On this site we’ve talked a lot about the importance of owning the World when you invest. But there are many ways to achieve this, and we ourselves utilise many of these methods.

We recently released a very popular video on the Stock Market Crash and briefly mentioned a Vanguard global fund I was using to capitalise on the cheap stock prices. There’s a compelling argument that the only equity fund you need is a total world equity tracker.

It seems that some of you who watched that video were interested in knowing why we had chosen The Vanguard FTSE All-World ETF (VWRL) over a Vanguard LifeStrategy fund or even over our own handmade World ETF portfolio.

This is perfectly understandable considering we often mention the LifeStrategy fund as a great way for beginners (or the uninclined) to own the World.

There are loads of global funds available to investors and even Vanguard themselves offer several, which all appear on the face of it to do the same thing.

This obviously isn’t particularly helpful when all you want to know is what you should be investing in right now. The enormous choice just clouds our judgment. Under the hood, most of these funds are very similar and any difference is minute enough to probably bear little importance in your decision making.

In this article we are going to mention what we invest in and why, explain the difference between The Vanguard FTSE All-World ETF (VWRL) and a Vanguard LifeStrategy fund, why we might invest in each and what truly matters when looking for a global tracker fund.

Editor’s note: Take advantage of the stock market crash with a boost when you open a new investment account using one of the links on the Offers page! Freebies include free shares, cash bonuses, or money off your fees.

YouTube Video > > >

What We Invest In?

Let’s start this video with disclosing which global tracker funds we invest in and when, and then we’ll get to the reasons why. While our portfolios are not identical, they do follow the same design methodology.

The bulk of Andy’s SIPP is invested in The Vanguard LifeStrategy 100% Equity Fund and Ben will be soon consolidating all his pensions into a SIPP in this very same fund. So, our pension investments will be pretty much the same.

Regular followers will know that we prefer to invest the majority of our money in accessible accounts such as a Stocks and Shares ISA or general investment accounts – that means not in Pensions and Lifetime ISA’s which tie up your money until you are too old to enjoy it.

For these accessible investments we both build our own World portfolios consisting of a core of about 6 ETFs – 1 for each major region – US, UK, Europe, Japan, Asia Pacific and Emerging Markets.

Andy also invests a portion of his wealth with the Robo-investing platform Nutmeg, which itself creates its own World portfolio.

And in addition to this has recently been buying The Vanguard FTSE All-World ETF (VWRL) during the recent Stock Market panic.

Why We Invest in These?

#1 – Vanguard LifeStrategy 100% Equity Fund

First and foremost, we think the Vanguard LifeStrategy 100% equity fund, or even its Bond variations, offer excellent one-stop shops for owning the World. It does however overweight the UK with about 23% of the fund, which a normal world tracker would not do.

In fact, this is one of the things we like most about it. We are obviously UK based and an income in sterling is very important to us. Technically this home bias means the LifeStrategy funds are not really global trackers as it’s based on Vanguard’s own proprietary view.

With that said it does hold investments in all the major global markets and does it all for an extremely low cost of just 0.22%.

This makes it perfect for our pensions as we don’t want to be managing a portfolio that we cannot access for decades. Vanguard handles all the rebalancing while you get on with living life now.

This also makes it a perfect ready-made portfolio for those who can’t be bothered to manage investments but perhaps know enough to be able to assess their own risk appetite.

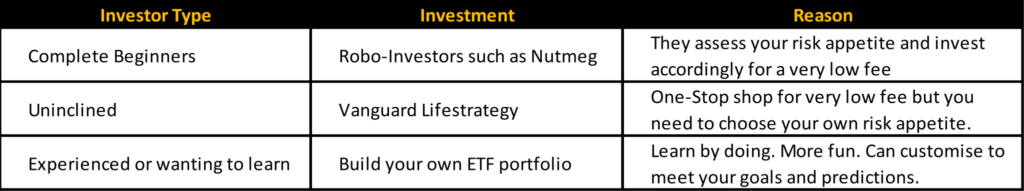

We aren’t financial advisors so don’t offer an advice service but will point people in the following directions:

One aspect of the LifeStrategy fund, which we feel is important, is its type – it is an Open-Ended Investment Company or OEIC, which is the most common but not necessarily our preferred fund type. That accolade goes to the Exchange-Traded Fund (ETF).

An OEIC only has 1-day pricing, so you don’t know the price you pay until when the order is executed.

We love ETFs so much because they offer live pricing; so like Stocks & Shares you know the price you pay before the order is executed. Which leads us nicely into:

#2 – The Vanguard FTSE All-World ETF (VWRL)

This ETF holds an incredible number of stocks – 3,365 at time of filming, which is a representative sample of the World’s listed companies.

Unlike the LifeStrategy fund, which in one way was actively managed by Vanguard, the FTSE All-World ETF seeks to track the performance of the FTSE All-World Index. This index includes approximately 3,900 holdings in nearly 50 countries, including both developed and emerging markets. It covers more than 95% of the global investable market capitalisation. Now that truly is a global investment!

So, why is Andy investing in this ETF over his usual self-built portfolio? Firstly, for simplicity. It’s so easy to buy and regularly monitor just one fund. He’s still continuing to invest in our own World portfolio on a monthly basis, but can more easily monitor the price of this ETF during the global crash.

We are always optimistic about the long-term future of the World economy, so it makes sense to put your money in a World investment that is market-capitalisation-weighted.

That means if Microsoft make up 2.6% of the Worlds capitalisation then 2.6% of your money is invested in Microsoft.

That also means that a very small amount of money is invested in companies that you have never heard of, which is awesome. But at such small percentages of the fund they will have practically zero impact on the fund’s performance.

You have to wonder whether that level of diversification is necessary but at least it doesn’t cost much at all. The OCF is the same as LifeStrategy at 0.22%, so cheap as chips as we would expect.

Another reason Andy’s choosing this fund over the LifeStrategy right now is that he’s been investing quite frequently and free investments apps such as Freetrade don’t offer OEICs but they do offer ETFs including, yep you guessed it, The Vanguard FTSE All-World ETF.

This has allowed him to buy regularly without incurring trading fees, which is awesome. By the way Freetrade are giving away a free stock to new customers if they use our special link, which can be found on the Offers page. You need to use the link to qualify for the offer.

This fund also distributes income on a quarterly basis, which we love as we like to see income flowing into our pockets regularly – I mean who doesn’t?

The LifeStrategy range distributes income yearly if you buy the income share class and offers a similar yield of around 2% – probably because they hold much of the same underlying holdings.

Granular Detail

Okay so you’ll be glad to hear we’re not going deep dive into each fund in this video because most of you will switch off but for those that want to do this themselves some good resources include Vanguard’s own site. Morningstar is another fantastic site, and so is Hargreaves Lansdown. Have fun.

What Matters When Looking for A Global Tracker Fund?

3 key things:

#1 – Make sure it tracks the World – many fund providers will give a fund a misleading name, so it’s worthwhile to check the detail. Quite often they will just track the developed World and even miss out big guns such as China.

#2 – Diversification – Always check how many holdings it has. The more the better as this will represent more of the World even if the percentage in the smallest holdings become seemingly insignificant. You can’t accurately track the World if the fund doesn’t own the World.

#3 – Cost – Our viewers know that fees are vitally important. Don’t pay high fees unnecessarily and remember that the higher the fees the less well it will do at tracking the World!

Do you invest in the World and if so, how? Let us know in the comments section.

8 Comments

Hi Guys great article as usual.

I just had a question, I purchased Vanguard Lifestrategy and an all World ETF, is this a bad move in terms of overlapping?

I was also looking at med/pharma and energy ETFs on Vanguard but again is this simply overlapping with what you already have , and is it better just to keep buying more Lifestragey. Also a quick question ,is it a good idea to sell a Vanguard product when it’s up and buy when down like you might a share?

Cheers

Hello,

I’ve also purchased both but feel that I’m overlapping also. Not sure if it would be best to sell or continue to invest in both. Any advice would be appreciated!!

I’d say pick your favourite! Ben

Yes it’s still best to buy low, we don’t really sell high on our ETFs and funds though, choosing to hold them for life and draw an income from them. We MIGHT sell ETFs to rebalance, for instance if you owned a mix of ETFs that each represented different geographies or sectors, like we advocate in our World Portfolio series (playlist) on YouTube – if one country or industry was doing really well we might sell at a high to buy more under-performing regions which are priced low. You can’t do this if you hold a single World ETF, or just LifeStrategy. And yes, LifeStrategy and the All World ETF do kind of overlap. Ben

Hi Guys I am new to investing and I was looking at doing some investing Via Nutmeg. I was just wondering what type of account I Should go for as I’ve already opened an investment ISA with Vanguard as I’ve seen Warren Buffett recommends them as the best on the market for passive investing.

Any Help would be great thanks in advance lads

Hi Gareth, if you already have an ISA with Vanguard you shouldn’t open another with Nutmeg this tax year, unless you are not using your Vanguard one. You can transfer the cash value from the Vanguard one into Nutmeg if you wanted. If you do sign up to Nutmeg, use our offer link and they’ll remove fees for the first 6 months.

Ben

Hi guys, I really loved your article and have held the lifestrategy 80 fund for 5 years. With both VWRL and Lifestrategy fund they are very heavy on US stocks, as they are market cap funds, however valuations for US stock right now is extremely high, with many economists and advisers using CAPE ration to suggest reducing allocation to the US, does this concern you?

Not at all – thre are many reasons why the market always goes up over the long term. And the US market is an essential element of any portfolio. But if you want to lower your allocation to the US, you might add on to something like VWRL with other non-US ETFs. Ben

Comments are closed for this article!