Can you make money with no effort? Yes, you can, and in this video we cover 6 realistic ways to make money with zero effort. If you’re anything like us, you have probably been cruising through life trying to maximise your income per effort input. Basically, trying to scrape by for minimum effort.

Neither of us want to be yacht sailing billionaires because we’re not prepared to put in the work. We do however, want to be millionaires as this is far more achievable and agrees with our work ethic.

That being said, the way to make real amounts of cash are by exerting some effort – so as well as 6 ways to make money for no effort, we’re also talking about ways to massively boost your income by applying just short bursts of effort at the start.

Don’t worry, this isn’t one of those get rich quick articles where if you sign up to our masterclass you’ll be making 30 grand a month – we don’t have anything to sell.

Do you want to make money the lazy way? Let’s check it out!

How To Make Money With Minimal Effort?

#1 – Matched Betting

We have a whole area dedicated to this here, but here’s a quick summary of what matched betting is. First of all, it is not gambling. Matched Betting is a bеtting technique used to profit from the free bets and incentives offered by bookmakers, and it can make you £500 every month for about half an hour a day of effort.

As long as it’s done properly, the element of chance is removed by placing bets both on one outcome and on the opposite outcome of an event. Normally if you placed bets covering all potential outcomes of a result, then you would lose money because the bookmakers obviously structure the odds in their favour.

However, with bookmakers continually trying to entice you to gamble they will flood you with bonus offers, aka free money. Because one half of the money on each bet you make is provided by the bookies in free bets, assuming you follow the process correctly you literally cannot lose.

Matched betting is legal and gambling wins are tax free in the UK, and anyone over 18 with an internet connection can do this. The gambling industry is fully aware of the practise but the profits from other gamblers more than covers any losses, so they haven’t cracked down on it.

#2 – Get a Lodger

No matter where you live there is always some demand for accommodation, especially as renting alone can be far too expensive for many people.

This can easily bring in thousands of pounds a year and in the UK can be done tax free up to £7,500.

The only effort on your part is to find a suitable lodger, but this can be a simple as placing an ad on spareroom.co.uk – and then effortless rental payments will flow in your direction month after month, which Ben (MU Co-founder) can attest to personally, having at one point had a lodger for 18 months.

The downside is having to live with a stranger, at least until you get to know them, which is probably why most people don’t do this, but thousands of pounds of easy money is not to be sniffed at.

#3 – Airbnb

If your home is in a tourist area and you don’t want someone permanently living with you, then an alternative to a lodger would be to occasionally rent out your place on Airbnb. The obvious time to rent it out would be whenever you’re away yourself but you could also go a step further.

Someone we know who regularly uses Airbnb as a tourist said that the owner of the house would go and live with her parents while the house was being used. Airbnb could be a nice little earner for you.

#4 – Pet Sitting

We all love our pets and many people will pay massive amounts of money for somebody to look after them while they’re away on holiday, out of town or even just at work.

A mate of ours used to pay £10 a day per dog for doggie day care while he was at work and others also pay good money for cats, rabbits, you name it! £220 a month is good money for letting a single dog sit around your house while you do other things. Look after a few and you may even have a very lucrative business.

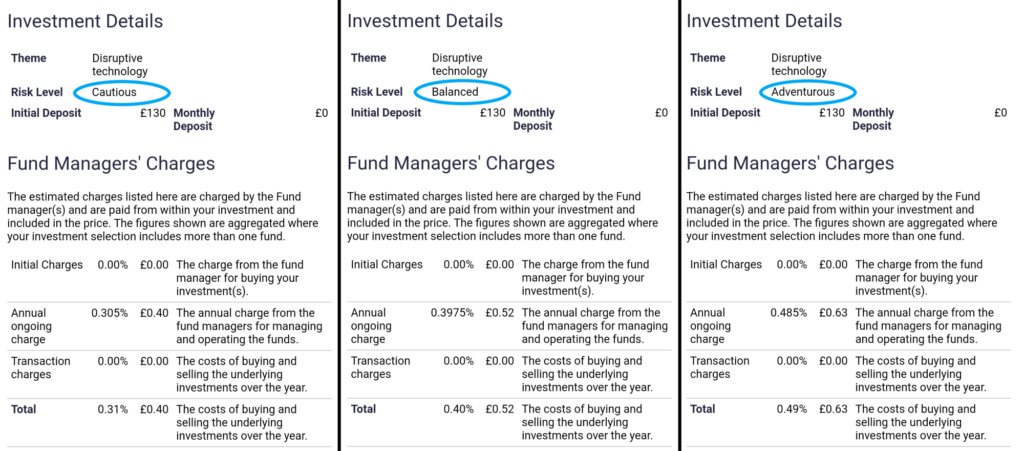

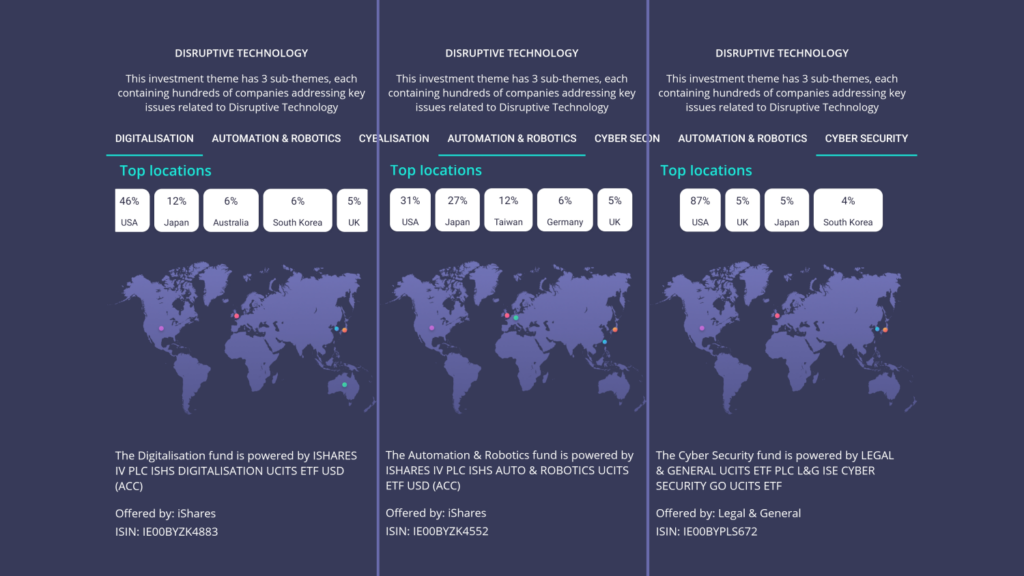

#5 – Investing

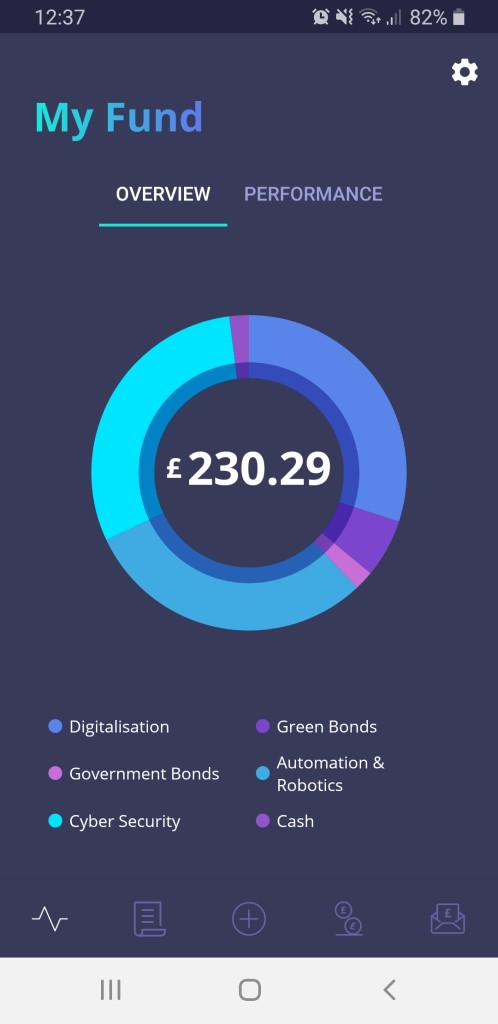

The best way to make passive income is by investing. For it to be completely passive you could invest through a robo-investor such as Nutmeg, Wealthify or Moneyfarm. These are great if you have no idea how to invest or you’re not inclined to manage your own portfolio. They charge you next to nothing and do all the work for you.

We’ve got some great introductory offers to many robo-investing platforms on the Money Unshackled Offers page, here, so feel free to check these out.

If you do want to manage your own investments, you can still do it semi-passively by choosing your own funds but there is some work involved such as choosing a platform, suitable funds, rebalancing and so on.

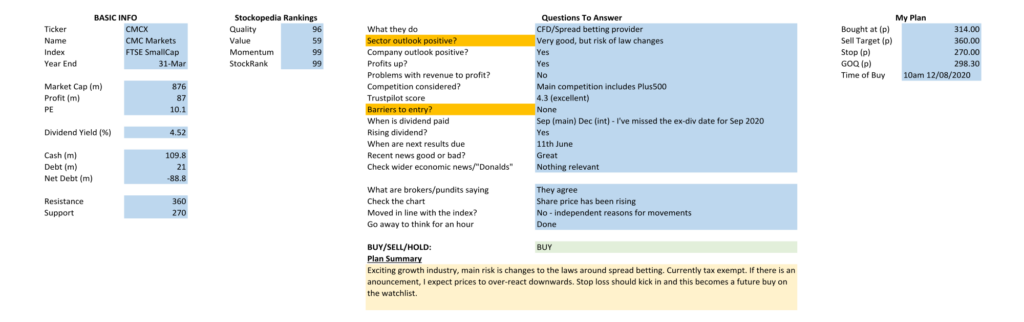

Picking individual stocks on the other hand is not passive at all if you’re doing it correctly. We enjoy it but please ignore those that say it’s easy money.

#6 – Rent Out Your Driveway

If you have an unused driveway or if your flat comes with a car parking space, then put it to use. People will pay hundreds of pounds a month to park a car in a city when they go to work. So why not take a piece of the action and make your space available on one of the many parking websites.

And don’t think you have to be living in the city to do this. If you live near an airport, a tourist attraction or even a train station this could be a great money spinner.

100% Passive Income Doesn’t Really Exist

All of these ideas, although relatively passive, will not make you mega rich anytime soon. Investing will eventually, but you want life changing money now.

Work that can be done once and pay you forever is very rare. In practice lots of upkeep will be required and when people talk about passive income there is never enough emphasis on the amount of hard work upfront.

Take YouTube for instance or a blog. How many times have you heard that if you set up a YouTube channel you will have passive income flowing in? We’re sure a very small number of creators do but for most it’s a full-time job – an enjoyable job but a full-time job nonetheless.

Most YouTube videos have a short life span, so is not truly passive even after you’ve shot the clips, but it is scalable, meaning income grows for no additional effort. It sure as hell beats trading time for money earning linear income from a job. If you can get past the initial struggle of no views and no subscribers, you will benefit from scale from that point on.

It’s very important to go through this struggle though. It took us an entire year of struggle to learn the basics but by doing so we cracked the code and now know how to create content that people want to consume.

Make More Money For The Same Work

We have established that lots of money is never going to come fast and easy, but can you get paid more for what you already do?

One way is just to switch employers, and this will almost certainly lead to an instant pay rise but what about knocking out a professional qualification as well? For example, Accountants can be doing the exact same job and even be at the same company but if one is a qualified accountant and the other isn’t, the one with the qualification might be paid £10k or even £20k more.

A short burst of effort to become qualified will reap dividends.

Short Bursts of Effort – Buy To Let Property

Every so often Ben buys a rental property, which takes a lot of up-front effort viewing multiple candidate houses, organising contractors to do renovations, sorting out the gas and electric, council tax, talking to lawyers…

But once that’s all over and the sale is stamped, Ben hands it over to an agent who manages it from that point onwards, sorting out the tenants, any further maintenance, gas certificates and so on.

Each short, one-off burst of energy adds around £300-£400 a month to Ben’s future income – indefinitely.

It’s Good To Be Lazy… Sort Of

The word lazy is used as an insult. Look at all these synonyms – idle, work-shy, inactive, do-nothing, bone idle. All have negative connotations.

And the opposite – active, industrious, and energetic. All positive sounding.

Your boyfriend or girlfriend will probably call you lazy if you haven’t washed up the kitchen pans…or is that just us dodging the chores?

In reality, there’s not a normal person on the planet that doesn’t want to maximise their output based on their input. Businesses live and die by this. It’s called efficiency.

Of course, in terms of your job that often means that the business owner will work you to the bone. Their input – your salary – is fixed, and the business will want to squeeze as much out of you as possible, which is one reason why so many people hate their jobs.

Bill Gates supposedly once said, “I choose a lazy person to do a hard job. Because a lazy person will find an easy way to do it.”

When it comes to the art of making money, there are certain jobs that can be heavily automated.

For example, in Andy’s (MU Co-founder) corporate days when he slaved as a financial analyst, he worked his ass off learning and building financial models, which would fully update at the click of a button.

He did this this so in future he didn’t have to repeat the work because deep down he’s (self-confessed to being) lazy. Essentially, he used short bursts of effort to boost work output and ultimately get pay rises.

When it comes to making money, laziness can be a strength as long as you are inclined to maximise output and your earnings, while doing as little as possible.

Do you know how to make real money with zero effort? If you do, let us know in the comments section!