“Be the bank” – not the borrower. We just flipping love owning everything; shares, commodities, property – debt. Banks own other people’s debt, and get massively rich in the process.

Peer-to-Peer Lending (P2P) is our favourite route into the world of owning other people’s debt.

We love P2P for its high interest returns, regular cash flow, safety relative to shares, that most give sign-up bonuses on platforms that we would have signed up to anyway!

Every P2P platform we’ve invested in and reviewed up until now has lent to a mix of businesses or individuals – but there’s a way to invest purely in another type of debt through P2P – commercial property bridging loans, the high-interest business property loans for property developers that are essentially short-term mortgages.

We approached a specialist platform called Loanpad to find out how they do it.

Editor’s note: If you like the sound of Loanpad, we’ve negotiated a £50 cash back deal for you when you open a new Loanpad account and invest £1,000 – on top of the 5% interest rate! The link to this offer and many others is on the Offers page.

YouTube Video > > >

Loadpad, rated Excellent on Trustpilot, is the first platform that we felt warranted a review that specialises in property loans – short-term mortgages on huge commercial properties, which as a member of the platform you own a slice of and get paid the interest.

We’re excited to tell you that we interviewed the CEO and founder of Loanpad personally to get the inside scoop on how exactly this platform and their sector works, where it’s going, and the future roadmap for Loanpad.

Our testing revealed that Loanpad do several things differently to its competitors – welcome solutions to the problems of diversification and risk that are more sophisticated than on platforms such as easyMoney and others.

This type of investing represents a new asset class, a sub-sector of the Peer-to-Peer Lending market that you’ve gotta be involved in if you, like us, want to own everything. So, are Loanpad worthy of being in your portfolio?

What is a Bridging Loan?

At a basic level, if you were buying a house to renovate, often the banks wouldn’t give you a mortgage because the property would be temporarily in too poor of a condition to be lived in. So instead you might take out a bridging loan, which are generally short-term loans of 6 to 18 months, secured against the property.

It is a high-interest and costly way of “bridging” the gap in time between buying a property project, and getting that property mortgaged cheaply by a bank, once it has been renovated.

This kind of loan is very common on commercial, i.e. business properties. Think of a run-down central London office block that is being modernised. The property developer needs to free up cash to get the work done, but borrowing on a mortgage isn’t appropriate because the building isn’t habitable during the works.

Instead, they’d use a bridging loan. The high interest rate charged on these loans is great for the bank doing the lending, and an incentive for the property developer to get the job done quickly and the loan repaid and swapped out for a far cheaper mortgage.

Nobody has it better than the banks when it comes to investment opportunities, and the more like a bank we can be as investors, the better for us!

And now, we can take part in lending bridging loans to property developers on platforms like the one we’ve tested today: Loanpad.

How It Works – Loanpad

Regulated by the FCA, Loanpad teams up with large established lending businesses to bring investors in the platform commercial property loans to invest in. The platform is home to 1,200 investors – including me now – has £7.5m of loans under management, and a growing portfolio of big commercial property lending partners.

You as the investor are acting like a mortgage provider, lending money to businesses to develop commercial property with.

We love the idea of “being the bank” – the banks get rich by lending money to businesses, and now you have the ability to lend on commercial property too.

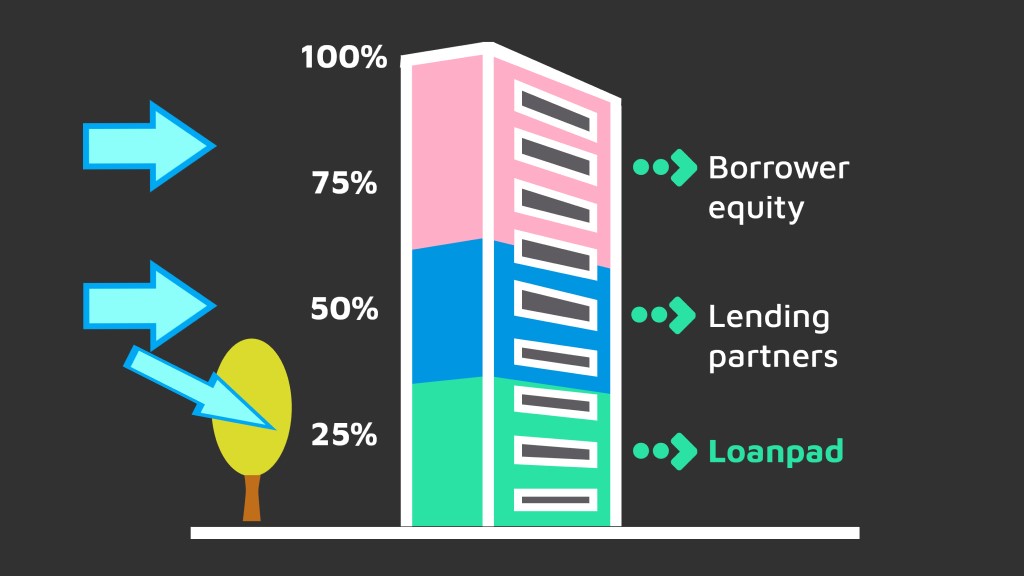

What you’re really doing is buying a part of a loan that has been set up already by a large lending business. The business buying the property puts in a deposit, and the lending company provides the loan. The lending company then sells part of that loan to Loanpad, who divides the rights to the interest and capital repayments on those loans to the Loanpad platform investors.

The 3rd party lending companies with the market experience are the ones who manage the loans, while Loanpad monitor and supervise as the senior charge holder.

Crucially, Loanpad investors are not the only lenders in each loan. The current ratio of loans across the platform are funded around 25% by Loanpad investors and 75% by the large lending companies.

This means there are other major players with skin in the game who could administer the loans if Loanpad ever went bust.

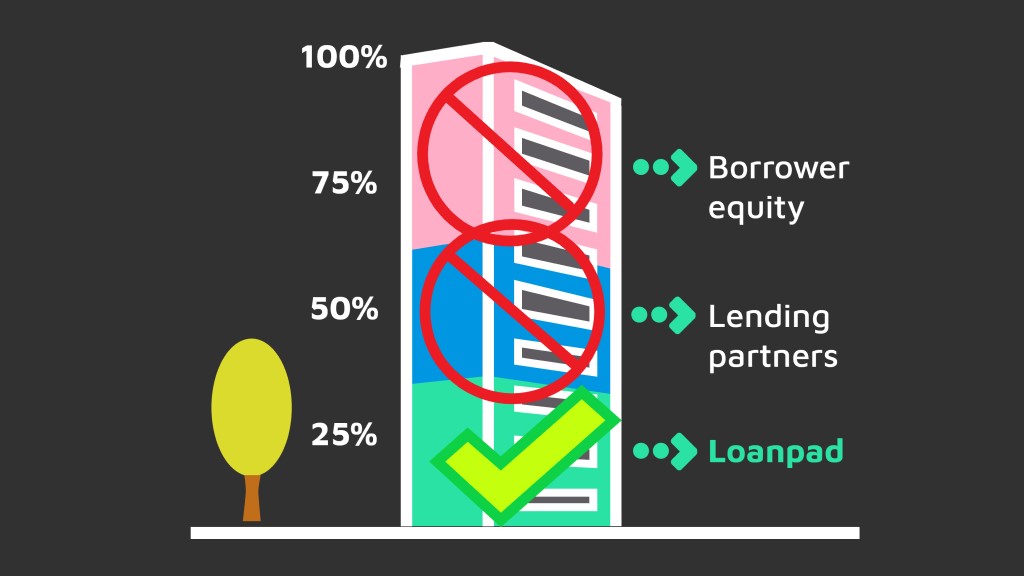

Plus, as investors, we can diversify our money across 4 times as many loans. And here’s the kicker – Loanpad have 1st charge lender rights on all loans in their portfolio, meaning if a borrower goes bust our investment gets the best protection. Let’s demonstrate this.

If the borrower can no longer repay the loan, the underlying property would be repossessed and money returned to the lenders, including us. But what if the value of the property had fallen, such as what might happen during a bad recession? Well first, the borrower would lose their deposit. If the property had fallen in value by more than this, then the 2nd charge lending partners would take the hit, leaving the lenders with the 1st charge to collect their money – on most loans in the portfolio this would be the Loanpad investors.

The Platform – Our Tests

Dropping a G

I dropped £1,000 into the platform, to give it a proper go and find out for myself how it works. The deposit was almost instant, certainly within the first couple of hours of me making the bank transfer.

