Today we’re looking at 8 retirement blunders that you need to avoid. If you get your retirement strategy wrong, you will likely retire poor, and your later life will be unpleasant or even destitute but avoiding these mistakes will help you to retire rich.

If you’re new to retirement investing and want the professionals to manage your money, a great option for hands-off investors is to open a SIPP with Nutmeg. They will build and manage your portfolio on your behalf in just a few clicks. New customers who use the special link on the Money Unshackled Offers page, will also get the first 6 months with zero management fees. If you’d rather manage your retirement investments within an ISA, check out our hand-picked range of ‘do-it-yourself’ Stocks & Shares ISAs.

Alternatively Watch The YouTube Video > > >

#1 – Not Saving Enough

According to unbiased.co.uk, almost 4 in 10 British adults don’t have a pension, including 1.4 million people who are within a decade of retiring.

Assuming you retire at State Pension age, which will be age 68 for most of our audience including us, then you will need to have enough money tucked away to fund 14 years of retirement if you’re a man or 16 years if you’re a woman based on the UK’s average age of death. And of course, you may live far longer than this, so you need to factor that in.

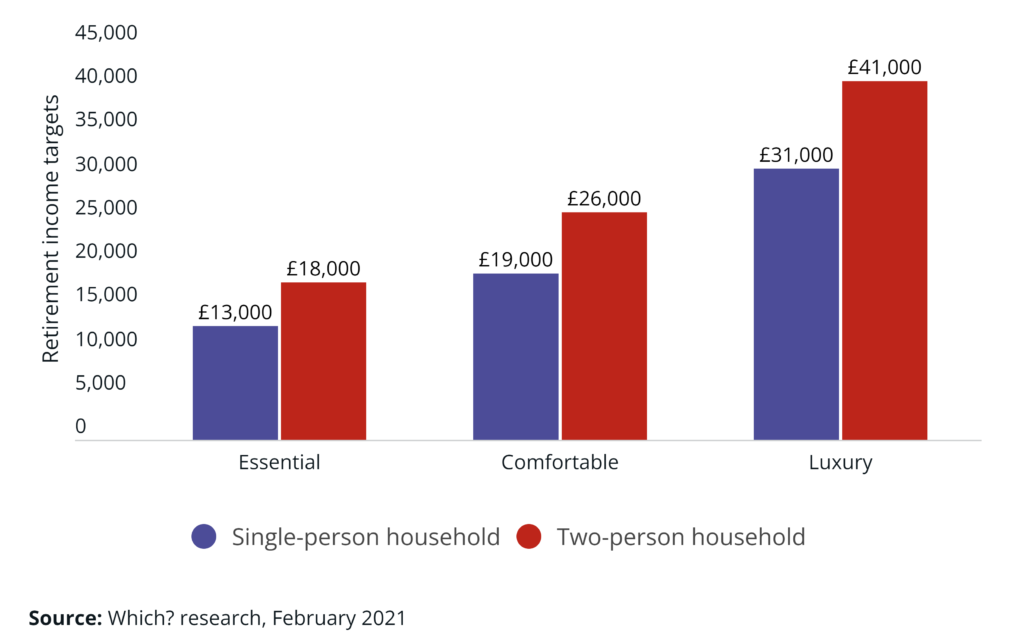

According to a Which? Study, these are the annual incomes needed to fund different qualities of lifestyle during retirement. A single person would need £13k just to pay for the absolute essentials like food and rent. That rises to £19k for a comfortable lifestyle and £31k for a luxury lifestyle. Bear in mind that even the money required for the Essential lifestyle exceeds that of a full State Pension.

Which? go on to state that for a single-person household, achieving a comfortable retirement would mean a pot of around £192k alongside the State Pension to get to an annual income of £19k via pension drawdown, or to reach £19k using an annuity you’d need nearly £306k.

We don’t know how exactly they’ve worked this out, but we tend to use the 4% rule. With the State Pension providing around £9k a year, that means you would need to find an extra income of £10k a year yourself. So, using the 4% rule we would say you’d need a pot of £250k.

Also, many people are paying into a workplace pension without realising how little they are actually saving. The headline 8% that you get on auto-enrolment is total nonsense; it applies only to your qualifying earnings, which is earnings between a lower and upper limit that’s set by the government.

The lower limit is currently £520 a month, which means if your salary is £25k, then you’re contributing 8% on just £18,760. Your total pension contribution is just £125 a month, and remember you need hundreds of thousands at retirement.

Basically, if you’re a low earner, then you’ll barely be making a dent on your required pension size because that lower earnings limit makes up a larger proportion of your overall salary.

Most of our viewers will have even loftier ambitions and will be seeking to retire much earlier than when they qualify for the State Pension, and they might need to fund 40-plus years of retirement. People tend to neglect saving properly for retirement because it always seems like tomorrow’s problem.

#2 – Delaying Investing

Investing works best when it has time to compound. Compound interest or compound investment returns behaves like a snowball. A small snowball can roll and get exponentially bigger and rolls faster as it gathers more snow. This is precisely what happens when you invest. Plus, the more time you give to your pension to grow, the less you have to contribute overall making your monthly retirement savings far more manageable.

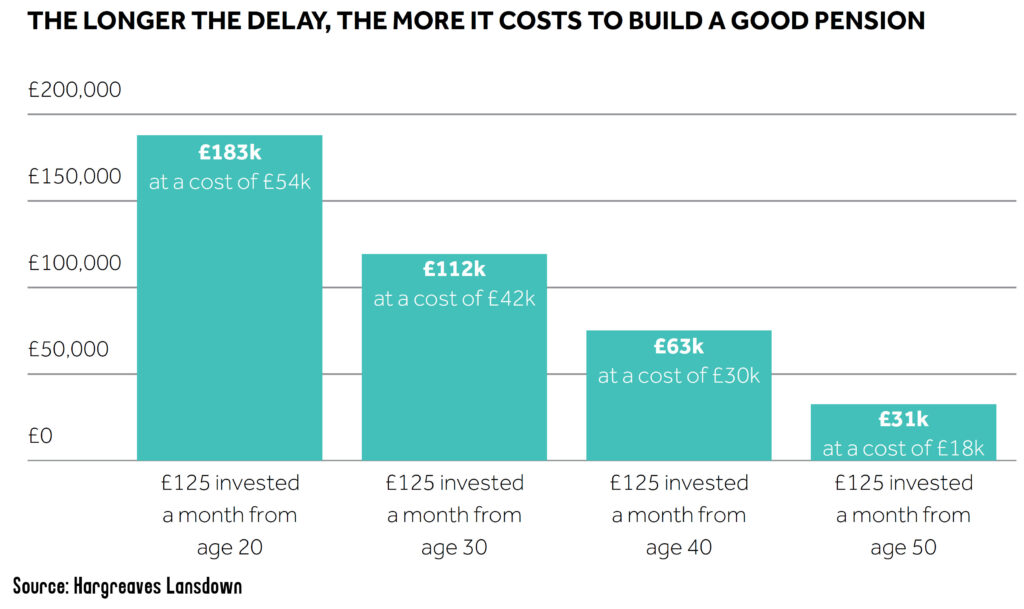

Hargreaves Lansdown produced this excellent graphic showcasing the impact of time on your projected retirement pot. The graph shows how much you will have at age 65 by investing £125 a month starting at different ages. Roughly speaking, every ten-year delay wipes out approximately half of the fund’s potential growth.

We actually think they have been very conservative by only using a 4% growth rate, which even ignores inflation. The impact of time would be even more telling had they based it on say an 8% return, which is what we think the stock market will return on average.

#3 – Never Reviewing Your Pension

Pensions are hardly the most interesting of topics and this is coming from a couple of guys who are passionate about investing. Our problem is that because its inaccessible for decades it just doesn’t have the excitement of a Stocks and Shares ISA – people want to get rich quick, which is the exact opposite of what a pension does. As a result, people tend to neglect the management and performance of their pensions which can be a very costly mistake indeed.

Research done by Hargreaves Lansdown found that only 37% of non-retirees had a clear idea what all their pensions were worth.

The biggest issue is likely to be the default funds being used in your workplace pension. Our research found that most default funds are investing in low performing assets with needless home bias to the UK market. We believe a globally diversified portfolio is likely to give the best balance of high returns and safety due to your exposure being spread across all geographic regions.

If you’re managing your pension investments yourself in a SIPP, which often provide the widest investment range and lowest costs, then it’s vital to review your pension every so often – perhaps yearly. Don’t forget to occasionally rebalance your investments, as over time your exposure to any one fund, stock, or region could drift away from your intended allocation.

It’s also a good idea to review the fees that your pension provider and funds charge. Fees across the industry have been cut in recent years, so always make sure you’re not overpaying with your current provider. We have an excellent guide which looks at all the best SIPPs, so check that out next.

#4 – Turning Down Employer Contributions

The good news is that every employer must pay into a workplace pension if you do. The bad news is that some people don’t take full advantage of this and are effectively turning down free money. Essentially any money you contribute gets an instant 100% return.

There are very few reasons that we can think of where it makes sense to not pay into a workplace pension up to the maximum matched percentage. Otherwise, you’re just throwing money away.

#5 – Only Using A Pension

There are many ways to build wealth and investing in a pension is just one of them. Unfortunately, it seems that the average person – at least those saving for retirement – only ever considers using a pension.

Ben’s (MU co-founder) preferred wealth builder is buy-to-let property. It’s obviously not quite as effortless as a pension but there many other benefits, including leveraged gains and the ability to access the money at any age. In fact, we did an entire article and video demonstrating how you can make 25% annual returns in property passively, which you should check out if property investing is of interest to you.

