Trading 212 is the investing app taking the UK by storm and for good reason. One standout feature that we love is what they call AutoInvest and Pies, which has raised the bar in what an investing platform should offer.

If the incumbent platforms don’t respond by bringing our similar and equally impressive features, then we predict that they will haemorrhage users to the likes of Trading 212, and we welcome this.

Competition amongst platforms is only good for the customer, so please share this article with all your investing buddies to raise as much awareness as possible.

In this article, we’re going to look at what the Trading 212 Autoinvest and Pie feature is, why you need to be using it and how its features can help you make money, plus we’ll look at some of its problems, and what we’d like to see in future to perfect it. Let’s check it out…

Trading 212 is just one of many platforms – for a full breakdown of all the major investing platforms in the UK head over to the Best Investment Platforms page to help you choose the one that’s right for you.

What Is AutoInvest & Pies

The basic premise for successful investing is that you build a diversified portfolio and invest regularly –such as every month – to average or smooth out your purchase price of your chosen securities.

Every once in a while – perhaps yearly – you should rebalance the portfolio to manage risk and bring the individual holdings back in line with your target allocation.

Doing so should boost investment returns allowing you to achieve your financial goals. At least that is the belief of most investors and what we teach.

While all this sounds relatively easy to do, in reality it’s far from easy and usually quite costly. That is, until Trading 212 revolutionised UK investing – and we don’t use the word revolutionised loosely.

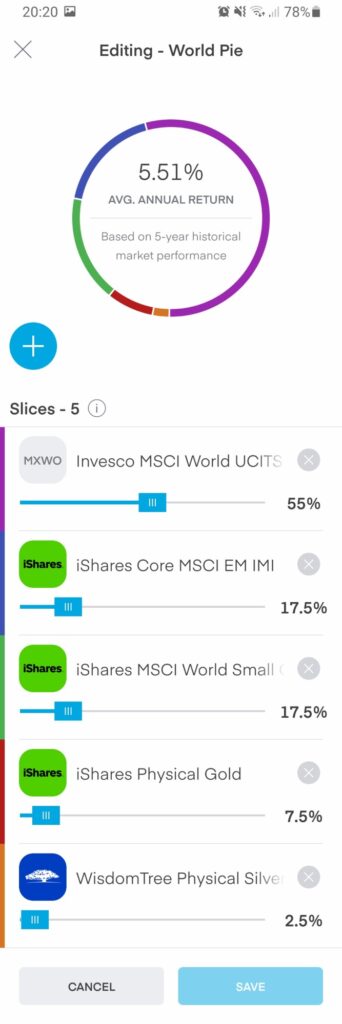

Trading 212 allows investors to custom build a portfolio containing stocks and ETFs by setting an allocation percentage for each individual investment with each investment forming a small part or slice of a wider pie.

Once you have set the percentage allocations the process is fully automated. All you need to do is create an investing plan, where money is deposited into this pie automatically based on the schedule that you choose. This is all done within the app.

You have full control over every aspect of your pie. You can easily adjust the allocation of each individual slice and rebalance with a single tap whenever you want.

You can even tell it how you want any dividend income treated, whether that is to remain in cash or to be reinvested according to your pie’s targets. There is no commitment necessary and you can stop and start investing as frequently as you want.

Why Trading 212

This article is specifically looking at the AutoInvest and Pie feature and is not intended to be a comprehensive review of Trading 212, but here’s a high-level overview.

FYI, this article relates to only their Invest and ISA accounts. They have a separate CFD account, which we are not looking at today at all.

According to financemagnates.com, Trading 212 is now the 2nd biggest UK investing platform by number of users. They offer over 10,000 global stocks and ETFs across a small number of markets including the UK and the US.

Other than the awesome Autoinvest and Pie feature, they also have set the bar high in terms of fees, with zero fees across the board – that is no platform fee, no trading fees, and no FX fees – no fees from them whatsoever.

They also have fractional investing for most of their stocks and ETFs allowing you to buy any pound or dollar amount that you wish.

At the time of filming, we think Trading 212 are the sole major platform offering fractional ETFs – not bad for a free investing app! All this and to top it off the app is clean and easy to use.

Despite all these incredible plus points for Trading 212 there are some potential drawbacks. These include how they are funded, and app downtime.

Firstly, as a fee free app, they obviously need to make money somewhere, and they are believed to be making healthy profits from their CFD platform and channelling this money into building a strong investing app.

The fear is that at some point they will start charging, as obviously businesses aren’t in the business of losing money to make you happy. They’re not a charity.

And secondly, the app has experienced downtime during times of high demand leaving investors unable to trade.

How Other Investing Platforms Have Failed You

Most other investing platforms do offer some sort of regular investing service, but there are many little nagging issues that ruin the customer’s experience.

For a start, other platforms have you specify a monetary amount that is to be invested into a specific stock or ETF, which means you have to do all the percentage calculations yourself – probably on spreadsheet.

Over time it will need rebalancing and you will then have to manually calculate exactly what needs to be sold and bought, which is a pain in the ass and another unwelcome reason to open up that unwieldy spreadsheet.

This is bad customer experience and to top it off you are usually charged for each individual trade, and are therefore more likely to avoid carrying out this proper investing practice in the first place in an attempt to minimise fees.

Revolutionary Features of AutoInvest & Pies

#1 – Set Percentages

All you need to do is add your chosen investments to your pie and move the slider or key in the percentage that you want for each. You don’t need to meticulously calculate how many shares you need to buy based on the share price or set a monetary amount. The clever technology does it all for you.

#2 – Fractions

With the old-guard platforms, you must buy shares and ETFs in full units; 1 share, 5 shares, etc.

When you have a fair bit of money you might think that isn’t a major issue, but when doing automated regular investing it can cause your money not to be invested if the share price moves too high and end up just sitting there in cash, which means your investments will soon break away from the intended allocation.

However, with Trading 212 and fractional trading they use smart internal technology to enable you to own fractions of units, so every pound of your money gets invested.

#3 – Choose Exact Date And Frequency Of Auto Investing

With most platforms that have regular investing you are stuck with the date they choose, which might not be to your liking.

Trading 212 however have not read the rule book and have allowed investors to completely control their deposit schedule.

You can choose the frequency of deposits including daily, weekly, monthly and even less regularly. You can even choose the exact day of deposit. Now that is the control that we like to see. Well done Trading 212!

# 4 – Rebalance With A Tap Of A Button

As mentioned, rebalancing used to be a nightmare – not so anymore.

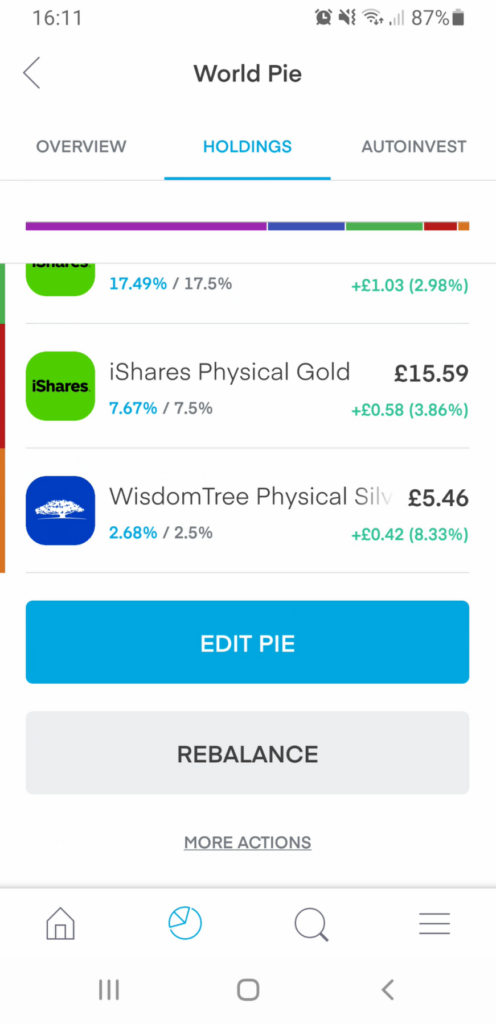

With 1 click you can see exactly what will be sold and bought, and then another click to confirm. Wait a few secs while this is actioned in the market and hey presto, your pie is back at its target allocations.

#5 – It’s Free

When Trading 212 first announced Pies we thought it sounded awesome and surely, they would class this as a premium feature that they would charge for. To our surprise it is completely free! At least it is at time of writing in December 2020.

It’s so good we would happily pay for it and it would be a great way for T212 Invest to detach itself from dependence on profits from its CFD arm and operate as a sustainable business model in its own right.

Why Using T212 Pies Helps You To Make Money

The pie feature encourages good investing behaviour and removes restrictions such as cost and inconvenience.

If you’re an experienced investor you will probably already know the importance of diversification and regular investing – and the Pie facilitates it almost perfectly.

Rebalancing controls risk and might also improve returns by selling high and buying low, and is a generally accepted good investing practice.

Also, the automated nature of the Pie removes temptation to deviate from your pre-set strategy.

We know anecdotally that investors struggle to invest in certain assets when they are historically high, but the Pie does it without a second thought.

And finally, we think most beginners will fail to build a diversified portfolio and rebalance, but this app makes it as easy as… pie! Everything is slick and straightforward.

Problems With The Pie

The Pie is pretty damn good but there are some little bugs or things we don’t like that need ironing out.

The Pie’s past performance that gets shown when building and editing a pie is totally wrong (see Image 1 above), because if the ETF inception date is newer than 5 years it messes up the calculation.

Some people may even be basing investing decisions on this, which is dangerous. The app is designed for investing noobies, so when you see the 5-year performance you assume it is true. It’s the only statistic on there and it’s wrong! Also, 5 years isn’t enough time to assess performance anyway.

Further to this, when you set an AutoInvest payment plan it provides you with a value projection based on this same 5-year average, which may look cool, but for the same reasons is total nonsense.

It’s a good idea but the execution needs tidying up. Let’s hope the guys at T212 are reading.

Also, while we like the encouragement of rebalancing with a big button there are no warning signs for noobie investors who may not be aware that you pay a bid/offer spread to the market makers every time you trade.

That’s right, there are still costs to trading even on a free trading platform, as some expenses like the bid/offer spread are outside of a platform’s control. There is a good chance that some investors will be hammering that button daily.

It’s probably not a good idea to rebalance more often than twice yearly. While this isn’t a fee levied by Trading 212 it still is a cost that investors should be warned about.

And annoyingly, not all of the ETFs and stocks are available yet in fractions, which means they’re not eligible for the Pie.

At time of writing, we wanted to buy some iShares Physical Silver but had to make do with the much more expensive WisdomTree version. Hopefully the securities missing will be added in due course.

Potential Improvements

By now you’re probably already sold on what the Pie and AutoInvest has to offer but we have a wish-list of improvements. Maybe if enough people request them, we’ll get Trading 212’s attention.

Firstly, we’d like to have the ability to set a placeholder percentage in the Pie for assets held outside of T212 such as property, P2P Lending or even shares held on other platforms.

This would mean we are building a Pie based on our overall assets, allowing us to better manage our wealth, not just those on the Trading 212 app.

Secondly, it is so close to being fully automated but falls just short of this. To complete it we would like to be able to set the rebalancing frequency to automatically rebalance at a set date, so there’s no need to remember to do it manually.

We would be surprised if this feature isn’t added in due course, at which point it would be fully automated after the initial setup.

And finally, we’d love to see an X-ray feature that analyses the underlying holdings allowing us to see country and sector splits, to eliminate the need for spreadsheets entirely.

What do you think of the Trading 212 Pie? Let us know in the comments below!

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday:

2 Comments

Very nice

Nice one

Comments are closed for this article!