Hey guys, in this post we’re going to be looking at some of the really common personal finance misconceptions that many people believe to be true. Some of these misunderstandings could be very damaging to your finances, so let’s set the record straight today. Let’s check it out…

As always don’t forget to grab your free stocks and free money when you sign up to any of a number of investing platforms and financial services. Check out the Money Unshackled Offers page for info.

Alternatively Watch The YouTube Video > > >

Misconception #1 – You Need To Avoid The Higher Tax Bracket

Everyone moans when the government has their hand in their pocket but it’s evident that many people don’t actually understand the tax system. Worryingly, some people believe that if they earn more money before tax, when they enter into a more expensive tax bracket, they’ll actually take home less.

The misconception is that when you earn over a certain amount and become a higher-rate taxpayer paying 40%, then this tax rate would apply to all your earnings. This is not true in the slightest.

In the UK we use a progressive tax system, meaning taxpayers will pay the lowest rate of tax on the first level of taxable income in their bracket, a higher rate on the next level, and so on.

For example, Max earns £60,000 a year. He gets the personal allowance of £12,570, which is tax-free. The 20% tax bracket currently applies to earnings between £12,570 to £50,270 or in other words the first £37,700 that exceeds the personal allowance. That means Max gets taxed at 20% on £37,700 and 40% on the next £9,730 earned.

For those who aren’t as fond with numbers as we are you can bang earnings into tax calculator, like the one at thesalarycalculator.co.uk, and it will tell you the amount of tax that will be paid.

Even if you don’t fully understand the numbers, it’s important to understand how the tax brackets are applied. Some people are even avoiding overtime or promotions because they think it will cause them to take home less.

If you’ve seen our videos or posts before when we’ve stated that’s it’s not worth working more, generally we mean that after income tax, NI, pension, and student loan deductions, the money earned is too small to be worth our limited and precious free time for the extra effort. But crucially, that overtime would result in more take-home pay.

Misconception #2 – Weddings Have To Cost A Fortune

According to hitched.co.uk the average cost of a UK wedding is £32,000. They surveyed over 2,800 couples to get to that eye-watering number. As someone who values their free time so highly, I cannot understand how that is the average cost of a wedding in the UK, which would take years of hard graft in order to save up for.

We reckon a couple could travel the world for more than a year and still have change to spare – some could probably travel for a few years on that budget and have the time of their life.

Alternatively, that’s a sizable deposit that could have gone towards their dream home. Or for those that want to set themselves free that is a very good-looking retirement pot that could easily grow to be worth more than £100,000 in just 25 years. And as for those taking on debt to get married… tut tut.

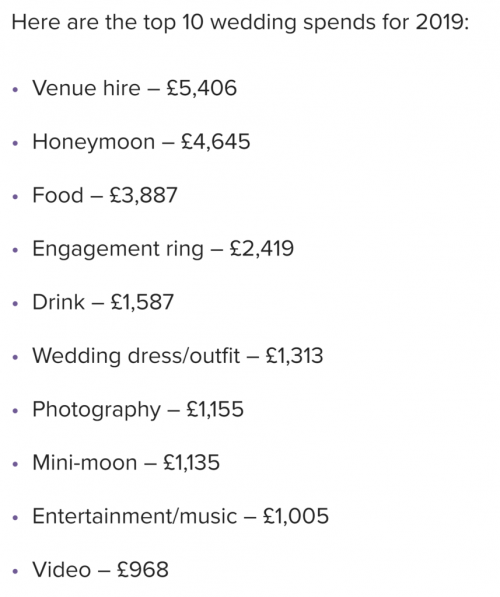

Above are the top 10 expenses for the average wedding. £5.4k is spent on the venue, £4.6k on the honeymoon, £3.9k on food and another £1.6k on drink. Then you have huge amounts on the ring, dresses, photography, and on and on it goes.

Money Saving Expert have a useful article giving tips on how to slash the cost. We won’t repeat it all here, but one interesting point is that you can get an all-in wedding reception for £4,500 … at Wetherspoon’s. It includes a three-course meal with wine for 100 people, a DJ, decorations and a wedding planner. And apparently this isn’t just any Wetherspoons, it’s a swanky pub in the heart of central London.

Fair enough that might not be to your taste, but the point is that there are loads of stories of people getting married on the cheap – and in many cases for even less than the cost of a swanky Wetherspoons reception.

As someone who doesn’t particularly care for weddings, before even spending a penny I’d encourage you to first consider whether you’re getting married because everyone else does or whether you actually want it. Sounds obvious but many people are too busy going through the motions and following society’s life plan that they never consider what they actually want.

Misconception #3 – I Can’t Retire Until I’m 65+

This is a two-pronged misconception. Many people believe that they cannot retire until they are at least 65 when they qualify for the state pension – and also that they will need to top this up with a workplace pension, which they assume to be the only way to privately save for retirement.

Our regular viewers who have a keen interest in investing will know this is not true at all. You can retire whatever age you please and this could be 20, 30, or even 40 years before the state dictated retirement age.

The state pension dates back to 1908 and was originally reserved for those who were 70 but back then life expectancy was short. Only 24% of people reached State Pension Age and of those the average life expectancy was a further 9 years. Basically, the government was paying barely anything out.

Fast forward to today and people are drawing on the state pension for 20+ years, which is a huge and possibly unsustainable burden for the government. The state pension cannot be relied on still being around to fund your retirement when you get to your 60s.

You must save for retirement privately and if you use the right savings vehicles, you can start drawing down on your retirement pot at whatever age you like. The only caveat is you must build it big enough to out survive you.

Anecdotally, most people give no consideration to retirement planning other than saving into a matched contribution workplace pension. In the rare cases of having a good salary and a generous employer making big contributions this could be quite a chunky pension that allows you to retire in your mid to late 50’s, which is the earliest a pension can be accessed. Unfortunately, for everyone else, retiring in your mid 50’s is unlikely unless you actively plan for your retirement.

Crucially, you can retire even younger than this if you prioritise your future and utilise a variety of other wealth building tools. Someone that saves £500 a month for 30 years could quite easily have a retirement pot in today’s value of money worth £600k, allowing a 20-year-old to retire at 50. This can be done using a combination of a pension and a Stocks and Shares ISA, which allows you to access the money at any age.

Another powerful retirement wealth builder is buy-to-let property and there are no limitations in what age you can access any income that it generates, nor any restrictions of when you can sell the properties to release your wealth. Obviously buy-to-let property is not easy if you do it all yourself, but the gains can be life-changing.

Check out this post next if you want to see a worked example of how much profit property can produce by having someone else do all the work for you and find out how you can get help starting to invest.

One further way we’re growing our wealth fast is the use of spread betting to invest in S&P 500 futures. Here we explain exactly what we’re doing. Very briefly, we’re using leverage to earn mega tax-free returns that can be accessed with no age restrictions. It’s a super complicated subject, so tread carefully with this one.

Misconception #4 – Buying New Is Always Better

Whenever you buy something that you want are you guilty of always buying new? There’s a misconception that used items are old, tired, and trampy. Hands up, for most items I’m guilty of overpaying just to get my hands on a needlessly brand-new item.

But there are numerous times when buying used items gets you almost as good of a purchase as new ones, but for significant cost savings. The most obvious one is a car. Some used cars are in such good nick that they still have that new car smell.

Other items where old is almost better than new include exercise equipment. Many people buy these items with the intention of starting a get fit and healthy regime but fall off quickly and then try to unload these bulky goods that take up too much room. You can then snap up a bargain!

With items like dumbbells, you can even resell later for a similar price to what you paid on the second-hand market, so they effectively cost you nothing during the time you owned them.

Many things that your kids need can also be bought used for considerable cost savings, especially when your kids are far too young to even notice or care. A brand-new pram can cost hundreds or even thousands of pounds but buy used and it can cost less than £50. Trust us, your kid(s) won’t even notice.

Used furniture is another huge cost saver. I’ve cleared a few things recently to make room and have been selling them at almost giveaway prices, for items that are in close to perfect condition. Understandably, for those of you like me who are still a little snobbish when it comes to new items, maybe you can buy used for things you won’t use that often. Outdoor furniture is a prime example of something that you will only use twice a year, but you can save a small fortune by buying used.

New build homes are also often worse than older homes. Forget the new-build premium, which is another problem – we’re talking about build quality here.

Properties these days are thrown up in no time with poor quality workmanship and corner-cutting. They are also super stingy with space, trying to pass off cupboards as double bedrooms. Older properties – even those built just 15 years ago – are usually far bigger with additional space for stuff that is often overlooked when you’re shopping around; things like storage space.

Misconception #5 – A High Salary Makes You Wealthy

The average person on the street – and the government, and the banks – thinks a high income from a job means you are wealthy, but there is fundamental difference between income and wealth. Wealth – when managed right – should be permanent savings. But salary income is the money you earn and often disappears as fast as it comes in.

A smart person will slowly turn income into wealth by investing wisely over time. Conversely, a dumb person with wealth will run it down to zero.

Wealth is how much assets you have. For example, a pensioner living in a house valued at £1 million is wealthy, even though her pension brings in a tiny income of just £100 a week.

Moreover, not all wealth is the same. In our example, although our pensioner has £1 million in wealth it is in an unproductive asset meaning it’s not producing any income. Income generating wealth is superior and includes the likes of businesses that you own and investments you have.

People tend to be interested in how much another person earns in their job but cares less about their wealth. It should be the other way around.

Someone who earns £100k a year from their job but blows the lot will work every day until they die. But someone who has financial wealth of £500k held in productive assets and only lives on the £20k a year generated from their investments theoretically never needs to work another day in their life.

Furthermore, a high wage income can be taken away from you at any moment. You could lose your job and may find it impossible to get another paying anywhere near the same. This frequently occurs in older age.

Most professionals should expect their pay to peak between the ages of 40 and 49, according to earnings data from the ONS, while salaries fall to their lowest level during their 50s. Or to put it more succinctly, you have got to turn income into wealth before it’s too late!

What personal finance misconceptions do you think are most common? Join the conversation in the comments below.

Written by Andy

Featured image credit: Ivelin Radkov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: