The stock market is one sexy playing field right now – not only are markets down to historically cheap prices for buying, but volatility is through the roof. The markets are all over the place!

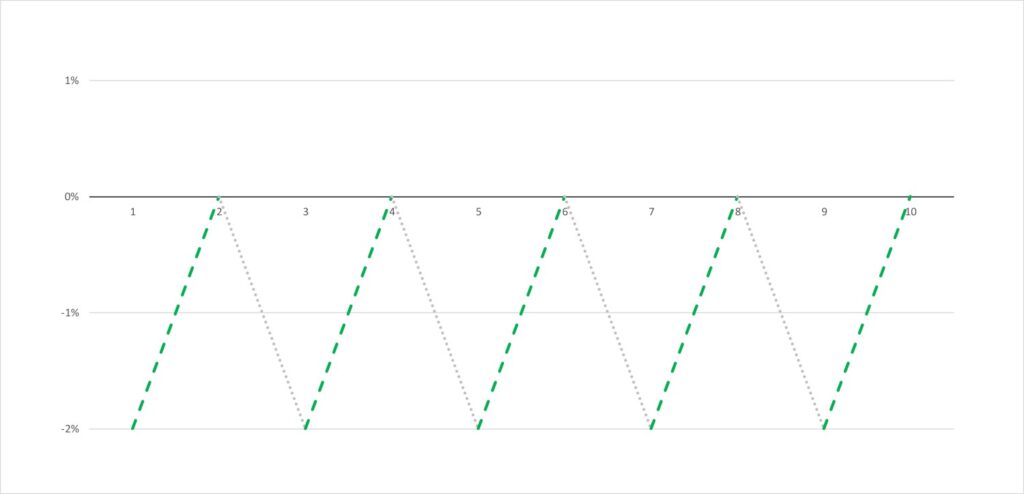

Good news sees a tick upwards, bad news sees a tick downwards. The draw towards day trading in such times is strong – check out what happens if the stock market moves up and down by 2% over a 10 days period. If you always bought at the bottom of down day preceding an up day, you’d make 5 lots of 2% – 10%! In 10 days!

That would be a good return for a whole year for a long-term investor, and you could do it in 10 days by day trading. Keep that up for a whole year and you’d return 3700% with compounding. £1,000 would become £37,000.

So why isn’t everyone doing this? Well, it’s not as easy as you might think to get it right…

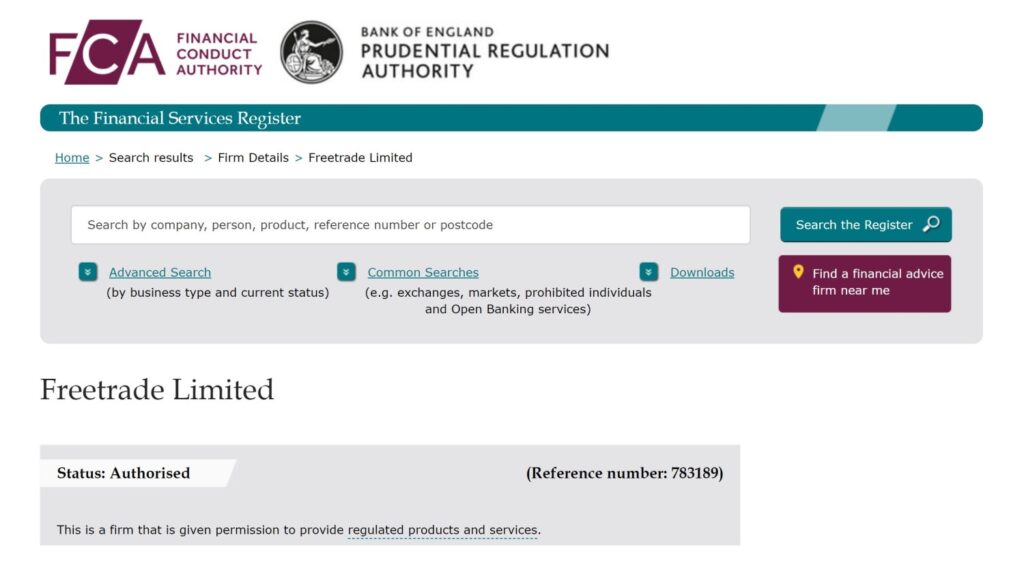

Editor’s note: Start investing with a freebie – investment app Freetrade are giving a randomly chosen free share to each new customer who opens an account using the link on the Offers page – it could be worth up to £200, and all you have to do is open an account and top up by £1 – what are you waiting for?

YouTube Video > > >

Why Day-Trading?

Short-term investing has the potential to be highly rewarding; it’s more exciting and hands-on, and the potential for high, fast returns just may attract some investors. Who doesn’t like fast, easy money?

So why isn’t everyone chilling on their private yacht in Miami having played around with day trading for a few weeks? Well, market timing is very difficult to do.

You have to be right twice — once when you buy the stock, and again when you sell it.

Day trading does have the chance to make you very rich, and we’ll get to the best way to go about doing that – but let’s first briefly cover the problems with it.

What Stops You Winning at Day Trading

Day traders are focussed on return, not risk. But day trading is riddled with risk.

The risks involved mean that for most people, on a risk/reward ratio it is likely to be less rewarding than long-term investing into a decent global portfolio.

There are 2 major problems for Day Traders:

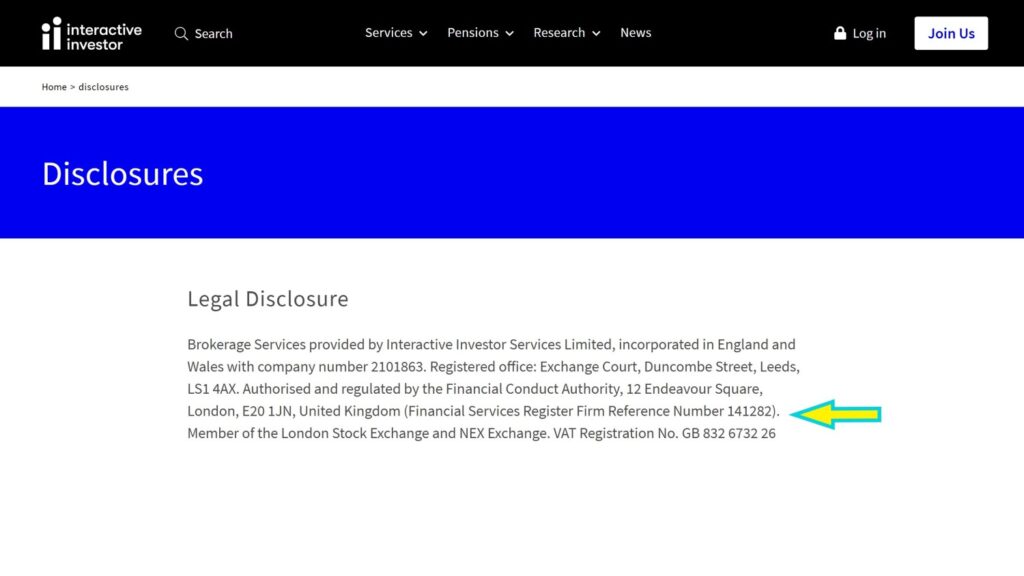

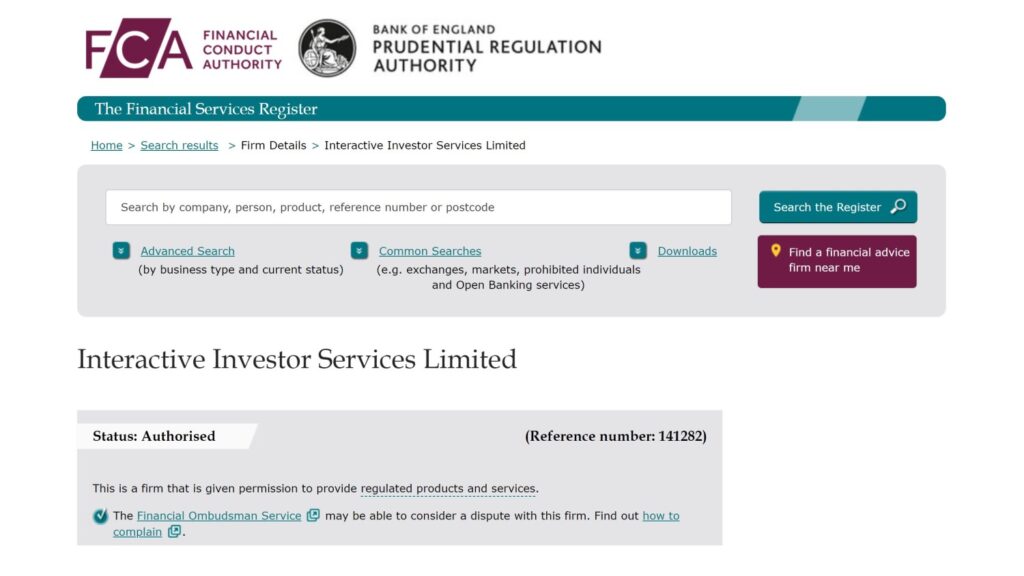

#1 – Trading Fees

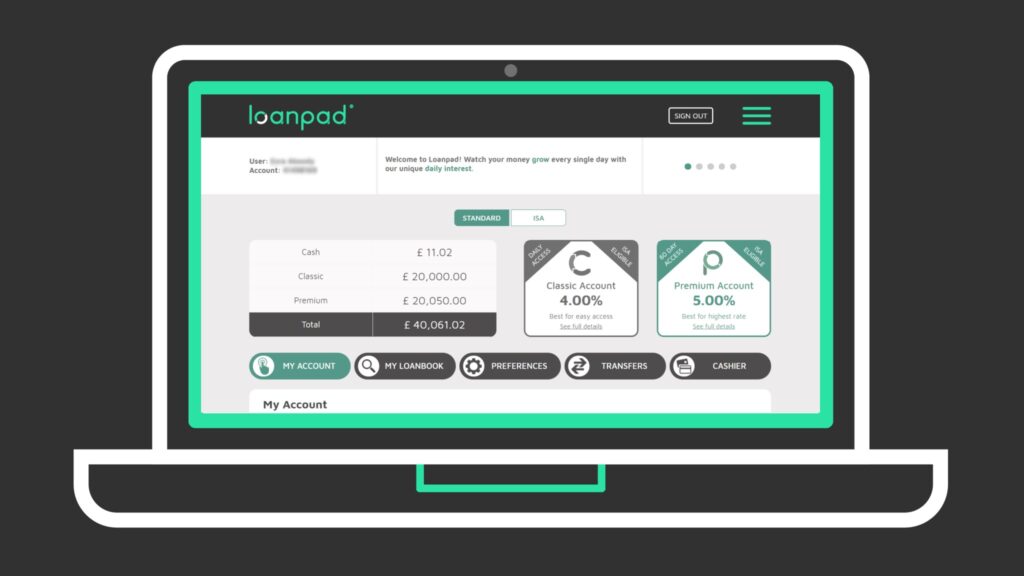

The traditional stumbling block for a day trading strategy is trading fees. At around £10 per buy and £10 per sell, trading fees on the premium platforms such as Interactive Investor and Hargreaves Lansdown make day trading almost pointless for all but the richest of investors.

Even if you use CFD’s or spread betting to trade these are riddled with all manner of fees.

The free trading platforms such as Freetrade do not have this problem. There are no trading fees, but even on these platforms, you still have to contend with stamp duty, and the Bid/Offer Spread.

All stock trading platforms have 2 prices: a buy price, and a sell price.

The difference is called the Spread, and this is the amount of money you would lose if you bought a share and immediately sold it.

High Street retailer M&S has a fairly tight spread of 0.15%, while smaller companies on the UK AIM index can have much chunkier spreads like the 6.25% of City Pub Group. It’s the kind of cost that stacks up if you trade frequently, but which long term investors might barely notice.

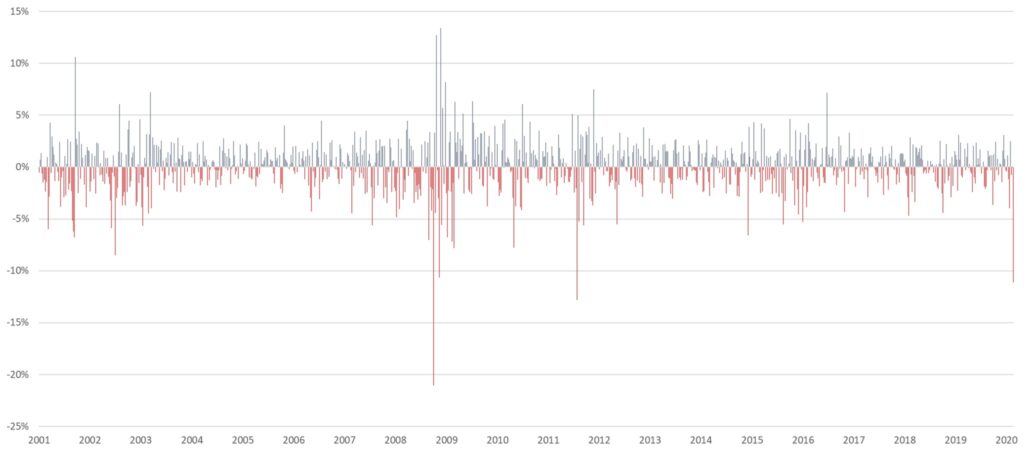

#2 – Timing the Market

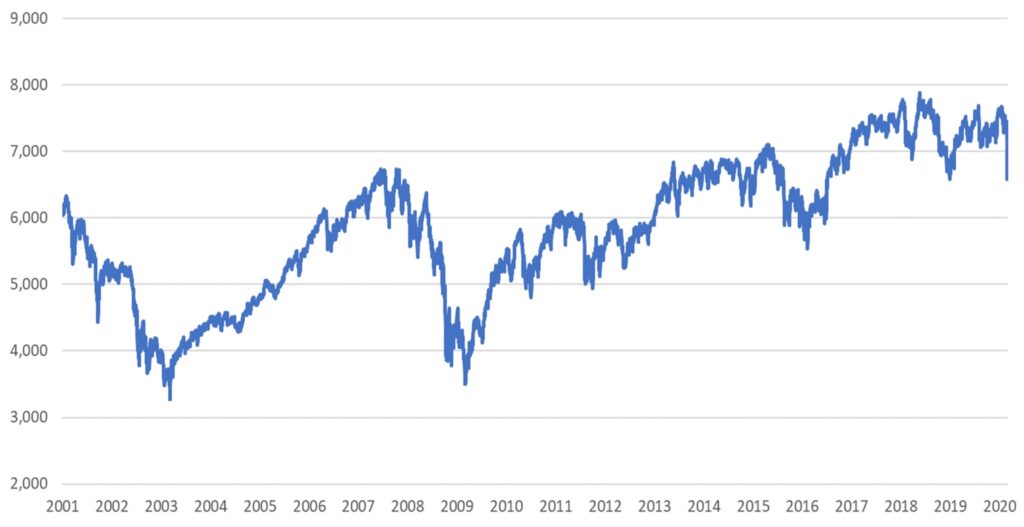

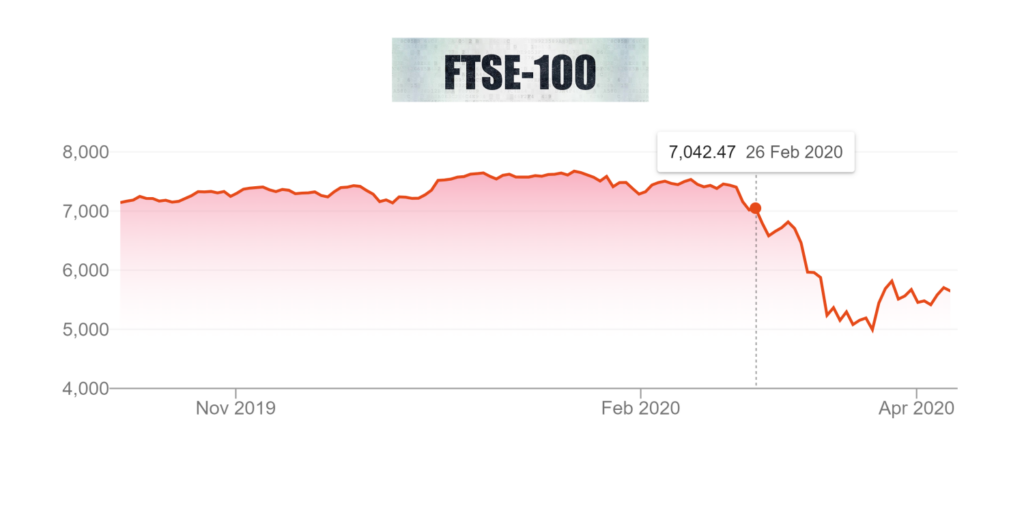

Let’s imagine a day trader who sunk his fortune into shares in the FSTE 100 on 26th February 2020, after markets crashed massively from around 7,500 in the days prior to 7,042. This would be a reasonable action from a Day Trading perspective.

But day traders can no more see the future than the rest of us, and could have no idea that the months following this day would see the markets drop off a cliff:

This day trader would have gotten half of his equation right at least – he did buy low, relative to recent highs.

But unfortunately, you have to get the “sell high” part right as well.

If You Insist on Day Trading – How to Lower Your Risk

How we would approach Day Trading is the same way we’d approach poker – we’d never put more than a twentieth of our total pot into any one transaction. Definitely don’t draw on all of your savings to Day Trade. Only trade what you can afford to lose.

The “risk” to a day trader is that the market doesn’t go up further than the price you paid for it for a long time, effectively becoming a long-term investment. We like to invest for the long term, but the kind of volatile stock you might pick as a day trader is probably not something you’d pick as your first choice for a long-term investment.

So; you could pick a stock that you think is volatile enough to rise quickly in the short term – buy it when it is lower than in previous days – and put in no more than a twentieth of your pot. If you’re right, a quick win is made. If you’re wrong, you have to decide whether to hold it for the long term, or to sell at a loss.

And selling at a loss is an emotional hurdle to overcome. You may end up selling your winners straight away but holding duds for a long time. By dividing your total pot into at least 20 parts, you could spread your risk over at least 20 trades.

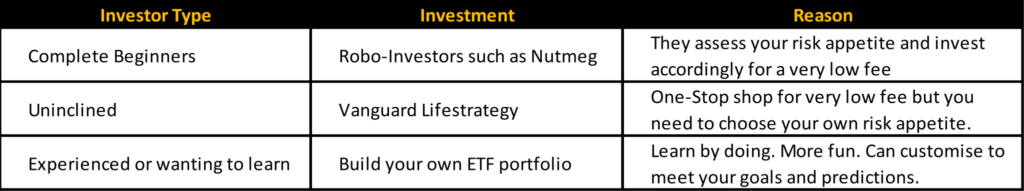

Day Trade Using ETFs

The biggest risk with shares is that they can go all the way to zero, and this is particularly so for traders who are looking to make a quick win from a falling share price they think might recover.

Maybe there’s a reason the price has fallen. Maybe what you’re buying is a company on its way to going bust.

When we look to make profits on a falling market, we buy ETFs. These are diversified across many companies, so the risk of it going to zero are slim-to-none. And we hope to make our profit when they revert back to their intrinsic value.

Maybe if a meteorite hit the earth wiping out all those companies at once. But then we’d have other things to worry about.

Long-Term Investing Advantages

We like to model our shares investing strategy on that of Warren Buffet, legendary long-term investor.

He returned around 20% per annum over his investment career.

There are 3 key advantages to investing for the long term over day trading. These are:

#1 – Passivity

Being a Day Trader is a career. You need to constantly hooked into The Matrix, aware of price movements happening in real-time and poised over your keyboard ready to take advantage of multiple micro-gains to make your profits worth the effort.

We can’t be bothered with all that. We’d rather be sat chilling at letting our well-balanced global investment portfolios do the work for us. And we can do this happily because of point #2.

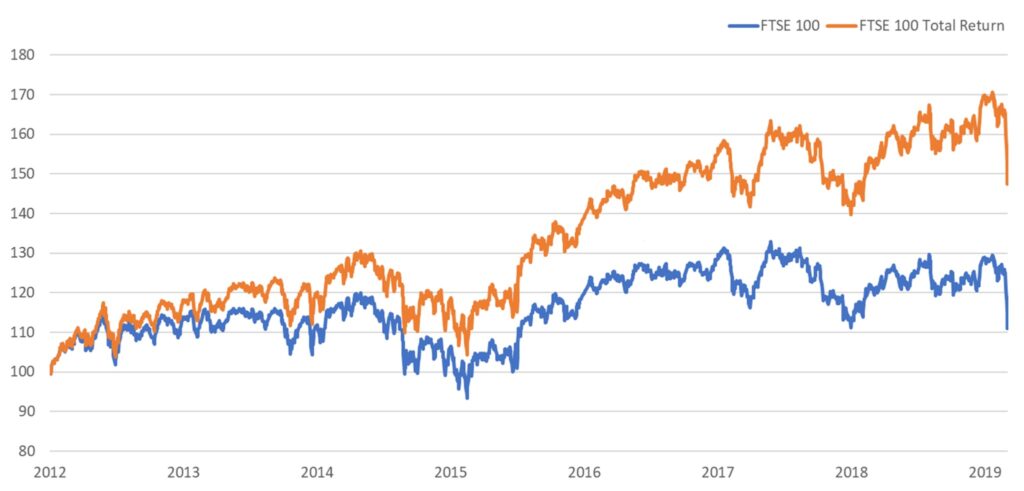

#2 – Long-Term Does Better on Average

Long-term investing weighs risk against return, and does better on both counts.

Risk is reduced if you drip your money evenly and at regular intervals into the market, as the highs are offset against the lows and you invest at an average price.

In a famous study of individual investors’ behaviour, Berkeley University professors Barber and Odean found that the most active traders realized the lowest returns.

Their 2017 study found that 80% of active traders lost money and only 1% of them could be called predictably profitable – maybe some of our viewers fall into this 1%? If so, let us know!

Whereas long-term investors should average the returns of the global stock market, which has always gone up over the long term – and up big.

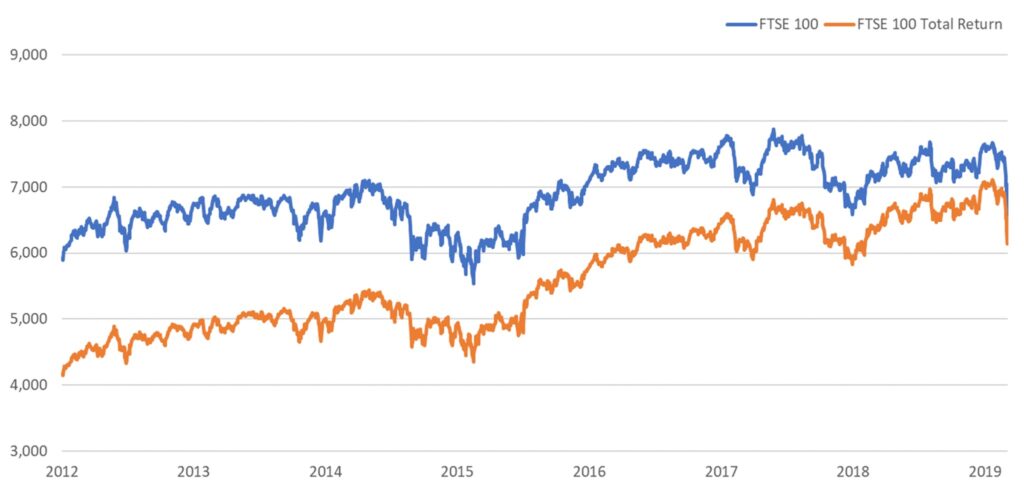

#3 – Dividends

Dividends are what turn a long-term investment portfolio into a passive-income generating machine, and are a key reason why long-term investing beats day trading.

No matter the swings in stock prices, dividends across your portfolio will likely continue to get paid.

Investing during a recession gets you the best of both worlds. You’re buying when the market is down, locking in a cheap price, and can hold on to your asset for the long-term, reaping sweet dividends as you do so!

Do you trade frequently, or hold for the long term? Let us know your success stories in the comments below!