These days everyone raves about index investing because it’s thought that fees are the deciding factor in how big your investment gains are.

What doesn’t get enough attention is tax and how it drags on your profits. Many investors will scrutinise the smallest of fees but turn a blind eye to crippling taxes.

In some cases, this will be because the taxes are taken unknowingly, and other times it might be that people feel they have no way to avoid them.

On this site we aim to arm our viewers with the knowledge to defend themselves from unwanted taxes and ultimately boost your wealth.

The main way governments are swiping at your invested money is by taxing dividends.

If you have a small investment pot, you’ve probably not even noticed – but for larger pots we would go as far as to say that these dividend taxes are an outrageous assault on your wealth.

We’re going to show you a way to combine index investing with building a portfolio of stocks that uses our new tax dodging strategy. Let’s check it out…

Alternatively Watch The YouTube Video > > >

We think the most cost-effective way to build this tax dodging portfolio is with Stake. Stake specialises in US stocks for UK investors, and offers 3,000 of them. Stake is FCA regulated and has fractional trading and has no FX fees when you trade. We’ll get to why this is so crucial later.

And Stake are giving away a free US stock worth up to $100 to everyone who signs up via the link on the Offers page.

The Dividend Tax Problem

First, we need to explain what the dividend tax problem is, because we think most investors have no idea what the issue is.

We can hear a few cynical know-it-alls sniggering that all you need to do is use an ISA and there’s no tax.

But this isn’t quite true, and it also doesn’t deal with the issue of what to do after you’ve used your ISA allowance.

The first problem is dividend withholding tax (WHT). This is a tax that international governments withhold from any dividend paid from companies based in that country.

An ISA does not guard you from this assault on your wealth.

The US withholding tax is not the worst, but it’s the most important due to the size and significance of the US stock market. A UK investor who has completed a W8-BEN form will pay 15% US WHT.

The next problem is the outrageous dividend tax applied by our own UK government.

It starts at 7.5% for basic rate taxpayers, climbs to 32.5% for those on the higher rate, and for those on the additional rate, they will have to stomach a 38.1% hit to their dividends.

There is currently a notional £2k allowance where no tax is paid but this used to be £5k and was reduced. The direction of travel suggests this will be removed entirely in the future.

Official government figures say that around 20% of ISA subscribers use the full allowance, and with many of these people having decent salaries or businesses, they will become victim to this nasty tax at probably the higher or additional rates.

We are happy… well, content… with paying taxes when they are on real profits. Dividend taxes, however, are taxes on cashflow.

If a company pays you a £1,000 dividend, the company’s market value falls by £1,000. You may have received cash, but your total wealth has not changed.

It’s really unfair to tax this. As a result, when companies pay dividends your wealth actually goes down due to the tax – paying dividends makes you poorer.

The FX Fee Problem

A big issue with ISAs is you can’t store foreign currency in them. This means every time you buy and sell a stock listed in dollars for example, you incur the platform’s FX fee.

Many UK platforms are taking advantage of this to hoodwink their customers. They like to pretend that their trading fees are low but hit you with an FX fee.

Trading 212 have begun to use this technique themselves by introducing a 0.15% fee.

It’s nonsensical to use an ISA to avoid one kind of fee i.e. tax, to then have to pay another in its place i.e. FX trading fees.

Since T212 have introduced these fees, it has elevated Stake’s competitiveness in the market and has potentially made Stake the go-to app for trading US stocks.

Stake charge 0.5% FX fees on deposits and withdrawals but nothing on trades. This allows you to buy and sell as frequently as you want without incurring additional fees.

As most other platforms charge FX fees on trades, the total cost can escalate fast.

The Solution: A No-Dividend Stock Portfolio

Investing for dividends is super popular, with many people loving this strategy of passive cashflow, and there are many funds available that invest for dividends as their objective.

But what we want is the option to eliminate dividend paying stocks from a portfolio entirely.

An alternative to dividend investing is picking growth stocks, which are companies that increase their revenue and earnings faster than the average business.

Growth stocks tend to pay low or no dividends, but we want to be as confident as we can possibly be that we won’t receive any dividend, as it would be taxed.

Unfortunately, there is no index that we could find that tracks the stocks in the S&P 500 that pay no dividends. But you can create your own, and that is exactly what we have done.

It probably shouldn’t need mentioning but to be clear, the main goal of any investment strategy should be to maximise after-tax profits.

There’s no point in investing in a portfolio of crappy stocks just to avoid some tax.

But with that in mind, we fully expect this home-made index of stocks to deliver phenomenal returns if it continues to perform anything like it has done over the past 5 years.

We have never seen any study into non-dividend paying stocks, so we’re very keen to see how this portfolio does.

The List of Stocks

There are currently 72 stocks within the S&P 500 that meet our no-dividend criteria. This will change on occasion as companies enter and leave the index, and as companies change their dividend policy.

We’ll take a look how we got the data in a minute, which will be useful to those of you who want to run with this themselves.

Here’s a link to a pdf of the full listing of 72 stocks that made the cut: Listing download

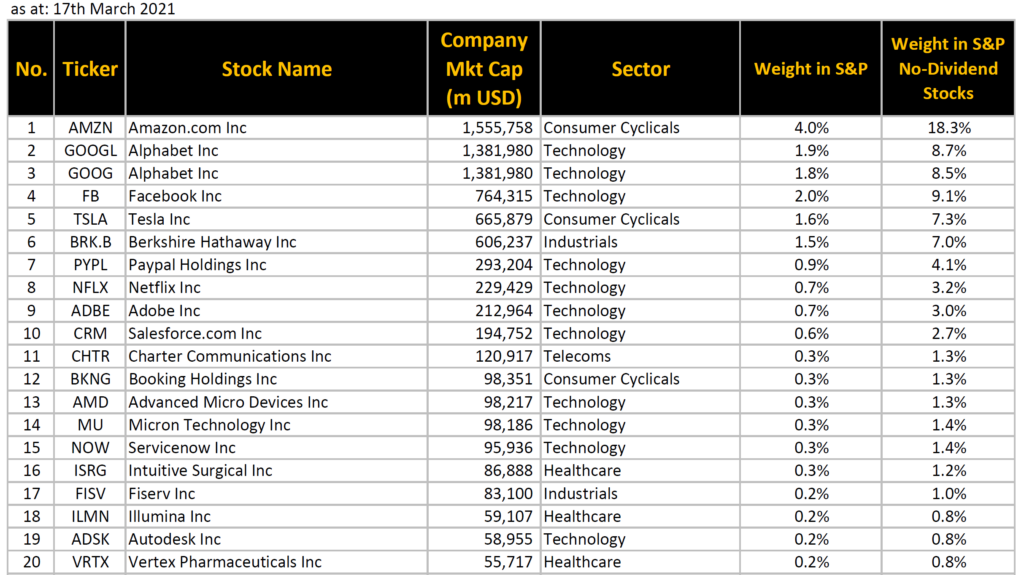

The top 20 are shown below:

We sorted it by market cap and no doubt you’ll recognise many of the names at the top.

First, we have Amazon. Then there’s Google’s parent company Alphabet. Facebook is there too. Fanboy favourite Tesla gets a mention. And Buffetts’ own Berkshire Hathaway. And on it goes.

The 72 stocks make up almost 22% of the S&P 500. That’s quite a sizable chunk, but don’t expect it to mirror the index’s performance closely.

As the majority of these stocks could be considered growth stocks, we would actually expect them to outperform the S&P 500. Only time will tell.

As a benchmark for comparison, over the last 5 years Vanguard’s S&P 500 ETF has returned 114%, which is 16.4% per year.

If you invested an equal amount into these 72 stocks, by our calculation they returned 26.9% per year, smashing the S&P average.

We doubt that overperformance of that magnitude can go on forever, but it gives us some faith that we can avoid dividend tax and still earn incredible returns.

The compound annual growth rate on these stocks is enormous. As a rule, we don’t tend to pay too much attention to past performance of just a few years, but with so many of the stocks delivering standout returns it’s difficult not to be impressed.

Amazon has returned 40% per year; Tesla 70% per year; AMD 97% per year; and so on.

Fine-tuning

Although this list of stocks is just a small selection of the S&P 500, there is still a hell of a lot there if you were planning to invest in all of them.

Some of you might want to take advantage of the analysis tools within the Stake app to fine-tune the stock list further. The Stake app has some awesome inbuilt analyst ratings, which you could use to narrow down on the best stocks.

How Much To Invest In Each Stock?

You have a few options. The easiest would be to invest an equal amount into each stock. Most indexes don’t do this, however.

The S&P 500 is free-float market capitalization weighted. This typically means the biggest companies make up the majority of the index.

Amazon comprises 4% of the S&P. If we were to use the same methodology as the index that would mean Amazon makes up 18.3% of this portfolio. This would absolutely terrify us – so we’d probably stick to the equal weighting method.

Facebook, the third biggest stock here, makes up 2% of the S&P, so would translate to 9.1% of the market-cap weighted version of this portfolio.

As you go down the list the weighting of each stock becomes less and less significant. At the bottom of the list these stocks are merely making up the numbers, rather than having any meaningful impact on it.

Rather than investing in all 72 stocks, you could just invest in the top 20 or so. These top 20 would cover 83% of our stock list, or 18% of the full S&P 500.

How We Built This Home-Made Index

Using Stockopedia’s stock screener tools, we were able to identify S&P 500 stocks and then filter down only on those that haven’t paid a dividend in any of the last 5 years.

For this portfolio we only want companies that are committed to increasing shareholder wealth by any means, other than dividends.

This usually means by reinvesting profits back into the business such as by expanding into new markets or buying new machinery, but it can also include share buybacks. These are great as it avoids that pesky dividend tax.

It’s not enough to exclude companies that didn’t pay a dividend in the last year alone because in many cases this was a temporary reaction to having a bad trading year.

And finally, we ranked the stocks by their S&P 500 constituent weightings.

What About Capital Gains Tax?

As it stands, we get a far more generous capital gains allowance than dividend allowance. The Capital Gains tax-free allowance is currently £12,300 per year.

This means you can sell stocks to realise a profit up to this amount every year and not pay tax.

For example, say that you bought 2,000 shares in company X at £10 each (totalling £20k). If the shares increased in value to £25 (totalling £50k), you could sell 820 shares at £25 and pay no tax.

In doing so, you would have sold £20,500 worth of shares, realising £12,300 profit, which falls within your tax-free allowance.

You just need to be smart and try and use this allowance to its full potential. Many investors will choose to voluntarily realise gains in a tax year up to the value of £12,300, and then reinvest their money back into the market, rather than taking all the profit in one go and getting a massive but unnecessary tax bill.

Have you been allowing governments to put their hands in your pocket? What do you plan to do about it? Let us know in the comments below.

Featured image credit: Elnur/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: