Which is the best investment platform for buying stocks and funds? The answer is that there is not one but several good ones that we have tried and tested over the years, and of these there are one or two that will be best for YOUR specific circumstances.

It all boils down to getting the right balance of Fees, Choice, and User Experience.

Editors note: Get your investing journey off to a flying start with the links on our Offers page, and which has £hundreds of sign-up bonuses for new users of investment platforms, that we use and love. Enjoy!

YouTube Video > > >

Fees!!

The platform costs should be number one in your mind when choosing an investment platform. Stock market investment platforms are historically notorious for slapping you with hidden fees, including:

- Platform fee

- Fees to Buy and Sell

- FX Fees

- Account fees

- Transfer fees

Navigating these and other fees successfully can be a headache – and it is investor frustration at the web of costs associated with investing that has led to the demand for the development of zero-fee investment platforms.

Zero-Fee Platforms

The top zero fee trading platform in our opinion is the Trading 212 Invest app, which also has the option of an ISA – I have been using this platform to invest for a few months now and can confirm that it is as zero-fee as it is possible to be.

The only costs that remain are the ones outside of its control – stamp duty is still there at 0.5% when you buy shares, but not on funds. Stamp duty is a legal requirement in the UK when buying shares.

Dividend with-holding tax on foreign shares is still there too, even if these are held within funds, deducted from dividend payments by the country of origin.

Many people prefer the Freetrade platform, another decent zero fee investing app, though beware that they charge £1 for instant trades and £3 monthly to invest through an ISA.

The disadvantage of using a zero-fee platform is that you are limited on investment range. They offer a decent range of shares but nowhere near all of them, and their range of ETFs is again limited.

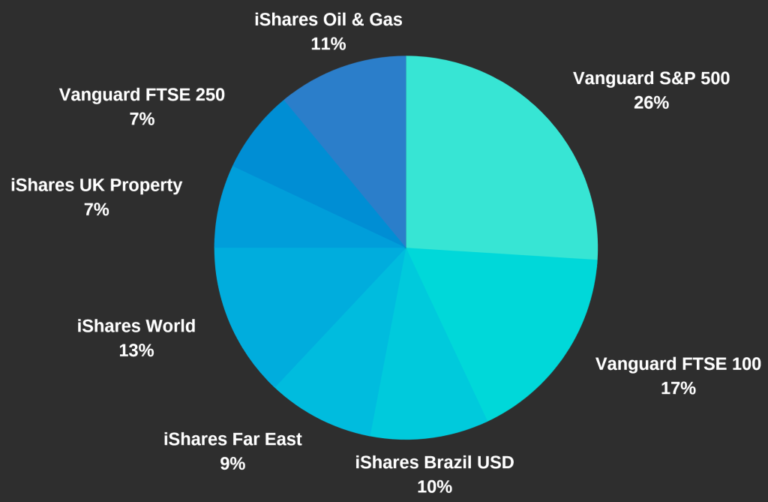

That said, I am building up a decent portfolio on Trading 212 of ETFs including the Vanguard FTSE 250, iShares FTSE 100, Vanguard S&P 500 and many more including the far east, Brazil, oil and gas and commercial property.

Safe in the knowledge that with zero fees, all my gains are mine to keep.

Editors note: Download your FREE 4 Step Guide to Stock Market Investing here.

The Complete Package – Traditional Investing Platforms

The big traditional investing platforms like Hargreaves Lansdown, AJ Bell, Interactive Investor and Barclays are what the seasoned investors use, as here you’ll find a much wider choice across more geographies and sectors.

Because they are premium service providers, they cost a lot to run and so seek to bombard investors with fees, such as the ones we covered earlier.

The fees that most significantly affect the values of most portfolios however are Platform Fees and Trading Fees.

All platforms are not made alike however, and there are 2 clear favourites of ours from amongst the traditional platforms, which keep these fees to a minimum. These are AJ Bell, and Interactive Investor.

AJ Bell

AJ Bell is a good choice of platform if your investment pot is small – smaller than around £20,000. This is because they charge a small percentage platform fee, being 0.25%.

The fee is quite small on smaller pots, but of course the amount of fees you pay will get bigger the larger your portfolio gets as it is on a percentage basis. Compare and contrast with:

Interactive Investor

For the wealthier individual – this is another premium platform. Interactive Investor charges £9.99 a month fixed platform fee – a lot if your pot is just a grand or two, but barely anything if you own tens of thousands of pounds worth of stocks.

Both platforms charge a small fee for buying shares, funds and ETFs, of £1-£1.50 for regular monthly investments. This is our preferred way to invest, as it avoids the pitfalls in trying to predict the market.

Finally, buying shares outside of regular monthly instalments costs between £8 and £10 on these platforms, but with Interactive Investor you get your platform fees back in trading credits.

Vanguard

You may be familiar with Vanguard from the famous Vanguard LifeStrategy Funds and Vanguard collection of ETFs.

We love to buy Vanguard funds and ETFs for their strong history of performance and low product fees, and one of the best places to buy these is on Vanguard’s own platform.

This would be my platform of choice if not for the zero-fee apps – for following an ETF-only investment strategy – as all the best Vanguard ETFs traded on the London Stock Exchange are on there.

It’s also the cheapest place to buy and hold the LifeStrategy Funds, which are all-rounder Funds of Funds and ETFs, perfect for beginners and investors who just want one diversified place to put their money.

Robo Investors

The third factor we mentioned after fees and range of choice was usability. The last couple of years has seen robo investment platforms hit the market, which aim to make investing easy for the masses.

Nutmeg is our favourite robo investor platform – called robo because it seeks to build a portfolio for you using algorithms to determine what is most suitable for you based on your money goals and attitude to risk.

You simply open an account, and it asks you a series of questions; after which it will start to build you a diversified portfolio.

It really takes the thought process out of investing, and you essentially get a fund manager – though you are simply assigned to one of the many Nutmeg designed portfolios – without having to pay to put the fund manager’s kids through college.

Nutmeg has an annual fee of 0.45%, though you can get the first 6 months fee-free if you use our referral link.

A beginner may as well try it for 6 months fee-free and then consider if you want to stick with the robo platform or move on to a platform where you make the decisions yourself.

Wombat is another new platform to the market that we reviewed a few of months ago, which also seeks to make life easy – by assigning easily understandable names to funds.

Know that you want to jump on the technology train and buy into a technology fund, but wouldn’t know where to start? Just join the wombat platform and buy the fund called “The Techie”. Simples.

So, Which Is the Best?

We’ve reviewed 6 platforms that we use and consider to be the best. If you’re a beginner, we would say go with Nutmeg or Wombat – Nutmeg have the lower fees if you use our link, and Wombat is free if you only invest under £1,000.

If you have a bit of knowledge and want to be able to buy and sell shares and ETFs without having to pay any fees, then Trading 212 is our zero-fee platform of choice.

If you’re only interested in Vanguard products including the Vanguard LifeStrategy Funds, choose the Vanguard platform.

And if you’re a serious investor or plan to be, who intends to build up a sizeable and interesting global portfolio, then it’s AJ Bell initially, and Interactive Investor if your pot is growing much beyond £20,000.

So whichever of those 6 applies to you, sign up to it and start your investment journey! And remember to check the Offers page on MoneyUnshackled.com to see if we have any sign-up bonuses for your chosen platform.

Which do you think is the best investment platform, and have we missed it from our list? Let us know in the comments below…

Written by Ben

1 Comment

Please note that Vanguard UK charges 0.15% platform fee capped at £375 a year. which is more expensive than some of the fixed fee platforms.

Also some Vanguard index funds are strangely not available on the Vanguard platform, but are available on many of the other platforms.

Vanguard UK does not have a brokerage (like Vanguard have in America) so an investor cannot buy individual company shares nor other providers funds and ETFs.

Comments are closed for this article!