Today we want to get you thinking about the opportunity cost of your outgoings. The difference between a rich person and a poor person usually lies in the life decisions they make.

Over the lockdown, it’s said that half the country got fit with Joe Wicks, while the other half got fat with Ronald McDonald.

We ourselves have racked up significant takeaway bills during this pandemic, with the main culprit being Dominoes at around £25 a pop.

Added up, the nations’ newfound love of takeout comes to a hefty cost, probably a few hundred quid every month on average. But that’s not the real cost.

As investors, we know that this money could have been put to work for us in stocks or the property market.

The returns we’re missing out on as a result adds up to a mighty opportunity cost over a lifetime.

In this post we’ll show you the real cost of a takeaway, amongst other things, and how much you could be better off in retirement if you made different life choices today.

And if you think this number is scary, you won’t want to know the real cost of that new car you bought last year!

Commission-free trading platform Stake are giving away a free US stock worth up to $100 to everyone who signs up via the link on the Money Unshackled Offers Page, so be sure to check that out!

Alternatively Watch The YouTube Video > > >

The Opportunity Cost

A common term in accountancy, which might be why most normal people have never heard of the concept.

After all, any conversation with an accountant usually ends in a boredom-induced coma.

And yet, if everyone learned about opportunity cost in school, we believe we’d have a nation of dedicated savers.

The opportunity cost casts a light on what could have been, by magnifying the effect of spending decisions over time.

At its core, it compares the return you get by spending money one way, such as the return of a full and satisfied stomach from a takeaway, versus the return you get on the best available investment opportunity, such as 8% in the stock market.

Why A Takeaway Costs You £1,000

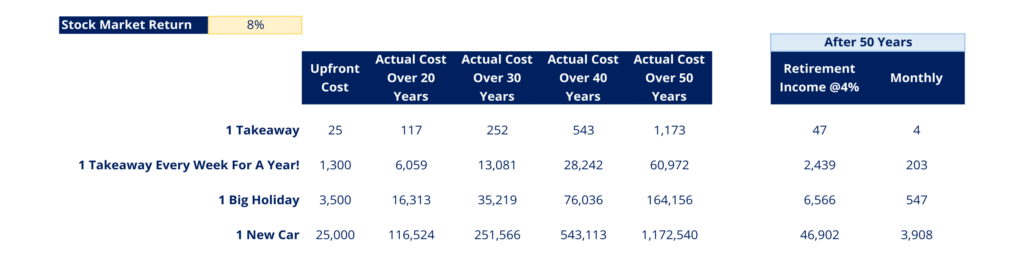

To work out the real cost of a purchase, you need 3 ingredients: the price, a rate of return, and time. Let’s look at a Joe’s most recent order from Dominoes:

Dominoes wanted £25 out of Joe’s freedom fund in exchange for their product. The historical rate of return in the stock market is 8%.

Joe is 20, and plans to hold his investment portfolio to retirement, so let’s say he lives at least into his 70s and regrets his decision to buy that pizza for the next 50 years.

£25 compounded at an 8% return over 50 years is a total cost of £1,173. That’s one expensive pizza! Nice, though.Is 8% Compound Growth Realistic?

Absolutely. The stock market is widely quoted as returning around 8% per year on average as a whole. However, some investments can do even better!

Since America’s S&P500 opened as an index in 1926 when it had 90 stocks, it has returned on average 10-11% per year.

And US Small Cap stocks had an average annualized return of 11.9% from 1972 to 2020, while US Large Caps returned 10.8% over the same period.

Over long periods of time, the stock market performs better than property, bonds and commodities.

And since you can easily invest in stocks from as little as £1 from the same sofa that you would annihilate that pizza, it’s an appropriate alternative to a Dominoes pizza box as a place to store your wealth.

Other Scary Numbers

Obviously, it’s not just takeaways – that’s just a silly but illustrative example that we chose. Even scarier is the full opportunity cost from life’s big decisions, such as buying a new car.

Millions of office workers choose to buy new cars with their middle-class salaries, believing themselves to be rich as a result. The opposite is true.

By the same logic as the Dominoes pizza purchase, a new car worth £25,000 could set you back by £1.1m over your working life.

British holiday makers choosing the Bahamas over somewhere closer to home like Portugal could easily burn an extra 3 or 4 grand – which may add up to over a £160,000 loss in retirement.

Here’s those same numbers over some different retirement timeframes:

One takeaway doesn’t really make a difference – yes, you’re £1,000 poorer in retirement, but for a 20 year old retiring at 70 that translates to just £4 a month lower income using the 4% safe withdrawal rule.

One takeaway every week for one year could set you back by over £60k in retirement, which translates to £200 a month less income during retirement. And that’s just if you do it for 1 year.

The number that makes us blink most though is the loss to future potential income that comes from buying a single new car while you’re young. And not even a particularly expensive new car.

You could be nearly £4,000 a month worse off! Maybe instead, get that money invested, drive an old banger for a few years, and THEN buy a decent motor.

We want to stress that we’re not saying there’s anything wrong with spending your money on new cars or pizza. You can do what you like with your money.

All we want to do is open your eyes to your options.

You need to know that by deciding to make a purchase now, you’re effectively choosing to forgo big increases to your income in the future.

The Flip-Side – Anyone Can Be A Millionaire

Over a career, anyone who passed on the chance to buy a new car in favour of stashing that cash into the stock market could very likely be a millionaire in retirement.

We just showed that buying a new £25,000 car really costs you £1.1m on average over 50 years. Over 40 years the cost is still £540,000.

And of course, if you’re buying new depreciating cars every few years, that could easily add up to multiple millions of pounds of sacrificed investment growth.

The point is, becoming a millionaire in the future can be as simple as making the right choices in your 20s and 30s.

Maybe that involves stashing a potential house deposit for a first home instead into BTL investment property, or whacking a big bonus you got from work straight into the stock market.

Time will work in your favour to set you financially free later.

Should You Live On Rice And Beans?

Some money savers do take the theory of compounding to the extremes. Stories abound in the FIRE community of people saving 75%, even 90% of their salaries to invest for retirement.

FIRE stands for Financial Independence, Retire Early, and for many, Early means within the decade.

You can bet THEY won’t be buying takeaways!

Followers of FIRE mostly get to retire young by penny-pinching their way through their 20s and 30s, but this lifestyle isn’t for everyone.

It certainly isn’t for us. Try as we might to resist the fast-food industry, or the delights of a 65-inch 4k TV, we are only human.

Surely there’s a better solution to scrimping and saving that allows you to buy whatever you want, and still build up a mighty Financial Freedom Fund?

Don’t Cut Back – Make More Instead

We’re firm believers in the abundance mindset, which is making the choice to make more money rather than cutting back. So, we’ll have the takeaway – so long as we’re making good money elsewhere.

The choice doesn’t need to be between having fun now and having fun later.

Just adding a side hustle to your main income stream could easily fund your chosen lifestyle, while allowing you to invest more of what you make from your job.

Here’s our most recent post about top side hustle ideas for inspiration.

Quickly, though, here are 3 of our favourite ways to make more money to fund a better lifestyle.

#1 – Invest First, Treat Yourself Later

As we alluded to earlier, you could get your money working for you first and pumping out returns, and then focus on saving up money to buy your lifestyle choices with.

MU’s Ben drove a smelly old 2003 reg Ford Focus for years before buying his awesome current car. That meant he could get thousands and thousands of pounds working for him during his 20s.

Basically, it’s delayed gratification. Which for all you investors out there, should come as second nature!

#2 – Side Hustle

A great side hustle open to anyone to make a bit of extra cash is matched betting, which we’ve both tried out and made a decent bit of regular money from.

We have a handy guide on how to milk this income stream, linked here: Guide To Matched Betting.

#3 – Start A Business

The best way to improve your income is to not have it be filtered through your employer’s organisation, losing a slice here to shareholders, a slice there to fund your boss’s promotion, and so on.

When you own your means of income, i.e. by owning and operating your own business, you keep all the profits.

You should make it your medium-term goal to move away from being an employee working for someone else for crumbs, and work for yourself, so you get the whole pie.

Or should that be, the whole pizza?

Are you getting a takeaway tonight? Join the conversation in the comments below!

Featured image credit: lassedesignen/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: