Unilever is one of the biggest companies in the world and yet many people have no idea who they are or what they do. But we guarantee that almost everyone has purchased their products.

Does their global reach and huge product range make Unilever stock an essential part of every investor’s portfolio? Offering an amazing dividend that keeps getting bigger and a strong balance sheet, surely this is the stock of dreams?

So, who are Unilever? How do their fundamentals look? What does Unilever’s future look like? And is it worth investing in?

YouTube Video > > >

Who are Unilever?

Unilever are one of the companies we featured in our very popular Youtube video ‘Best Dividend Stocks UK’.

The company is a colossus with a market cap of whopping £127b, which is up from £109b in that previous video, so that’s some nice growth in such a short time.

Next time you’re in a supermarket or even just look in your cupboards and check out the manufacturer of those products. We bet a large majority of these are owned by just a small number of companies – Unilever being one of them.

In fact, according to Unilever, “Seven out of every ten households around the world contain at least one Unilever product.” They also own over 400 brands with 13 of these having sales of over one billion euros.

We love this company because brands, and lots of them, create a protective moat, which make it very difficult for competitors to enter the market. A protective moat is a key thing legendary investor Warren Buffet looks for when investing. Consumers tend to have loyalty with their favourite brands and keep coming back.

Not only does this give Unilever a more predictable income stream but it allows them to charge more than competitors – often a lot more. Take Domestos, Supermarkets tend to charge about £1 for a bottle but the non-branded supermarket version is around 45p – For essentially the same product. This is a whole lot of extra margin for Unilever.

Unilever’s Geographic Reach

They are also hugely diversified in terms of geographical reach with exposure to markets all around the world with particular exposure to emerging economies. It is these countries where large growth is expected to come from.

In fact, almost half their revenue comes from this area. Strong brands across many geographical markets make it less risky for investors…perhaps.

Remember as an investor you’re looking to stack the odds in your favour.

Dividend and Yield

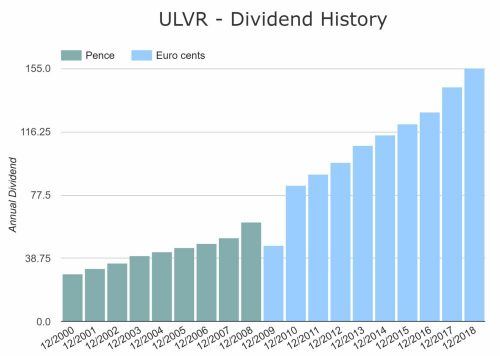

The dividend yield is certainly not the highest in the FTSE 100 but it’s still decent at 2.80% with a healthy dividend cover of 1.52.

A rising dividend with healthy cover is exactly what you want to look for when constructing a dividend portfolio. Unilever even pay out the dividend on a consistent quarterly basis, which is great for your cashflow.

Bear in mind that Unilever now decides dividends in euros, so while the dividend is consistently rising in euro terms, UK investors will see a level of volatility due to currency exchange rates.

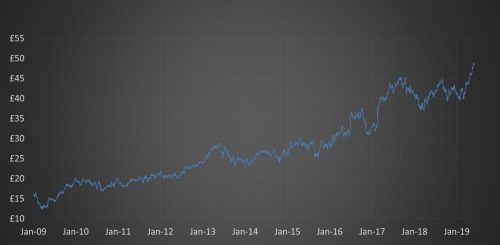

Share Price

Just look at that share price growth on top of any dividend payouts. Whilst a chart like this is historical and not necessarily an indicator of the future, it goes to show that performance has been good.

Whilst your investment style will dictate whether this is good or bad, we tend to like this consistent growth. Stocks that show sharp drops may look like opportunities, but it is far too common to get stung again as further drops often occur. I should know as I’ve been stung a few times myself.

Earnings

We find the best place to go for information on earnings for any stock is the companies accounts. Investment Websites are good but can sometimes have errors. Unfortunately, annual accounts are long, complicated and extremely boring.

Revenue has hovered around the €50b mark for past 3 years but despite this they have managed to grow Net Profit and EPS. Bear in mind that we see a huge surge in non-underlying items. By following the notes, you can find that this relates to the disposal of its Spreads business. These sorts of gains are one-offs and should be treated as such when analysing stocks.

Whilst a full analysis of earnings goes beyond the scope of this article, we are happy with the company’s earnings.

Price Earnings Ratio

According the Hargreaves Lansdown the P/E ratio is 19.80, which is based on the adjusted EPS – This is excluding non-recurring items, which we assume to be things like the disposal of the spreads business just mentioned.

This is high when compared to the FTSE 100 PE of about 15 but we think that Unilever has better growth prospects and certainly more protection against a price drop.

Risks

Unilever relies on the power of its brands. They need to ensure that their brands stay relevant.

Changing consumer demands and even new taxes such as sugar tax can have a huge detrimental impact on Unilever’s business. Then there is the problem with plastic packaging. Unilever needs to find a way to reduce its use of plastic.

Customers are becoming more concerned with the environment and are beginning to avoid products that unnecessarily damage the environment. There is also taxes and fines that will damage profitability if they don’t act on this now.

Do you like the look of Unilever Shares and will you be investing? Let us know your opinion in the comments section.