Myth #1 – It’s All Or Nothing

Probably the biggest myth doing the rounds is that there’s no point even trying because it’s so difficult to achieve FIRE. The naysayers spreading this falsehood believe that FIRE is an event. They see it as you are either FIRE, or not. But that is totally the wrong way to look at it and they fail to see the benefits of just being on the path!

FIRE is a journey with many destinations and goals along the way. There are many degrees of financial independence.

One of the earliest goals for you might be to start living on less than you earn. That’s an achievement that can turn your whole life around in a day. The next goal might be to pay down all your consumer debt – credit cards, store cards, overdrafts, and so on. The advantages of doing this are obvious. You don’t need to have attained FIRE in full to benefit from these smaller goals.

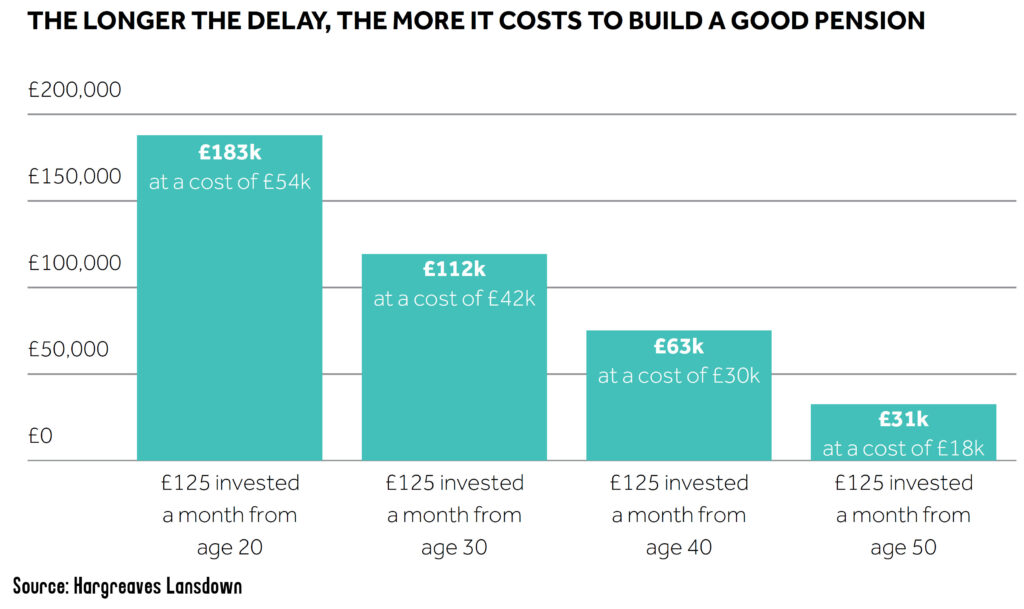

Say you have a goal of producing £40,000 per year passively from your freedom fund, which is what we call our retirement savings. You might have determined that to achieve this you will need a freedom fund of £1 million. On the journey to £1 million – or whatever your FIRE number is – you will probably start with just a few thousand quid. That doesn’t sound like much, but that small amount means life will no longer push you around like a leaf in the wind.

At that stage the passive income is almost non-existent, but a small freedom fund gives you breathing space from life’s little disasters.

As your freedom fund grows there is a noticeable change in life dynamics. For instance, once your pot hits £30k you might have the confidence to negotiate a higher salary because now you have a trump card – you are able to quit your current job and find another without financial fear. The balance of power has shifted from the employer to the employee.

Someone we knew had an engineering job and later his employer tried to make him do sales as well. His finances gave him the confidence to say no, and his employer backed down with their tail between their legs. This guy had a freedom fund and so was able to dictate terms and pull the strings!

As your freedom fund continues to grow you will be presented with new opportunities to make money that are probably unimaginable right now. Maybe someone you know is starting a business, or is taking on a new property project, and is raising capital. You don’t need to have completed FIRE in its entirety to benefit!

Moreover, if your goal was ultimately to earn freedom but you fancy having a bit of that freedom early, you can very easily take a career break and spend a few grand jet-setting around the world. You can continue working on FIRE when you return – no problem.

Myth #2 – You Will Get Bored / Have No Purpose / Can’t Socialise

We’ve tried to encompass all the main criticisms of early retirement into this one super-myth. They’re all total nonsense. The naysayers are clearly jealous and know they don’t have what it takes to succeed. Because they can’t do it, they want to discourage you from doing it.

Come on man, how will you get bored when you have both time and money? Why could you not find or build a purpose? And not being able to socialise is ridiculous. Having your manager choose all your friends is pathetic.

When you’re free you will be able to do more of the things you love. If you want to spend your days hitting golf balls, then there’s a good chance you’ll make friends with people who also like doing the same.

Generally, people who plan to retire early are goal-oriented and driven. Sometimes, and we’re guilty of this ourselves, the FIRE community has a tendency to promote FIRE as if it’s lying on a beach all day in a hammock. While that would be ace for a few weeks it probably would get boring pretty quickly. But you’d go find something else to do.

Those who are keen to retire early are rather looking forward to starting the next phase of their life – one that has gone unfulfilled for far too long due to being a wage slave.

It doesn’t matter if you don’t even know what it is yet – it will come to you later. I’m betting your purpose is not shovelling crap into a skip for somebody else, but that might be what you currently find yourself doing out of necessity. That’s not a purpose!

Once your free time opens up, you’re likely to focus your life on things that truly make you feel fulfilled. This could be charity work, spending more time with family and friends, traveling the world or learning new skills.

And guess what, FIRE does not mean you have to stop earning money. You’re free to pursue whatever you like. If you want to open a small business, for instance a B&B, that normally wouldn’t have supported your lifestyle, well now you can. Cos now you’re doing it out of love, rather than for money.

Myth #3 – FIRE Relies On Extreme Frugality And High Incomes

I suppose this one depends on what your definition of extreme frugality is. Some people choose to get to FIRE by living on rice and beans, living in a dive, and not owning a car nor many other possessions for that matter, but this is just one way. And not the way we would ever recommend.

If you think you can’t be happy without buying designer clothes, driving a fast car, living in the trendy part of town, and holidaying in the Bahamas, despite earning an average salary, then yeah you probably won’t ever attain FIRE.

But somewhere in between those examples lies the sweet spot. For me, I insist on having a certain level of comfort and lifestyle but it’s not luxurious by any means. I have a car – but it’s an old Ford Focus, not a brand-new Tesla. I want to go on holiday – but it’s likely to be in affordable Spain, not the Maldives. I want to eat out – but I choose Nandos, not a three-star Michelin restaurant.

You get the point. You can still do and have all this stuff without it costing the earth, and still achieve FIRE. It’s simply a case of spending less than you earn and investing the rest.

The more you earn the easier it is – we won’t lie about that. Once you’re living your desired lifestyle, every extra penny earned above this is there to be invested and help you reach FIRE.

Truth be told, we’ve yet to meet an early retiree who achieved FIRE by avoiding Starbucks.

Our approach is simple: Decide on your savings per month or SPMs first, and work hard to achieve that goal. Once you achieve your savings per month, spend the rest of your money however you want to – guilt free. If that means buying lattes or takeaways, go for it.

Myth #4 – The Next Bear Market Will Obliterate Any Hopes Of FIRE

This is another complaint by the naysayers. They argue that the next bear market will devastate investment pots, and that future returns will be lower than what they’ve been historically, such that if you were to continue drawing from your freedom fund it will soon run down to zero.

This argument is inflamed by the current lofty valuations of stock markets, especially the S&P 500, which at time of filming is sitting at all-time highs. The S&P’s Price Earnings ratio currently stands at 35, while its median value over history is under 15. You can easily to see why some people might think we’re due the mother of all crashes, capable of wiping out any chance of living off your investments.

Perhaps counterintuitively, a crash might actually benefit the FIRE community. High share prices only benefit those who already have wealth and are retired. For those accumulating wealth and hoping to FIRE in the future, like we are, we’re being forced to pay over the odds right now to buy into the stock market. We would love a crash, and low share prices would only fuel the FIRE community’s growth!

As for those who have already FIRE’d we don’t think there is too much to worry about from a bear market. For a start there are many studies that have analysed safe withdrawal rates such as the one carried out by William Bengen and then later the Trinity study.

Champions of the FIRE community have also come up with strategies designed to weather a bear market. One such strategy is to have a big pile of cash that can be drawn from when the stock market has tanked. This ensures you are not selling your investments at knockdown prices.

Another strategy or extension to the cash pile strategy is to build a high-yield, dividend portfolio, so even if the market crashes, you don’t need to sell off your investments. High dividend stocks tend to be more stable because they’re in mature, often monopoly like, industries.

And let’s not pretend that once you’ve FIRE’d you won’t be reacting to the market. The idea of FIRE is not to shrink your expenditure if the market tanks, but it remains a tool in your kit – at least until the market recovers.

And that leaves us with perhaps the biggest myth-buster of them all, which is your ability to earn money. When you consider that most people who achieve FIRE are ambitious and driven people who are good at making money it seems highly unlikely that their freedom funds will ever run dry.

Many who “retire early” find themselves continuing to make money following their passions. Take us for example. The day we hit FIRE doesn’t mean our income from Money Unshackled will suddenly come to a grinding halt. Sure, we might post videos less frequently but even as multi-millionaires we can’t see a day where our passion for helping people to make money would stop.

Myth #5 – Society Will Collapse If Everyone Reaches FIRE

This is a hilarious one because it’s never going to happen anyway. Only the truly committed will ever achieve FIRE and most people just aren’t. However, let’s play along and assume it did.

The people peddling this myth are implying that your plans for FIRE are in some way immoral – that you being free is damaging society. They don’t really believe that and secretly they just resent you because you’re doing something they can’t.

They question: who will serve you in the shops? Who will clean the toilets? Who will collect the rubbish bins? Who will cook in the restaurants? Of course, all this is total nonsense. Society would be far superior if everyone wasn’t broke. And remember it takes a long time to get to FIRE, so the country would still have a workforce.

As part of the FIRE community, even if you’re not directly doing it yourself, you will be investing money into companies that are changing the world, inventing new technologies and developing new life-saving drugs.

Plus, while you’re working a 9 to 5, you’re not spending money in society. But when you’re financially free you will be out there living, and the economy will grow because of it.

At the end of the day many people want to stay productive and are happy to work when the conditions are right, and the choice is theirs.

What do the people around you think about FIRE? Join the conversation in the comments below.

Written by Andy

Featured image credit: marekuliasz/Shutterstock.com