Oil prices have collapsed in 2020 following the outbreak of the corona pandemic, down a mega 63% since the start of the year at time of filming in April.

The West Texas Intermediate oil price has just fallen through the floor. At time of filming it was around $23 a barrel – incredibly cheap when we consider it was at $135 in 2008, its historical high. We filmed this video mid-April, and by release date it had fallen even further… into historic negative territory! Buy Buy Buy!

Below we cover why Oil prices are so low, the easy ways you can invest in Oil, and how we just invested in Oil the MoneyUnshackled way – layering in cashflow and diversification into this classic growth asset.

Editor’s note: Invest in Oil while getting a freebie – investment app Freetrade are giving a randomly chosen free share to each new customer who opens an account using the link on the Offers page – it could be worth up to £200, and all you have to do is open an account and top up by £1 – what are you waiting for?!

YouTube Video > > >

Why Oil Prices Are So Low

2 things happened in early 2020 to push Oil prices to record lows – The Oil Wars, and about 2 weeks later, the coronavirus and resulting lockdowns.

The drop in demand from recession and lockdown would normally be enough to reduce oil prices, but the price was artificially lowered further by the activities of a major global player in the industry, Saudi Arabia.

The Saudis decided that they didn’t like the way Russia were looking at them at an Oil conference in March 2020, and announced that they would flood the market with cheap oil – a form of mutually assured destruction for both economies.

At time of filming, Trump had just backed an international deal to get prices back up, but the next day they’d actually gone down further!

Oil as an Asset

Oil fits into the core of our investment portfolios. The core is reserved for cash flow generating assets like rental property, Global dividend-paying ETFs, and high interest Peer-to-Peer Lending, and Oil stocks are the biggest and most dependable dividend payers out there.

Oil itself is a commodity, and we also hold these in our core portfolios as they help us to Own Inflation and so Own The World.

We’ve previously mentioned that commodities like Oil and Gold might make up 5-10% of your total portfolio.

Oil, as a commodity, is a growth asset – meaning it doesn’t generate cash flows, so you invest in it because you believe the price will grow.

Whereas shares that go up and down in price still pay dividends – it’s nice to get regular cash injections from your dependable shares holdings regardless of the ups and downs of the market, but your commodities do not pay you a cash tribute.

So, by investing in oil commodities we are banking on the assumption that oil prices will go up in the future. Now let us tell you 3 easy ways to buy Oil, and which is best.

The Different Ways You Can Buy Oil

#1 – Invest in Oil Directly with an ETC

The purest way to invest in Oil – outside of actually buying a barrel and storing it in your garage – is through an ETC (Exchange Traded Commodity).

We decided this one was as good as any other: the WisdomTree WTI Crude Oil ETC (CRUD) which has an OCF of 0.54%, at the top of the fee range that we consider to be acceptable.

This Crude Oil ETC works like an ETF in that it tracks an index – the WTI Crude Oil price index in this case, and we can see that it has fallen around 63% from $9.0 to $3.6 since January 2020:

To buy this ETC, you need to have an account on a premium investment platform, such as Interactive Investor.

The free trading platforms Freetrade and Trading 212 Invest have too small of an investment universe to offer this.

Interactive investor is the platform that Andy holds the vast majority of his portfolio in, because it is relatively cheap if you hold a large portfolio, and in our opinion is the best of the premium platforms.

There is no way to invest in Oil directly through the free platforms. But there are extremely close – and in some ways better – proxies to investing in Oil directly, which they do offer.

#2 – Buy Oil Stocks

With any good investment platform including the Freetrade app, you can invest in BP, Royal Dutch Shell, ExxonMobil, and a whole bunch of other Oil companies.

Oil companies’ share prices tend to move in the same direction as world Oil prices, though movements are not necessarily on exactly the same scale.

While crude oil prices fell 63% YTD, an index of the top oil companies (World Energy Index) fell 42% – still a huge drop. By comparison, the FTSE 100 fell only 23% over the same time period.

The reason an index of oil companies hold their value better than the oil price is because many of them are absolute goliaths in the stock market: cash-rich mega-companies.

They are accustomed to the crazy twists and turns in the oil price, and are well protected with their gargantuan cash reserves.

They are so stuffed full of cash that they find it easy to adapt to tough market conditions by cutting their investment expenditure, and have incredible dividend paying records.

That’s the beauty of investing in Oil via company proxies – companies pay dividends and can smooth out returns.

Shell has managed to deliver an uninterrupted and uncut stream of dividend pay-outs since World War II – ExxonMobil haven’t missed a dividend in 138 years.

Staying Power

We expect they really are too big to fail. The Oil companies of today will be the hydrogen and fusion companies of tomorrow.

Those sandal-wearing hippies who harp on about the evils of the Oil giants fail to understand that it is these very Oil giants who are investing the most cash into new clean energy alternatives.

The Oil companies won’t allow themselves to end up like the fossils that they burn.

It won’t be Greta Thunberg who turns the world green – it will be BP, ExxonMobil, Total and Shell.

#3 – Using an ETF

This is the best way in our opinion. ETFs are diversified, low-fee, and mostly track indexes that can be easily monitored.

To invest in Oil companies, we’d invest in an ETF that tracked an index of global Oil companies.

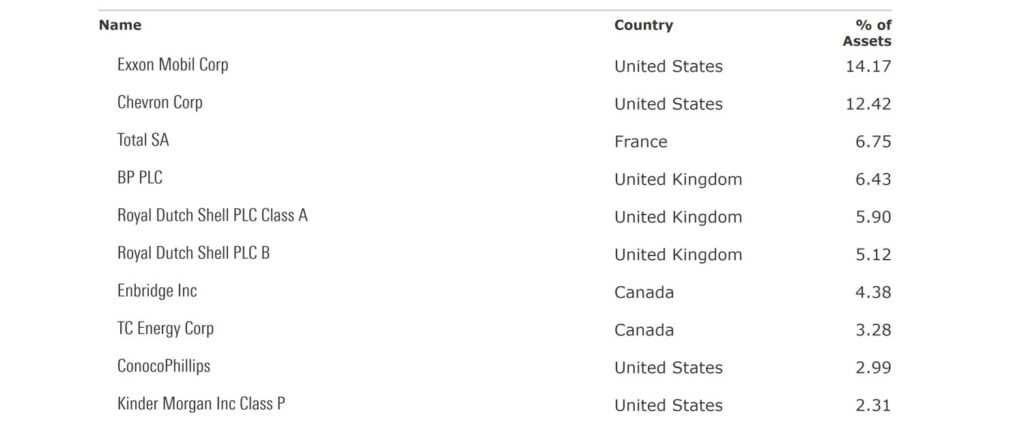

The index that we want to track is the MSCI World Energy Index. The ETF I invested in is called the SPDR® MSCI World Energy UCITS ETF (WNRG), which has an ongoing charges fee of just 0.3%.

This ETF is listed on multiple stock exchanges, but we’ll pick one that’s traded on the LSE.

Here’s the listing of holdings within this baby:

It’s near perfect for what we’re trying to achieve, stuffed full of Oil super-giants from across the world.

In one neat little package this ETF tracks Oil as closely as it is likely possible to get by using stocks rather than tracking the oil price.

It is an accumulating fund, which means that all the dividends are collected from those legendary dividend-paying companies and reinvested into your fund’s value as they arise.

The index dividend yield at March 2020 is an incredible 8.28%! No matter the ups and downs of oil prices, you’re still getting an amazing boost to your investment off the bat, even if some companies in the index do cut their dividends during the current recession – we expect many will not.

An Oil ETC is unlikely to compete with this ETF’s growth power that comes from layer upon layer of accumulating dividend pay-outs, boosting the underlying value from the Oil assets.

To buy this ETF, you again need to use a premium platform like Interactive Investor.

Portfolio Tip

Remember not to put all of your eggs in the Oil basket – If you’re buying ETCs, we say that commodities shouldn’t take up more than 10% of your portfolio.

If we include Oil stocks and ETFs, we wouldn’t put any more than 15% of our portfolio in Oil and prefer to diversify across sectors.

Will you be taking advantage of Oil’s historic lows? What platform are you buying on? Talk to us in the comments section!

Written by Ben

4 Comments

Hi Ben, thanks for your very useful information.

If we decide to invest on Oil for long-term, (invest in oil commodity directly via ETC) apart from OCF fees, is there any other fees involved?

if we keep this ETC for more than a year for example, any other fees to expect?

thanks

There would be platform fees for the platform you bought it on – the ETC and the ETF mentioned in the video are only available on premium investing platforms like Interactive Investor. And there would be an initial trading fee, and again in the future when you sold your position. Thanks, Ben

WisdomTree WTI Crude Oil ETC is also on T212. Currency is in Euro’s on the Deutsche Borse Xetra and its named OD7F, unless I’m looking at something completely different.

Also, we should go for a pint next time I’m in Brum and the pubs are up and running. I’ll spare the few quid rather than investing it as means to say thanks for the informative vids and also to meet Andy, seems like a decent bloke. Ben’s piercing eyes however, are scary.

The version on T212 is listed on the German stock exchange – we just invest through the London Stock Exchange where possible to keep things simple for tax, and because we’re from the UK. Thanks for the drink offer!

Comments are closed for this article!