At some point during your financial journey, chances are you’ll end up having to factor in kids.

The media is full of scare stories with huge numbers about how much kids cost you during a lifetime, and it’s enough to make any investor think twice about saddling yourself with these little liabilities.

But these stories are more often than not just using silly assumptions to get you to click. And let’s face it, the decision to have kids comes down to so much more than just finances.

But once you have them, you need to change your approach to investing and financial freedom. Suddenly you’re now also responsible for someone else’s financial future.

You want to give them the best possible start in life, while balancing your OWN money goals. You need to make sure they’re provided for if the worst were to happen.

You want them to respect the value of money and investing, and to give them a little monetary head-start when they reach adulthood, so they aren’t tied to a desk for their whole adult lives.

We’ll show you how little changes now on your part can make a life-changing difference to your child by the time they hit 18-years-old. We’ll cover the investment vehicles to use for kids, and the other considerations you need to have in place.

You might even be trying to retire young yourself, in which case, we’ll show you how you can do this with kids without necessarily being tied to one location, and how much longer you might have to hustle before you can retire. Let’s check it out!

Alternatively Watch The YouTube Video > > >

Investing For Kids

If you’re into investing, it’s probably because you want to give yourself the best future. Well, when you have kids, you also want to give them the best future.

Which means you need to be investing for them too.

Arguably the best way to invest for a child is to use a Junior Stocks & Shares ISA.

You have to invest in assets like stock market funds instead of say using a Cash ISA, as holding cash long-term is like burning money – left over 18 years it would massively devalue against inflation.

The simplest Junior Stocks & Shares ISA we’ve come across for those who don’t know how to invest or don’t want to do it themselves is with Nutmeg. It’s no more complicated than opening an account and setting up a monthly direct debit, and checking back in 18 years’ time.

Check them out on the Best Investment Platforms page – if you do open an account with them using our offer link, you’ll pay no management fees on the account for the first 6 months.

Unless you have your young uns’ out cleaning chimneys to earn their keep, you’re going to have to cut back on your own monthly regular investments to give them a slice.

Do you want to give your kid £100,000 on their 18th birthday? Invest £300 a month with compounding for 18 years. What about £200k on their 30th birthday? Invest £250 a month with compounding for 30 years.

I don’t know about you, but I could have really done with an extra £200k on my 30th birthday!

The MOST you can invest for your child in a Junior Stocks & Shares ISA is £9,000 a year for the tax year 2021/2022, which is £750 a month if you want to make it a regular investment. £750 invested with compounding over 18 years is £266,000. Over 30 years it becomes £628,000.

These are big numbers, making for big life opportunities. All these figures factor in inflation and are given at today’s value of money.

2nd Generation FIRE

Imagine having the investing knowledge and the skills you have now, but being 18 again, and also having a large starter pot built up since your birth by your parents.

You might have a 10-year path to guaranteed freedom ahead of you. You could be financially free before your 30th birthday!

This is entirely possible for your child and is called 2nd Generation FIRE. FIRE is the goal of being Financially Independent and Retiring Early.

Many of our viewers are pursuing this path for themselves, but how much easier would it have been if you’d been raised to be an investor?

FIREing If You Have Kids

Is your investment endgame goal to be able to retire earlier than what’s considered “normal”?

If so, you probably have a figure in mind for how much money you’d need to have built up in your portfolio before you can sack off the day job. If you haven’t calculated this yet, do so now using the early retirement calculator that we’ve built for this very purpose.

The problem raised by inserting kids into the equation is that your “expenses” boxes are very likely to now be higher, which has a ripple effect both on your required pot size to be financially free, and also on the number of years it will take to reach it (because you are saving at a slower rate). But how much do children really cost?

Ridiculous sensationalist numbers fly around the media every so often like in this article from the Guardian, which claims kids cost their parents over £230,000 each.

How could anyone with 2 or more of these little money leeches ever afford to retire?

The True Cost Of Children

Well, the truth is that kids don’t need to cost anywhere near £230,000. For a start, there are economies of scale which mean that having two or more kids can cost much the same as having just the one, at least until they hit their teens.

If one of the parents has left work to look after the kids, that’s one lost salary regardless of how many kids you have.

For the first several years, hand-me-downs mean you only have to buy clothes, toys and equipment for the first child. And food doesn’t have to cost too much, especially relative to the other costs.

So if we could trim that cost down from the reported £230,000 per kid to more like £230,000 for all of them, would that be a more realistic figure?

Well, no. You could spend that much, but there’s no real need. Let’s look at some of the costs.

Tax-Free Childcare

The nursery my daughter goes to costs £800 a month for full time care after childcare tax credits, and is needed from age 1 for the next 3 years – before age 1, maternity/paternity leave removes the need for childcare.

If you or your partner have a low salary, you might quit the day job to look after your child yourself instead until they go to school at age 4.

If both parents are in work, even part time, you will be given money towards the cost of nursery for pre-school children. If there’s only one parent living with the child, only they have to be in work. Other rules apply, but most people will qualify for this unless one of you earns over £100,000.

For every £8 you spend on childcare, the government spends £2. It means childcare that would cost £1,000 a month in reality costs you £800.

The Other Costs

Then there’s food, and you can spend as much as you want on food – if you want to be frugal, it’s possible to be frugal. You could probably get away with £40 a week.

I get all clothes, equipment, furniture and most of our toys from hand-me-downs or family friends, or you could use Facebook Marketplace or Freecycle instead. And again, holidays cost as much as you want to spend.

Your gas, electric and water bills will go up by maybe £20 a month – mostly independent of how many kids you have. They share the same central heating, and in the early years, the same bath.

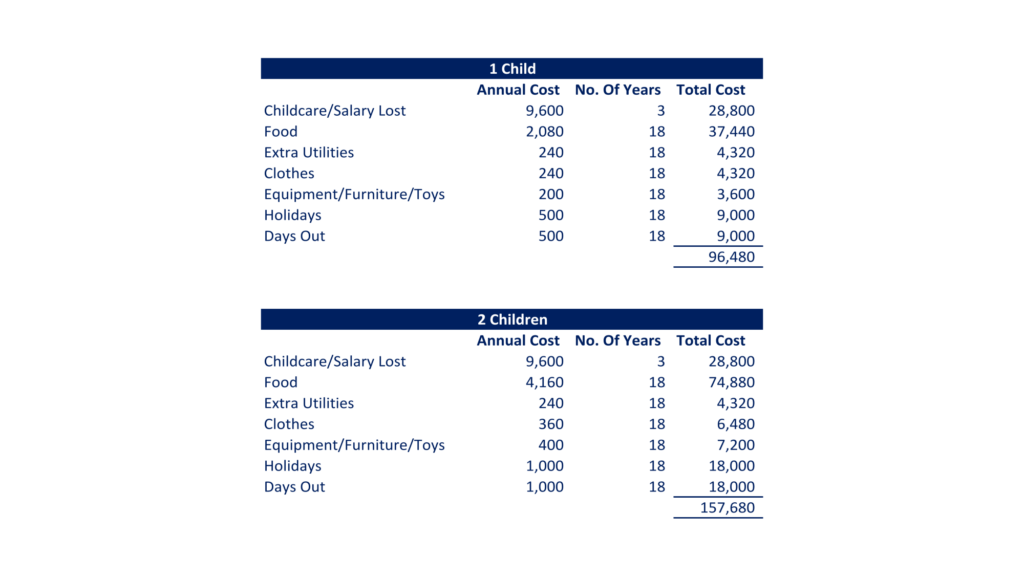

Here’s what 1 or 2 kid might cost you if you’re careful, if you make the choice to live outside of the expensive hubs like London which have excruciating early-years childcare costs, and if you’re sacrificing a low salary and making economies of scale. If your family’s number for FIRE is £1m, an extra £150k isn’t going to set you back by that many years.

Maybe you think these numbers are being overly optimistic, but remember that many people do manage to raise well-rounded kids while on minimum wage salaries. The point is, kids don’t inherently have to cost the earth – a lot of it is personal choice – and you have a lot more control over the costs than the newspapers would have you believe.

For the record, neither of us have the intention of raising kids on the bare bones, but there is definitely some sort of balance that can be achieved.

And as for FIREing while your kids are still under 18 – don’t forget that for 8 hours a day they are safely imprisoned in school, meaning you can still get on with enjoying your hard-earned freedom!

World Schooling

Here’s a wild idea for those wanting to retire early with kids – World Schooling.

It’s basically home-schooling or digital remote schooling done while you’re travelling the world as a family, often with other families doing the same thing so the kids have a peer group.

It’s an answer to the problem of being tied to one location so your child can go to school, when all you want to do is see the world now that you’re retired.

We won’t go into it any more here, but just be aware that an international network of travelling home-schoolers exists, and that you can find out more about it starting with this World Schooling article.

Teach Them What School Won’t

Wherever your kids go to school, you will have to personally take a firm grip on their education around money. Financial education is appalling in this country – let’s be fair – in all countries.

Around the world, kids are pushed towards entering the workforce as young adults, to trade time for money from the day they leave education until the day they slump down defeated into their armchair in old age.

It needn’t be this way for your kids. But they won’t learn in school how to manage money and how to become a successful investor, so you’re going to have to teach them yourself.

If you are building them an investment portfolio, why not show them what you’re doing and get them involved?

Let them apply what you teach them about money to their early spending and earning decisions, rather than leaving them to discover the idea the hard way after a decade or more of miserable 9-to-5 graft and a string of avoidable financial mistakes.

Insurance

There are 2 stages in your life as an investor that should be approached entirely differently when it comes to insuring your family’s future.

The first phase is during the accumulation years of your investment portfolio, when it’s not yet big enough for you and your family to draw-down on, should the need arise.

It might be sensible during these years to take out income protection insurance to keep money coming in each month if you lose your capacity to do your job.

You might also consider life insurance to cover you in case of death, and health insurance to cover you if you become incapacitated.

The second phase comes during the draw-down years of your investing career, when you probably no longer need any of these insurances.

If your pot is large enough, you can afford to self-insure against mishaps, meaning your investments will be providing your family an income in perpetuity, regardless of any further input from you.

Check out the Lifestyle Insurance page for more information on the relevant insurances that you might want to consider with Assured Futures. This is the very insurance broker that Andy uses for his income protection insurance.

Wills

Finally (in a very real sense of the word), you need to write a will. An investor’s financial situation is likely to be far more complicated than a normal person’s.

Where normies might keep their wealth in a high street savings account, YOURS might be spread across pensions, multiple properties, stocks, gold, artwork, and so on.

Take the time to properly document where all of your assets are, how they can be accessed by the appropriate people, and how they should be divided up.

For your kids, and hopefully one day your grandkids and great grandkids, the decisions you make here might help change the course of their own financial futures for the better.

For those of you with children or planning to one day, how do you invest and manage your finances? Join the conversation in the comments below.

Written by Ben

Featured image credit: Sharomka/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: