Much has been made of the financial gap between the young and the old. From house prices, to rents, to taxes, to university fees, to the changing demographics of the country, and even the response to the pandemic – all seem uniquely designed to screw with young people.

In this post we’ll be laying out all the perceived ways in which Generation Z are being cheated by the system. Then we’re going to fact-check that narrative and see if there are any ways in which Gen Z is actually better off.

Finally, we’re going to look at the actions that you need to take NOW to avoid being one of those left-behind. Let’s check it out!

First up: Commission-free trading platform Stake (the go-to investing app to buy and sell US stocks) are giving away a FREE US stock worth up to $150 to everyone who signs up via this offer link and then funds their account with £50 or more within 24 hours. Don’t forget to claim yours!

Alternatively Watch The YouTube Video > > >

Issue #1 – Housing

The biggest planned shake-up of planning laws for 70 years has just been abandoned after a backlash from government backbenchers and their older home-owning voters. Reforms designed to help hit a target of 300,000 new homes annually by the middle of the decade will be watered down.

Planning reform is just one solution to the housing crisis that’s causing misery to so many young people who are unable to afford their own home. When reforms like this are cancelled it just compounds the problem.

Where 19% of 25-to-34-year-olds were private renters in 1997, that figure was 44% in 2017. And those aged 35-to-44 are three times more likely to be renters than they were 20 years ago.

Another problem with housing is that there isn’t enough stock of good, 4-bed-plus family houses.

The blame for this is often laid at the feet of the old, who continue to live in castles too big for their needs after their kids leave home, while young families are forced to live in new-build cardboard boxes.

But the true fault lies with the government. Their stamp duty tax on house purchases actively punishes people who choose to downsize.

An older couple choosing to help out the younger generations by moving out of their £500,000 4-bed house into a £350,000 2-bed face an immediate stamp duty tax payment of £7,500. It’s not surprising that they choose not to do this. The tax system is therefore structured to limit the availability of family houses for young people.

Regarding rising house prices and rent prices, are they ever going to stop? A decent-ish 2-bed flat in Birmingham rents for around £1,000 a month. How can a small cube in an apartment block cost so much?

The situation is echoed across the country, with people forced to pay ridiculous prices for substandard living conditions.

At our age, our parents’ generation were all about 10 years into paying off their mortgages on big houses.

Fact Check

Which really matters – house prices, or how much your mortgage payment is each month? The fact is that interest rates were much, much higher in the past.

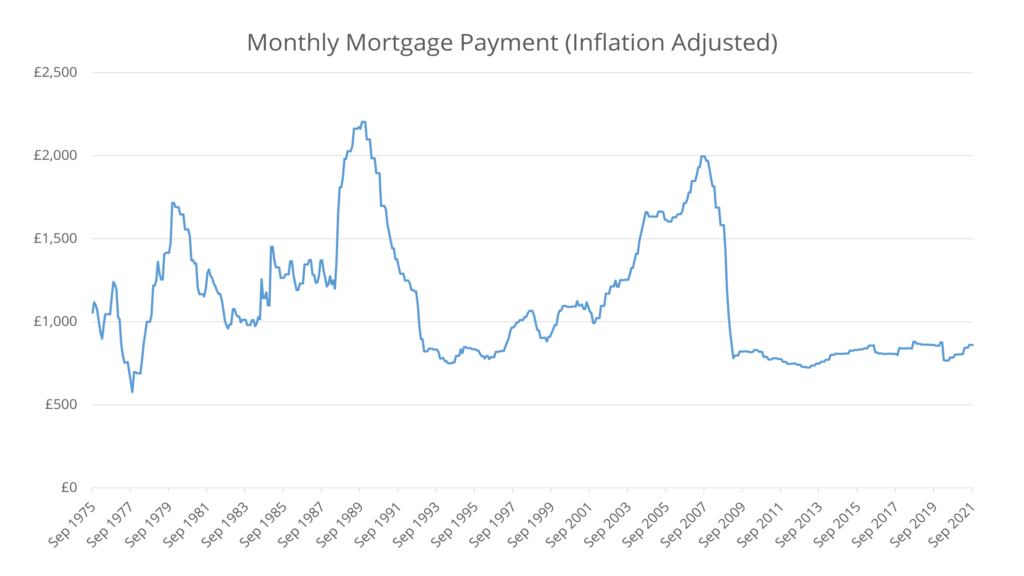

We’ve taken the inflation adjusted average house prices going back to the 1970s, and worked out from the Bank of England base rate in each of those years roughly how much a family would be paying for their monthly mortgage, in today’s value of money:

Surprisingly, the current generation is living in one of the BEST times to buy a house, in terms of affordability, thanks to record low interest rates since the 2008 financial crash. People in the 80s, 90s and early 2000s had it much, much worse.

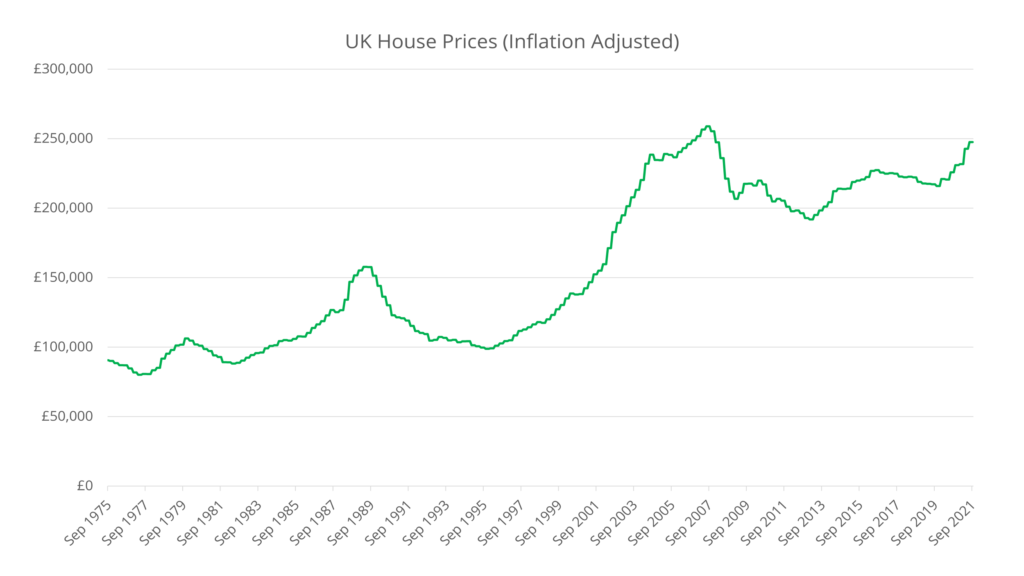

And looking next at the inflation adjusted house prices in isolation, though Gen Z really does have a deposit problem, it’s not a unique one – equivalent inflation adjusted prices were previously seen in the years before the financial crash:

Issue #2 – Taxes

Young people don’t seem as annoyed as they should be about ever-rising taxes – those who came before them didn’t have to pay anywhere near so much.

The tax burden right now is the highest it’s been since 1948, at 35.5% of GDP, and it’s expected to rise further before the next election. The trajectory since the 90s has been a steady upwards climb, and the government has big spending plans for the next decade that will need more taxes to pay for them, such as going green and ‘levelling-up’.

Tax is paid predominantly by those of working age. Pensioners, who are the ones who actually vote, tend not to tolerate big tax rises on their wealth.

Indeed, in a policy representative of the age divide, the government is hiking National Insurance taxes on younger, asset-poor workers so that the social care of older, asset-rich people can be funded without those retirees having to part with their wealth or insure themselves against the costs of care.

As the Resolution Foundation noted, ‘a typical 25-year-old today will pay an extra £12,600 over their working lives from the employee part of the tax rise alone, compared to nothing for most pensioners’. Pension income will not be subject to the levy.

You can double this hit when you factor in that Employers NI has gone up too by the same amount – an indirect tax on your future wage potential.

Fact Check

A counter argument in favour of the elderly holding onto their assets would be that those assets will eventually be passed on to Gen Z through inheritance. Indeed, inheritance may now be the only viable way that the average Gen Z-er can scrape together a house deposit.

But obviously, not everyone stands to inherit so you still have to question how fair this is.

Issue #3 – Education

University has been devalued as an institution. It used to be that only the brightest young minds went to university, and those who went found that it transformed their fortunes.

Now, everyone and his dog has a degree. People working on the checkouts in supermarkets have degrees. Degrees are increasingly worthless. It’s work experience that gets people the best jobs – not degrees alone.

But you still have to go to uni to be on a level playing field with your peers. You have to spend 3 years racking up £50,000 in student loan debt to get a basic job.

This generation is unique in that they almost have to be saddled with debt (which they’ll never pay off) just to get the minimum wage.

Young people suffered the worst financially from the lockdowns in terms of opportunities lost, damaged education, and careers interrupted – the current batch of school and college leavers have had a particularly rough couple of years.

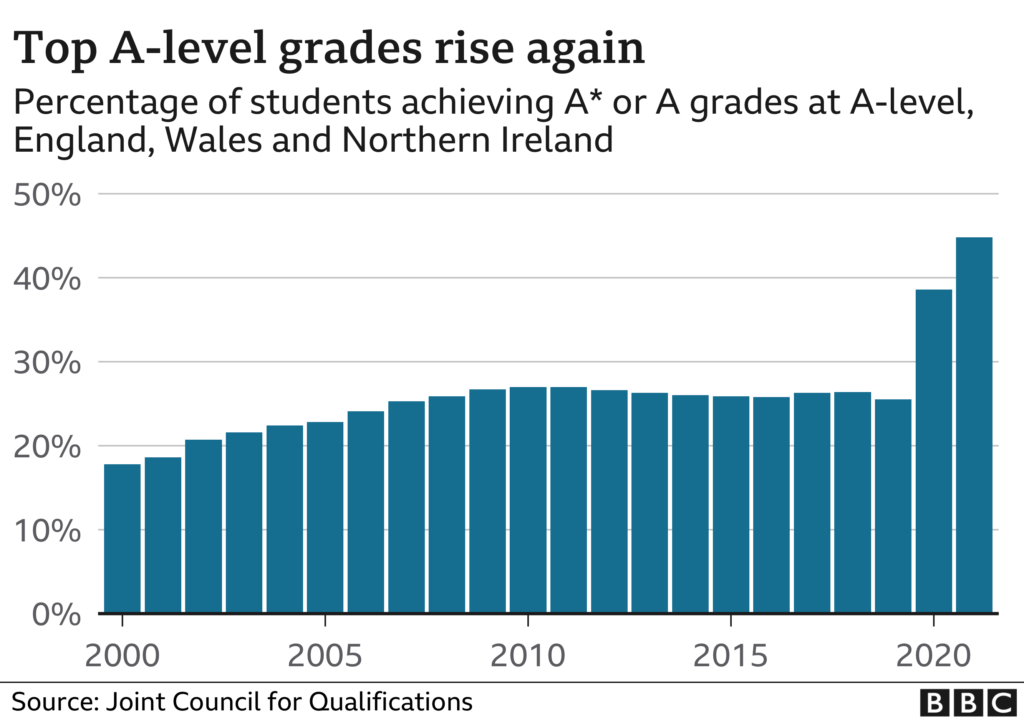

Not only has their learning been disrupted but many of them have been given top grades as no exams were taken – damaging trust in the grading system:

Genuinely clever kids have the same top grades as kids who in other circumstances would have got lower grades. Will they unfairly miss out on places at the top universities as a result of the increased competition?

An obvious issue is student loans, which never existed in the modern form for previous generations. University even used to be free.

There’s no denying that university fees are high, but we don’t believe student loans are as damaging to your finances as they appear to be.

Fact Check

Student loans aren’t really loans: they’re a tax on your income that you only pay if you get a high enough salary, currently taxed at 9% on any income earned over £27k for Plan 2. That “debt” you think is weighing you down isn’t really doing anything of the sort.

The alternative to this student tax used to be to force the whole country to pay for your degree through higher income taxes.

Whether asking 20-year-old cleaners to pay the university fees of 20-year-old students through higher taxes is fair or not will depend on how you think a tax system should be run. There’s an argument that everyone benefits from having an educated population. We ourselves are split on the subject. Either way, the taxpayers would be footing the bill – the question is whether it should be just those with degrees paying that tax, or everyone.

Issue #4 – Changing Demographics

Mass immigration since the 1990s has pushed down wages in the UK. It’s simple supply and demand economics.

There was an almost infinite pool of people willing to take a limited number of jobs in the UK. That’s why you see office workers on close to the minimum wage, and why nobody wanted to be a delivery driver before the current food and fuel crisis. This has made it difficult for Millennials and Gen Z to earn good money from good careers.

Fact Check

Whether due to Brexit, or the knock-on effects of Covid travel restrictions, or both, there are signs that low wages are starting to improve in certain sectors, like truck drivers and brickies. But for as long as there are skilled social care nurses on low wages, the problem won’t have gone away.

What You Need To Do NOW To Not Be Left Behind

Despite a few positive signs, we think it’s fair to say that Gen Z is the first generation in a long time to be worse off than the generation that came before them.

Given this, it’s crucial that young people take extra steps that their parents and grandparents didn’t have to.

Step #1

To address your immediate money issues, you need to stop what you’re doing and reflect on your career. Do you need a better paid job or even a complete career change?

Could starting a business pay better than what you’re making now? One advantage of working for yourself is that you don’t have to split the profits of your labours with an employer.

Or could you top up your job income with a side hustle? Check out our matched betting guides for just one way to make extra money on the side for just a few hours a week.

Step #2

Something you must do is get a firm understanding of your pensions. Previous generations more or less had their retirements handed to them – you must work harder for yours.

Too many people are contributing too little to their pensions. The rule of thumb is that someone starting saving at age 20 should be putting aside 10% for the rest of their working career. Fall behind and you’ll have to pay much more later!

Where you invest your pension matters too. We’ve shown in this previous video how UK workplace pensions are geared towards underperforming investments, often with too little investment risk taken on the part of young people. The result is a mediocre growth rate and much smaller pension pot. We show you in that video how to take control of your own pension funds.

Step #3

Perhaps even more important than your pension is that you get on the housing ladder a.s.a.p, unless you’re happy to rent forever. With house prices growing ever higher, you’re only going to be left further and further behind the longer you fail to prioritise this goal.

If that means cutting back on the new car until you’ve built that house deposit, so be it.

If you know you won’t be able to afford a house for years to come, a good alternative would be putting your savings into investments like stock market funds and gold to protect against inflation. Those with houses already should be doing this too.

Houses, stocks and gold are financial assets, in the sense that their prices generally go up. Everyone who doesn’t own assets will be left behind financially in the years to come. Those who own assets will be swimming with the tide of inflation rather than against it.

Do you think Gen Z is being cheated? Join the conversation in the comments below!

Written by Ben

Featured image credit: View Apart/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: