We honestly believe that anyone can be wealthy. Wealth is not just reserved for an elite group of people – anyone can get it.

You’re watching this video – so obviously you want to get rich – and getting rich starts with really wanting to get there. Money is attracted to those who seek it.

Contrary to popular belief, your ability to become rich is not just down to your intelligence, work ethic, luck, who you know, what you know, your upbringing, and it’s certainly nothing to do with staying within the law. By this we mean you don’t need to be a drug dealer or a criminal to get rich.

In fact, becoming wealthy is not even difficult and can be achieved by following these four steps – Plan, Automate, Ignore, Get Rich!

It essentially boils down to what you do with your money and how you invest it. In this post, we’re going to look at these crucial four steps. Put them into action and you will become wealthy. Let’s check it out…

Getting Rich Has Never Been Easier

Undeniably, getting rich in today’s world has never been easier. With the advancement of incredible technology such as the Internet and the mobile phone, we all have access to the world’s information at our fingertips.

When Phil Knight founded Nike, or its predecessor Blue Ribbon Sports, he had to travel to Japan, trick his way into a meeting with a potential supplier – god knows how he did this with the language barrier, and also struggle to raise finance from what was then a very different banking sector to what it is today. Then of course he had the not-so-easy task of selling the shoes.

Most of us will openly admit that this would be an absolute ball ache to have done any of this, but today we don’t have the same excuses. You can literally do all of these things from the comfort of your home.

Another thing we can do from the comfort of our homes is invest in pretty much any kind of investment on the planet. This gives us a massive advantage over generations that came before us. As a matter of fact, these opportunities are arguably far better than what the wealthiest and most financially savvy people in the world have been taking advantage of for centuries.

The sad reality is that despite this fantastic opportunity most people will either fail to capitalise on it or will get it horribly wrong and will be far worse off as a result. So, what do you need to do?

Lay A Strong Foundation

First things first, you need to pay down your expensive bad debt, build up an emergency fund and then begin to invest. To do any of these you need to live on less than you earn. These are all vital steps but help with achieving these goes beyond what we’re talking about today.

Plan

End Goal

As with any target in life you need to have a good plan for how you’re going to achieve it. A goal to become wealthy is not a good goal because the end point has not been defined. You’re unlikely to reach a goal if it’s ambiguous.

A better goal would be to build wealth of X number of £££s by X Age.

From that end point, you work backwards to calculate the amount of money you need to invest and what you likely to need to invest in. You also need to factor in your attitude to risk.

This is really important as it will show you how feasible this goal is. Let’s say an investor, let’s call him Dave, can invest £500 a month for 30 years but his end goal is £8 million. To achieve this, Dave would have to earn on average 20.1% annual returns. This is highly unlikely from the stock market. That’s Warren Buffett level performance.

After a harsh dose of reality, Dave realised that a more realistic final pot from £500 a month for 30 years might be just over £700k. This can be achieved with 8% annual returns, which seems like a good barometer as this is roughly what the S&P 500 has returned on average over many decades.

Aggressive Versus Defensive Assets

Although 8% returns are more realistic, is a broad stock market index like the S&P 500 in line with Dave’s attitude to risk? This index has on occasion plummeted in value by over 50% and has remained below its peak for years and years, meaning you could be sitting on huge losses for far longer than you can stomach.

Because equities are so volatile many investors will build a diversified portfolio across asset classes.

The S&P 500 might be considered a more aggressive strategy but you can temper this volatility by also investing in less risky or more defensive investments such as bonds, but this could also include cash, insurance products and commodities like gold. The problem with investing in a more defensive basket of assets is that it will highly likely lower your overall returns over the long term.

If we assume that a portfolio mixed between aggressive and defensive assets returned 4% annually and the monthly investment and timeframe remained constant, then the final pot would be just £344k. When you factor in inflation of say 3% annually, the final pot in today’s terms would be just £210k – not bad but significantly below what our investor Dave had initially wanted.

Dave has a few options. He can accept that that is the likely outcome, come to terms with the fact that he may need to take on additional risk, extend the investing timeframe from 30 to say 40 years, find a way to increase his monthly contributions or a combination of these.

What To Invest In

We believe that your portfolio should be kept as simple as possible. Although this is not personal advice, we feel that the more risky or aggressive element of the portfolio should be invested in a broad stock market index or a few indices that cover the whole world stock markets.

Investing in individual stocks is not for the faint hearted and if done properly is not passive at all. In fact, we would urge most investors to avoid it entirely, and those that do insist on investing in individual stocks should limit the amount they invest to a small percentage of their portfolio.

We ourselves allocate just 15% to this type of investing. This means that 85% of our portfolios are planned, diversified and passive. But as we say, most people would be better off sticking with index tracking funds.

Automate

Once you’ve decided on your portfolio or have outsourced the work to a robo advisor, the key is to automate your investing every month.

You should look to set up a direct debit or standing order to your investing account, so that the money is invested as soon as you get paid your wage. This has three main benefits:

#1 – Pay Yourself First

It’s far too commonplace to save whatever you have left at the end of month, but this will too often be nothing. It’s far better to pay yourself (aka your investments) first.

This forces you to live within your means and allows you to spend guilt-free knowing that you’ve already taken care of your future according to the plan you’ve already laid out.

#2 – Pound Cost Averaging

Investing in the stock market is a roller coaster. There is a real danger that you invest at the top, only to see share prices crash leaving you with paper losses for years.

As a reminder, if you had invested in the S&P 500 in the year 2000 you would have had to wait until 2007 until the stock market recovered back to previous highs, for it to only crash once again, making you wait a further 6 years before share prices recovered.

This obviously isn’t great but it’s not a major problem because if you automate your investing you will have smoothed out your purchase price. By investing monthly, you end up buying when stocks are high and crucially also when they’re low.

#3 – You Will Fail To Time The Market

Knowing that stock markets go up and down can tempt people to try and time the market. Don’t be tempted to wait because the chances are you will never start. You are more likely to buy high and sell low. Historical charts show incredible buying opportunities but when you’re in the thick of it will you be able to find the courage to invest?

All those lows coincided with apocalyptic news stories projecting doom and gloom. Humans are hard-wired psychologically to get this wrong. This is why auto-investing in good times and bad will see you build wealth over time.

Ignore The News

If you follow the ‘plan, automate, ignore, get rich’ strategy as per this video we think it’s sensible to completely ignore the news when it comes to investing. The media are in the business of selling newspapers, and to persuade you to watch their TV programs or read online articles.

Bad news sells, which is why every news piece is sensationalist. If you follow the news you will always find a reason not to invest. There’s always something bad going on.

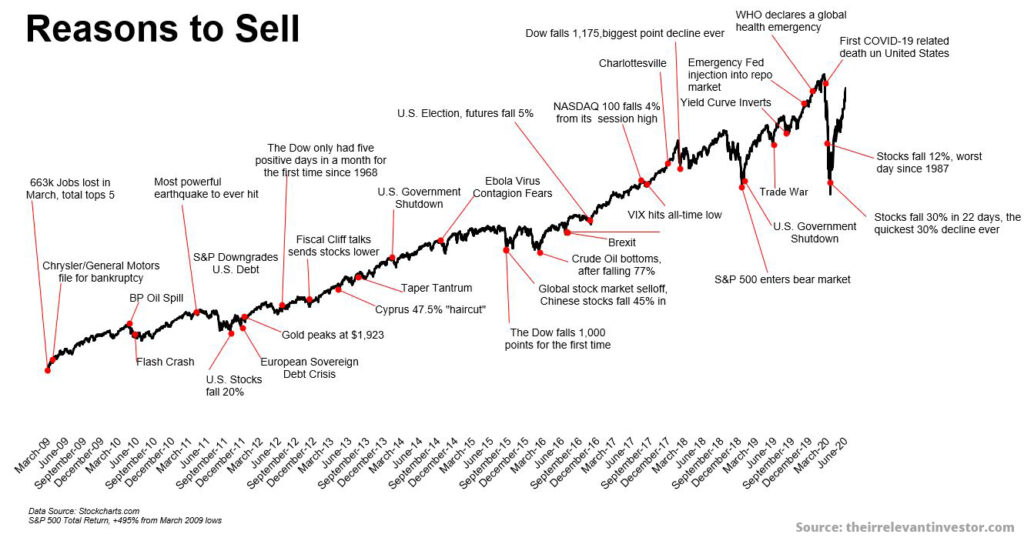

Over time most of these reasons are completely forgotten about and the stock market powered ahead regardless of these negativities. Apologies if this chart looks a little blurred but we thought it makes the point far better than we can.

Let’s just take some time to look at some of these. We’re sure the Flash Crash felt like a big deal at the time. When the US government shut down people were like, “oh my god, the world is ending!”. The Brexit vote was in 2016, and Trump was elected at around the same time – again, everyone in the media thought the economy was done for. The markets continued upwards.

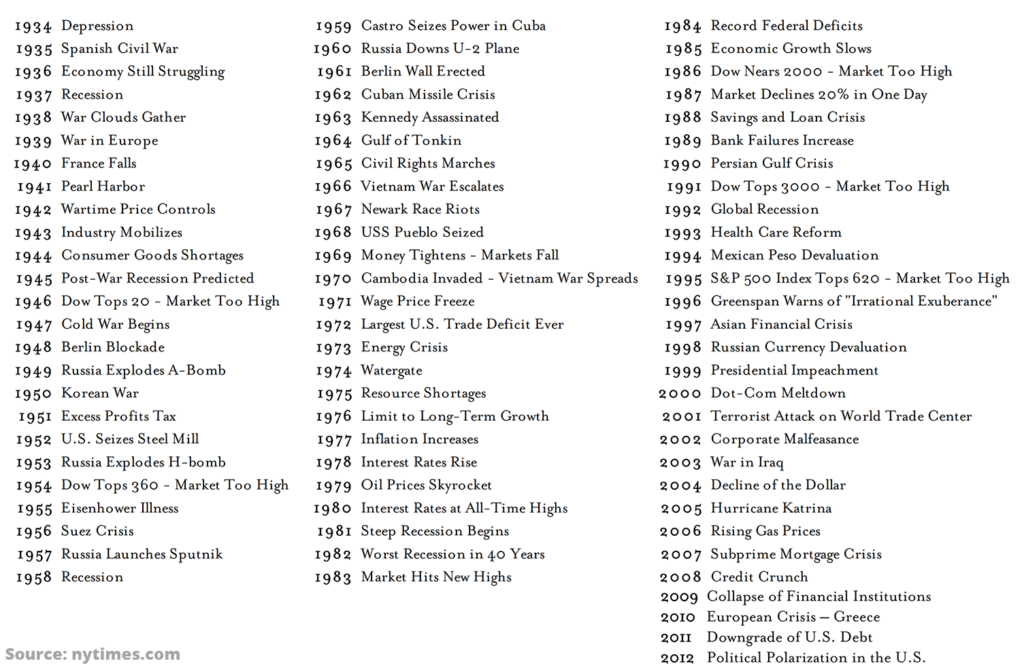

If we were to look further back in time there are always many reasons not to buy – events like the Cuban Missile Crisis must have felt like the only thing worth talking about at the time, but can anyone remember the impact this had on the stock market? Of course not.

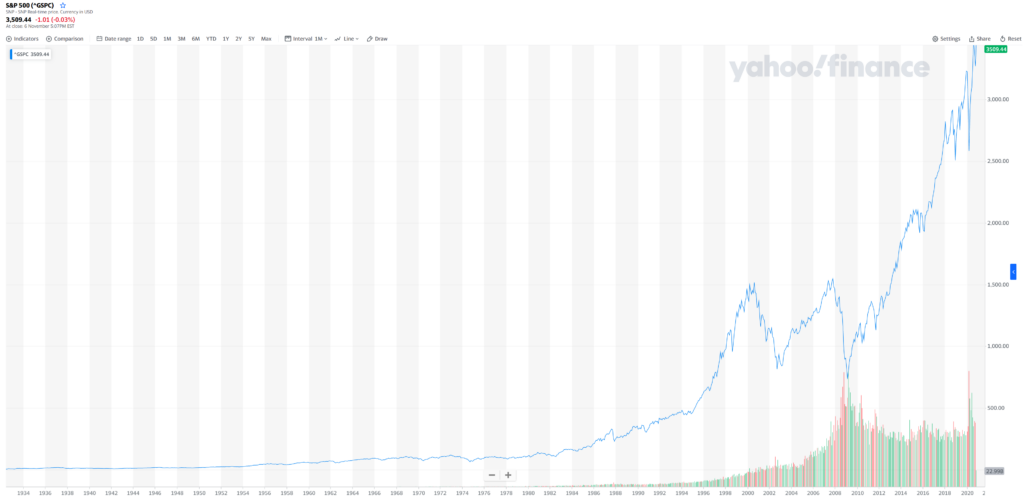

And there’s one good reason you should buy. Charts like this make it look like share prices didn’t move for decades but the volatility was no different than what was experienced in the 90s to the current day.

A logarithmic chart will show this better. As you can see the trend has always been up and we see no reason why this trend will ever end!

Get Rich

Follow this investment strategy and you are very likely to build wealth and be able to live the life you want. Moreover, this strategy excels further because it is passive. It doesn’t involve you putting in any effort other than the initial setup and the occasional rebalancing. The process is fully automated, and you don’t ever need to fret about events that could upset your goals.

While everyone else is busy worrying you can get busy living! Crucially, this passivity frees up your time to go generate more income, allowing you to boost your monthly investments. The more you can invest the sooner you will hit your financial goals.

This is why we always encourage our viewers to break free from the chains of employment. Some career paths do pay handsomely, but your salary income will forever be tied to the hours input. With a business you can scale your income. Whether you work towards boosting your employment income or whether you choose to build a business empire, the fact that you don’t need to constantly manage your investments means you can focus on what matters to you.

Will you be following this passive investment strategy, or will you be chopping and changing your portfolio? Let us know in the comments below.

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: