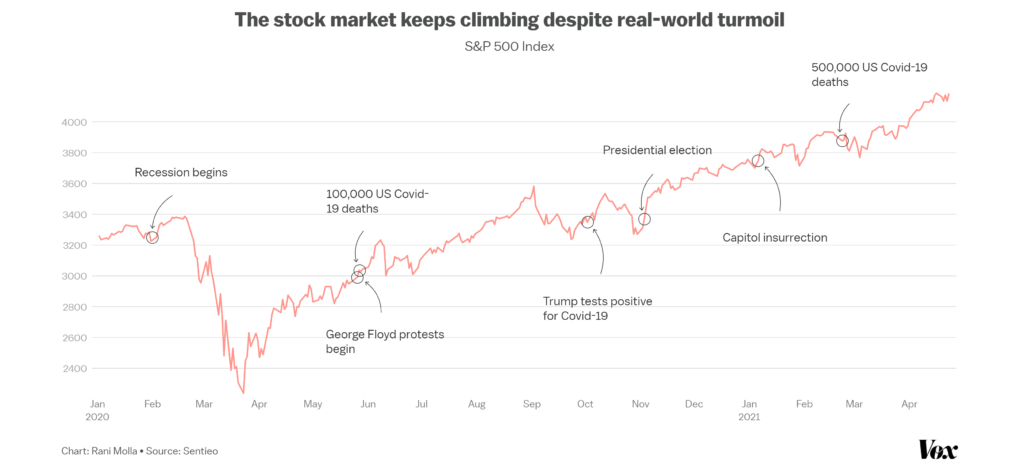

For a couple of years that have been so bad, it’s hard not to wonder why the stock market has been so good.

As lives were lost around the world, and millions of people were put on the unemployment list due to actions taken to tackle Covid-19, the global stock markets soared – none more so than the S&P 500, which for the last year has acted as though it is immune to bad news.

Everywhere, there is chaos.

- On the streets, tensions about race are boiling over.

- On the M25, selfish eco-protesters bring Greater London to a halt in an ever-escalating war on climate change.

- Australians are beaten by police for leaving their homes and shot at with rubber bullets.

- In the White House, Biden schemes to raise the corporation tax rates not just in the US, but on companies around the world in a G7 deal.

- And lockdowns everywhere have inflicted irreparable damage to businesses.

Meanwhile, millions of investors continue to plough money into stocks because the charts keep moving higher and higher. The difference between the actions of the stock market and the reality of real life has rarely been starker than in 2020 and 2021.

Today we’re looking at the various reasons why the stock market continues to soar in bad times, and the lessons we can learn from some of the stocks with the most interesting stories to tell from the pandemic.

Alternatively Watch The YouTube Video > > >

The Bulletproof S&P 500

The market was rocked in March 2020, as stocks plunged for about a month, but then something strange happened.

Even as the media was losing its head over the covid-19 virus (and this has not changed 18 months later), and as America burned from street protests, and as millions of people were laid off and businesses shuttered due to government lockdown policies – the market just recovered and then boomed as though nothing had changed

An outgoing president seemingly refusing to accept the outcome of an election (supposedly the market’s nightmare scenario), and then the Capitol building being stormed in what the media reported as a “coup”, did not stop the S&P from soaring. At time of filming, it’s just below an all-time-high at around 4,500, well off the top of this chart

It’s a far cry from the start of the pandemic, when billionaire hedge fund manager Bill Ackman went on the airwaves to warn that “hell is coming”. Maybe it did for many – but not for him, nor for investors generally.

How can it be that food banks are overwhelmed and people can’t afford heating or even housing, while stocks are hitting all-time highs? Let’s now look at what can be learned from the bull market of the last 18 months.

Lesson 1: What Goes Down Doesn’t Always Bounce Back

Investors, like everyone else, were initially in denial about the realities of Covid-19 when it first began to take hold globally in early 2020. Indeed, in Jan and Feb 2020, the market continued to record all-time highs.

What we saw then was that while stocks often rise slowly, they also fall fast. Once the world caught on to what Covid-19 might bring as countries like Italy were ravaged, stock prices collapsed, wiping off 34% percent of the value of the S&P 500 from mid-February to mid-March.

We’re all familiar with the sudden rebound that then happened for most stocks, but some were not so lucky. Exxon Mobil is an example of a stock that fell, and stayed down.

While the stock market as a whole enjoyed a bull run in the second half of 2020, fossil-fuel energy companies floundered, after a brief hopeful recovery that I took full advantage of at the time, telling investors to Buy, Buy, Buy!

The woes of Exxon and the Oil & Gas industry teach us the importance of not holding faith in a commodity or industry just because it’s previously always done well.

A unique unforeseen event like a global lockdown can change everything. People didn’t need Oil & Gas when they were not travelling to work or going on holiday, but the resulting fall in share prices were perhaps short-sighted – oil prices are slowly coming back, though they have not yet reached their pre-crash peak.

Lesson 2: Central Bankers Wield God-Like Power Over Stock Markets

At the start of the crash, no-one had any idea of what the future looked like, how deep the crash would be, or how long it would last for.

But extraordinary measures taken by America’s Federal Reserve and similar central banks in the UK and elsewhere reassured financial markets and investors that major corporations would not be allowed to fall apart.

Most analysts point to the actions of the Fed in the US as being the most important factor in restoring confidence during market turmoil, since America holds around 55% of the value of the world’s companies and many economies around the world are impacted by the success or failure of America.

In March 2020 they announced a series of big support packages, including saying they would buy both investment-grade and high-yield corporate bonds (basically, it would lend to businesses, whether they were risky or not). Stock prices immediately about-turned and started marching upwards.

In the words of Invesco’s chief global market strategist, “The Fed can be very, very powerful, almost omnipotent, when it comes to the stock market.” Some companies were able to capitalise on the soothing words of the Fed more than others.

Boeing stock didn’t recover at first, as questions still hung over the viability of its operations, but with the markets in a giddy ecstasy over the Fed’s interventions, Boeing was able raise $25bn of cash from the markets in a corporate bonds issue, allowing it to avoid the need for government help.

Boeing’s smashing success in getting itself out of a hole financially, and the resulting rise in its share price, was mirrored by a few other companies including Nike, who’s stock price gained 35% in a week following a $6bn bond issue. Its stock price has not stopped climbing since.

Stake, an app that specialises in trading US stocks, are giving away free stocks to new customers – including Nike stocks, which are currently trading at around $150 each. If you want to invest in US stocks and pick up a free share in one of Americas great companies, just follow the link here and fund your account within 24 hours.

Lesson 3: Some Bulls Run Faster Than Others

The S&P 500 bottomed out 33 days after the crash started, and since then has continued to climb, powering ahead of its pre-crash highs.

While growth was mostly strong across the board, some industries did much, much better than others. Technology companies – which make up a significant chunk of the value of the stock market – soared on the back of remote working and the need for better entertainment and communication tech in the home.

A representative stock of the tech boom is Apple. It’s responsible by itself for much of the growth of the S&P 500, since Apple makes up 6% of the value of the index and has itself grown by 156% since the bottom of the crash.

The point here is to be highly diversified, so you own the industries of the future, whichever they turn out to be. You can’t know before a major economic event what the specific circumstances behind it will be.

This time it was a virus, which killed oil and promoted tech. The next one could be a war that promotes defense stocks like Boeing, or a shortage of an essential raw material that promotes mining stocks. Or an event we can’t even imagine.

Lesson 4: ‘Temporary’ Keeps Being Redefined

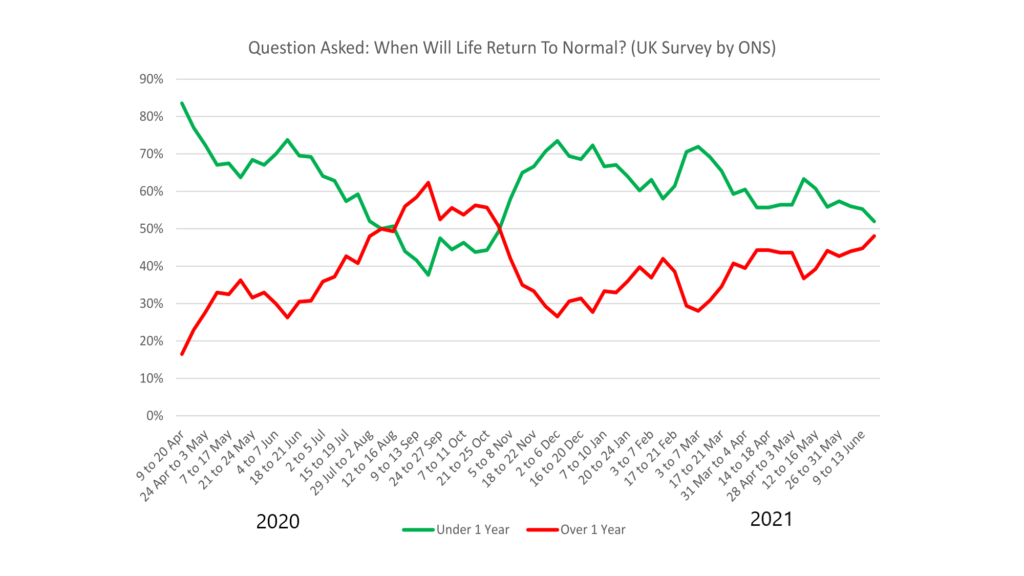

Back in spring of 2020, the markets were confident that within a year, the pandemic would be over. Of course, it wasn’t.

But the general attitude remains that within months, life will be back to normal. People who believe the pandemic will be over within 12 months have been in a majority throughout the pandemic (which has in fact been ongoing for well over a year), other than a brief couple of months of pessimism prior to the vaccines being announced.

Even in June 2021, more than half the UK population believed everything will be back to normal within the next 12 months.

This optimism for a speedy return to normal has run throughout the pandemic.

American Airlines, representing the struggling aviation industry, fell and flatlined after early signs of recovery when it became obvious in early Summer 2020 that summer holidays would, after all, be cancelled.

But the vaccines, announced in November 2020, led to a steady climb of recovery, until Spring 2021, when the markets were faced with the cold hard reality of another summer without travel.

What the story of the airlines underlines is that stock prices swing on human emotion – when things looked hopeful prices rose, and when looked bleak they stagnated or fell.

No doubt if there are lockdowns in 2022 people would be hailing 2023 as the year when things get back to normal!

Lesson 5: 2021 Could Have Looked Very Different

The lucky timing of the vaccine announcements in late 2020 gave the stock market a booster shot of confidence that 2021 would be an incredible year of reopening and growth, with markets going into overdrive again from that point onwards.

The company responsible was Pfizer, the pharmaceutical giant that released the first covid vaccine. Interestingly, the news in November 2020 that Pfizer had come along to save the world only resulted in a temporary increase to its share price. It’s only now, in late 2021, that Pfizer’s share price is benefiting from its ongoing role in the pandemic.

Companies that provide the people with what they want tend to be rewarded with share price growth. And in a world where viruses may now cause more havoc, the desire to own big healthcare companies in your portfolio has surely grown.

Lesson 6: Where America Leads, The World Follows

It looks like the US is poised to emerge from the pandemic before much of the rest of the world, by spending its way to an economic recovery that many less affluent countries cannot afford. But opportunities remain for economic growth longer-term in the emerging markets, which right now are being ravaged by the pandemic.

Stocks like Nvidia, whose revenues come predominantly from emerging economies, may benefit from an economic recovery in those regions. The emerging markets have faltered in 2021 while the developed world led by the US has seen runaway growth.

With vaccines becoming more and more available, we think emerging markets will catch back up with the developed world, and companies with strong exposure to the emerging markets may stand to do rather well in the coming years.

Lesson 7: Where Else Could Investor Money Go, Anyway?

With interest rates, and hence bond yields, so low, investors don’t really have a more lucrative alternative asset class to put their money in. This is helping to keep the stock market buoyant.

As long as interest rates stay low, it’s stocks all the way!

It’s Hard To Think What, If Anything, Will Spook Investors

A big one could be when taxes are inevitably raised both in America and in the UK. Increasingly our governments are going after investors’ wealth. Biden in the US is keen to tax capital gains and corporate profits to the hilt, and Boris in the UK has recently increased dividend taxes, and said corporation taxes will increase to 25%.

Invesco comments again, that they “think on a short-term basis, we could see a sell-off if there is a risk [of a tax rise] that appears imminent, but we have to recognize that all current risks are being cushioned by this incredibly accommodating Fed. … It’s a powerful upward force on stocks that can counteract the downward forces.”

The Stock Market Is Not The World

The past 18 months have been a wild ride for both the economy and the stock market, but in different directions.

It’s clear that the stock market is not representative of the whole economy, much less society. The stock market represents one piece of the economy — long-term future corporate profits — and so long as there is confidence in those being high, the stock market will be too.

What’s your view on the rising markets, and will stocks continue soaring? Join the conversation in the comments below, and don’t forget to bag that free stock with Stake, worth up to $150!

Written by Ben

Featured image credit: Adirach Toumlamoon/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: