If we forget the performance of our investments for just one moment, and instead let’s look at how safe your stock market investments are, should the investment platform or fund fail.

The first question we need to ask is are our investments protected at all if the investment platform fails?

There no point making an absolute killing on your investment if you would lose the lot should the investment platform go bust.

Many of you reading will either have or will have massive investments pots. If you’re anything like us and hoping to achieve financial freedom, then you will be building up an enormous investment pot that will generate you an income while you enjoy life – the way life is meant to be! You’ll never enjoy it fully if you are always worried about losing it.

You might not have put much thought into how safe your investments are because you may have assumed that the UK government wouldn’t abandon you if the investment platform did go bust. Surely, they wouldn’t?

Or perhaps you know that your investment pot is below the FSCS limit and therefore you think you’re safe. Well… it’s not that simple!

We’re not financial advisors – just investors! – but we did carry out a lot of research to corroborate all of the points in this video. It would be worthwhile doing your own due diligence before applying this info to your own portfolio, but everything we do say is believed to be accurate at the time of writing.

This article is about protection for stock market investment platforms – Peer to Peer Lending is not covered by these rules.

Editor’s note: Investment platforms are giving away free stuff! Open a new investment account on any of the many platforms listed on the Offers page, and scoop up freebies including cash back of up to £100, free stocks worth up to £200, or management fees cancelled on your portfolio!

YouTube Video > > >

Financial Service Compensation Scheme (FSCS)

The FSCS is the protection scheme that will likely save your bacon should your investment platform or fund go bust. It’s essentially a completely free insurance policy as it’s funded by the financial service industry.

Actually, its not really free because it’s funded by levies on authorised firms and they will of course pass those costs on to their customers via their fees. So, you indirectly pay for this protection.

Taken straight from the FSCS website, the FSCS exists to protect customers of financial services firms that have failed. If the company you’ve been dealing with has failed and can’t pay claims against it, they can step in to pay compensation.

In 2008 they recovered £20 billion, so based on that history we can consider it to be reliable protection.

The First Thing You Need To Do

Before making any investment, you need to check that your investment provider or adviser is authorised by the Prudential Regulation Authority or the Financial Conduct Authority to carry out the type of regulated activity that FSCS can protect.

How Do You Check?

If you’re going with a well-known company like Interactive Investor you can just assume it is, but to check it’s very straight forward and it’s better to be safe than sorry. Every company that is regulated will say it somewhere on their site but obviously don’t trust that because any company that is hoping to defraud you would pretend to be.

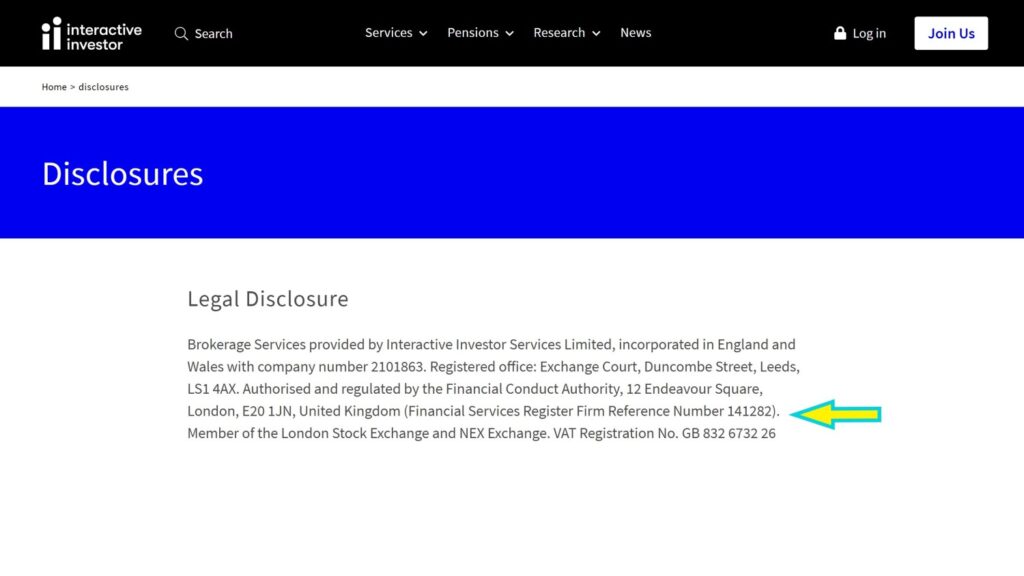

To check properly yourself you need to find their FCA’s reference number. If we use Interactive Investor as an example, they publish their FCA number on their Disclosures page – a page only people as sad as us would care to visit.

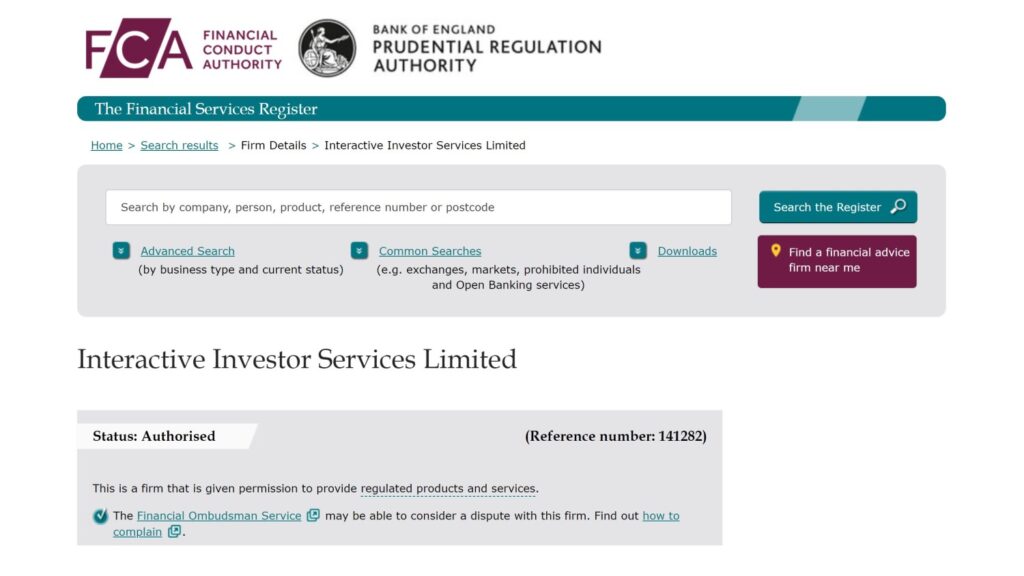

Take that number and bang it into the FCA’s site to check yourself, and boom! – there you have it. This is a firm that has been given permission to provide regulated products and services.

Companies like Freetrade tend to be very transparent about their authorised status and protection. Freetrade have a dedicated page detailing this and even link straight to the FCA’s page:

How Much is Protected by the FSCS?

Your investments are protected up to £85,000 per eligible person, per firm. This seems like a paltry amount, but this protection works alongside other protections, so in practice the protection is much higher.

According to an article from MoneyWeek magazine, their conclusion was that if your investment account is worth twice the FSCS limit, losses would be very unlikely. And even if it was ten times the limit, the risks are probably still low. Let’s now look at why this is the case.

Client Money and Asset Rules

Investment platforms are required to separate client money and assets from their own resources.

This is a crucial piece of protection because they are not permitted to use client money and assets in operating their own business.

Your investments (including any uninvested cash) are ring-fenced and in event that the platform became insolvent – they would be unable to touch your investments or money. However, if the platform did become insolvent the appointed Administrator is entitled to claim their costs for distributing client money and assets from the client money pool.

We wouldn’t worry too much about this though as any money you lose as a result of this would be covered by the FSCS up to a limit of £85,000 per client.

From what we have seen from past broker failures (Beaufort Securities, Pritchard Stockbrokers, Fyshe Horton Finney, SVS Securities), the FSCS protection on top of pooled client money has been adequate compensation for almost all clients.

What About Funds and ETFs?

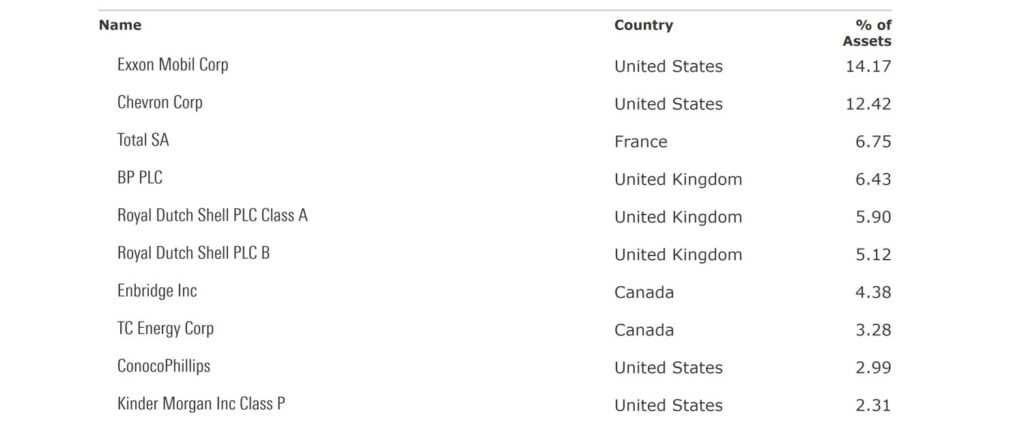

This subject has the potential to cause confusion, but we’ll summarise in simple terms. Most ETFs are not domiciled in the UK and tend to be in Ireland for tax purposes, but this throws a spanner in the works.

Many popular ETFs on the London Stock Exchange (such as the Vanguard FTSE 100 ETF VUKE) will be authorised in Ireland.

So, what does this mean? Firstly, it means that your collective investments domiciled outside of the UK are NOT protected by the UK protection scheme.

We did lots of research here to try and determine whether the Irish equivalent protection scheme covered Irish domiciled ETFs but could not find anything conclusive – with various sources contradicting each other.

From what we found it seems that Irish ETFs are NOT protected by the Irish equivalent of FSCS.

The saving grace is the ring fencing rules and if we quote some Vanguard documentation:

“In practice, for all UK and EU authorised funds, the underlying investments must be held separately from the fund manager by an independent trustee or depositary. With both Ireland and UK authorised funds, in the event that a fund provider defaults, the underlying investments will remain intact.”

In any case the Irish equivalent protection scheme is pretty lacklustre anyway, with the maximum protection a dismal 90% of your loss up to a max of just €20,000 per investor.

How Can You Reduce Risks?

The larger the investment firm the safer your money should be. The firms themselves are likely to be more profitable and therefore safer.

For many of the big platforms you will be able to check them yourself as they are publicly listed companies, such as AJ Bell and Hargreaves Lansdown. You will want check their accounts, history of its key people and news about its past activities. These checks won’t be as easy for private firms.

The bigger the platform the more the FCA will monitor its activities and hopefully therefore reduce the chance of mismanagement.

As your investment pots grow into the hundreds of thousands, you might want to start purposely splitting your money across multiple platforms for added peace of mind.

This currently is a nuisance, in part because you benefit from reduced fees on larger investment pots, but we see a time in the not too distant future when platform fees are eliminated.

Should You Be Worried If You Have Less Than £85k?

The short answer is yes you should be partially concerned. You won’t lose any money as you would be compensated, but to reclaim the money from the FSCS could take many months. At time of writing they are saying it will take 7 months to reimburse claims relating to investments.

There is an opportunity cost of having your money tied up for that length of time. You may need the money to live, there might be a crash in the markets that you need to take advantage of, or you may miss out on huge growth in the markets.

At least you will be compensated for the amount lost due to broker failure. Don’t forget that this compensation is not to protect you from poor investment performance.

But on the whole, don’t worry about too much – it’s almost always better to hold investments than to not – and cash is riskier to hold in our opinion because you don’t get the ring-fencing protection that an investment gets.

The protections are there should the worst happen. Until then, keep investing with confidence.

How do you reduce investment risk associated with broker failure? Let us know in the comments section.