A properly diversified stocks portfolio will cover the whole world and be made up of ETFs or funds that allocate across all geographies.

Many investors do this by owning a single product, such as the Vanguard All World ETF (VWRL).

Others prefer to piece together a global position manually with several ETFs.

This way they can choose how much of their portfolio to allocate to each region – perhaps to place greater emphasis on the emerging markets and less on the USA.

This second approach will include the act of rebalancing, an important annual task if you own more than one investment.

Apart from the allocations, these methods are pretty much the same, right? Wrong. They are massively different approaches: one method compels you to back the winners, while the other buys the bargains.

So which approach is best? The all-in-one approach, or owning several regional ETFs?

We’ll look at the arguments for and against both methods and whether it makes a difference in which you go with.

Unsure if your investment platform is the best one for you? Then check out the new Best Investment Platforms page where we’ve done the work for you!

2 Approaches To Equity Portfolio Building

The most popular approach to world equity portfolio building is to do just that – build a portfolio using multiple funds and ETFs, and even individual stocks, to choose your own allocation.

The other way to do it is to buy 1 fund that simply tracks the entire world by market capitalisation – such as Vanguard’s All-World ETF.

The all-in-one approach tracks the world markets faithfully. When a region outperforms, the fund composition changes to have a higher allocation in that region.

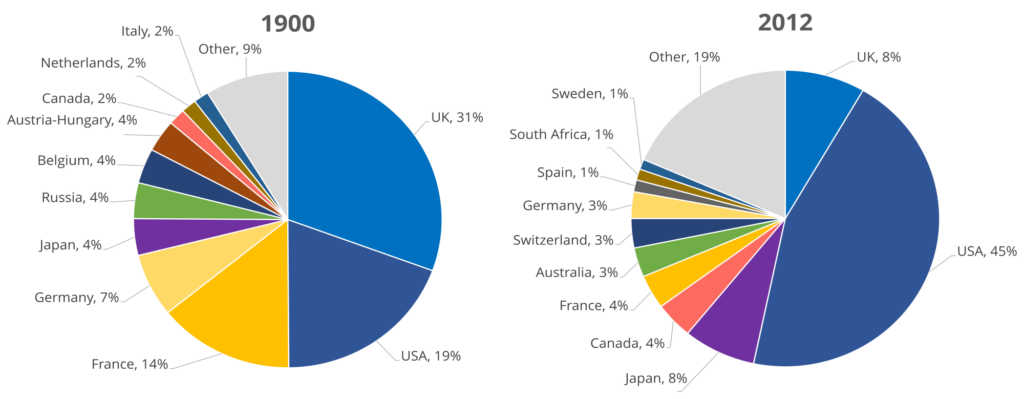

Whole world indexes have only been around for a few decades or so, but we can see how a world tracker would have moved between 1900 and 2012 in this study by Credit Suisse.

As national stock markets rose and fell over the timeframe, more prominence would have been given to America and less to the UK and France.

And we know that in the years since this study, US stocks have continued to grow to around 55%, and UK stocks have fallen to around 4% in global market cap.

A world tracker automatically backs the winners. This is different to a set-and-forget multi-ETF portfolio, which in fact does the opposite at regional level.

The regional approach sets allocations for several world regions, which usually include the US, UK, Europe, Japan, Rest of Developed Asia, and Emerging Markets.

The allocations you assign will soon become different from the actual allocations, because of drift from over and under-performing regions, and must be rebalanced annually to bring them back in line.

It is this rebalancing that forces you to reject the winners and buy the bargains.

Rebalancing

The job of rebalancing is to bring your asset values back in line with your initial target percentages.

Once a year you’d reduce your position in the best performing ETFs, and increase your position in the worst performing.

This controls risk by not having all your eggs drift into one temporarily-overperforming basket, and theory says that it is likely to deliver a performance boost over the years by forcing you to sell high, and buy low.

Reasons To Just Use A Single World Fund or ETF

#1 – No Need To Choose Allocations

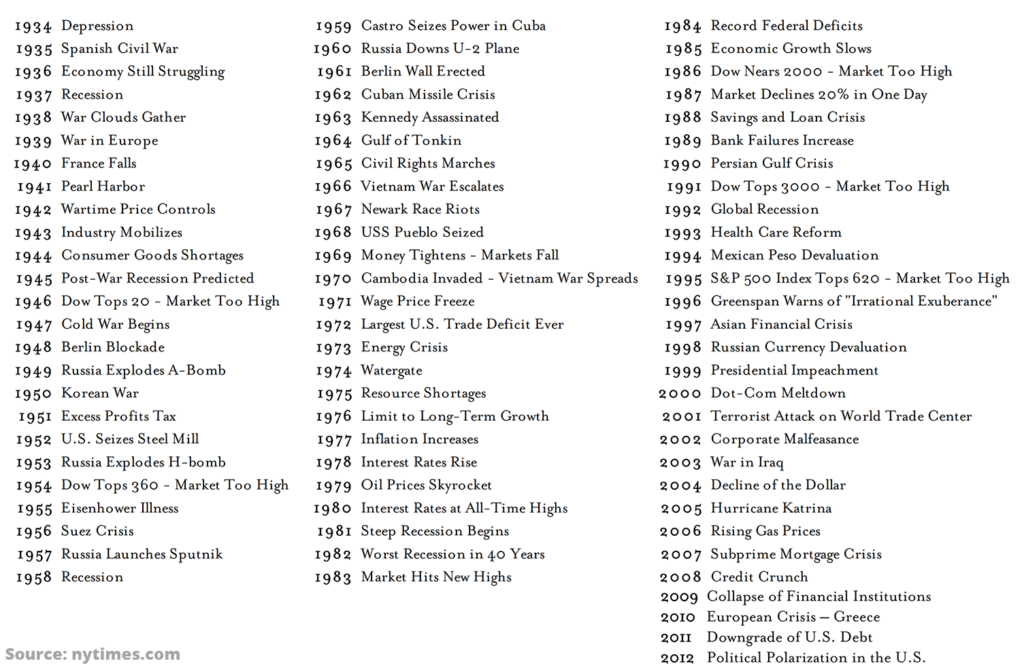

The story of the last century has been America’s outperformance over all other stock markets, and the decline of the old-world countries into market-cap mediocrity.

Looking back at that pie, a multi-ETF portfolio that weighted regional allocations toward the market cap of the world at the time would not have done nearly so well over the long term.

Someone investing in 1900 probably grew up knowing that the UK was the powerhouse of the world, and if they’d built their own portfolio they likely would have been happy to overweight the UK – and would have been wrong to do so.

It might have been better to have the process automated by just tracking the world.

#2 – Backing Winners With A Track Record

Backing world winners is a good strategy in itself. These companies have proven they can do well, by securing such high market caps.

These companies will likely have competitive advantages and good management teams which were capable of making strong profits in the past, and so will likely be able to make strong profits again in the future.

The companies a world tracker focuses on are the ones with proven track records.

In its own way it is guessing which areas of the world will do best in the future, based on proven tracks records of market capitalisation, while removing the need to rebalance.

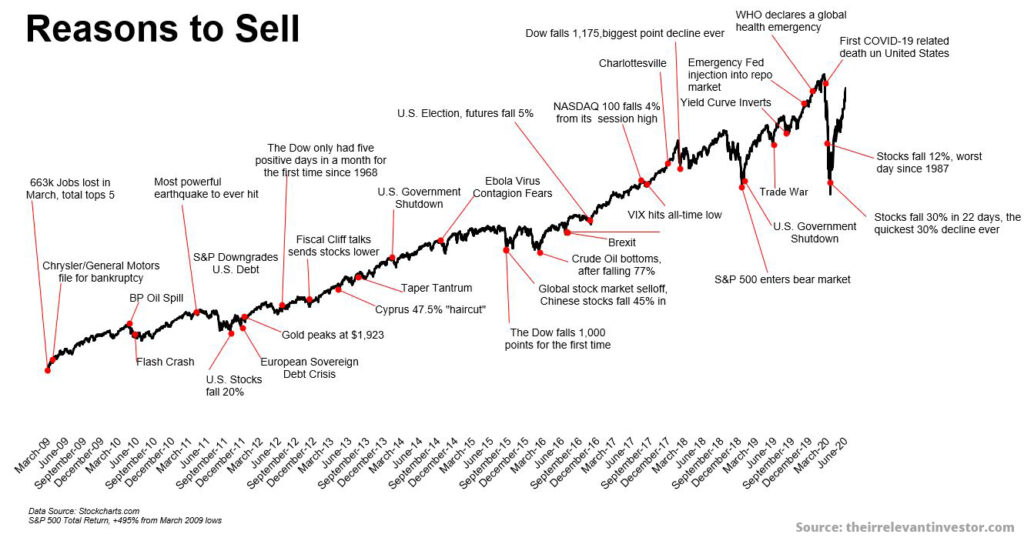

If you have ever rebalanced a portfolio, it’s hard to escape the nagging feeling that you’re throwing good money after bad.

“Why am I selling S&P 500 stocks to buy Japanese ones?”, might be a legitimate complaint. “Why am I swapping Amazon and Google for Toyota and Nintendo?” Maybe there’s something to be said for backing the winners instead.

#3 – Structural Reasons

Choosing to use a single world tracker is a rejection of guesswork – by which we mean you don’t need to set initial regional allocations – and also a rejection of favouring underperforming regions.

There’s good cause to suspect that there are structural reasons why some of these regions are underperforming and will continue to do so.

The poor relative performance of the UK stock market is largely compositional, meaning the sector allocations of its indexes help explain poor performance.

For example, as at the end of 2019, more than 20% of the FTSE 100 was in financials.

That is significantly higher than for other major stock markets – 13% in the US and 16% in Germany.

Tight regulation of financials since the 2009 crash leaves 20% of FTSE companies with little room for manoeuvre to make profits.

Countries like America and Germany have natural advantages. America is the size of a continent and is heavily weighted towards tech stocks, which by their nature are very innovative.

Germany is known for and has always had a strong car manufacturing industry that has outperformed. There’s a high chance this will continue, so why sell these stocks if they do well?

Reasons To Build A Custom Portfolio Of Regional ETFs/Funds

#1 – It Can Be Cheaper

You might set your initial allocations more towards cheaper stock markets, i.e. those with a lower PE ratio. And the act of rebalancing forces you to sell high priced stocks for cheaper ones elsewhere.

The PE ratio of the UK’s FTSE100 index is 18, while America’s S&P500 is 25.

Having the freedom to allocate a higher percentage allocation to the UK than the Vanguard All-World ETF’s tiny 4% means you could buy more UK at a potential bargain, with the assumption that PE ratios will eventually level out.

Backing winners is expensive. The long-term average PE ratio for the S&P 500 is 15, far below where it sits currently at 25.

If you like to bag a bargain, rebalancing a custom multi-region portfolio can do this.

A one-fund portfolio that moves to track the world will favour more expensive stocks.

For example, if Tesla doubles in price, and other stocks stay the same, its market cap will go up and so the fund will gain a higher exposure to Tesla.

#2 – Emerging Markets

Backing winners doesn’t have to be only based on track record. By building your own custom world portfolio, you can choose to back nations that are poised to do well in the future – the Emerging Markets.

Emerging markets turn into developed ones. Remember that many of the developed countries we know today were once emerging markets.

China is widely expected to become a major competitor to the US over the coming years, possibly even overtaking them economically.

Having the freedom to allocate your portfolio manually more towards the Emerging Markets means you will reap a higher reward if China or other emerging markets have a growth spurt.

The Vanguard FTSE All World ETF only has 5.6% in China.

We don’t know how much this will change over the next 20 years but we’re betting it will take a much larger piece of the world pie.

Maybe it’s a good idea to customise the allocation more in favour of the emerging markets now, rather than waiting for a world tracker to catch up?

So – Which Approach Is Better?

We can’t conclude which method will turn out better as the future is unclear, and historical data we have access to doesn’t go back far enough to properly compare what would have happened over a meaningful timeframe.

The multi-ETF approach has the following going for it:

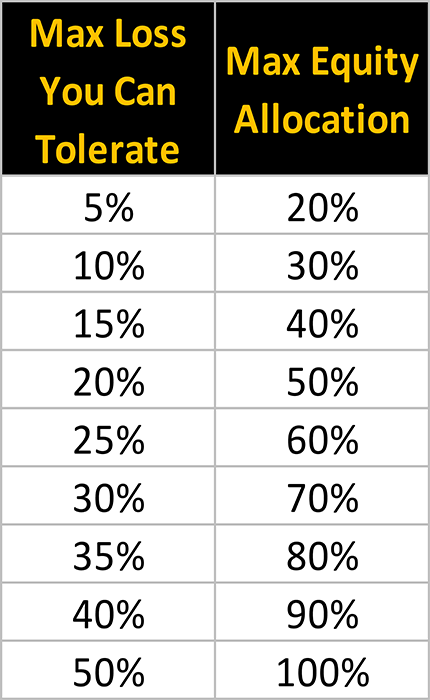

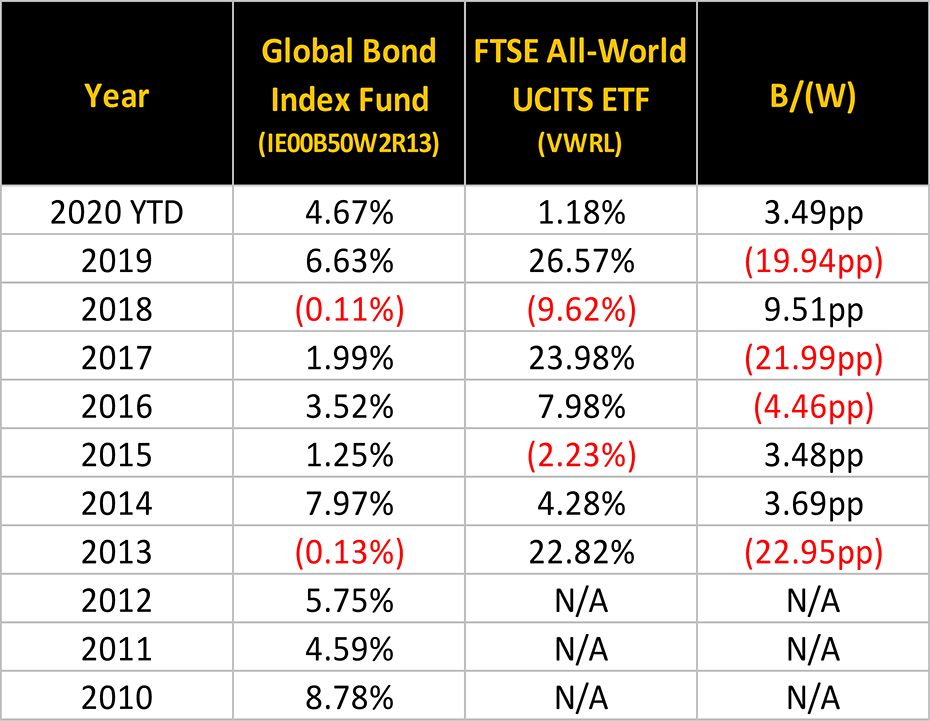

- At asset class level, the act of rebalancing stocks against bonds has been proven to reduce risk by keeping to a fixed allocation – logically that should apply within the stocks category too

- You can custom build your allocation towards cheaper markets

- You can custom build your allocation towards emerging markets, or any region you like

But the historic returns under such a portfolio are unknown.

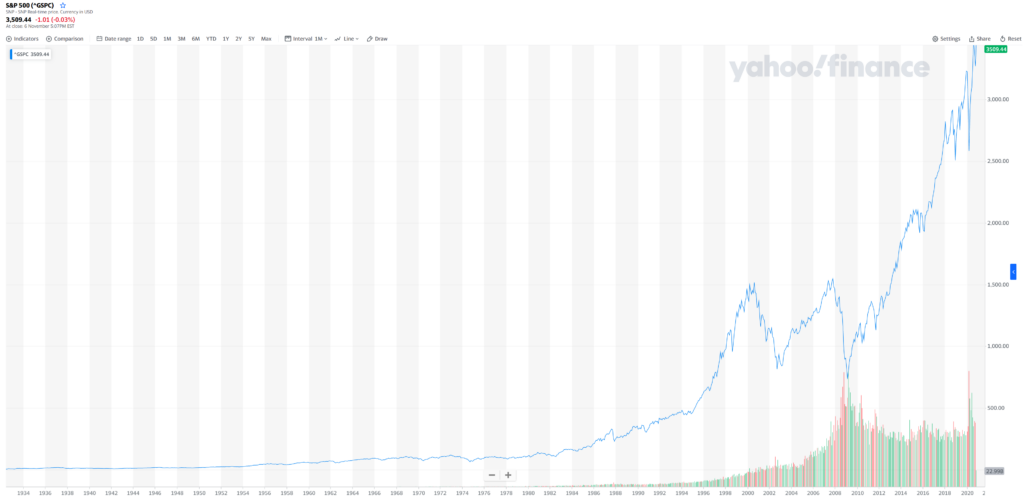

As for single world trackers; the index behind the Vanguard FTSE All World ETF has history only going back 15 years – not long enough to draw conclusions.

But we can look at other world indexes to see how well a single world tracker would have done.

Over the last 51 years since 1969, the MSCI Net World Index, which tracks stocks from developed economies, has returned an average of 8.7% per year.

Maybe you think an 8.7% return is good enough to not have to worry about which approach is better.

Maybe you could squeeze out a higher return by using multiple ETFs – maybe not.

The MSCI World Index strangely doesn’t include the Emerging Markets. For that we would need to look at the MSCI Net Emerging Markets index but the data we could find for that only covers the last 20 years.

Over that limited time frame it returned on average 8.8% annually, which again is pretty good.

Don’t Overthink It

The conclusion is, don’t overthink it. Whichever of these 2 strategies you choose you are likely to do very well.

Let us know which approach you’re taking in the comments below!

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: