We’ve been running Money Unshackled for close to 4 years now, and if you’ve been following us from the beginning, you may remember that we used to promote peer-to-peer lending (P2P) as a great way to make excellent investment returns of around 6 or 7%.

During those good times we would recommend – for want of a better word – that every investor should consider having some peer-to-peer loans in their portfolio. But in 2022, should investors continue to invest in P2P loans?

Peer-to-peer lending really was an incredible way to get a good return on your money for relatively low risk. Unlike the stock market where the market value of your investments fluctuates massively on a day-to-day basis, peer-to-peer lending generally provided stability and excellent interest payments, which when left to compound would enable your investment to steadily grow more or less in a straight line.

Most of the British public are risk averse and shy away from the stock market, so that steady growth from peer-to-peer was perfect for them, which was why Zopa – one of the leading peer-to-peer providers – was able to lend out over £6billion and had 90,000 investors over 16 years.

Until recently, it looked like the peer-to-peer industry was going from strength to strength, which culminated in the 2018 IPO of Funding Circle for £1.5 billion.

But in 2020 trouble began to brew. The Covid pandemic and various government actions provided serious challenges to the peer-to-peer industry. In December 2021, Zopa – which was in fact the world’s first peer-to-peer lending provider and survived the 2008 financial crisis – announced they were closing this part of their business, which we’re calling a betrayal of their customers.

In this post, we’re going to take a look at what happened at Zopa and before them RateSetter, and what has been happening generally in the peer-to-peer industry. We’re going to look at the current state of the peer-to-peer lending market, and if you’re looking for a new platform to replace Zopa or you’re completely new to peer-to-peer lending, we’ll suggest some alternative platforms to invest your cash. Now, let’s check it out…

And while you’re here, check out the MU Offers Page which including £50 cash bonuses, FREE STOCKS from Freetrade and Stake, and Stockopedia 25% discount & FREE trial.

Alternatively Watch The YouTube Video > > >

What Happened With Zopa?

On Tuesday 7th December an email hit my inbox stating that after 16 years of peer-to-peer consumer investments at Zopa, they’ve taken the ‘difficult decision’ – their words – to close this part of their business. And to make the process as easy as possible for their customers Zopa Bank will be buying the entire loan portfolio at current face value without any of the fees you’d normally pay for a loan sale.

Now, doesn’t that sound awfully nice of Zopa – they’ll buy your loans at face value? And, just in case that sarcasm isn’t clear, let me say it another way. Zopa are forcefully buying the existing loans off their customers at their so-called face value and word it as if they’re doing their investors a favour.

The first problem we have with this is that collectively these older loans will be averaging a return of around 5% or more. If the loans had a market value, it would exceed the face value because interest rates today are lower than the interest rates on many of these existing loans. The dilemma investors now face is finding a new home for their money, which pays a similar rate of interest.

The second problem we have with this is that they’re selling the entire loan book to Zopa Bank – the very bank that they were able to establish over the last few years on the back of their successful peer-to-peer customers. Call us cynical but it sure as hell looks like they’ve been planning this since they first decided to launch a bank.

Why Zopa Are Closing Peer-To-Peer

In their words, “over the last few years, customer trust in P2P investing has been damaged by a small number of businesses whose approach led to material losses for customers investing in those platforms. Linked to this, the changing regulation in the sector has made it challenging to grow and remain commercially viable. We’ve therefore decided to fully focus on Zopa Bank and we will be closing the P2P business with effect from 7 December 2021.”

We have no reason to doubt that this is mostly true but what they don’t say – and this is speculation on our part – is that they can’t be bothered with the hard work and inefficiencies involved in raising capital from retail investors via peer-to-peer lending.

Instead, they have Zopa Bank, which can more easily lend without the cost and hassle of waiting for customer deposits. What most people don’t realise is that banks have a licence to create money without needing to find it first from savers or investors.

There’s an interesting article on Investopedia that explains why banks don’t need your money to make loans, which we’ll link to down below for some bedtime reading, but the bottom line is that banks lend first and look for reserves later. Or in other words, since Zopa launched a bank, the writing has been on the wall for its peer-to-peer business.

News just in – whilst we were filming, on the 14th of December, we got an email from Lending Works saying they too are closing their retail investor arm of the business. Another one bites the dust!

The Peer-To-Peer Lending Industry Is In Disarray

Some of the less well-known and in some cases nefarious peer-to-peer platforms have previously collapsed and entered into administration, which was referred to by Zopa as a reason why they chose to exit the peer-to-peer business.

However, we doubt that these platform collapses alone have been the main factor in the damage caused to the industry. The loss of industry giant RateSetter and the halting of lending by most major platforms, including the industry leader Funding Circle, has arguably caused more problems, leading to lost faith of investors.

RateSetter, which was the third biggest platform at the time, had a similar fate to Zopa. At the tail end of 2020, Metro Bank acquired RateSetter and at the beginning of 2021 they purchased the RateSetter loan portfolio, and the industry lost one of its best platforms.

When Covid struck in March 2020, major players like Funding Circle stopped lending investors’ money, instead choosing to only lend government funds via schemes designed to prop up failing businesses. In this way, they took the easy route, and realised they didn’t need investors anymore.

A Funding Circle representative told Peer2Peer Finance News that there had been no change to its plans in light of the Zopa news, adding: “We’re still planning to review retail lending once the government-backed Recovery Loan Scheme ends in June.”

We’re expecting Funding Circle to follow suit and also close the peer-to-peer side of their business.

Another major reason for the deterioration of customer faith was the sudden freezing of secondary markets, which meant investors could not sell their loans. For sensible investors this wasn’t a problem because they were prepared to lock up their money for the duration of the loans – often up to 5 years.

But many other investors took the secondary markets for granted and foolishly thought it was guaranteed. Perhaps most peer-to-peer platforms overstated how liquid the loans would be, but in fairness not many would have predicted the scale of the panic that Covid caused.

Has P2P Lending Lost Its Shine?

In addition to the difficulties we’ve already mentioned for the industry, we also think that the interest rates being offered by the peer-to-peer platforms are getting dangerously close to being too low and not worth the hassle or risk for investors.

We recall seeing rates being offered between 6-7% prior to the pandemic but now the norm is around 4%. Don’t get us wrong, we fully expected rates to drop when the Bank of England lowered the base rate, but this was only lowered from 0.75% to 0.10%, so we’re not sure why the peer-to-peer rates dropped so harshly.

Investors are getting a worse return after the pandemic but there is potentially also an increased risk of losses. We believe that investors want bigger returns and so have gone elsewhere, but at the same time the interest rates being offered aren’t high enough to tempt traditional savers away from the comfort zone of a bank account or Premium bonds. The peer-to-peer platforms have found themselves in no man’s land – pleasing nobody.

Moreover, once upon a time, the media would raise awareness for the peer-to-peer industry as an innovate way to grow your money but now that’s all died down. It seems that peer-to-peer was the cool kid for a few years but now people are more interested in meme stocks and going to the moon with crypto.

Should You Still Invest In P2P Lending?

We think there is still a huge need for peer-to-peer lending. Let’s be frank, the rates offered by banks on a Cash ISA or Savings account is atrocious – you can currently expect around 0.6% if you shop around.

Premium Bonds aren’t much better; the prize rate is now 1% but with average luck you will probably get nothing, depending on how much you have saved.

So, with most peer-to-platforms paying around 4% you are at least defending your wealth against inflation, and you might see some real growth if inflation drops back down to normal levels.

Crypto might be making all the headlines but they’re hardly comparable asset classes. Crypto is more akin to gambling and you could make a lot of money or just as likely lose a lot of money.

A diversified global stock market fund should beat peer-to-peer in the long-term but expect a bumpy ride, plus with company valuations sky-high right now, you’d be forgiven if you consider the stock market too high risk.

And finally, the peer-to-peer industry doesn’t get enough credit for surviving an apocalyptic event like the pandemic. The government literally forced businesses to shut-up shop for months on end and ordered people to stay at home, and yet from first-hand experience, our peer-to-peer investments continue to perform.

For the platforms we were using, even when a platform has had to call in the administrators or voluntarily exited the industry, we have received every penny back of our investments without any problem. While that’s not a guarantee of the future, it does reflect well.

The Best P2P Lending Platforms For 2022

Despite the permanent loss of 2 of the 3 biggest platforms, there is still plenty of choice of platforms for investors. If and when Funding Circle start lending retail investors’ money again, they will be the biggest platform by a country mile. We’ve also had a good experience with Funding Circle in terms of interest earned, with an average annualised return of 5.8%, so fingers crossed that they stick around.

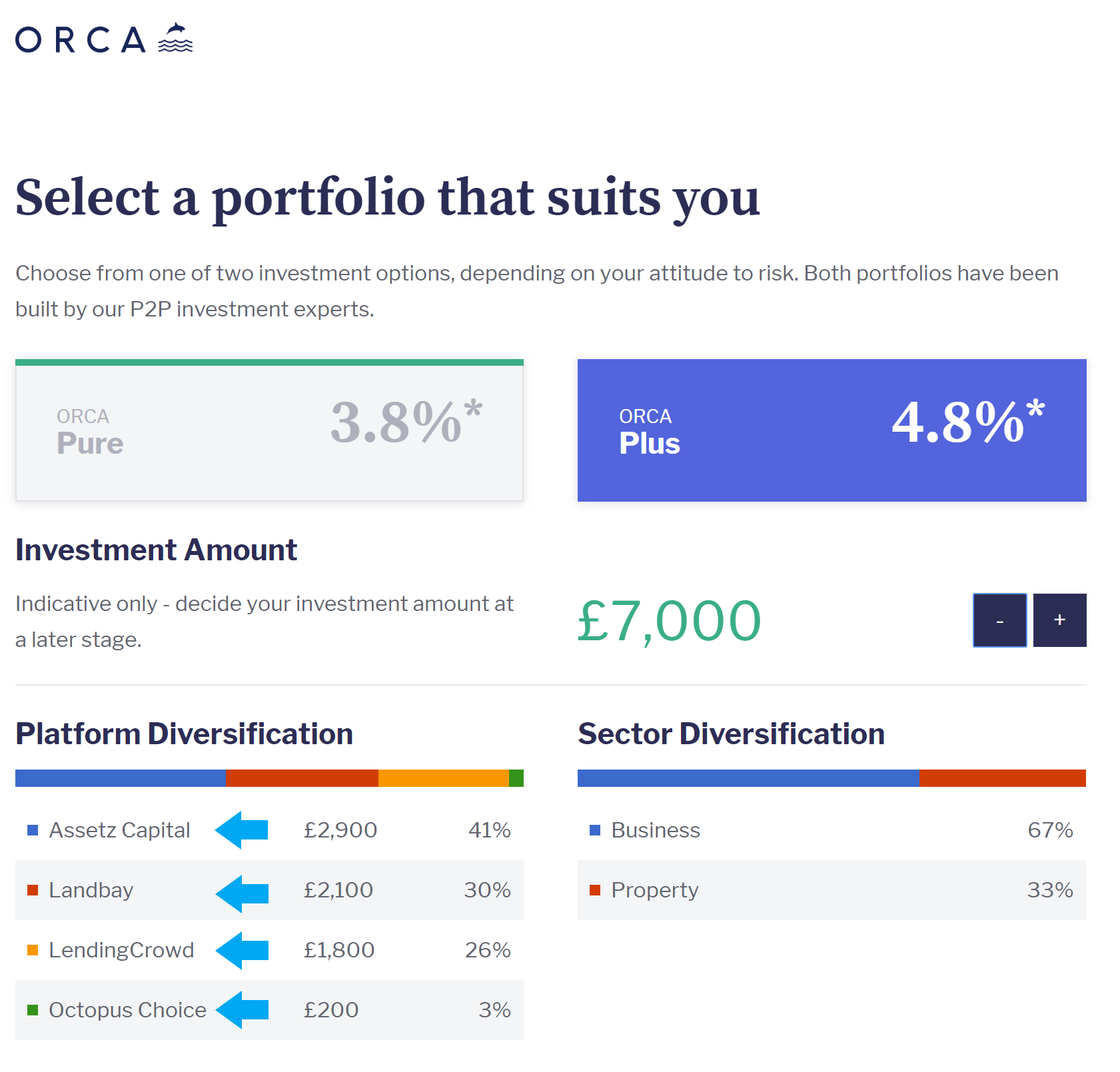

But if you want to start investing straight away, then you have the likes of Assetz Capital, Loanpad, easyMoney, Kuflink, ablrate, and others. Remember, diversification is key, and that applies to both the number of individual loans and to the platforms themselves. We encourage you to spread your money over multiple platforms to reduce the platform risk.

Many of these platforms are even offering new customer welcome bonuses when you use the special referral links found on the Money Unshackled Offers page.

Generally, they each pay £50 to new customers just for making a small investment, and you will of course earn whatever interest rate they’re offering on top, so definitely worth snapping up multiple bonuses if you plan to sign up anyway. These welcome offers come and go, so it is worth checking out the Money Unshackled Offers page for the latest offers.

At time of filming, Assetz Capital offer 3.75% on their Quick Access account, 4% on their 30-Day Access account, and 4.10% on their 90-Day Access account. We’ve used Assetz Capital for about 4 years now and really like their website and offering. However, we think the naming of their accounts is misleading as these access times can only be expected in “Normal Market Conditions”.

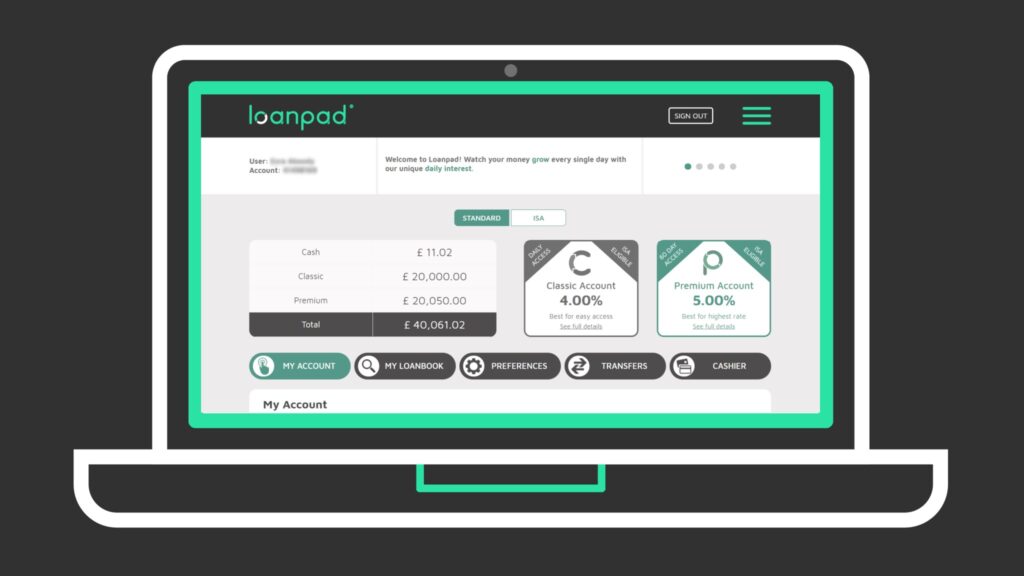

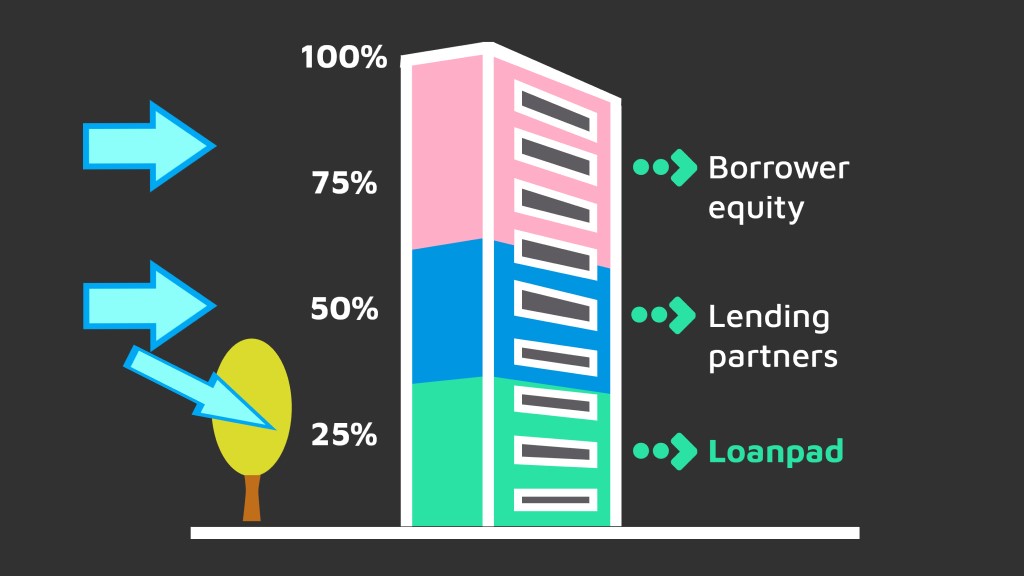

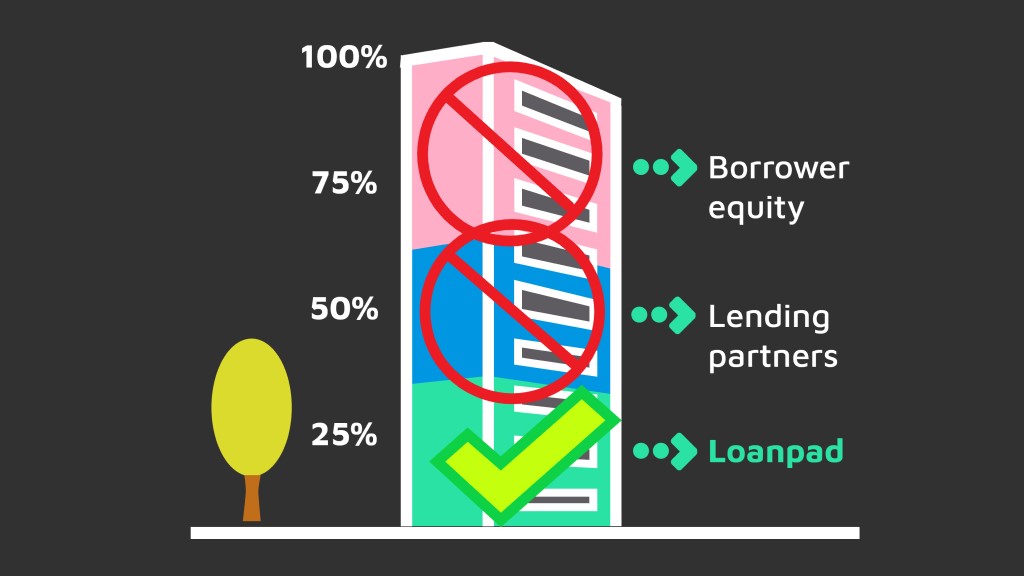

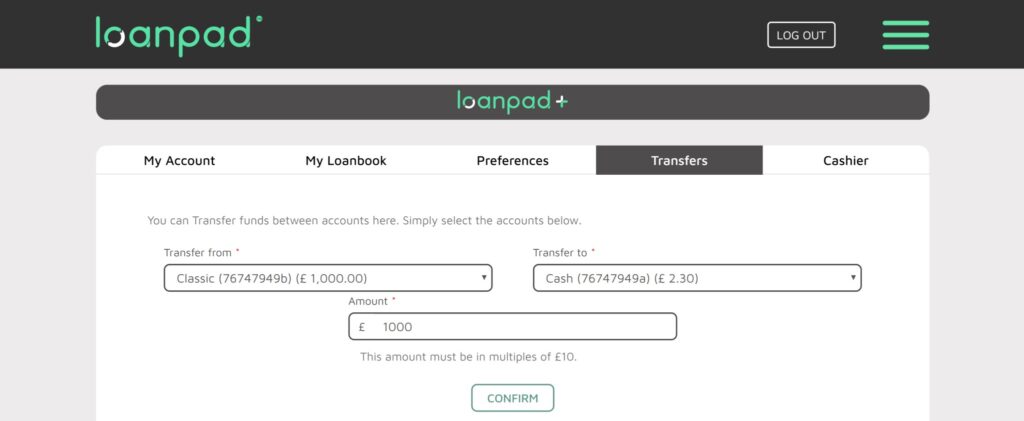

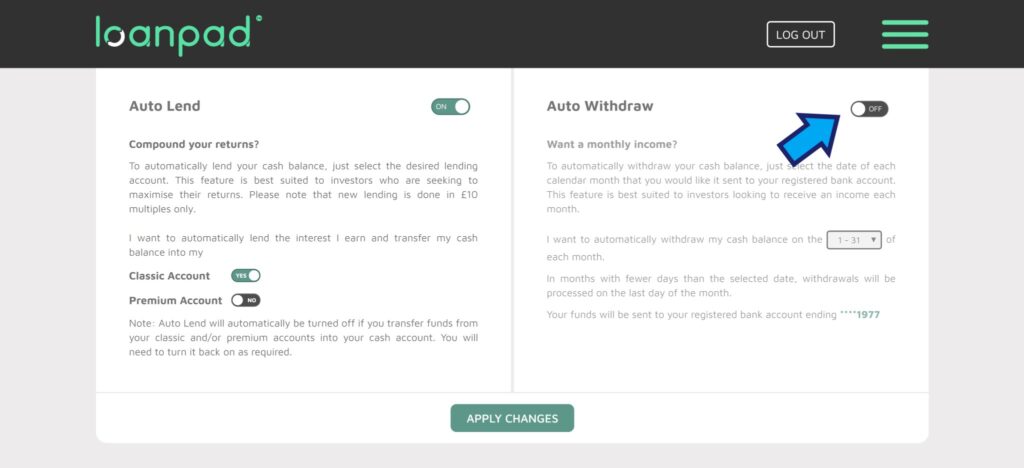

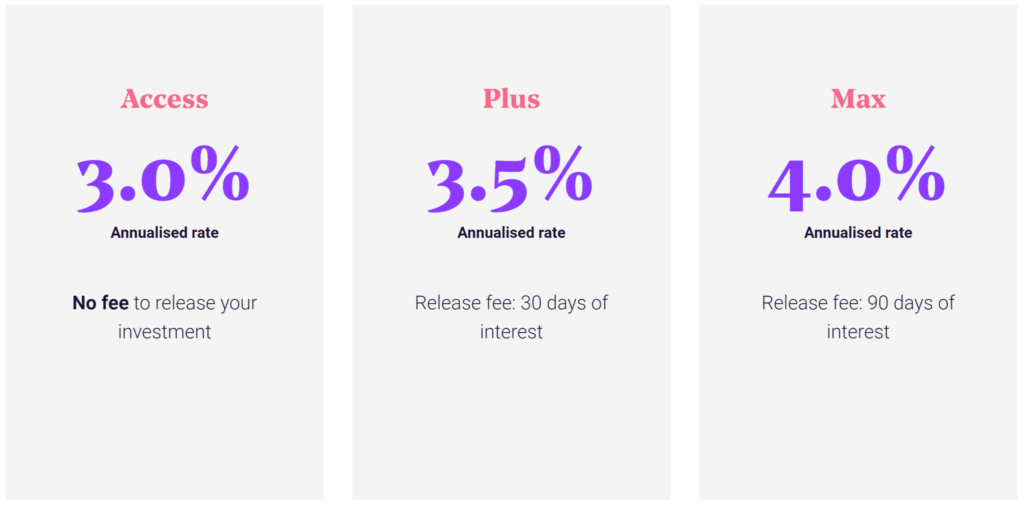

Loanpad is another platform we’ve had a very positive experience with. They’re currently offering rates of 3.0% and 4.0%, pay daily interest, have an easy-to-use website, and we really like their approach to protecting investors’ money. In the case of a loan default, there is a hierarchy in which losses are incurred. Loanpad investors will be repaid before the other lending partners which are big institutional investors, and before that you are protected by the borrowers’ equity. All loans are secured by property that they can sell to recover your money if the loan defaults.

Have you invested in P2P Loans and how has your experience been? Join the conversation in the comments below.

Written by Andy

Featured image credit: Lane V. Erickson/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: