Here it is, investors – the breakdown of Ben’s personal stocks and shares portfolio by Geography and by Sector, in what we’re sharing with you now as the current Money Unshackled World Portfolio. The £ amounts are different, but the % weightings are the same.

Viewers of our World Portfolio series will know the importance of diversifying your wealth across the entire globe, giving yourself the best chance to benefit from exposure to growth markets and ride a wave of global prosperity.

The World Portfolio that we constructed in episode 2 of this World Portfolio series from just 7 core ETF index tracking funds invests in all the key global geographies, and across all major sectors including financials, health, technology and energy.

It also has holdings in REITs, so you benefit from an exposure to commercial property markets; and in the expanded version, commodities, the stuff that underpins inflation.

Today, we’re peeling back the cover on the Money Unshackled World Portfolio on Freetrade, and showing you EXACTLY what you are investing in when you buy these 7 core ETFs, as a percentage of your portfolio. Then we’ll tweak the portfolio by adding a further 5 satellite ETFs to make this baby pop.

We’re so pumped for this one! Let’s check it out…

Editors note: The video version of this article is the third in a series on the Money Unshackled World Portfolio, which we’ve built on the zero-trading fee platform Freetrade. If you want to emulate the World Portfolio then sign up to Freetrade with our link on the Offers Page. By using this link you’ll get a free stock worth up to £200!

YouTube Video > > >

World Portfolio Overview

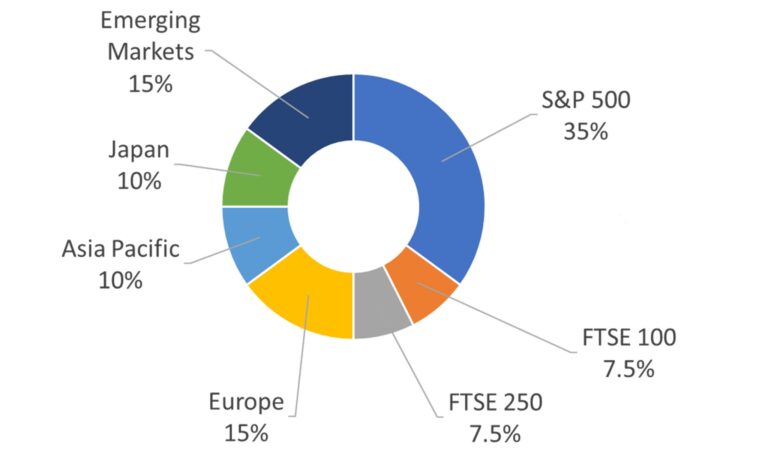

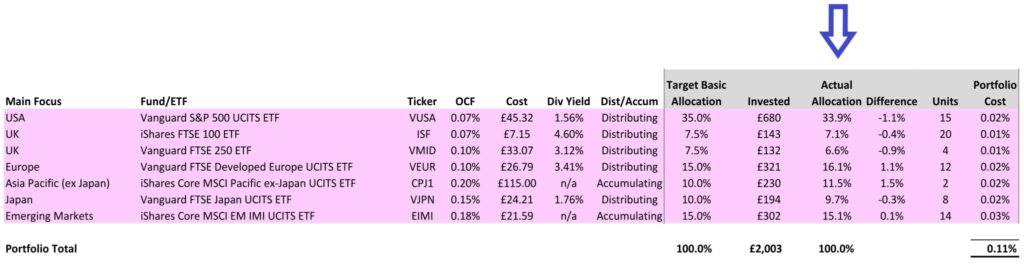

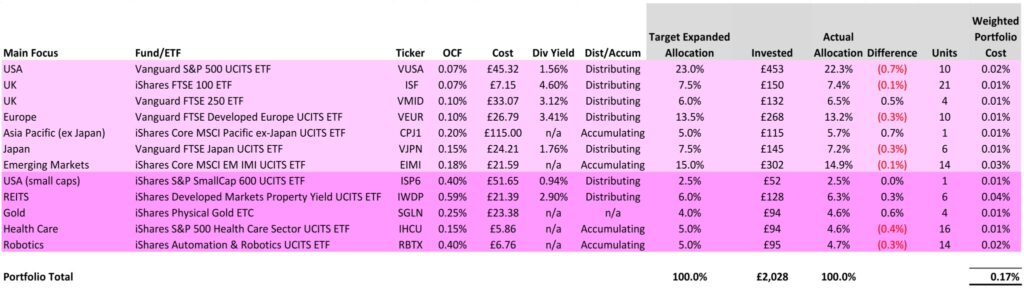

To recap on episode 2, we had selected 7 ETFs on the Freetrade platform that nicely covered the World in as few ETFs as possible, keeping the balance between simplicity and portfolio weighting:

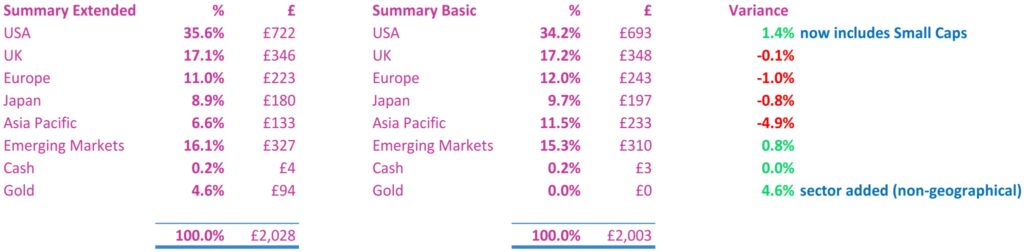

Let’s see how that translates into an actual portfolio. Throughout this article, we’ve used a portfolio size of £2,000 as an illustration, but of course this portfolio would perform similarly if your pot was smaller or bigger than this.

You’ll notice that because we’re buying actual units, and not just talking theory, that the total is a little different to £2,000 – as close as we could get while keeping the weighting we wanted.

The real world necessity of buying units makes our actual allocation slightly different to target allocation – but do we really know if 35% or 33.9% was the right weighting to pick until decades from now anyway?

And check out that weighted average Ongoing Charges Figure for the whole portfolio! At just 0.11%, this simple world portfolio is a fraction the cost of even the legendary Vanguard Lifestrategy funds, which would clock in at 0.37% if you include the Vanguard platform fee. Of course, Freetrade has no platform fee, and no trading fees.

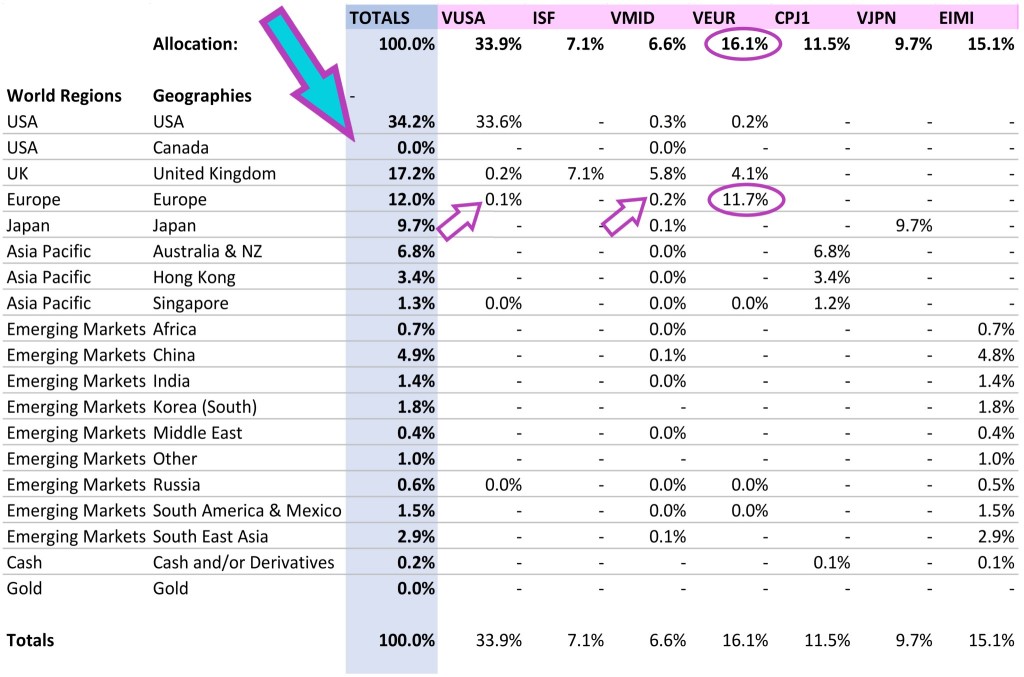

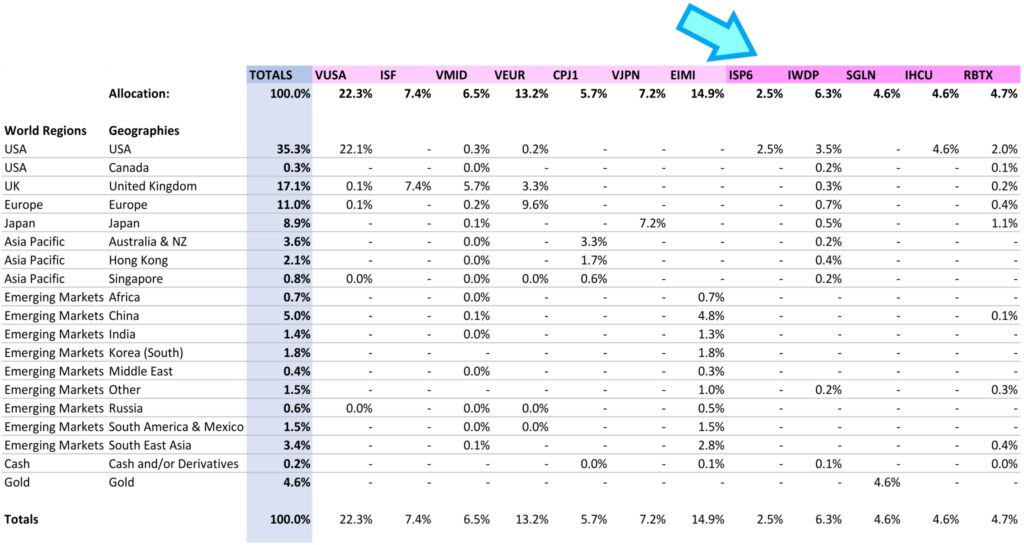

We looked under the bonnet of each of these funds to see what actually was inside them. For example, 4% of our UK FTSE 250 fund (VMID) is geographical exposure to the US, not the UK, and 25% of the Europe fund (VEUR) is geographical exposure to the UK.

Geographies – Basic Portfolio

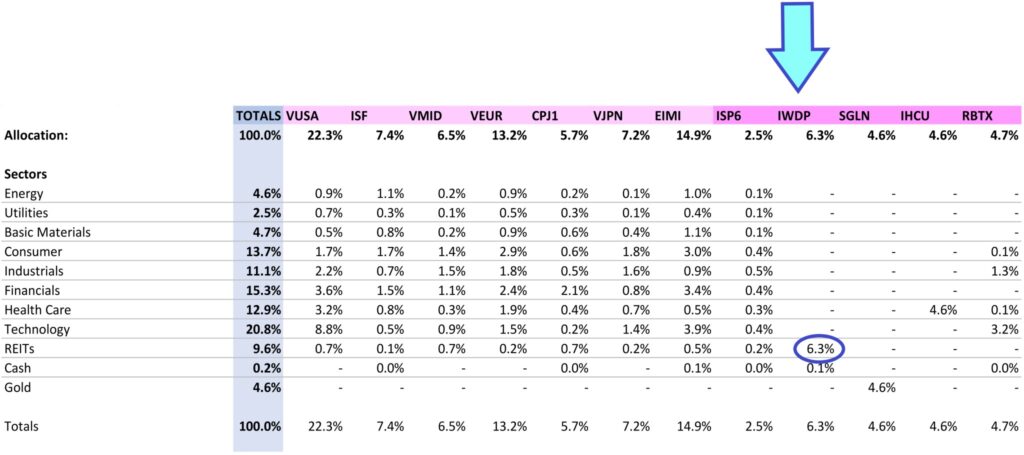

This is the portfolio of 7 ETFs broken out by Geographical region. You see we have applied the actual weightings from earlier, and the figures in the table are as a percentage of the portfolio. Down the left here is true split by country and region within our portfolio.

Look at Europe for example, just below the arrow 12%. This means that 12% of our whole portfolio is in European countries, despite what ETFs we bought. 11.7% of this is coming from the dedicated European ETF, even though VEUR is 16.1% of the portfolio, and there’s some European exposure in the VMID and VUSA funds too.

When we were setting out the ETF weightings, we purposely chose to buy 15% of the Europe ETF and an equal 15% across the UK ETFs –because we wanted more of our money in the UK than in Europe – knowing that there was some UK hiding in the Europe fund.

So here’s what we’re really investing in by Geography. Pretty good spread. Now let’s look at Sectors.

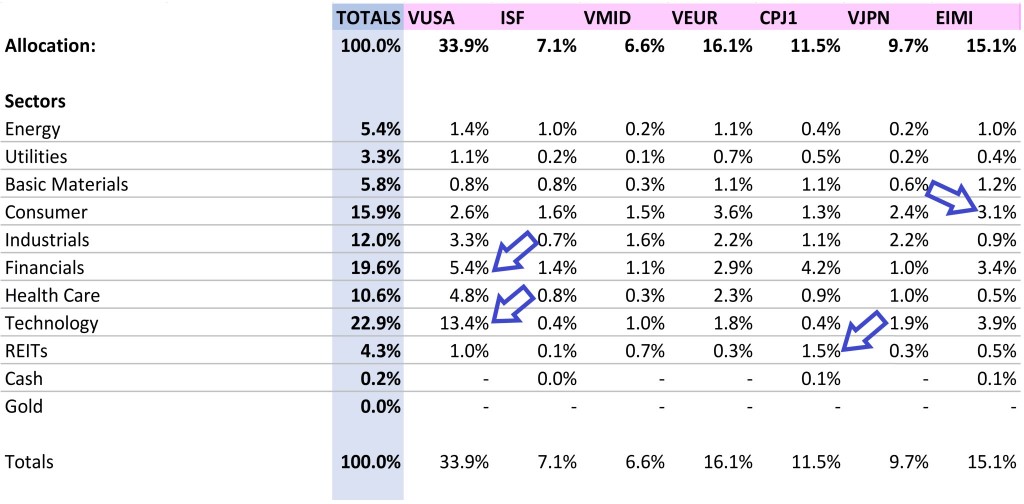

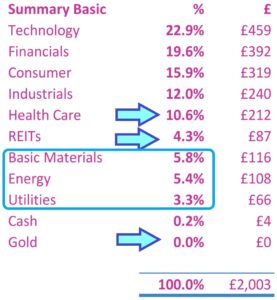

Sectors – Basic Portfolio

Now this is what we were really interested in – you can get an idea of what geographies you are invested in by the fund names, but not the sectors.

We wanted to find out the true weighting by sector in our portfolio, so we could tweak it to reflect our predictions for the future.

