How big does your pension pot need to be? The answer comes down to how big your income needs to be.

A basic retirement income doesn’t actually need to be that big – remember you’ve likely nearly paid off your house and sent the kids off packing by the time you can legally draw your pension.

Which.co.uk says the average pensioner spends just £12,500 a year.

Using an inflation linked lifetime annuity with Aviva, shockingly you’d need a pension pot of £700,000 to achieve this.

However, the average private pension pot for 55-65 year olds only stands at £105,000, which translates into a meagre £1,900 a year income using an inflation linked annuity.

The pathetic returns on annuities means that if you’re still young, you need to either start ramping up your monthly pension contributions big-time, or know how to squeeze every last penny out of your pension pot by using the stock market.

In this article we’ll show you how you can triple your pension income by trusting in the stock market, and for all you under-55s out there, hopefully get you thinking about whether you’re putting enough aside for retirement in the first place.

The New Approach To Pensions

It used to be that on retirement day you would legally have to buy an annuity with your pension pot. No longer. You still can, but the returns are a joke.

The Annuity approach pays you an income by swapping your pension pot for an insurance product – it’s the low-risk, terrible-return approach that guarantees you a basic income.

How basic? Well, to confirm what we suspected about annuities, we ran a quote through Aviva for the average UK pension pot size of £105,000 and were quoted a £1,900 annual income, inflation linked.

That’s equivalent to a 1.8% rate of return, but with all your capital surrendered to the insurance company – don’t let them have it!

The new approach to pensions is the Drawdown method – continuing to hold investments with your pension money, and drawing an income from them – rather than seeking certainty from insurance products.

The drawdown method weighs likely market returns against your likely lifespan, and trusts in capitalism to see you through. The rest of this article assumes we follow the Drawdown approach.

Risks Of The Drawdown Approach

If you get the Accumulation stage a bit wrong for a while, you can always course correct.

But in the Withdrawal stage, being old and possibly infirm, you probably can’t just go back and get a job if your pension income is insufficient to live on. You’re stuck with the cards you’ve dealt yourself!

You’ll also need a plan for managing longevity risk – the risk that your cash will run out before you pop your clogs. And finally, there’s sequence risk.

Sequence Risk – The Risk Of A Bad First Decade

Getting a good rate of return is more important in the early years of retirement.

We know the stock markets average around 5% returns after inflation – that’s 8% nominal returns minus 3% inflation. But that’s just an average.

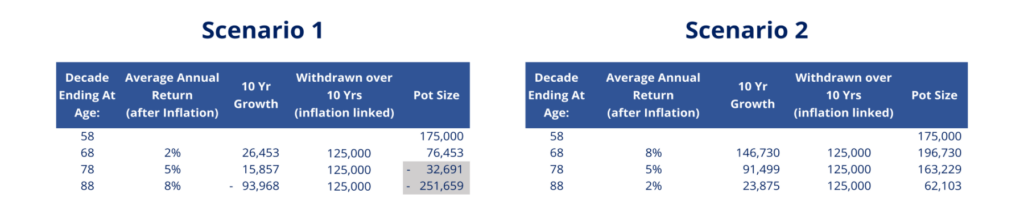

Here’s 2 scenarios. In both, we retire at the earliest possible pension age for our generation, age 58, and have a good innings until age 88.

Scenario 1: In the first 10 years your investments perform terribly, returning around 2% after inflation. We get to enjoy some good times in the decade before we croak, at 8% over inflation.

Scenario 2: Here it’s the opposite, with the good times happening early on and our final years spent grumbling at the news and chuntering that the young-uns are messing everything up: “those damn kids!”

So what’s the difference? In Scenario 1, we run out of money at age 76. In Scenario 2 we outlive our money.

Safe Withdrawal Rates

To make sure we don’t run out of money, some clever boffin (who we’ll get to soon) came up with the concept of a safe withdrawal rate – the amount you can cream off the top without damaging your pot.

You might have heard about the 4% rule. This is the amount you can withdraw safely from an American portfolio. It’s the amount you take out in year 1, and then you adjust it for inflation thereafter.

UK researchers might quote you closer to 3%.

This is because the UK stock market has underperformed the US on average by around 1% over the last 100 years, and bonds by around half a percent.

But these academics are living in the past – there’s no barrier now stopping UK citizens owning a majority of US market funds instead of UK ones!

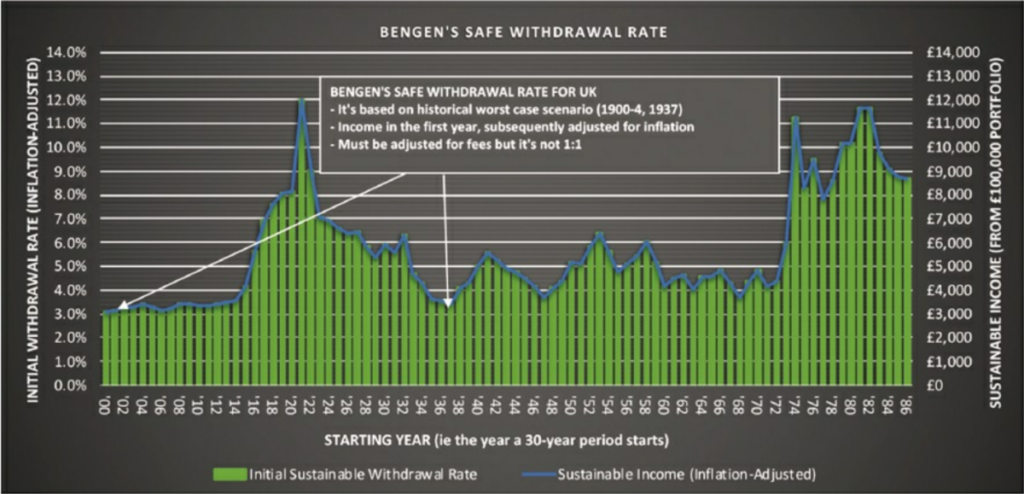

Here’s the UK funds version – there are 86 blocks of 30-years between 1900 and 2015. 1900-1929, 1901-1930, 1902-1931, and so on.

We can see that the worst-case real-world scenario was 3.1%.

Pensioners using this rate would have survived financially through 2 world wars, the Great Depression, several recessions and the risk of nuclear war, without denting their portfolios at all!

A similar history applies for US funds, at a safe withdrawal rate of 4%.

Layering The Cake

The clever fellow who came up with the Safe Withdrawal Rate, Bill Bengen, suggested that it can be increased by adding layers like you would to a cake.

You can take that 4% and ramp it up quite significantly by making your retirement plan smarter.

Layer 1 – Adjust For Spending Patterns

Older people spend less. It’s a fact. New retirees in their 50s and 60s will spend about 50% more than they spend by age 80. We should recognise this in our retirement plan.

Here’s a tried and tested way to do this gradually: if you skip your inflationary income rise on every market down-year – that’s on average once every 4 years – history shows you could have added 0.6% to your initial withdrawal rate.

Layer 2 – Asset Allocation

The 4% rule is based on a 50/50 portfolio split of equities to bonds, but according to the research, you could sack off bonds, and have 100% allocation to equities instead. “Blasphemy”, we hear you say. “Pensioners need bonds to stabilise their pension!”

Except, interestingly, the history of the last 115 years tells us that a 100% stocks portfolio would have survived with a higher safe withdrawal rate than one split 50/50 stocks to bonds according to Bengen’s models – 0.5% higher.

But we do hear you. We ourselves probably wouldn’t want 100% in equities in old age, even if it does have the best history. We’d sleep better at night with some diversification.

Layer 3 – Small Caps

Further studies show that having 25% of your portfolio in small-cap stock funds over the last hundred years allowed for a higher withdrawal rate even in the worst years.

Doing this would have in fact added 0.4% to the safe withdrawal rate.

Layer 4 – Probability

This is the final layer, and up until now the cake could be baked so as to remain whole for your lifetime. But this final layer accepts that you won’t live forever – the longevity risk.

By running 10,000 simulations of different periods of stock market history, it’s been calculated that adding an extra 1% to your initial withdrawal rate gives an 83% chance that you won’t run out of money.

And that’s increased to an 87% chance of success when we factor in the high chance of dying before age 88 – i.e. 30 years after retiring at 58.

That means 13% of the time, this strategy will fail – in almost all cases, it will be due to sequence risk – the risk of having a bad first decade.

So, failure doesn’t mean you just keep ploughing ahead – you’ll get an early warning from the markets and course-correct in the early years, maybe by downsizing your home or living less lavishly to make up the difference.

Whether a much better lifestyle in retirement is worth the 13% risk of having to course-correct is of course your call to make.

So… How Big Does Your Pension Pot Need To Be?

Let’s add all that up. Starting with 4% invested largely in US funds, we add 0.6% to recognise we spend less when we’re over 80, we add 0.5% because we’ve sacked off bonds, we add 0.4% for having a quarter allocation to small-cap funds, and we add 1% in exchange for a 13% chance of course-correction.

That’s 6.5% total; or £6,800 from the average £105,000 pension pot. Still not enough! But triple what you’d get with an annuity (£1,900); or double the 3.1% UK unadjusted withdrawal rate (£3,300).

Here’s how big your pension pot needs to be under each approach to give you just £12,500 per year:

- Annuity @1.8% = £694,000 Pot

- UK Standard SWR @3.1% = £403,000 Pot

- US Adjusted SWR @6.5% = £192,000 Pot

The average 55-65 year old therefore has about half as much saved up as they actually need for a basic retirement using the highest risk approach – and nowhere near the amount needed to use a low risk annuity.

Should You Use Such A High Withdrawal Rate?

History tells us that this works, and the rates are designed to protect you from the worst-case scenario.

But you also have to be able to sleep easy at night. So maybe somewhere between 4% and 6.5% then, depending on your attitude to risk.

Ideally though, and what we plan to do, is build up such a large pot that you don’t need to withdraw anywhere near 4% and still live very comfortably. This only happens by hustling now.

Building The Pot

Hopefully this study highlights the dangers of neglecting to build a sufficiently big pension portfolio.

And it’s important to have visibility over it so you can make sure your future is being managed properly.

We’ve both consolidated our old work pensions into SIPPs for just this reason. Left unchecked, they could otherwise be poorly managed by workplace pension providers as we proved in this video:

YouTube Video > > >

By using a single SIPP to consolidate your old pensions, you can tailor your growing retirement fund to your risk profile, reduce your ongoing fees, and have oversight of the total balance – so you can easily check if you’re on track.

We looked at the Nutmeg SIPP in that video, and we think it’s one of the best for a set-and-forget strategy. You set the direction, and they do the rest.

We’ve arranged for you the first 6 months without fees when you open your SIPP through the link on the Offers page. Check it out and see if it’s the right SIPP for you!

How big is your pension pot? Is it going to be enough? Let us know in the comments below!

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: