Investing is a minefield at the best of times, and there are tonnes of potential traps that investors need to watch out for.

How do you pick the best stocks or best funds? How do you build a portfolio that is suitable for you and in line with your attitude to risk? Who can you trust? How can you minimise tax? What are acceptable fees? This list of questions could go on forever.

Rather than come to a grinding halt due to analysis paralysis and end up doing nothing, we’re going to share with you the key areas that we think investors should focus on, and likewise the main noises that you should ignore.

Whether you’re a seasoned pro or an investing noob, there’s a world full of distraction out there and we’re going to cut through the noise.

FYI: The Stake platform are giving away a free US stock worth up to $100 to everyone who signs up via our link on the Offers Page!

Part 1 – Market Noises You Should Ignore

First up, a rundown of the major factors investors should not be focusing on, but which sadly tend to be the only things that many focus on.

Performance League Tables

You’re bound to have seen these before. You’ll find them in financial publications and newspapers.

What you usually see is a big list of funds and their performance over a few different time periods – usually ranked by 3-year performance or something similar.

Performance tables are our #1 biggest annoyance about the investment media, and one of the biggest nonsenses.

First of all, that performance is in the past and may just reflect a confined good or bad period, or fad, or short-term luck. Stock markets often move in cycles and assets, industries and fund managers fall in and out of fashion.

For example, renewable energy and electric vehicles are the craze right now and as a result funds that include them are doing very well.

So, if you were looking at a league table, funds focussing on UK equity, which wouldn’t have exposure to this would reflect badly in the table, but ESG funds would likely be sitting pretty near the top.

Whatever has led those funds to the top of the league table might not necessarily repeat. Track record is useful, but should only ever be used to start research, not conclude it. And a short-term league table is just a vanity project.

Only Looking At The Name

When buying individual stocks, a lot of private investors tend to buy stocks just because it’s a company they’ve heard of or their friends are buying.

If you’re reading about stocks, do you tend to ignore articles on stocks you don’t know and go straight to the big names? Of course! We all do, and we know we’re certainly guilty of this.

The financial magazines and publishers know their audience, which is why in magazines like the Investors Chronicle you have a big page on companies like Vodafone, but some unheard of stock that might be about to set the world alight only gets an inch of column space.

Don’t solely invest in companies just because you’ve heard of them, as a big name doesn’t necessarily mean it’s a good buy.

When we’re picking stocks we tend to use a stock screener like the one found on Stockopedia just to bring back a list of stocks. We may not have heard of these, but this is where the research begins.

Perhaps one way to unearth a hidden gem is to identify a consumer brand that you’re familiar with, and that you think is about to take-off – say Apple.

We picked them randomly, so don’t take that as a stock tip. Then check who supplies them.

Do this with either Apple or Android phones and you’d discover a company called Qualcomm. Now, Qualcomm is no small fry with a market cap of $168bn, but may have better growth potential than the big name brands, and could we well placed to take advantage of the growing list of devices that need processors.

Hot Stock Tips

Never buy a stock just because some guy or some publication said it was a buy. On the odd occasion that we talk about specific stocks, we always caveat it saying don’t buy this unless you do your own research.

One of the main reasons not to invest solely on stock tips is because knowing when to buy is the easiest part. It’s knowing when to sell that is the hard part, and when the profits are made.

For example, a few months back we were very confident with the short-term prospects of Jet2 – a UK airline.

Since we tipped it, for want of a better word, that stock went on return over 100%. Awesome. But how do you know when to sell unless the tipster continues to keep you updated?

On that note, Ben (MU co-founder) sold his position a few weeks back at a handsome profit. That doesn’t mean it’s a sell for you, but it no longer passes his investment appraisal.

Also, have you noticed how most stocks always seems to be a buy and only a handful are a sell?

Nobody except maybe the few people watching or reading who own the stock wants to hear about some company that is in a sell position. Therefore, the journalist or tipster has no reason to write about them.

There are so many buys because tipsters need to tip. Its what gets eyeballs on their content and gets them paid.

We won’t mention them by name but can you think of a particular website that says you’ll make a million pounds if you buy this stock?

They then seem to repeat the same article every day but with a different stock each time.

We’ve had great feedback by people saying how well they’ve done with the stocks we’ve mentioned and asking us to do more of this, but we won’t until there’s a stock worth talking about.

News

Listening to the news is such a tricky one. If you’re going with a passive index investing strategy, then you can ignore the news completely and your returns will probably be better because of it.

This is because the news is overly negative and fearmongering, again because that’s what sells. Presenting the world as a terrifying place grabs their audience’s attention, and keeping eyeballs on their content gets them paid.

Nobody would tune into the news if all they said was everything is ticking over nicely. But people do tune in when it’s some scandal, or catastrophic collapse in the economy, or some terrorist attack.

Ignoring the news might work fine for a passive strategy, but when picking stocks, you obviously need to know as much as you can about the company and the risks it faces.

Here you will have to just fine-tune your own news filter, and work out for yourself what matters and what is just noise.

Part 2 – What You Should Really Focus On

League tables, big names, pundit tips, the news cycle… all are recipes for disaster for long-term passive investors. If you focus on the following instead, you can cut through the noise and find real, sustainable returns.

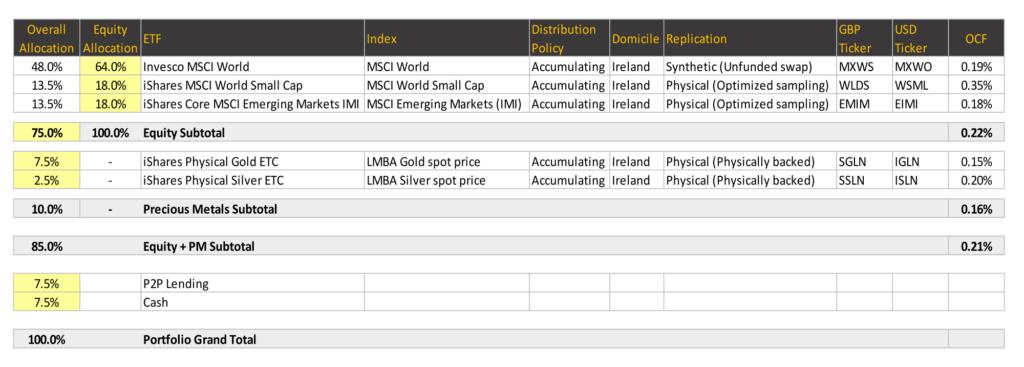

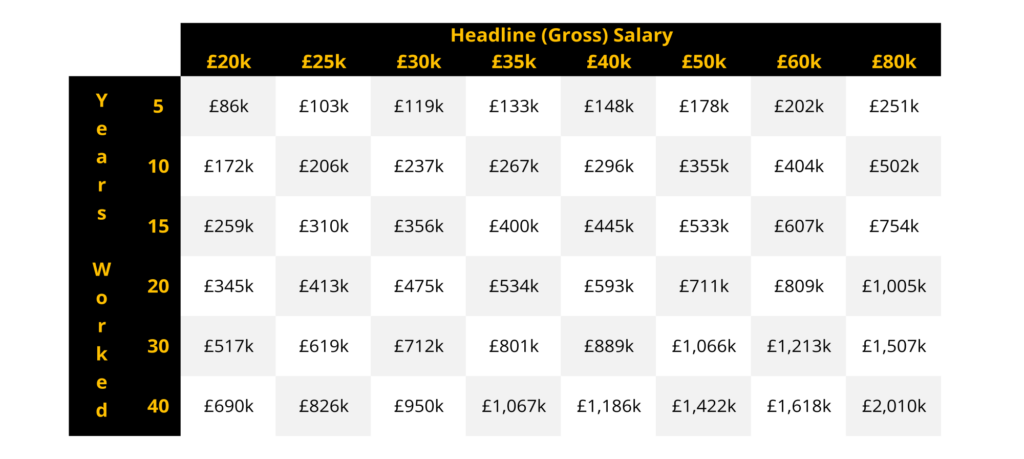

Fees

In our opinion fees are one of the most important factors to consider. And you need to minimise them! Which is why if you watch our channel you will have seen how committed we are to slashing costs.

Between platforms, funds and market factors, fees can decimate returns.

For instance, a £30k investment over 30 years earning 8% will result in £272k profit.

The same investment but only returning 6% due to all manner of fees will only result in £142k profit. That’s almost 50% less! Fees. Matter.

In the past we have said that we think robo-investing is good for those who don’t want to manage their own portfolio.

The odd person has commented saying the fees are higher with robo-investors than do-it-yourself platforms, but our response to this is that you need to balance the fees with the amount of effort you need to exert and the knowledge you have.

We could save money by installing our own bathrooms, but it’s not the best use of our time as we don’t know how to do it and the builder can do it better. However, we do pick our own investments as we do know what we’re doing there and know how to slash fees.

So, fees should be kept as low as reasonably possible. Investment returns are variable and not guaranteed – but fees are certain, so it’s a definitely a focus area.

Taxes

We are obsessed with taxes or rather, paying as little as legally possible.

You should never let taxes stop you from investing, but rather should arrange your investments in a way that maximises after-tax returns.

This is often by reducing tax, but not always. Sometimes the tax matters less than the investment’s overall potential.

For example, when someone from the UK invests in US stocks, dividends will be subject to a 15% withholding tax. This on average works out to be an effective drag of about 0.3% per year, as the S&P 500 yield is around 2%.

While this is less than ideal, it would have been a terrible mistake during the last few decades to avoid US stocks and instead choose stocks from more tax friendly jurisdictions. Historically, US stocks have smashed other stocks markets. Therefore, focus on overall after-tax returns!

Risk

It’s okay to miss out on the mega returns if those stocks or investments are not suitable for your risk tolerance.

You will of course have seen most of the internet bang on about stocks like Tesla or Nio but these stocks are also just as likely to experience big drops as they are surges in share price. If you can’t stand the heat, get out of the kitchen!

When you make an investment, it’s important to understand how volatile the price is. Beta is a measure of a company’s stock price volatility relative to the market. By definition, the market itself has a beta of 1.

Tesla, a volatile stock, has a beta of 1.8. What this means is when the market moves by 3%, Tesla might move 5.4% – that’s both up, and down! Conversely, a stock like Proctor and Gamble has a beta of less than 0.4, so when the market moves by 3% P&G might move just 1.2% – less growth, but better in a crash.

Bear in mind betas are based on historical price movements so aren’t perfect, but they be can be a good indicator of how volatile a particular stock is.

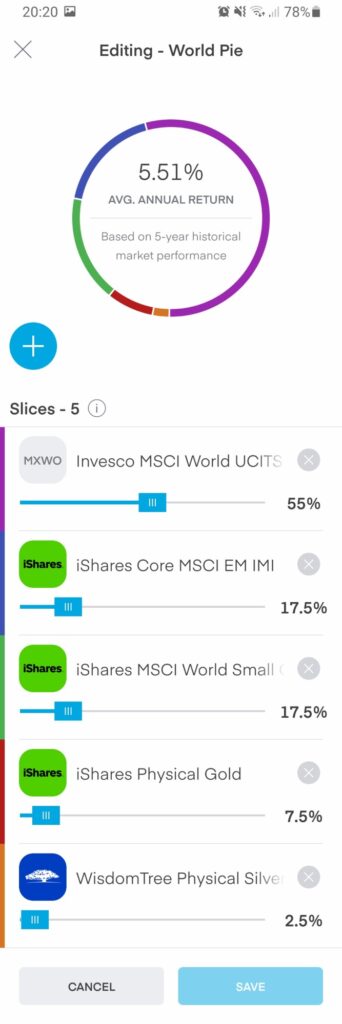

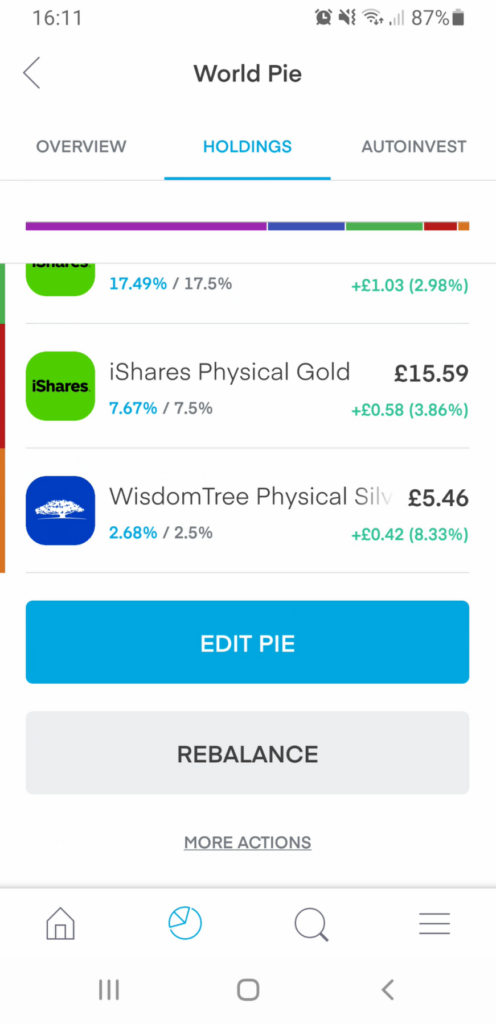

Where You See The World Going Long-Term

It’s ok to look at the world around you and point your portfolio slightly towards the direction you think the world is headed in.

For instance, we believe the following to be true about the world today:

- It’s getting richer and people are living longer

- People are demanding ever greater convenience and smarter solutions

- Governments will continue to mess up their economies by printing money and increasing debt

We would always keep the majority of our portfolios as balanced and global, but might take advantage of our long-term outlook by creating small allocations, say 5% to cover each trend like this:

- Buy stocks in healthcare companies

- Buy stocks in tech companies

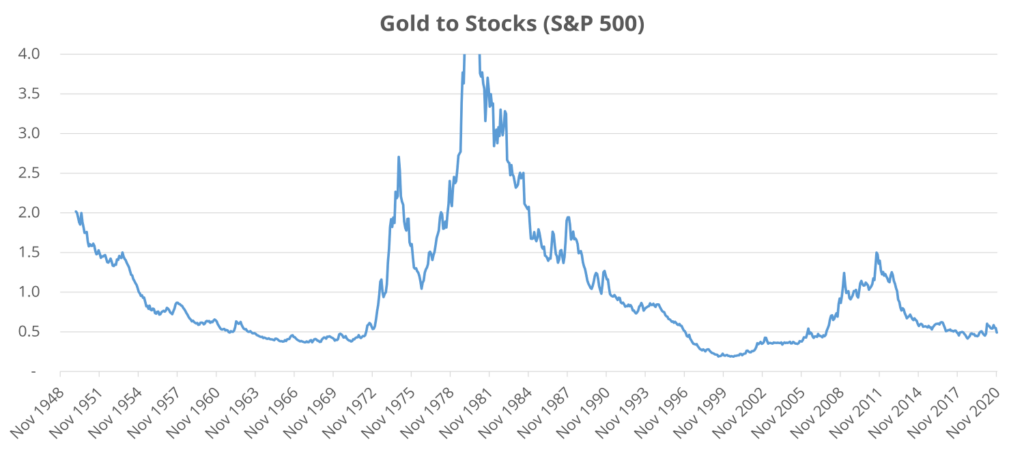

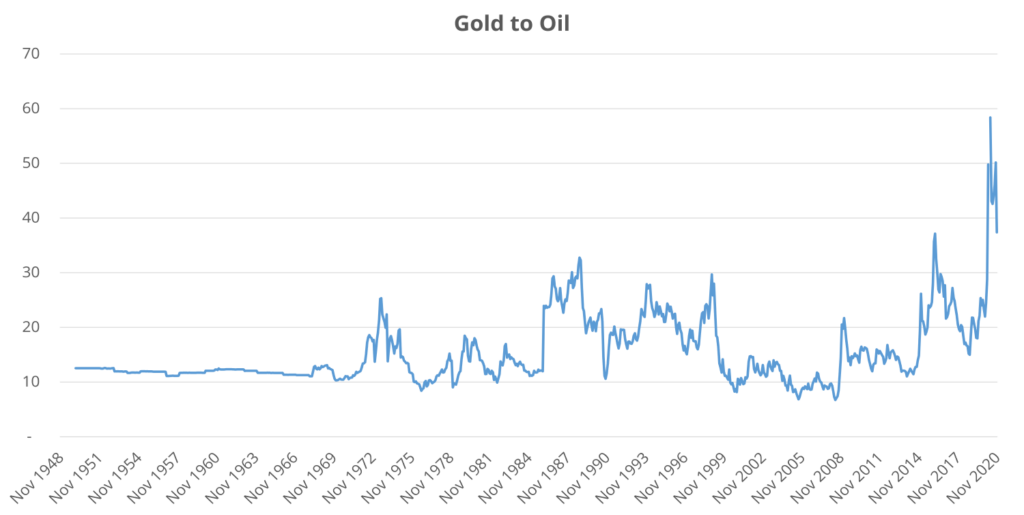

- Buy gold to protect against economic collapse

What do you think are the most important things to focus on when investing? Let us know in the comments below.