Above is the split by sector on the Money Unshackled Basic World Portfolio of 7 ETFs. Now we can see the detail we see things like how the USA ETF has the bulk of portfolio’s Tech sector exposure, and also with Financials, while the bulk of our REITs are in the Asia Pacific ETF, and most of our Consumer products exposure comes from Emerging Markets. Awesome!

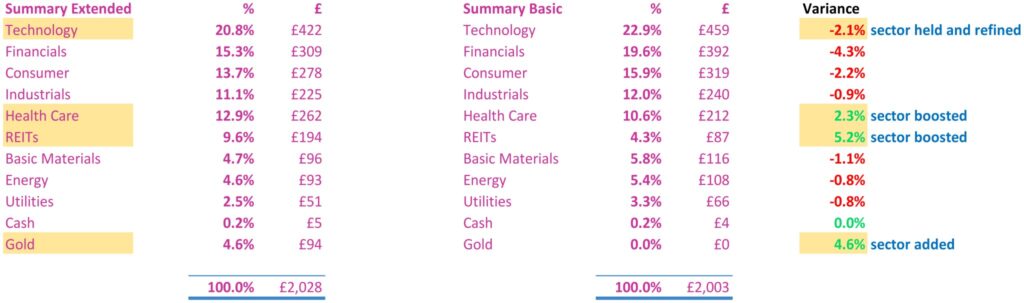

Above is our Basic Portfolio summarised by Sector. It looks good but we’d like to be able to tweak it. So let’s do that!

We think healthcare will be a crucial sector as the World’s population ages and gets richer, so we want to boost the weighting there. REITs might be considered low at 4.3% – we want to boost that to around 10%. And there are no commodities in the portfolio other than proxies.

We want some gold in our portfolio – not too much as gold pays no dividends, but gold is money in its purest form and is a good recession hedge. We’d also like some exposure to Oil, Gas and other energy commodities, but we get this in proxy via the Energy, Utilities and Basic Materials sectors, which already make up nearly 15% of our portfolio.

The Expanded Portfolio

The beauty of using a free trading platform like Freetrade is that you’re not constrained to having to stick to the simplicity of just a handful of ETFs like you would on a traditional platform – the fees aren’t there to stop you.

Normally platforms charge trading fees per ETF, fund, or share; so you would want your portfolio to be simple and compact.

Freetrade removes such obstacles and means we can add on some so-called satellite ETFs which orbit around our core World portfolio without incurring any trading fees!

Right. Let’s do some tweaking!

We wanted to boost REITS, boost Health, and add Gold, so we’ve added 3 ETFs to the portfolio. We are also interested in Small Caps – which are small listed companies – as they have the best growth potential, and we want to make sure we’re invested in the Technology of the future so we’ve added a Robotics ETF.

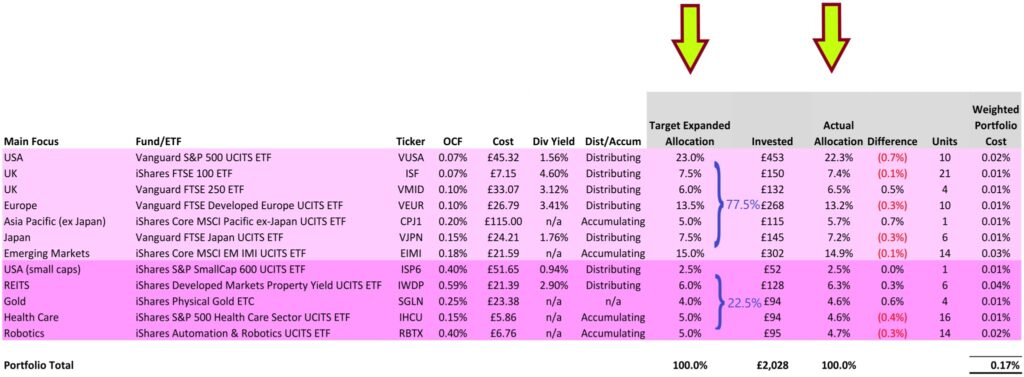

To fit new funds into the portfolio we need to tweak the target allocations

The core portfolio has been squeezed to 77.5% of the total, leaving 22.5% of room for the satellite funds in dark pink. This in turn changes our Actual Allocation when we go to buy the Actual funds.

This weighting can be changed and isn’t set in stone, but a small tweak to change the sectors can have unintended consequences on the geographies, and vice versa. We’ve carefully balanced the allocation to get the best out of both as we’ll come to shortly.

And look at that weighted portfolio cost! It’s bigger than before but still miniscule at only 0.17% – it’s barely there at all!

Geographies – Expanded Portfolio

Let’s look at how our fiddling has affected the geographical split.

ISP6 is the Small Caps ETF, and it is all in the USA. Next, IWDP is our REITs fund and is also predominantly US located, as is IHCU (the health fund) and RBTX (the Robotics fund). For this reason, we slashed our core USA ETF down by 12% in our Target Allocation to make room for these satellite additions to the US region. The SGLN fund tracks the price of Gold, and is not in any specific geography.

Now look how this compares to our Basic portfolio of just 7 core ETFs.

USA is pretty much the same, but now includes Small Caps and doesn’t only include the large S&P500 companies as before.

The other regions are pretty much the same too, Asia Pacific down by half but this region of the world which includes developed countries Australia and New Zealand is perhaps less interesting than the Emerging Markets, which have gone up a bit. And we now have Gold commodities in our portfolio!

As gold’s value is fairly speculative and it doesn’t pay dividends, we don’t want more than 5% in our portfolio, but it’s worth holding a little bit.

Bitcoin and Crypto Blockchain ETFs are not yet available on the free platforms, but Gold acts similarly and is in many ways a safer proxy. The famous Bitcoin boom that got everyone so excited happened in 2017 – in the past – and yet people still want to jump on the bandwagon.

If you wanted to invest in Bitcoin or other cryptocurrencies, you could buy some outside of your main ETF portfolio.

Sectors – Expanded Portfolio

Of the new funds, we see that the Small Caps (ISP6) are spread across all sectors. We see that IWDP is indeed a REITs fund, and contributes 6.3% of REIT awesomeness to our total portfolio.

The Healthcare fund (IHCU) does what it says on the tin, and Robotics (RBTX) contributes 3.2% to the Technology sector.

To summarise:

Our tweaking has meant the technology sector has come down a bit but largely held at over 20% of our portfolio. It fell because we had to reduce the core USA ETF (VUSA) to accommodate the satellite funds, as the USA would be too much of our portfolio otherwise. And most of the world’s tech is in US companies.

We replaced some of this lost technology with Future Tech in the form of Robotics companies, which we find more exciting for growth.

We boosted the Health Care sector by nearly 2.3% of our portfolio to account for the aging population, and we bumped REITs up to nearly 10% of the portfolio.

REITs are awesome as they have performed better than average stocks recently and pump out cash dividends – we felt the Basic portfolio was lacking at just 4.3%. Better to have closer to 10% we think. And of course, we’ve added Gold commodities.

What – No Bonds?

Most ready-made portfolios like 4 of the 5 Vanguard Lifestrategy funds and many of those sold by financial gurus include bonds. We hate bonds.

Frankly they’re boring, they rarely perform as well as equities, and their function as a cash flowing asset can be substituted with Peer-to-Peer Lending, which pays great interest and has chunky sign up bonuses.

Plus bonds in a portfolio are another layer of complexity when you’re trying to carefully tweak your equities by geography and sector – far easier to say “this collection of ETFs is my equities portfolio”, and “this separate cash over here pays me interest in Peer-to-Peer accounts”.

Conclusion – A World Owning Portfolio

So there you have it – what we’ve just walked you through actually reflects my personal portfolio – the £ amounts are different, the percentage weightings are the same!

If you want to copy the portfolio and Own The World, feel free. We put hours into balancing this baby, but now all the work is right there, done for you. We’d love to know if you intend to use this portfolio, so please let us know in the comments below.

Just download the Freetrade app using the link on the Offers Page, where you’ll also be given a free share worth up to £200 when you use the link and open an account by depositing £1 or more; and start owning the world!

Written by Ben

12 Comments

Ben, this is informative. However I was wondering if you still had your lifestrategy fund, and if so, wouldn’t you be tracking the global index twice with now more weighting in the core ETF’s in total? I’d be interested to see Andy’s portfolio too, as I’m sure I watched him say he’s mainly into stocks and shares and you’re into property (brick and mortar).

Thanks for the content guys

I dabble in a lot of platforms, including Vanguard and their LifeStrategy fund, but I hold my main stocks portfolio in Freetrade. It’s a global, complete portfolio that Andy and I have designed for anyone to be able to replicate and tweak. Andy has a legendary stocks portfolio, far more complex than mine! Maybe one day we’ll cover it, but it’s not so simple to replicate with total coverage as this Money Unshackled World Portfolio on Freetrade. And yes, I still have my property portfolio, which is where I hold most of my net worth. Ben

Hey guys,

Great straight to the point content. The improvements in presenting is evident from earlier videos as well.

I assume all of the information you used about the ETFs was available on freetrade? How much insight does freetrade actually give you into your investments? I assume all of the excel looking stuff above was created by you in excel but is the source of the data freetrade or did you find it elsewhere?

Thanks

Hey guys,

Great straight to the point content. The improvements in presenting is evident from earlier videos as well.

I assume all of the information you used about the ETFs was available on freetrade? How much insight does freetrade actually give you into your investments? I assume all of the excel looking stuff above was created by you in excel but is the source of the data freetrade or did you find it elsewhere?

Thanks

Thanks John, I guess practise makes perfect!

Freetrade is a zero trading fee platform meaning they don’t make the huge incomes from fees that other platforms do, so to keep their costs low they don’t offer much information at all about the ETFs on the platform itself. They have a web based forum but that is more for user dicussions.

No, we got all the raw data from the iShares and Vanguard websites (all the ETFs in this portfolio are either iShares or Vanguard, as they tend to be the cheapest and best), and the spreadsheet analysis was compiled by muggins here 🙂

Ben

Whoops sent the same comment twice

Thank you so much for this video, I am very keen on copying it! I have an allocated amount I would want to put into these ETF’s but I am not the best on the excel spreadsheet, Would it be possible to send me this spreadsheet please so I can input the amount I want to spend and I guess there is a formula in the spreadsheet that tells you how weighted the amount is per ETF?

I am new to the channel but I am very keen to carry on following you! Keep up the good work!

Thanks in advance

Good idea – It’s on our to-do list to put a spreadsheet on the site for downloading, but the investing app will also keep a track of how much you have of each ETF. Thanks for watching! Ben

Hey Ben, did you ever publish your spreadsheet template? I tried to make one myself but it ended up being insanely complicated. Morningstar have a tool for exposure but you have to pay. Also, are you going to do a part 3 now that there are so many more interesting ETFs on Freetrade? Would love to see it 🙂

Sorry I never found the time to produce a spreadsheet worthy of mass release! Yes I’d love to write a new chapter in the world portfolio – especially as there are some very interesting synthetic ETFs hitting the market.

Thanks, Ben

Hiya

Been following all your videos. Awesome stuff. Was wondering since everything has started kicking off in the last couple of months have you done any changes to your portfolio that you covered above.

Thanks for your insight.

This mix remains similar for the stock market portion of our portfolios. I have stopped buying rental property until after this blows over. In terms of ETFs, I added an Oil ETF when the Oil price collapsed back in April.

Thanks, Ben

Comments are closed for this article!