Another excellent way to build a retirement pot is using a Stocks and Shares ISA. These are very tax efficient as they avoid most taxes such as capital gains tax, which means your investments can grow unopposed from the taxman.

The second advantage of ISAs is you can withdraw the money whenever you like. This flexibility makes them incredible when used alongside pensions as you can effectively retire early and use the ISA to bridge the gap between your early retirement date and when your pensions become accessible.

Our third way we love to invest is using a spread betting account to invest in financial futures. This is super complicated and extremely risky and probably not suitable for most people, but for transparency we’ve included it here.

We use 3x leverage on this part of our portfolios to supercharge our investment returns. If you’re an experienced investor you should check out these articles/videos next [Spread Betting Startegy Overview, Step-By-Step Guide] where we explain exactly how we use spread betting to earn mega returns.

#6 – Assuming The State Will Provide

Research in 2020 found that 1 in 6 workers over 55 had no pension provisions other than the State Pension. Frankly, these guys are in serious trouble. As we mentioned earlier the State Pension is currently a little over £9k a year, which is £180 a week and this does not even cover the most basic of lifestyles.

And don’t assume that you will get the full pay-out either. You need to have paid National Insurance tax for 35 years, known as an NI qualifying year, otherwise you will only get a proportion of it. For example, if you’ve only paid 20 years that is 20/35ths, so you’d only get £103 a week.

In most circumstances you should be able to accumulate 35 years of NI qualifying years, but some people may not if they take a career break for example. You can always make voluntary NI contributions every year to qualify, for instance if you retired young.

You can easily check your state pension record by searching Google for ‘check-your-state-pension’ and visiting the government’s website.

What’s more, there are whispers in the finance community that doubt whether the government can afford to continue paying a state pension to everyone for much longer. The country is broke, and the state pension is just a humongous pyramid scheme, which relies on current taxpayers to fund the current crop of pensioners.

There is a possibility that the state pension will be means-tested in the future, so don’t count on it being there for you. Personally, we plan as if it won’t even exist, and if it does it’ll be one hell of a sweet bonus for us!

#7 – Failing To Claim Back More In Tax Relief

Tax relief on pension contributions is one of those rare occasions when the taxman gives you something back. The government effectively pays 20% of your total contribution. For higher rate taxpayers this is 40% and for additional rate taxpayers it’s 45%. This means a £2,000 pension contribution could effectively cost you as little as £1,100.

However, the government only automatically adds the 20% tax relief to your pension, and you must claim back the rest if you’re a higher or additional rate taxpayer. You have to actively claim this money back though via your self-assessment tax return or by contacting HMRC directly. Many people are missing out simply by being ignorant of the tax system.

Not claiming their tax relief is one of the most common retirement mistakes people make and is literally throwing money away. Your tax-relief, once claimed, will either be supplied as a rebate at the end of the year, or as a reduction in your tax liability, or as a change to your tax code.

If you’re one of these unfortunate souls, you can thankfully make backdated claims, but you can only claim back any tax relief for the last four tax years.

#8 – Not Shopping Around When You Retire

So, the big day has arrived, and you can finally tell that boss you hate to stick the job where the sun don’t shine. Congratulations! You’re now retired.

You can normally take 25% of your pension as a tax-free lump sum, and after that there are two main ways to draw a taxable income.

One way is Income Drawdown, or Pension Drawdown, which is a way of taking money out of your pension to live on in retirement. The pension remains invested, and the investor draws an income from it.

The other is to buy an annuity from an insurance company, which provides a secure retirement income for life. If an investor chooses this option, they should shop around as rates can vary significantly.

No sensible person would ever take out car insurance or choose an energy provider without running a price comparison first because you know that the providers of such services will always rip off the complacent. The same is true if you take out an annuity from your existing pension fund provider.

According to a 2019 Which? report, shopping around for an annuity can increase an individual’s retirement income by up to 20%.

As a little sidenote to this point, before taking out an annuity be absolutely clear that it’s the right financial product for you. We here at Money Unshackled are not very fond of annuities because the rates are measly, and when you die all the money is usually lost. Those with guaranteed periods where your beneficiaries can benefit after your death naturally have even worse rates.

With your bog-standard single-life annuity, if you die relatively young having just taken it out you may have wasted hundreds of thousands of pounds, which could have been passed on to your loved ones.

Annuities are usually best for those who need a guaranteed income and cannot cope with the whims of the stock and bond markets. We believe the State Pension should be enough to provide a guaranteed income though for most people and should replace annuities as their base layer, to be topped up with riskier investment-based income.

Which of these blunders have you made and what other tips can you give to retirement savers? Join the conversation in the comments below.

Written by Andy

Featured image credit: Krakenimages.com/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: