Written by Andy:

How do you choose the best Stock & Shares ISA for 2021? Whether you’re a seasoned pro or an investing noob, each year we should all consider what options we have when it comes to choosing the investment ISA that we’re going to use for the year ahead.

If you’ve never carried out this exercise, there’s a high chance that you’re massively overpaying.

If you already have a Stocks & Shares ISA from previous years you don’t need to continue using the same one. And in many cases, it would be best not to.

A lot changes in a year, so what was once the best investment platform for you a year ago may no longer be.

We regularly get asked which is the best investment platform, and we would love it if there was a simple answer but unfortunately there is not a one size fits all approach.

As the new 2021/2022 ISA season draws closer, I’ve been evaluating my options. So, rather than take you through a big list of different investment platforms and compare them, we think it would be more beneficial to take you through my thought process and show you how I came to decide on which investment ISA I will use next. Let’s check it out…

Alternatively Watch The YouTube Video > > >

Best Investment Platforms For Your ISA

Before we get into the mechanics of the decision-making process, a great resource that we’ve put together is a curated list of the top investment platforms, including a comprehensive fee comparison table.

Naturally, a comparison table like this can be completely overwhelming for all but the most experienced investors, so we’ve also handpicked our favourites and categorised them into hopefully more understandable groups.

For example, Interactive Investor is our favourite Fixed Fee platform. As the account fee they charge stays the same no matter how big your pot grows, it’s great for investors who have or plan to grow substantial wealth.

Another of the categories is Commission-Free apps and our favourites here that offer an ISA are Freetrade and Trading 212.

These two investment apps are in a league of their own for anyone who wants to trade even semi frequently. Neither of them charge any trading fees, which can really rack up fast with the platforms that do charge them.

My Current Investment ISA Provider

Many of you will know that I’ve been using Interactive Investor over the last few years as my current ISA provider because it has almost suited my needs perfectly.

The way I like to do the bulk of my investing is to invest monthly into a few low-cost ETFs. I don’t want to incur any growing account fees, trading fees, FX fees, or any other type of sneaky fee that the platform can conceive.

Invest wrongly with Interactive Investor and you’ll have your pocket picked but do it right and they are one of the cheapest platforms around.

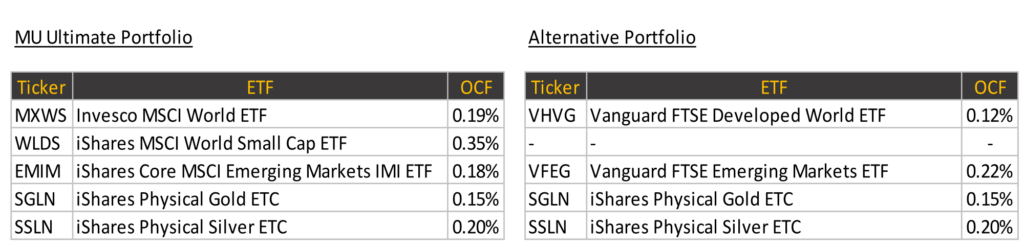

Both of our core portfolios contain just 5 ETFs. If you’ve seen our blog or the YouTube channel before you’ll know that we bang on about these all the time, but if you’re new to Money Unshackled, check out this post on the Ultimate Portfolio next.

As Interactive Investor’s monthly investing service is free, investors can build this 5 ETF portfolio with no trading fees.

All of these 5 ETFs are priced in pounds, so I avoid their nasty FX fee, and it is VERY nasty, so be warned. This IS NOT the platform for trading directly in international stocks in our humble opinion.

But for my portfolio their pricing structure means I only ever incur their monthly account fee of £10, which works out at just 0.14% of my ISA annually at its current size, and that percentage will reduce as my investments grow.

Naturally, you might be wondering why I’m thinking about using an alternative investment platform for my ISA considering there would be no additional charges for new money. Well, the reason is diversification across platforms. Your money is only protected by the FSCS up to £85k per firm.

Is Your Money Safe?

When you make any investment, you need to first consider the risk of losing your money due to platform failure. If the platform were to go bust, is your money safe?

While the FSCS protects up to £85K per firm, in practice the level of financial protection is much higher. Your investment platform must segregate your investments from their own business capital.

If this segregation of client assets fails in any way, then the FSCS protection can pick up the slack up to £85k.

In practice this means that your investments are likely to be safe well into the several hundreds of thousands but pinpointing an exact number would be impossible.

With my ISA sitting currently around £87k that puts me right on the limit of what is effectively full protection. I’d be very comfortable with a lot more than this with one platform but even if I don’t add more money to my pot it should grow to £875k in 30 years’ time with average compounded returns. That’s more than enough to get me worried about protection, so in my eyes it makes sense to start using another ISA provider now for new money invested.

Having multiple ISAs would be a pain in the backside to manage, so when the time comes, I’ll probably draw a line at two ISAs, as long as any other wealth such as SIPPs, property, and so on are invested elsewhere.

The size of the platform also makes a difference. Hargreaves Lansdown has assets under management of over £100 billion and is top dog. We feel that there is strength in numbers, and the FCA is far more likely to regulate the major players more stringently as they pose a greater risk to the financial system should they collapse.

For comparison purposes Trading 212 only has £2.7b of assets, but they are growing fast.

Before you invest a penny, you should first check that the platform is FCA regulated and protected by the FSCS.

All platforms worth their salt will have all the relevant info clearly visible on their website.

Fees

We think the next most important consideration when choosing a platform is fees. So much so that fees will influence how you invest. Don’t underestimate the seemingly small fees that you incur like FX and trading commissions.

Investing £500 a month for 30 years at 8% returns would get you a £709k portfolio. However, lose 2% of that to fees and the pot is just £490k – a whopping £219k smaller.

Different fees will affect investors in different ways depending on how and what they invest in.

We’d both love to trade more frequently and have more fun with our portfolios but we know that due to the nature of fees this is detrimental to our portfolios.

Account fees should never be more than 0.25% in our opinion if they also charge trading fees on top, which most do.

Vanguard’s own platform charges just 0.15%, AJ Bell’s is 0.25%, and Interactive Investor is a flat £10 monthly fee. Whereas Freetrade charge just £3 monthly for an ISA and Trading 212 is completely free.

The next fee to watch closely is trading fees. In all honesty, anything costing more than free is too much.

Some of the major platforms have discounted monthly investing services, which charge around £1.50. This is just about acceptable.

However, with the likes of Freetrade and Trading 212 charging nothing to trade, we think the days of paying to trade should be left in the past where it belongs.

The final major fee, which seems to be less understood and overlooked by investors, is FX fees.

We think a lot of platforms are taking advantage of investors’ ignorance here to hammer them with a nasty currency conversion markup.

Trading 212 were industry leading until recently when they decided to implement a 0.15% FX fee.

This is still tiny relative to many of the more established platforms but for anyone who trades frequently in any stock or ETF listed in a foreign currency this will quickly add up.

Trade in and out of a stock 6 times in a year and that small inconspicuous FX fee would add up to 1.65% (that’s 11 trades at 0.15% each).

On some platforms it might be 10x that, making trading practically impossible.

Investment Range

You need to make sure that your chosen investment platform has a good investment range.

Trading 212 and Freetrade have grown their range considerably over the last year or so. However, the more expensive traditional platforms have far superior ranges and we’d be surprised if they didn’t have what you were looking for.

It boils down to whether it’s worth paying more for this better range. We’re not sure that it is.

The commission-free apps now offer enough to make do, and when you factor in the lower fees it’s probably more than enough.

Unfortunately, some of the ETFs I want to invest in on Trading 212 are stupidly only available in dollars, including the largest component of the Ultimate Portfolio (available as US Dollar version MXWO on Trading 212), despite GBP versions being available elsewhere like on Interactive Investor.

Looks like I will have to incur this small FX fee or invest in something else.

One similar portfolio to the Money Unshackled Ultimate Portfolio would be to switch out the Invesco and iShares ETFs and bring in the Vanguard FTSE Developed World and Vanguard FTSE Emerging Markets ETFs instead. These cost just 0.12% and 0.22% respectively.

We personally don’t think these ETFs are quite as good as the Ultimate Portfolio for our purposes but should perform similarly. The Ultimate Portfolio funds avoid some dividend withholding taxes by being partly synthetic, which the Vanguard funds fail to match. This might be one of those occasions where you let fees influence how and what you invest in.

I have also been considering Vanguard’s own platform because it is well priced. The problem is Vanguard only offers Vanguard’s own products and strangely, you actually get a better choice of Vanguard funds elsewhere.

For people who are just interested in getting a decent range of funds at rock bottom prices, Vanguard’s platform might be for them.

Customer Service

You might be able to tolerate bad customer service at Burger King but when it comes to your money, the service better be top notch.

It goes without saying to check out reviews before committing. Trust pilot is your main port of call here of course.

When we’ve spoken to Interactive Investor, we’ve generally had great service.

We’ve requested ETFs and had them promptly added to the available range and even had some added to their regular investing service on our request – but not all.

The commission free apps do consider requests, but I was essentially pied-off (in a polite way of course) by Trading 212 when I asked.

Functionality

There’s an endless list of possible features that investment platforms could offer. You need to choose a platform that offers the ones that are most important to you.

The capability to place limit orders might be essential for you, whereas we are happy to invest using market orders.

You might insist on having detailed analysis of the available stocks including revenue and earnings, and portfolio analysis. You might also want guidance and suggestions about what to invest it.

Some platforms also produce best-buy tables, and others produce large volumes of content to read. Other platforms have built up incredible communities.

All of that is great, but one feature that we think stands head and shoulders above everything else is Trading 212’s Autoinvest and Pies feature. The Pie feature is brilliant and we reviewed it here, but as it stands, Trading 212 performed an act of self-sabotage by introducing a card fee to Autoinvest.

This fee at 0.7% can be avoided by not using Autoinvest, and instead manually adding funds to the Pie using a bank transfer.

Which Platform For 2021/2022?

On balance, the best ISA for me in this upcoming tax year will be Trading 212 – though if I didn’t have so much money in Interactive Investor already, I would have leaned towards them again.

Although the introduction of some fees on Trading 212 is an unwelcome irritation, these can be avoided by jumping through a few hoops and avoiding certain investments.

What ISA will you be subscribing to this tax year? Join the conversation in the comments below.

Featured image credit: Aaban/Shutterstock

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday:

5 Comments

Hi guys can you please help, I am a complete newbie. I tried getting hold of Trading 212 but there’s and unknown time for the waiting list. So I got hold of the Freetrade app from your site, with a view of using your MU ultimate portfolio for my ISA, however MXWS is not available. Can you recommend another to replace it. Or would I be better off using another provider, your help would be very much appreciated?

Regards,

Danny

Hopefully T212 open their doors again soon. Have you looked at Vanguard ETFs? We fancy a combo of Vanguard Developed World and Vanguard Emerging Markerts ETFs (at about 88% and 12% weighting respectively) to arrive at a cheaper version of their All-World offering. Vanguard don’t offer synthetic ETFs, but if we couldnt get hold of the Ultimate Portfolio we’d be going with Vanguard ETFs. It doesn’t have any small caps is the other issue though. We cover this portfolio here https://youtu.be/mY80He4iLhM (Portfolio #2). Cheers, Ben

Much appreciated, thank you.

Hi, I opened a stocks and shares ISA in the last tax year with freetrade funded it until the end of that tax year. Then opened a stocks and shares isa with a different provider in this tax year. but I still pay the monthly freetrade platform fee so I dont have to close the freetrade ISA opened in 2020/21 tax year. is that in line with the rules, I cant find an answer to that at HMRC. Any help would be appreciated. Thanks.

You are not paying into your ISA on Freetrade, so I’m almost certain that simply paying the upkeep fee would be within the HMRC rules, and should allow you to freely invest in a different ISA this tax year. Ben

Comments are closed for this article!