Shell is the FTSE 100’s Oil goliath, and for us investors, the most striking thing about it is its whopping dividend yield, ticking along around 5.75%.

As lovers of cash flow, this is an amazing yield for our portfolios, alongside capital growth. But dividends have been flat for the last several years, with experts not expecting any sudden rises in the short term.

Is the UK stock market’s number one Oil kingpin still worth investing in?

The FTSE 100 – still a haven for Blue Chip Companies

Doom-mongers in the media like to imagine that Brexit and US/China tensions is going to spell the death of the world economy, despite centuries of growth, innovation and prosperity. But companies like Shell laugh in the face of such negativity.

Shell is a cornerstone company of the FTSE 100, the UK’s top index, making up over 11% of the value of the top 100 companies all by itself, but is global in its nature.

Dividends – Good Yield, But Where’s My Growth?

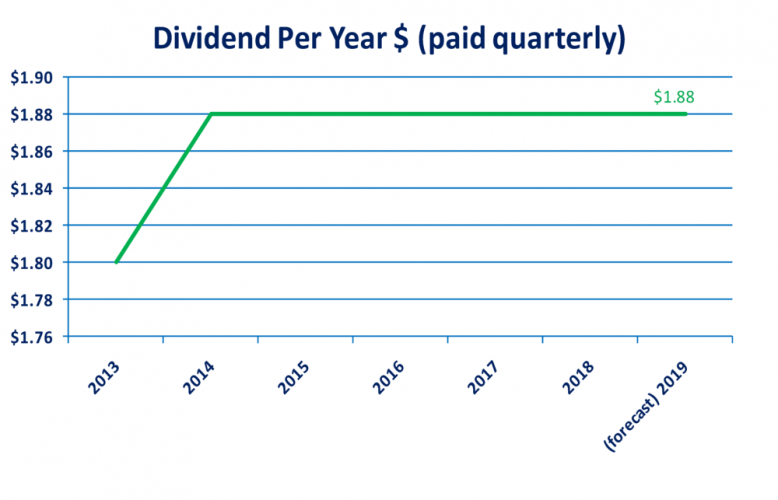

Check out their recent dividend history. Shell have flat-lined their dividend payouts at $1.88 for the past 5 years, and are forecast to continue this trend into the current year. Shell announces their dividends in US Dollars because they are an epic global company, and Dollars are the currency of the world. And oil is of course priced in dollars.

They choose to be listed on the UK stock exchange, but like many companies in the FTSE100, their trade is global.

What does this flat dividend line mean for us as investors? Well, the dividend yield is currently 5.75%, which is fantastic for a Blue Chip company, but this chart tells us that Shell aren’t willing or aren’t able to grow their dividends, so investors have been losing out each year to inflation. We like to see companies growing dividends at least in line with inflation.

A reliable 5.75% yield is worth hanging around for though, so let’s look at how recent capital growth in the stock price stacks up to see if that helps sweeten the deal.

Royal Dutch Shell (RDSB) Share Price History

Source: Google

Shell’s Stock Price

Here’s Shell’s recent stock price history. We can see that it’s been tracking slightly upwards over the years, and is currently at a relatively high price point when compared to its recent history. Could this mean the price is more likely to fall than rise in the next couple of years?

It’s impossible to say, but with the US/China trade war and a pinch of Brexit uncertainty, we wouldn’t be surprised if the share price were to fall in the short term – especially if a global downturn occurred, which would likely effect oil prices. But Shell’s history of steady share price growth is one check in the “pro” column for this stock.

Price Earnings Ratio

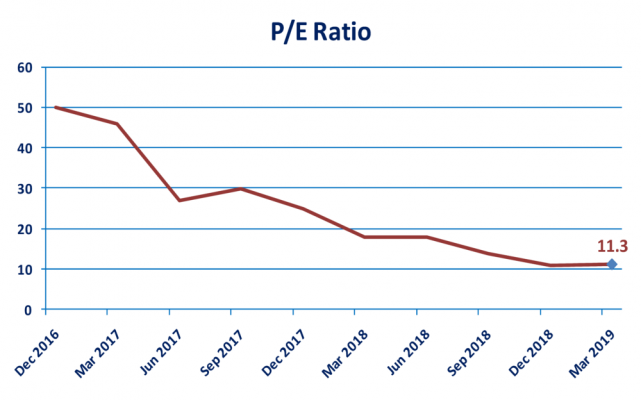

Shell had a Price Earnings ratio at April 2019 of 11.3. The price earnings ratio is calculated as Share Price divided by earnings Per Share, so the higher the share price, the higher the Price Earnings ratio. Likewise, if the company’s earnings fell, the PE ratio would increase.

We want to see a low PE ratio relative to a company’s history and to its competitors, so we know we’re getting value for our invested money.

But don’t forget this can also be a signal that its future might be bleak – perhaps other investors know something you don’t.

We can see that the share price had fallen over the last couple of years relative to earnings, so to invest now would be at a bargain price compared to a couple of years ago.

11.3 is also low compared to one of Shell’s main competitors in the Oil industry, Exxon Mobil, who has a PE Ratio of 16.5 at April 2019.

Shell’s PE ratio is 32% lower than Exxon’s, possibly making Shell a good place to invest in Oil in terms of the value of share capital.

Long Term Investment Horizon

We also need to look at soft factors when predicting the future performance of a stock.

Let’s look at the long term bumps in the road for Shell investors:

Oil as a Dying Fuel

There isn’t much of a worry that Oil is disappearing as a world resource anytime soon, despite public perception. There’s TONNES of the stuff under the ground, and new sources are being found all the time.

The problems are rather practical and political. New sources of oil are being found in the world’s oceans, but getting drills to them isn’t easy – and there’s the environmental impact of accessing that oil to consider.

New fracking technology could keep the oil industry going for a long time, but there is strong political push back against such projects due to the perceived impact on the environment.

As the world turns to new energy sources such as wind and solar, demand for oil will likely fall. But a company as big as Shell surely would adapt to such an eventuality.

Besides, when the sun isn’t shining, and the wind isn’t blowing, Oil is going to be one of our main fall-back fuels for many years to come.

Should I Buy Shell Stock?

In Summary, we believe Shell is a reasonable stock to hold in your portfolio.

Its high dividend yield, solid PE ratio, steady share price growth and strong history as a staple of the FTSE100 make it a dependable cash flow asset.

But its dividend payout is not increasing, and its long term horizon is littered with potential political pitfalls as the Millennial Generation demand cleaner energy.

Andy has held Shell in his portfolio for many years and will continue to hold, whilst those juicy cash flows keep coming in. But buying directly into individual stocks is not the only way.

There are alternatives to buying Shell stock directly – being such a large chunk of the FTSE100, you could invest in a FTSE100 tracker, which gives you exposure to this great company but also diversifies you across the rest of the top companies in the index.

Do you hold Shell shares in your portfolio? How do you rate its performance? Let us know in the comments section.