Coca Cola is probably the best known brand in the world and is one of the biggest US blue chip companies. Investors recognise Coke as a strong dividend payer, and at first glance it should be a great fit in our portfolios at Money Unshackled, given that we crave dependable passive income.

But recent years have seen Coke struggle in a new world obsessed with ethics & health, and with a rocky world economy. Is Coca Cola still worth investing in?

Why We Like Blue Chip Dividend Stocks

Blue Chip stocks get their moniker from the game of Poker, where traditionally the “blue chips” hold the highest value. In the stock market, blue chip companies are the biggest, most established global companies, and tend to offer their investors dependable dividends in place of fast growth.

You’re never going to get rich overnight by holding a blue chip stock, as they are mostly already past their main growth stages.

But our portfolios benefit from holding a foundation of these dependable assets that provide steady cash flow to support our lifestyles.

Dependable Dividends

This is what we mean by dependable.

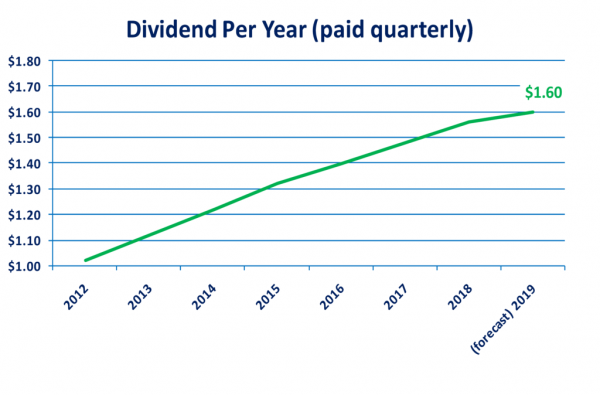

Dividend investors have seen big rewards from holding Coca-Cola stock, with more than 50 years of consistent, reliable dividend growth. The current annualised dividend payout is forecast at $1.60 for 2019, and pays quarterly, with 40 cents paid already in March 2019.

The current yield on the share price is 3.38%, which is around what it has been historically too. A company cannot control its yield percentage as it cannot control its share price, so the consistent dollar returns are what we look at for historical analysis.

But as investors we like to know what the current percentage rate of return is too, and 3.38% is pretty decent if we can also achieve capital growth on top too.

Coke’s Stock Price (KO)

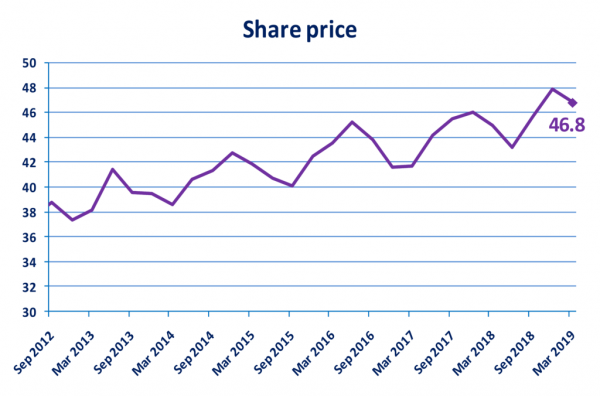

A mid-range dividend means we also crave returns from stock price growth to sweeten the deal. Here’s Coke’s recent stock price history. We primarily care about the last several years when looking at stock price as it’s the best indicator of current performance, but even this is highly imperfect as an indicator of future performance.

The best we can take from looking at the share price history is that Coca Cola’s share price has been steadily growing at a consistent rate, with regular peaks and troughs. This gives us some confidence that Coke will continue to experience price growth to supplement our gains from dividends.

The low volatility gives us a little bit of comfort which may help you sleep at night.

Coca Cola’s Price Earnings Ratio

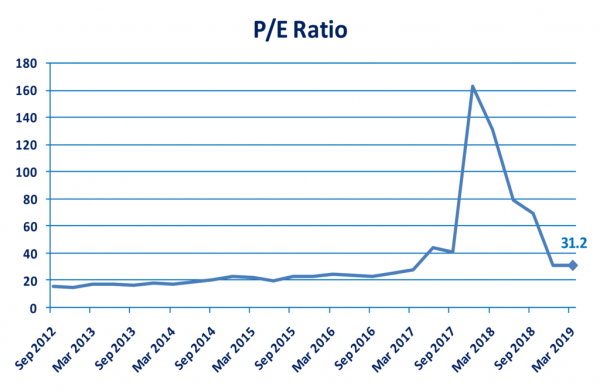

Coca Cola had a Price Earnings Ratio of 31 at March 2019. The price earnings ratio is calculated as Share Price divided by earnings Per Share, so the higher the share price relative to earnings, the higher the Price Earnings ratio. Likewise, if Earnings per share reduced, the PE ratio would increase.

This is what happened in late 2017/early 2018 when we saw a spike in PE ratio, due to a one-time charge of $3.6bn related to the repatriation of overseas earnings following the Tax Reform Act in the US, temporarily hurting Coca-Cola’s net earnings, which fell by 81%.

The PE ratio has now settled back down to around the 30 mark, where historically it had been around 20. This higher PE ratio of 31.2 compared to the history could mean that Coca Cola stocks are now overpriced compared to the value you could attain pre 2017.

But how does Coca Cola’s PE Ratio compare to other companies? In the US beverage industry, the average PE Ratio is around 27, with the market as a whole averaging around 18.

This suggests that Coke is overpriced compared to both the industry and the market.

Stock Picking – Soft Factors

There are many soft factors that we must look at when predicting the future performance of a stock.

The financial histories we have just looked at are historical, not current, and definitely don’t reflect the future, rather they only hint at how capable the company has been up until now.

Here’s 5 soft factors we should consider alongside the numbers

1) Endorsed by the wallet

A good endorsement of a stock is whether investment gurus actually put their money where their mouth is and buy it.

Warren Buffet is the biggest guru of them all, and he holds significant shares in Coca Cola.

We could all do a lot worse than following Warren Buffet, and this endorsement by the wallet is a check in Coke’s favour.

2) Brand Power

Coca Cola has been around for more than a century and its brand has endured the test of time. It consistently tops the list of world’s most recognised brands, and is part of the everyday lives of billions of people worldwide. This supports the theory that Coca Cola is a stable business that will continue to deliver dividends to its shareholders, and it’s everyday use by billions makes Coke a safe haven during market downturns.

3) Competition

Coke doesn’t really have to worry too much about competition. It is by far the market leader in the carbonated beverages market, and it’s customers are loyal – Coke are masters of marketing , with adverts that show Coke as being part of everyday life. We all have a preference between Coke and Pepsi, and given the choice will stick faithfully to our drink of choice.

Coke is a global company that dominates the market in many developing nations, with opportunity still for growth in foreign markets.

4) Sugar – the 21st Century Bogeyman

The world is waking up to the fact that sugar has direct links to obesity and Type 2 diabetes, and governments are starting to take action against companies with products that contain significant amounts of the stuff – products like Coke.

In the UK, the Sugar tax has artificially inflated the price of a bottle of Coke above what would be the market rate – perhaps not significantly enough to make a bottle unaffordable, but it has certainly had the effect of highlighting to the public that the drinks they are buying are considered unhealthy.

Luckily for Coca Cola, of their 3 main products, Diet Coke and Coke Zero are both incredibly popular and seen as alternatives to original full sugar Coke, and sales of these Diet Coke and Coke Zero have risen massively in the last few years. In the UK, Coke Zero is already the biggest selling drink-even more popular than the original Coca-Cola.

We think that Coca Cola’s low sugar range and diversification into non-cola products like it’s purchase of Costa Coffee in the UK will allow them to weather this storm, but the continuing focus on health is a risk factor to consider

Main products Diet Coke and Coke Zero both contain alternatives to sugar that are also considered by most health bodies to be bad for health.

5) Environmental concerns

One factor to keep on your radar is environmental and green regulations that will likely come down the line in the years to come. As investors we buy for the long term, and the world’s renewed focus on plastic and other waste could mean that in the next decade there will be crackdowns on products with single use containers like those sold by Coca Cola.

As a producer of billions of bottles and cans, Coke is indirectly one of the main contributors to litter in the environment, and we would expect Coke to be among the companies first on the firing line if world governments decide to act.

We expect they would still survive, but the share price would likely take a beating in this scenario.

Should I Buy Coca Cola Stock?

In summary, we believe Coca Cola is a reasonable stock to hold in your portfolio. Its consistent dividend, steady share price growth and strong brand and customer base make it a dependable cash flow asset.

But its yield is not that great, and the future is littered with potential pitfalls as the health and environmental lobbies gain in strength and legal backing. Also, that PE Ratio gave us cause for concern as it suggests Coke’s stocks might be overpriced compared to its own history and against other stocks in the industry.

There are better dividend stocks out there, and if your portfolio is small and your investable cash is limited, you might instead choose to place your cash into alternative holdings.

Do you hold Coca Cola stock in your portfolio? How do you rate it’s performance? Let us know in the comments below.

Investing In Coca Cola (KO) Stock – Should You Buy? Video Review:

YouTube Video > > >