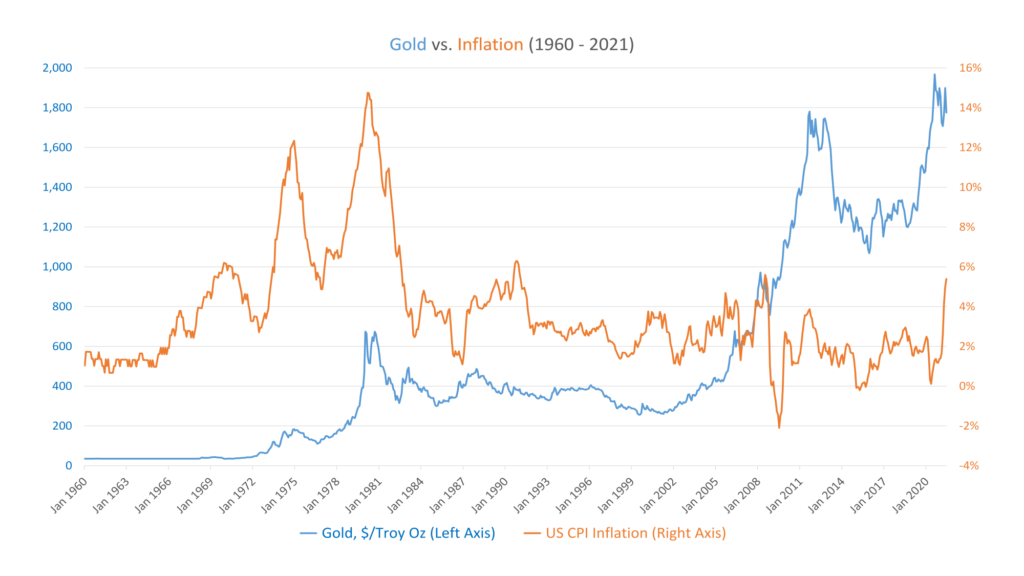

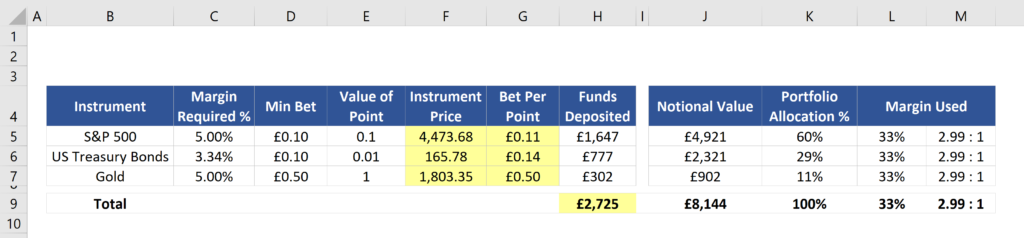

We’re building a portfolio that is weighted 60% S&P 500, 30% US Treasury Bonds, and 10% Gold. In the last post we discussed why we’re doing this; in short, this will significantly reduce volatility compared to a leveraged 100% S&P 500 portfolio. This is super important as volatility is the enemy when using leverage.

If you’ve not seen the first spread betting post, linked here, you might want to read that next as it will explain the reasons why we’re doing all this in more detail.

Our method of spread betting disregards most of the available instruments on spread betting platforms, most of which are more suited to day trading and have high fees. The 3 instruments we are investing in are amongst the few that are suitable for long-term leveraged investing, due to their incredibly low spreads, and because they are futures there are no overnight fees, common on other spread betting instruments.

Step 2 – Choose Your Platform

The next thing you guys will want to do is to choose your spread betting platform. You want to make sure that they at least offer each of the instruments that we’ll be investing in; equity index futures, bond futures, and commodity futures, or more precisely the S&P 500, US Treasury Bonds, and Gold.

You’ll also want to make sure that the spreads are super tight. Each instrument will have different size spreads, so comparing platforms can be extremely difficult.

Unlike an ISA you can have as many spread betting accounts as you like, so if you later change your mind, it’s no problem.

And lastly, you’ll want to make sure that the margin required for each instrument is as low as possible. For example, most platforms will give you 5% margin for S&P 500 futures. This means you can take out a position 20x bigger than the amount of cash you deposited. For US treasuries CMC Markets will offer 3.34% or 30x leverage, whereas many other platforms only offer 20% or 5x leverage.

We did not scour the entire market in meticulous detail but from the research we did carry out we found CMC Markets to provide the best service and the lowest costs for what we need.

Step 3 – Calculate How Much To Bet

With normal investing you can simply key in the amount of money you want to invest, and it will buy the required number of shares automatically. However, with spread betting you need to place a bet per point movement – you’ll then need to work out what notional value or exposure this is.

Unlike other spread betting brokers we’ve used, CMC helpfully displays this in the order ticket, so you can use trial and error to calculate the right bet size if that makes it easier for you, but we think it’s important to understand the mechanics of what is going on.

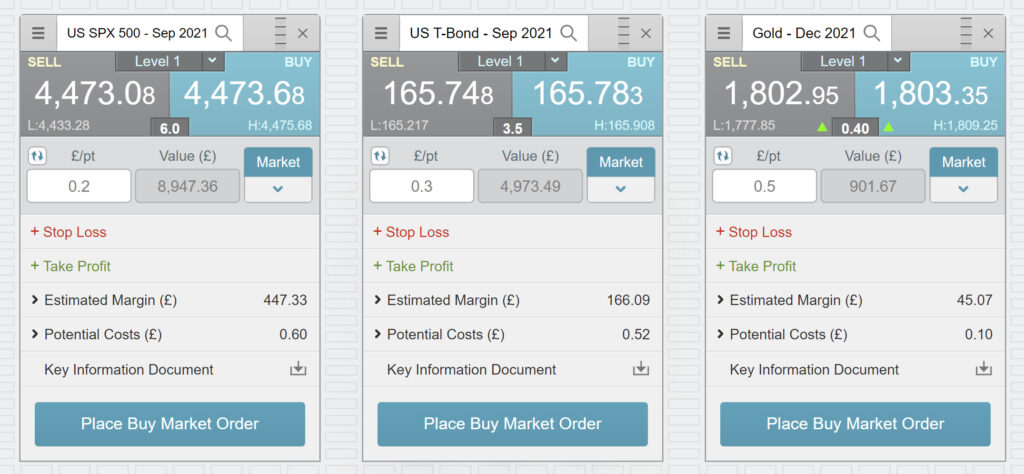

In this example, we’re placing a bet of £0.20 per point on the S&P 500. The value of the point is indicated by the last large number on the order ticket– so in this case it’s the first decimal place. This is not intuitive at all but unfortunately that’s the way it is. This bet has a notional value of £8,947.

The maths is as follows:

Take your bet of £0.20 and divide by 0.1. Remember 0.1 is the value of each point for this instrument. Then multiply it by the value of the index. Currently the S&P 500 is 4,473.68, so we get a notional value of £8,947.

This is quite complicated so let’s look at doing the same for US Treasury Bonds. In this case let’s place a bet of £0.30 per point. The last large number is to two decimal places, so we divide £0.30 by 0.01. Then you multiply this by the instruments value, which is currently 165.783. This gives a notional value of £4,973.

We might as well go for the hat-trick and show gold as well. Here we’ve got a bet of £0.50 on gold. The last large number is a whole number, so we take £0.50 divide by 1 and multiply by 1,803.35, which is the current price of gold. This gives us a notional value of £902.

A challenge with our spread betting strategy is building a diversified portfolio because of the relatively high minimum bets. On CMC Markets, the minimum bets are:

- S&P 500 – £0.10 per point, which is currently a notional value of £4,475.

- US T-Bond – £0.10 per point, which is currently a notional value of £1,657.

- Gold – £0.50 per point, which is currently a notional value of £903.

Remember these figures don’t represent the amount of cash you need to deposit, because we’re going to get to these large amounts using leverage.

You can see the minimum bet size and notional values for yourself for any instrument on CMC by opening an order ticket for the relevant instrument and keying in the number 0 into the £/pt box and hitting enter. It will default to the lowest allowed bet size, which is a neat little trick.

We’ve created an excel spreadsheet that will help you work out the right asset allocation, linked here. To make it as simple as possible the only cells you should change are those highlighted in yellow.

You can keep changing the size of the bet for each instrument until you get the right allocation. If your leveraged pot is less than £9,000 (so £3,000 of your own money if you’re using 3x leverage) you might struggle to get the exact target allocation. In this example we’ve got it close enough. The more you invest the less of an issue this becomes.

Step 4 – Deposit Some Money

You now need to fund your account, and this could not be any easier. Click the big blue button at the top that says ‘Add funds’ and follow the prompts. Deposit by card and the funds will be available in an instant.

To reiterate in case you’re not absolutely clear yet, this cash will sit in your account as collateral, and won’t physically be used to “buy” any investments with. You can place bets more or less regardless of how much cash collateral you have on account, but to do it as per our strategy you will want to calculate the correct cash amounts for your bets.

With a £8k to £9k notional position being about the smallest amount needed for our portfolio allocation you’ll need to deposit just £3k of cash to be around 3x leveraged.

Step 5 – Place Your Bets

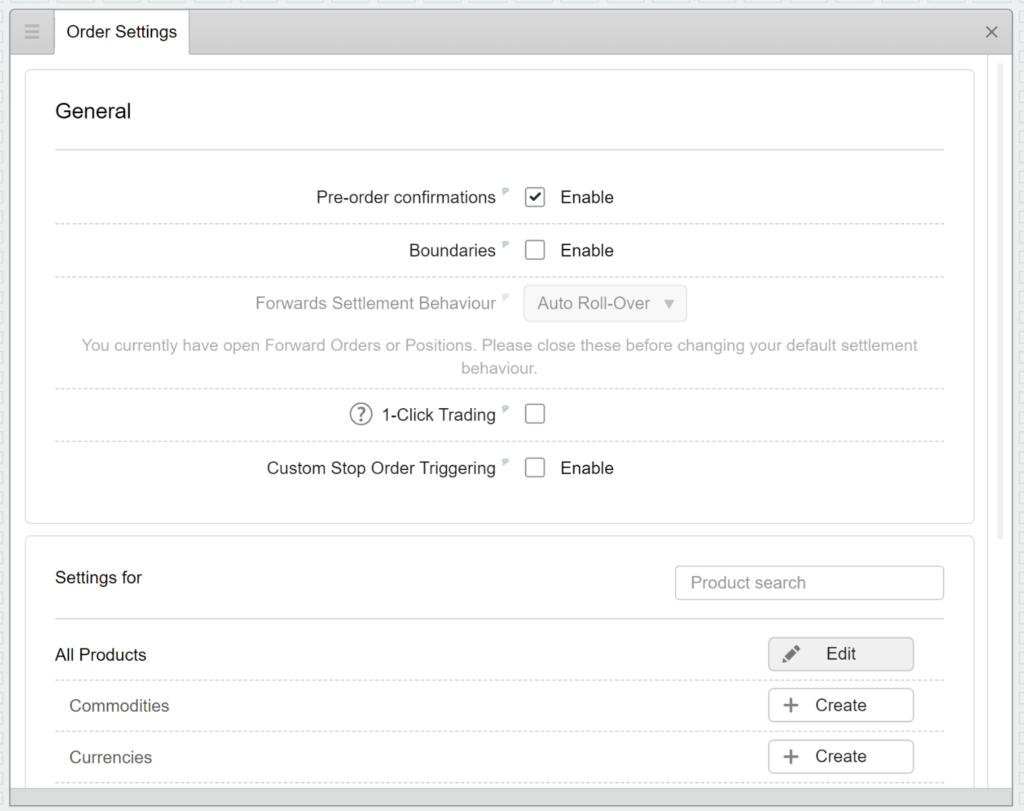

Before placing your first investment first check the order settings for futures are set to automatically roll your contracts onto the next quarter, otherwise they’ll get closed out. We’re investing for the long-term, not just one quarter. It should be set to Auto Roll-Over’ by default but to check go to ‘Settings’ and then ‘Order Settings’. Make sure ‘Forwards Settlement Behaviour’ is set to Auto Roll-Over.

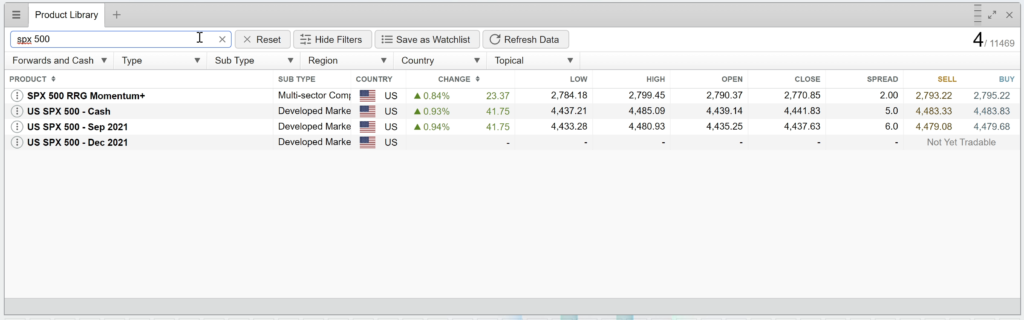

To place your bet you need to open up an order ticket for each instrument. You can do this by clicking products, then selecting whichever one you want. We’ll click ‘Indices’ and then search for SPX 500. For some reason when spread betting the index is often called ‘SPX’, ‘US 500’ or ‘USA 500’.

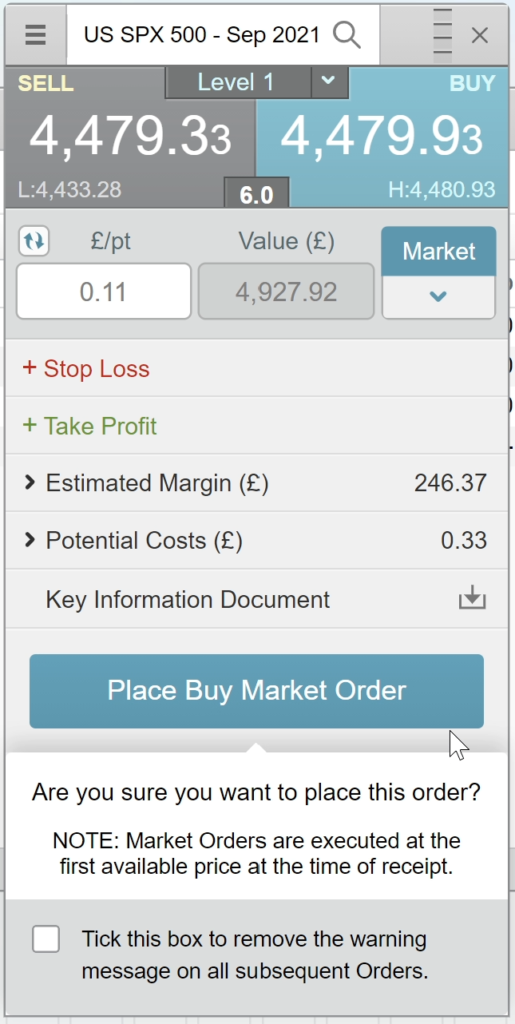

Notice that one of the search results is a cash bet – we don’t want that. We’re investing in futures – in this case the September contract. Whenever you’re placing your bet, the contract will be dated for an upcoming month, so the fact we’re buying the September contract isn’t important. Click on the ‘Buy’ price and this will open the order ticket.

Double check the name in the ticket is the right instrument, and if you’re happy enter your bet amount. Make sure ‘Market’ order is selected, and then click ‘Place Buy Market Order’. A warning message should appear. Click ‘Place Buy Market Order’ again to complete. You can then repeat this exact same process for T-bonds and gold.

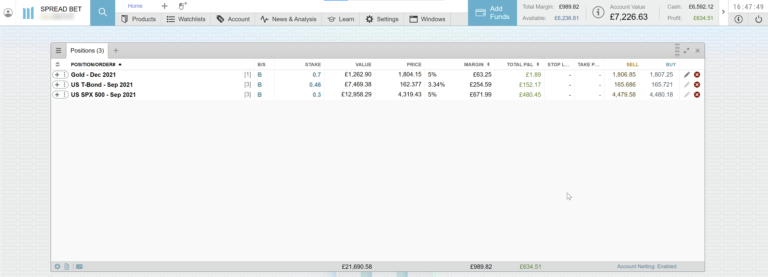

You can view your open positions by clicking on ‘Account’ near the top and then ‘Positions’. Here you’ll be able to see the stakes you have bet, the notional value at the time of placing the bet, your minimum margin requirement, and your unrealised profit. Each time a futures contract is rolled over, or whenever you sell and rebuy, this profit or loss will be realised, so rather than show as profit here it will instead be reflected in your cash position.

Step 6 – Record What You’ve Just Done & Monitor Leverage

We like to keep a transaction log of what money we’ve deposited, our profit, and the amount of leverage we’re using. You’ll find this in the same Excel file we mentioned earlier, linked to here.

Each month, we intend to invest new money but even if for whatever reason we don’t, we will record something on this log because as a minimum we want to monitor our use of leverage. If the leverage falls below our intended amount (in our case 3x) due to market movements, we will place more bets to bring that leverage back in line. We are probably happy to allow leverage to hover between 2.5x and 3.0x.

Instructions in how to complete this log can be found within the spreadsheet.

Step 7 – Invest Monthly (Optional)

We’re using the same principles with spread betting as if we were buying ETFs. By this, we mean we’re not trying to time the market and instead we’re just regularly investing into our portfolios.

Earlier we mentioned that you would need about £3k to start. If you were to bet the minimum each month you technically would need £3k every month. Most people obviously don’t have this kind of money on an ongoing basis, but we have a little workaround.

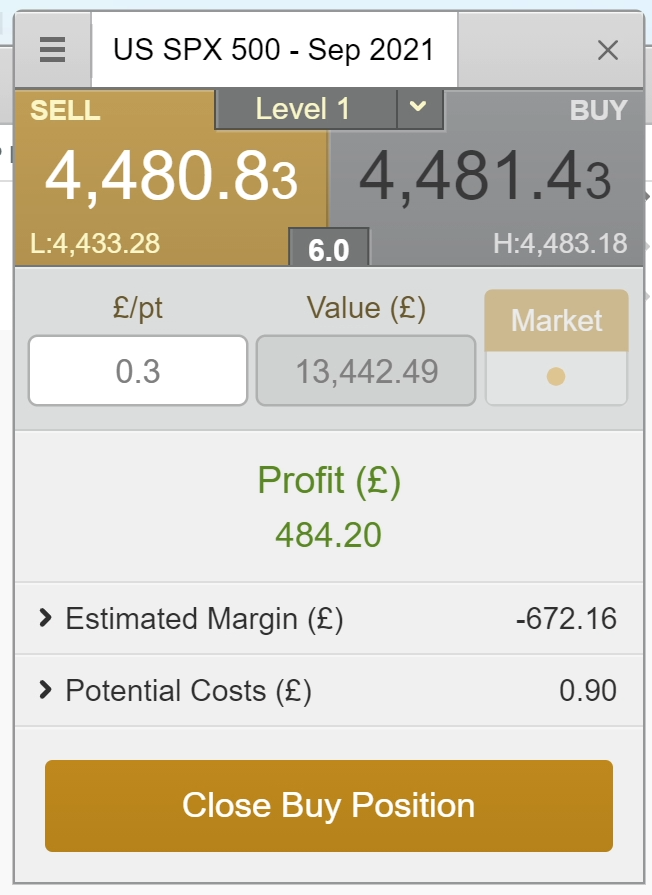

All you need to do is close your existing position by clicking the cross next to the instrument in the ‘Positions’ window, and then click ‘Close Buy Position’ from the order ticket that pops up. Once closed, you can then place a new buy order. By doing this you rebuy whatever you just sold plus a little extra. The spreads on these instruments are so thin that this workaround will only cost you a few pence each time you do it.

As your portfolio grows in value you might not even need to do this workaround as new bets placed will begin to have a smaller and smaller impact on the overall allocation. For instance, rather than having to buy all 3 instruments each month in the 60/30/10 allocation you might only have to top up gold for example, which only needs a few hundred quid.

Final Points

That’s all the steps you need to get started spread betting using our long-term leveraged index strategy, and we hope you found this post useful.

Do bear in mind that this strategy is extremely risky because of the amount of leverage we’re using. If you want to implement it yourself but with less risk, you can scale back the amount of leverage used to maybe 2x or less, or allocate even more to bonds than stocks for example.

What do you think of using leverage? Are the scare stories worth listening to or are they overdone? Join the conversation in the comments below.

Written by Andy

Featured image credit: Andrey_Popov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: