Peer to Peer Lending is today what the high interest savings account was a decade ago – 5%/6% interest returns on your deposited cash – actual cash in hand returns instead of pennies!

The only difference is that savers must now become investors, meaning they take on some risk – you are lending your money to people and businesses after all, and some may go bust – but some of the platforms and services like Orca seek to minimise this risk as much as possible.

It is simply fact that in the modern age of ridiculously low interest rates, to win in life some risks now must be taken to get those life changing returns.

But is there a best way to invest in P2P Lending?

Editors note: Don’t forget to check the MU Offers page when signing up to P2P platform – you could miss out on a £50-£100 cash bonus!

YouTube Video > > >

Avoid the Large Returns

Counter intuitive? Not at all. There are some P2P platforms out there that advertise returns on investment of 20% or more – what they don’t advertise is that such high returns on a zero-effort investment means risk must be sky high.

20% of nothing is a 0% return – these platforms tend to invest in one big project that may or may not succeed.

Think about it – a P2P platform is a middleman for 2 parties, a borrower and an investor, also known as the lender. The other side, the borrower, must therefore be willing to pay at least 20% of interest on their loans, meaning banks (which tend to lend more around the 7% mark) probably have considered them uncreditworthy.

Focus on business and personal loans

A lot of P2P platforms deal specifically in new build commercial property projects, of the type that tend to be left part finished or made into car parks if a recession hits.

Whereas the P2P platforms we use lend to mostly small and medium sized businesses, with loans split across hundreds of borrowers.

Diversified by business activity, by amount and by project, this type of loan portfolio will include some businesses who invest in property anyway, but these become a smaller and diversified element of a wider portfolio.

Stick to the Big Names

Sticking with the big, established players in the market is in our view a sensible move.

Ratesetter and Funding Circle for example are to the P2P world what HSBC and Lloyds are to the banking world – big established platforms that are good at what they do.

There are maybe 10 really good P2P platforms that we would rate for providing a professional service with decent returns in the 5%/6% region, most of which we each have significant deposits in.

They’re always evolving and trying to improve their services and returns, but of these, our 3 favourites currently are:

RateSetter

Offering you a choice of rates around 4%-5.5% depending on whether you want instant access to your cash or don’t mind fixing it, you can set your own acceptable rate to give you greater control over your finances.

Ratesetter has a £100 sign up bonus for new users when you invest £1000, so an immediate 10% boost to your returns in year one. Ratesetter also has a provision fund, to protect users from defaults on loans, on the rare occasion when one of their carefully vetted borrowers goes bust.

To date, nobody has lost money to bad debt on Ratesetter thanks to this provision fund: it has a 100% track record over 9 years ensuring that no investor has lost a penny.

We feel our money is in safe hands with these guys, but of course there always has to be some small risk of future losses.

Assetz Capital

Another great platform, Assetz Capital offers a higher interest rate of 6.25% on its Great British Business Account.

It also gives you a £50 sign up bonus if you invest £1000 with our link, so another 5% boost in year one. All these sign up links are on our website, linked below.

Remember, on these decent platforms your investment gets split into hundreds of loan parts, lending to many, many businesses at once.

Some of these will go bust, but these losses tend to represent a sub 1% hit to your returns.

The last 7 years have seen Assetz Capital evolve from 10% borrowing rates with 5% defaults, to lower 7% borrowing rates and tiny 0.1% defaults over the past 3 years.

They’ve clearly de-risked the portfolio as they’ve grown and are being more selective about the businesses they accept as borrowers.

We can testify that in the couple of years we’ve each been using it, we have been receiving the target return.

Lending Works

Another sign up bonus, £50 for £1000 invested, another big interest rate of 6.5%. That’s on Lending Works, again with a provision fund to protect your losses (called the Shield).

Lending Works make a big deal about their Shield, which has resulted in every payment of capital and interest being paid to lenders on time since they launched in 2014.

Once you have more than an emergency fund, why would anyone leave their savings languishing in a bank savings account? 0.1% interest rate? No thanks – we’ll be using Lending Works, Assetz Capital and Ratesetter.

Minimise Your Platform Risk

The reason we each started investing our wealth into multiple P2P platforms (aside from receiving multiple sign up bonuses), was to massively dilute our risk, without sacrificing returns.

You could just invest in Assetz Capital for a 6.25% return, and spread your loans automatically amongst hundreds of businesses, but what happens in the unlikely event that Assetz Capital goes bust?

This is called Platform Risk, and the way to mitigate it is to use multiple platforms.

The risk of one of these platforms actually going bust without a contingency plan is small, but why take the risk in the first place when we’re talking about thousands of pounds?

You could invest £3,000 across the 3 platforms mentioned earlier – £1,000 into each – and if one did collapse during a nasty recession, only a third of your pot is at risk.

Orca is a cross-platform service that seeks to tackle this platform risk on your behalf, but is it any good? Let’s take a look at Orca.

Orca Money

Orca Money is a platform of platforms, or put another way, when you deposit money into an Orca account it invests on your behalf into multiple P2P Lending platforms.

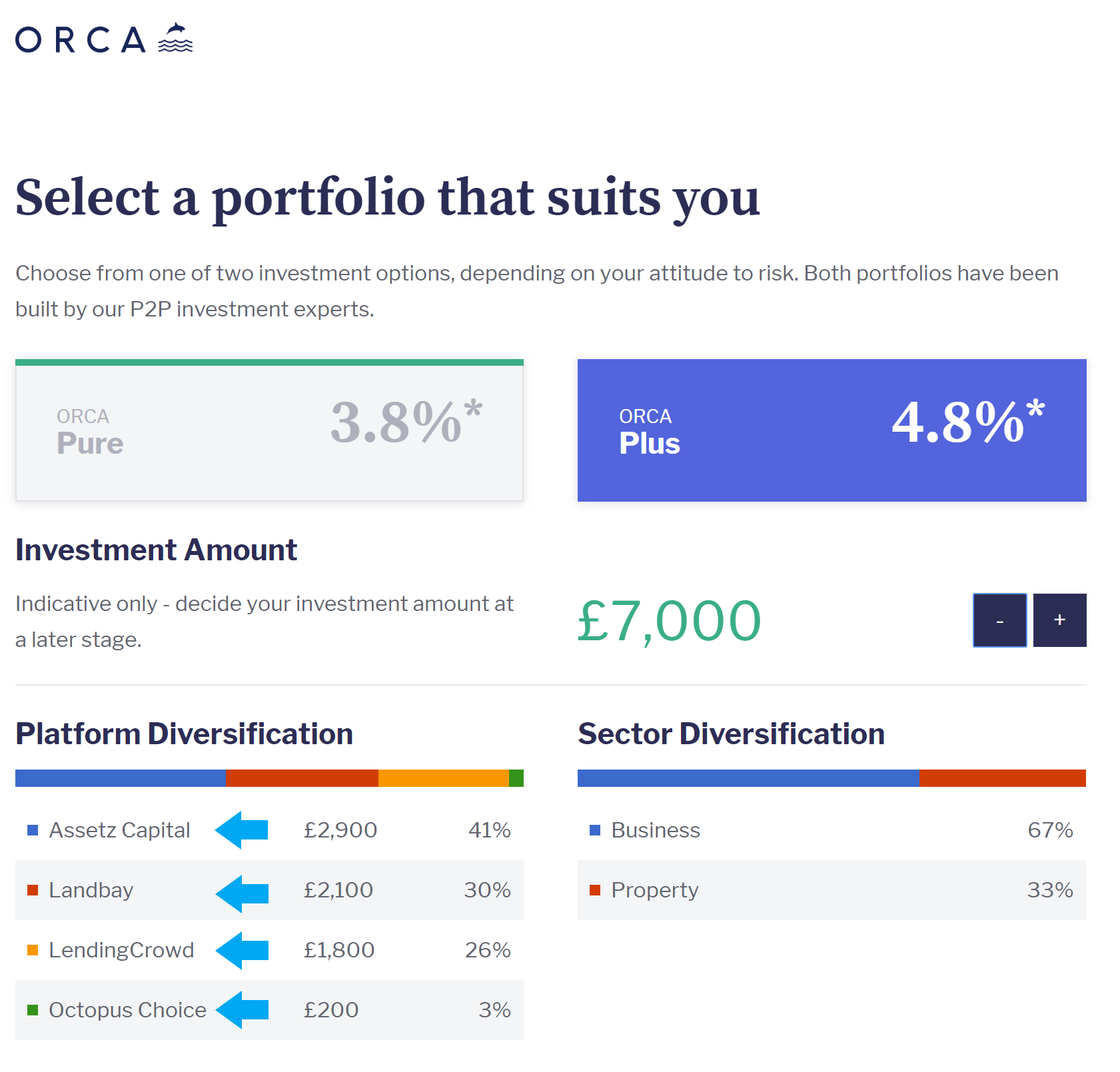

This is a great innovation, but falls short of the best way to invest in P2P in our opinion. The most diversified offering requires a minimum investment of £7,000, which spreads your investment across 4 platforms.

We’re actually annoyed that the platforms you see below are the only platforms on offer – no Ratesetter, no Lending Works, no Funding Circle.

If you invest less than £7,000, you get less diversification: £3,000 diversifies across just 2 platforms, most of which is in Assetz Capital (which we love), and the rest in Landbay (which we’re sceptical of as it is a higher risk property projects platform).

It’s the same mix when you invest £1,000. For £1,000 you are probably better off just picking one platform and being diversified across many businesses rather than putting £300 into Landbay – and scooping up a sign up bonus by going direct.

If you have £2,000 or more to invest, we say split that money across 2 or more platforms directly instead of through Orca – and achieve better diversification.

One good thing though about Orca is you can invest through an ISA, into multiple platforms.

This is not possible going direct, as you only are allowed one ISA per year. It is on you to weigh up if an ISA is important to you, versus the benefits of going direct.

Double Fees

Finally, diversifying your P2P investment through a third-party platform like Orca results in a double layer of fees – fees are already built into the returns of the individual platforms, but then you have Orca fees on top!

It may be worth it for the all-in-one approach, with an ISA wrapper around the whole portfolio, though it is not our preference to pay extra fees, and an ISA only comes into its own once you are making over £1000 of interest each year.

We appreciate what Orca is trying to do by addressing platform risk, but you can just go direct and open accounts with your favourite platforms.

Best Way to Invest in Peer to Peer Lending

Diversify across multiple platforms to limit your risk and scoop up all those juicy sign-up bonuses in the process.

As well as the 3 platforms we mentioned above, we also invest funds into Funding Circle, Zopa, Growth Street, and Lending Crowd – most of which also have sign up bonuses. The links for all of these are on the MU Offers page.

Don’t keep your money wasted in the bank. Get it working for you!

How much do you have in P2P and do you use any of the big platforms mentioned in this article? Which one do you think is best? Let us know in the comments below.

1 Comment

Why viewers still make use of to read news papers when in this technological world

the whole thing is available on web?

Comments are closed for this article!