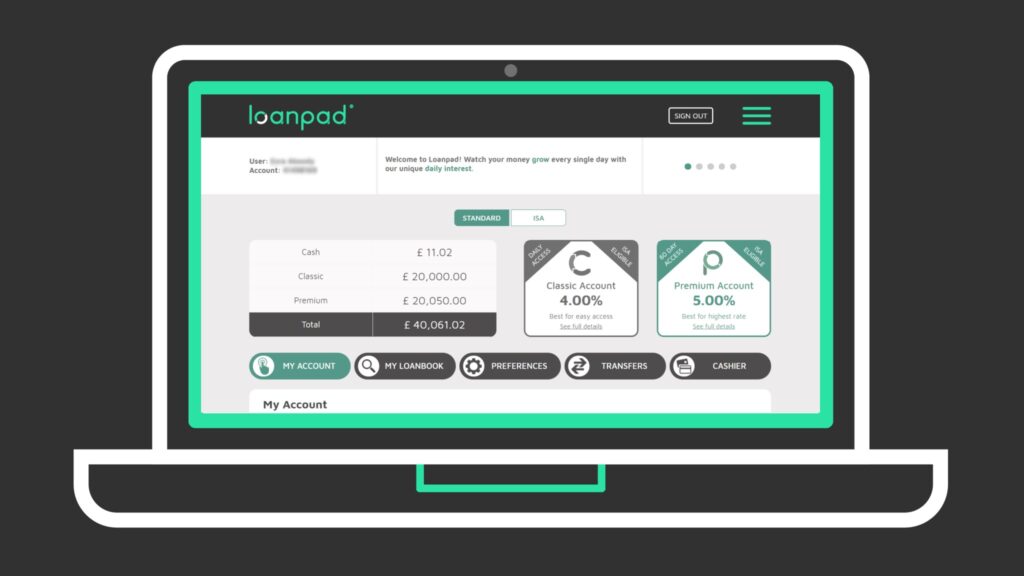

I was receiving daily interest payments, at 4% in the Classic account. When you fire up the platform as a new user, you choose between the Classic Account (daily access with a 4% interest rate) and the premium Account (a 60 day access account with 5% interest).

Both of these accounts are available as a standard account, or as an ISA – in this case an Innovative Finance ISA, which you are allowed to pay into alongside your Stocks & Shares, Lifetime or Cash ISAs.

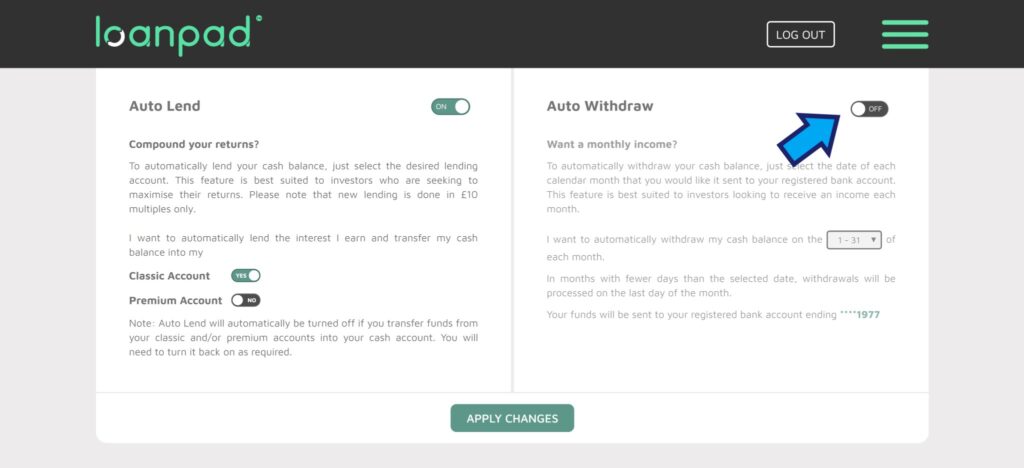

The platform has auto-lend and auto-withdraw features which you toggle on or off in the Preferences tab, which are useful for those of you, like us, who just want to invest and forget.

There’s also a free monthly newsletter and blog for members, which you may as well take advantage of – any free investing knowledge is worth digesting.

Withdrawals

We’re pleased to be able to report that Loanpad have a secondary market – the best platforms have to have this function, which lets you sell your investments to other investors, allowing you to exit the platform if you want to before the loan maturity dates.

That said, if there wasn’t anyone available to buy your loan parts, these loans are all short term anyway – between 3 and 18 months generally – so organic liquidity is decent.

The platform also has a cash fund to pay you out if you withdraw your investment too – they build up their cash until they can take on another loan, and expand naturally, but the cash that’s in the platform lying around can be used for investor liquidity too.

So access to cash is fairly competitive compared to other P2P platforms.

If you use the Premium account, remember that there is a 60 day wait to access your money, which is the price you pay to get that higher 5% return.

Withdrawing My Precious Cash

Now what you all want to know – how quickly could I get my hands back on my cash? I tested the platform’s liquidity by withdrawing my full capital in one go.

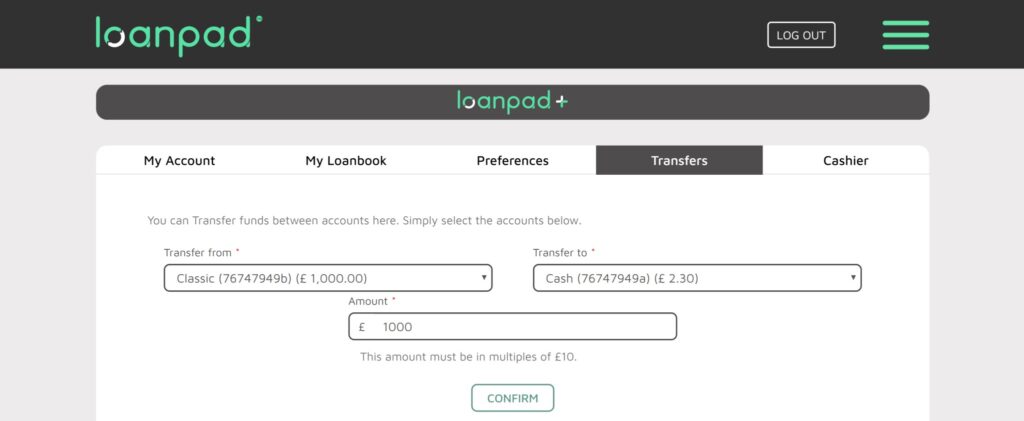

To withdraw money from Loanpad is a 2 stage process. Step 1; I transferred my capital of £1,000 from my Classic account to the Cash account. You can see my interest is all sat in the Cash account as this is too small currently to be auto-lent:

Withdrawals are not immediate; but I initiated the transfer at 8am, and when I checked back in the afternoon the funds had moved into the Cash account. Remember, I had the Classic account with easy access; the Premium says it will take 60 days to release funds.

Step 2; withdraw from the Cash account to my bank account. This happens instantly on the platform, but the banking system takes 1-3 business days for the cash to move, which we don’t think is the fault of the platform. I released the cash on a Wednesday evening – by Thursday lunchtime I had received the full amount plus interest back safe and sound into my bank.

Interest

The interest rates are 4% and 5%, which is largely comparable with big P2P platforms like RateSetter, and lower than what you might expect with a platform like Assetz Capital or Lending Works which might aim for slightly higher risk businesses – higher risk in theory than Loanpad because Loanpad loans are asset backed.

Loanpad is backed by property and invests in a different area of the market to those platforms, and is more directly comparable to easyMoney’s P2P platform which offers interest of just 3.67% at the lower end.

As we’ve seen from our testing, interest is paid daily which is great for cashflow and visibility – but a problem for those who are investing small amounts is that interest cannot be reinvested into the platform until you have built up multiples of £10 in your cash account.

Your interest will simply build up, not benefitting from the effect of compounding until you’ve hit the magic £10 number.

What you could do is switch the auto-withdraw button to “on”, thereby withdrawing your interest to your bank account each month to reinvest as you please.

Loanpad have told us directly that they recognise this issue and have plans to enable sub-£10 investments within 6 months – this would hopefully resolve this issue by allowing investments from a penny upwards. Awesome!

Diversification and Rebalancing

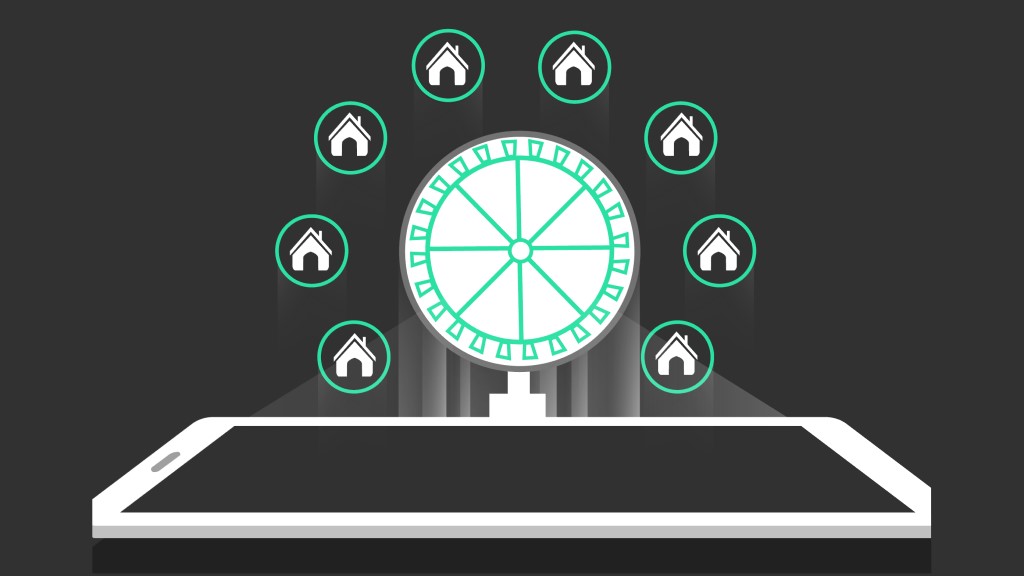

We like the diversification method on this platform. You see, unlike other platforms where you own parts of specific loans on the platform, on Loanpad’s platform you own a small fraction of all the loans on the platform.

These are the loans I was invested in – these are all of the loans on the platform, all backed by 1st charge rights to the underlying physical property.

If one fails, all investors suffer equally, and likewise if one fails, you suffer less for everyone owning a bit rather than just you and a few of the other investors.

Every day, at mid-day, your portfolio rebalances. This takes account of new users on the platform and new loans added/closed out, and rejigs your allocation to each loan to smooth out your exposures.

Diversification and rebalancing happens automatically, and takes the decision out of loan picking.

This works for us, as we can’t be bothered over-thinking individual components of a well-diversified portfolio, but those of you who like to pick your specific investments will likely be disappointed here.

Protection

We’ve mentioned the innovative diversification method, the 1st charge rights to asset repossession, and the cash buffer to aid withdrawals, but there’s actually another couple of protections built in.

There is an Interest Cover fund, which is used to continue to pay you interest in the event that any of the loans failed to deliver. From time to time a borrower may be struggling and need an extension granted to their interest payment deadline, but you the investor would not in theory be affected.

And they have an Innovative Finance ISA option on the platform which protects your money from the greedy tax man. Hands off my cash, tax man!

Vs the Competition

The platform most like Loanpad is easyMoney, another commercial property lending platform I already hold a decent amount of my wealth in, and I can honestly say that Loanpad is the superior platform.

easyMoney delivers and does what it says it will, but diversification doesn’t happen instantly on easyMoney; rather it takes a couple of weeks to spread. Loanpad does diversification instantly.

Compared to Peer to Peer Lending platforms in general, the simple user interface reminds us of platform RateSetter; on Loanpad too, you simply choose an interest rate and then you get paid exactly that rate, no messing.

All told, this is a great, user-friendly platform that we’re happy to chuck some hard-earned money into and forget, with the full expectation that it would still be there with interest in a few years’ time.

Bridging Loans – Added!

Well that’s another piece of the world we now own – commercial bridging loans. Another piece in the puzzle and a step further towards our ambition of owning the entire world!

And don’t forget – we’ve negotiated a £50 cash back deal with Loanpad for any new customer who signs up through our link with £1,000, so take advantage of that now while you can.

Have you found another way to invest in commercial bridging loans? Is this an asset class you want to add to your portfolio? Let us know in the comments below.

Written by Ben