We’ve said time and again that bonds suck as an investment, and instead have chosen to put the bulk of our respective investment pots into the stock market. With the benefit of hindsight was this a bad idea?

We all know that Covid has ravaged stock market investments this year – which have then recovered – and the stock market has since been waiting patiently for more news before it decides what it does next. Meanwhile this year, bond markets have received attention for a strong performance in tough times.

If you’re anything like us, you too have probably been ignoring bonds and may be wondering whether you should add some to your portfolio.

So, today we’re going to look at bonds – what they are, what we’ve said in the past, a look at their recent performance, reasons why you might want to invest in bonds, how you can invest, and finish off with our latest opinions.

What Is A Bond?

Bonds are a popular choice among income-seeking investors and those that want to temper the volatility of the stock market.

Companies and governments can raise money by issuing bonds, which are essentially “IOUs”. You lend your money, and at the end of the agreed period you should receive your money back along with regular interest.

Companies can use the money to fund projects, pay-down other debts and make acquisitions, while governments will use the money for public spending, on such things as new roads, education, the NHS and so on.

We think it’s fair to say that bonds are perceived to be more difficult to understand than shares. There are several factors that all impact on a bond’s return such as inflation, interest rates, the economy and ratings agencies.

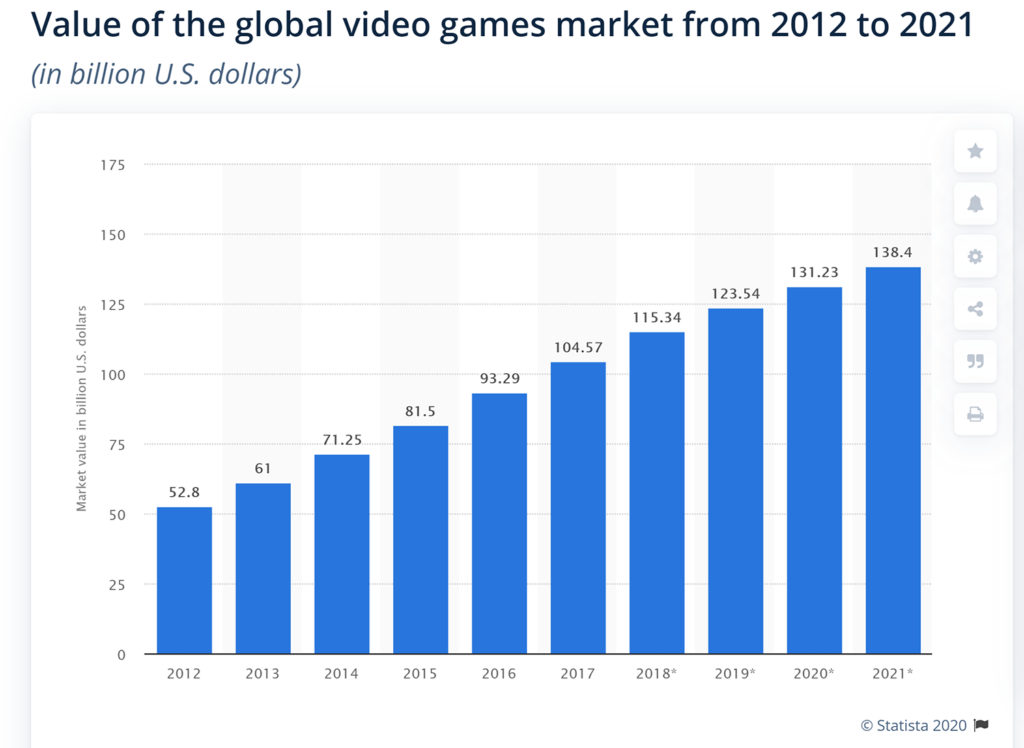

Bonds also don’t make particularly interesting news stories, so are covered far, far less in the media. Microsoft launching a new Xbox console, or Disney launching a new streaming service are vastly more interesting stories than bond yields falling by a fraction of a percent.

If something is boring, then nobody will read about it and so naturally will be less well understood.

Bonds 101

We’re not going to drone on about the intricacies of bonds but let’s quickly run through the need-to-know aspects:

- When bond prices rise, their yields fall, and vice versa

- Unlike dividends on shares, the bond issuer is obliged to pay the interest coupon, so income is predictable

- When central bank interest rates rise, bond prices tend to fall, and vice versa.

- Corporate bonds rank higher in the pecking order than shares if a company goes bust. Therefore, bondholders should receive some or maybe all of their money back.

- Government bonds issued by some countries such as the US and the UK are seen as “risk-free”, in that the chances of these major economies defaulting are extremely minimal.

What We Previously Said About Bonds

Long-time viewers of this channel will know that we rarely ever mention bonds, and the few times we have we have been critical of their abysmal yields and rock-bottom returns.

Although bonds would likely give us lower portfolio volatility, we have said we would rather risk our money in the stock market than accept pitiful bond returns.

Prior to the Covid pandemic, UK interest rates were 0.75% and widely believed to be as low as they could possibly go. Therefore, it was reasonable to assume that bonds would only fall in price as global central bank interest rates were slowly increased over time.

We now know that things have panned out quite differently, but how has this impacted bond returns, and how does this compare to a reasonable alternative stock market investment?

How Have Bonds Performed?

The performance of bonds has not been a straight line in 2020. Prior to the pandemic, bonds underperformed. During the beginning of the pandemic when panic ensued, bonds outperformed hugely; and then there was the pandemic recovery, which saw bonds underperform again.

With trillions of dollars of quantitative easing, government intervention and fear in the markets, money has been pouring into safe havens such as bonds. According to a Morningstar survey of UK fund flows, bond funds received £872 million of net new money in August alone.

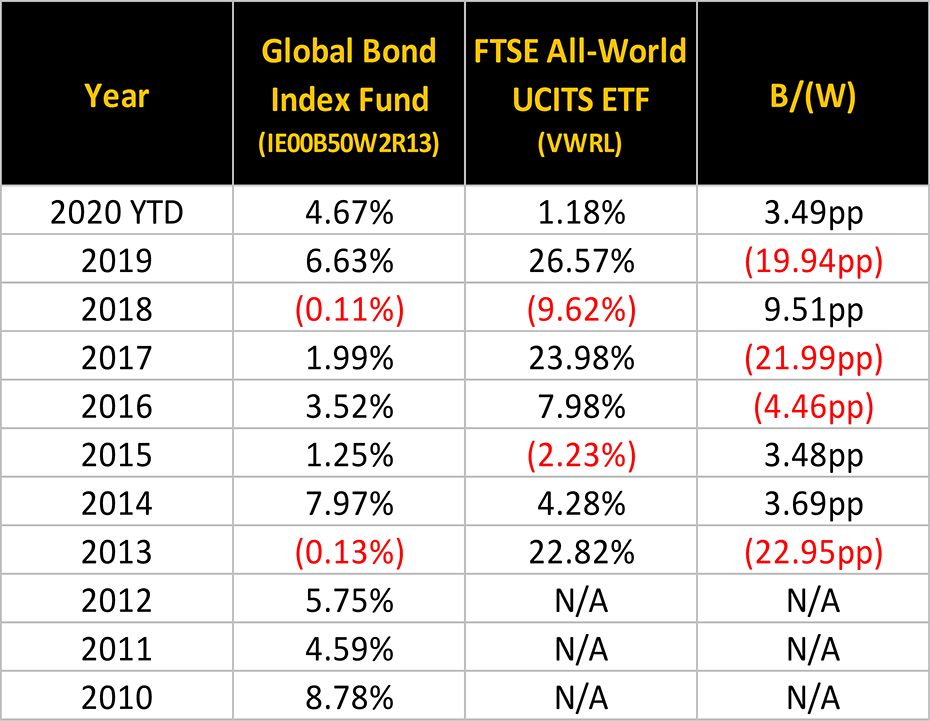

Here we can see the annual returns of bonds and how it compares to a global stocks fund:

We can use the Vanguard Global Bond Index Fund as a way of measuring bond performance overall, which is a particularly good representation as it holds almost 13,000 bonds and manages £5.7bn of assets. The Vanguard FTSE All-World ETF is a good representation of world stocks.

2020 looked like it was going to be awful year for stocks but is on track to finish in positive territory. Bonds are set to beat it however, with returns of 4.67% ytd.

The table clearly shows that bonds are less volatile over the years but if you had been pre-empting a stock market crash in 2013, 2016, 2017 or 2019 and took harbour in bonds you would have missed huge stock market gains.

This relatively small time frame echoes what we know about long term equity returns, which is it is better to ride the waves of volatility in the stock market if you have time to recover from any potential crash.

If you need less volatility, then bonds do seem to fit the bill but at the expense of total returns.

Why You Might Still Want Bonds In Your Portfolio

#1- Volatility Could Return

Covid is far from over and heading into winter it could get far worse. The huge levels of global government stimulus could be running out of steam, which could cause a sell-off in stocks.

There is also a looming US election, and in the UK, there is Brexit to deal with, which seems to be forgotten news right now but is likely to come back with a bang.

#2 – Don’t Rule Out Negative Rates

Economies are stagnating and central banks may have no choice but to move onto negative interest rates. This will lead to higher bond prices. More on this later.

#3 – Too Much Risk Is Priced In

Some analysts believe that fear of corporate defaults has been overdone and there is room for price increases.

The global head of fixed income at Fidelity said, “Many companies will have strong enough balance sheets to survive another six months of local lockdowns.”

#4 – Portfolios Need To Be Balanced

2020 has reminded investors why a balanced approach to portfolios is necessary. When dividends are cut and income dries up, bonds can provide much needed income.

Also, insurance and pension companies cannot only hold riskier investments because their customers cannot have their retirement funds wiped out. To preserve capital, these companies have no choice but to stick with bonds even knowing it will be a terrible investment for returns.

How To Invest In Bonds?

Most retail investors in the UK don’t invest directly in bonds and in fact not many investment platforms will even offer this service. It is still possible to buy individual government and corporate bonds, but we see little reason why anybody would want to do this.

Most UK investors will opt for bond funds over direct investing and this is how we would do it. Like funds that invest in stocks, you will have the choice of actively managed funds or passive funds.

Actively managed funds cost significantly more and according to Morningstar, “The typical active fixed-income fund manager struggles to beat the fund’s benchmark after fees.” Armed with this knowledge and what we already know about the importance of keeping fees to a minimum, we personally wouldn’t invest in actively managed bond funds.

Based on a list in The Investors Chronicle of top bond funds we noted that cost does vary quite substantially but the average seems to be in the range of 0.5% to 0.8%, which is far too high in our view considering the historical returns on bonds are generally quite low.

We don’t plan to end the debate between passive and active investing in this video and we’ll leave this for another time, but there is an argument that high-yield ETFs typically avoid smaller bonds for liquidity reasons. Therefore, active managers have numerous opportunities to add value by investing in smaller, less-liquid bonds that offer higher compensation for that illiquidity.

Vanguard along with many other index fund providers offer very competitively priced passive bond funds starting from as low as 0.07%, with most costing around 0.12%, which is significantly cheaper than the active alternatives. Other cheap bond fund providers include iShares, Invesco and SPDR, among many others.

You’ll be able to buy bond funds and ETFs through any decent investment platform. Freetrade have a ton of bond ETFs available and if you sign up via our link, you’ll bag yourself a free share worth up to £200. You have to go through our link to get the free share and this can be found on the Money Unshackled Offers page here.

Why We’re Still Not Investing In Bonds

Yields have been nothing less than a joke in recent years, and since the pandemic they have collapsed even further. Bonds are very expensive and are now often guaranteeing a loss if you hold them to redemption.

An investment manager speaking to the Investors Chronicle said – and we paraphrase – they now only use bonds to manage volatility in broadly diversified portfolios, instead of as a source of predictable return.

With hindsight, the time to hold bonds was 2020 but this ship has now sailed. But if we had the gift to foresee economic catastrophes, we would also know which stocks would benefit, and these would provide far greater returns than any bond. So with this in mind, a good stock picker would do better picking stocks than panicking and taking shelter with bonds.

Having said this, there is still a high probability that central banks such as the Bank of England will resort to negative interest rates sooner or later. This would likely push bond prices upwards, so you could benefit in the short term if you know when to take profits.

Some of you might be wondering why we’re not buying bonds if we think the bank base rate is going negative. Quite simply, we both believe that no matter what interest rates are, stocks will always find a way to provide stronger positive returns eventually.

We wouldn’t want to miss a bull run in the stock market by trying to time the bond market.

If we were investing in bonds, we would be doing so as part of a long-term strategy. As we’re only in our early 30’s we feel that it’s better to risk our money in equities than to settle for likely low returns from bonds.

Also, according to Andy (MU Co-founder), he has speculated enough on interest rates by choosing a tracker mortgage on his main home. If rates do fall, he will get the benefit there, and likewise if they rise he will feel the sting.

Alternative Interest-Bearing Assets

We do invest a small allocation of around 10% of our portfolios in P2P Lending for regular income, which in many ways is similar to corporate bonds but without fluctuating capital values.

Most of the major P2P platforms have temporarily stopped making new loans using retail money and instead are making loans solely using government funds such as the Coronavirus Business Interruption Loans Scheme. If you are an existing lender you should still hopefully be receiving regular repayments, which far surpass the yield on bonds.

Loanpad, which is one of the few platforms still lending new money will be paying 4.0% interest – currently at 4.5%. Ben (MU Co-founder) personally uses Loanpad himself and has been very impressed with how they have handled the Covid situation.

In addition to the decent interest on Loanpad, new investors who use the link on the Money Unshackled Offers page will get a £50 bonus if they invest at least £5,000.

Do you invest in bonds, and if not, why not? Let us know in the comments section.